317-912-1000

317-912-1000

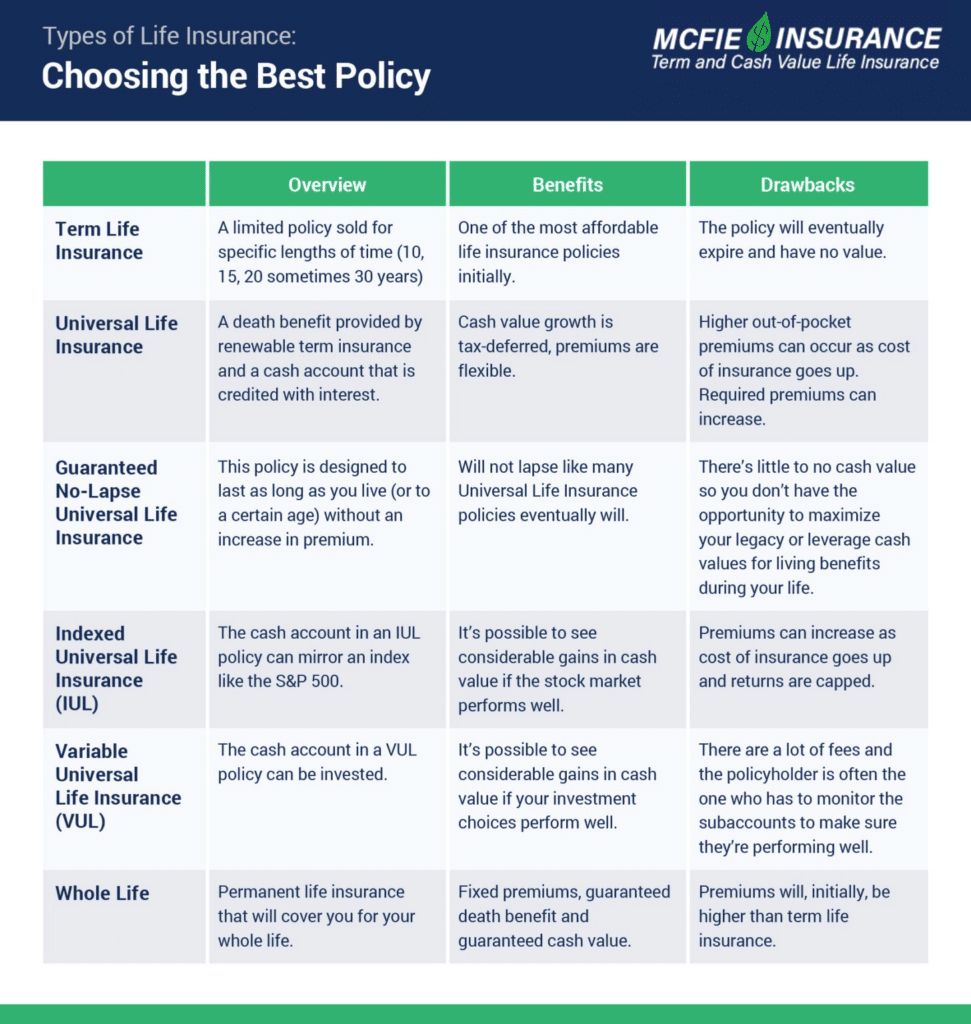

When it comes to choosing a life insurance policy, there are many different types of life insurance available.How do you know which life insurance types might be right for you? Here is a guide to the most common types of life insurance and how to choose the one that will be best for you.

Common types of life insurance policies include the following:

To help you understand each one better, we’ll take a deeper look at all six types to determine which policy or combination of policies is best for you.

Get a working knowledge of how each type of life insurance policy works.

After reading this 10-page booklet you'll know more about life insurance than most insurance agents.

Download here>

Overview: Term life insurance is a limited policy sold for specific lengths of time. You can find policies for 5, 10, 15, 20, or even 30 years. Coverage varies depending on the policy but can go into the millions. When you have a term insurance policy, you pay a fixed premium each month, quarter, six months, or year, depending on the premium mode you choose. Your premiums purchase the death benefit – the money your beneficiary receives if you pass away. If you die during the term, your beneficiary is paid the death benefit. The caveat to term insurance is that your death benefit is only paid out if you die during the coverage period.

Benefits: Term insurance is one of the most affordable life insurance policies initially. The premiums will usually be the lowest of all types of life insurance policies at the time you see the quotes, but premiums on term insurance won’t stay low forever. Most people who choose term life insurance plan to end coverage at the end of the term and stop paying premiums — which would become significantly larger each year thereafter.

Drawbacks: For term insurance to provide the benefits of life insurance, the policyholder must die during the coverage period. If you die without renewing a policy, your family won’t receive the death benefit. Dying beyond the term means that you paid premiums for years, with nothing to show for it. Also, term insurance doesn’t build cash value, meaning that there’s no guaranteed way to recover the cost of insurance over time. There is no favorable tax-deferred treatment of cash value growth either.

Universal life insurance is a popular type of insurance introduced in the 1980s. It is classified as permanent life insurance, which ought to mean the coverage extends for your entire life. In practice, this is not usually the case.

It’s important to know that all universal life insurance products are still based on one-year term insurance behind the scenes, so the cost of insurance is ever-increasing. Premiums beyond the cost of the one-year term insurance, accumulate as cash value, which can be used to pay future premiums on the underlying one-year term insurance or may accumulate faster than the premiums required for the one-year term insurance.

The death benefit on a universal life insurance policy can be selected in one of two ways called Option A and Option B.

Option A

A universal life insurance policy under Option A will pay a fixed death benefit regardless of the cash value accumulation in a policy. But if the cash value is not sufficient to cover premiums on the underlying one-year term insurance, you may have to pay more premiums in the future to maintain the death benefit.

Option B

A universal life insurance policy with Option B is often promoted as a better deal because your beneficiaries receive both the cash value and the death benefit. In practice, this simply means that the death benefit is calculated differently. Premiums on this type of policy will be more expensive over time and the cost of the one-year term insurance is still subtracted from the cash value. This means you can still end up having to pay more premiums in the future to maintain the death benefit.

In nearly all the universal life insurance policies we have reviewed, there is a point in time (usually between age 60-80) where guaranteed cash values go to zero. This is why we believe universal life insurance should not be considered lifetime coverage.

When choosing between these options, it’s also important to know that the cash value in a universal life insurance policy is not the same as the cash value in a whole life insurance policy. Cash value in Universal Life insurance (UL) policies is handled differently depending on the type of universal life insurance policy you choose.

For:

In contrast, the cash value in whole life (WL) is like equity in the death benefit. It is the portion of the death benefit that is no longer at risk for the insurance company. They are willing to make policy loans for this amount from their reserves (more on whole life insurance below).

To explain further, here’s a breakdown of the different types of universal life insurance:

Overview: Cash value in a plain universal life insurance policy earns a rate of interest set from time to time by the insurance company. Premiums are suggested by the life insurance company but can be flexible.

Benefits: Cash value growth is tax-deferred. Flexible premiums are one of the best seeming benefits of universal life insurance, but this “benefit” carries a risk.

Drawbacks: Flexible premiums are the Achilles heel of all universal life insurance products. Whenever less premium is paid into a UL policy, or less interest is earned on the cash account, or a combination of these two things, there can be a shortfall in expected cash value that results in higher out-of-pocket premiums required in future years to keep the policy going.

Overview: A guaranteed no-lapse universal policy will have fixed premiums. These premiums go to purchase the death benefit as well as a guarantee that your policy will not lapse and a certain minimum death benefit will be maintained as long as you pay premiums, even if there is not enough accumulated cash value to cover the increasing cost of insurance. Accumulated cash value is often very low. With this type of policy, you can also choose to only keep coverage to a certain age, like 95 or 100.

Benefits: Guaranteed no-lapse universal life is often the cheapest option for a universal life insurance policy – you can think of it as a more expensive term policy that lasts longer than most term insurance. You won’t have fluctuating premiums, but there aren’t many other living benefits since this type of policy doesn’t accumulate much cash value.

Drawbacks: Since there’s little to no cash value, these policies don’t give you the opportunity to maximize your legacy or to leverage cash values for living benefits during your life. Guaranteed no-lapse policies require on-time payments. If you’re late on even one premium payment, you can forfeit the no-lapse guarantee. This can easily cause you to pay into the policy for years and end up with nothing to show for it because of one late payment, which you might not even realize was late at the time. There is usually no requirement for the insurance company to notify you when a payment arrives late.

Overview: Indexed universal life insurance can build cash value, and the cash fund is tied to the performance of a stock market index or index fund. The insurance company sets a participation rate that determines how much of a return on the underlying fund you see in cash value growth. For example, if the participation rate is 50% and the index return is 6% in a given year, then you would see about 3% growth.

The insurance company also guarantees a floor, so if the index loses money in some years, they may guarantee a minimum return of 0-2%. The cost of insurance and running the company is still subtracted from the cash fund, so even though you may have a guaranteed floor, it is possible to lose money in indexed universal life insurance. Premiums are flexible since this is a type of universal life insurance.

Benefits: Indexed universal life does build cash value with tax-deferred benefits based on your policy’s participation formula, market performance, and wherever the insurance company sets its expense rates. It is possible to see considerable gains in cash value if the stock market performs well and expenses are low. You’re also usually able to adjust your death benefit and premiums (within certain limits) to make the premiums more flexible.

Drawbacks: When you tie your cash value to an index, your policy becomes dependent on the way the index performs, and the way the insurance company sets its fees. Even when the market performs well, it is doubtful whether you can accumulate as much cash value in an IUL policy as you could through a combination of guaranteed whole life insurance + investing extra money directly in an index of your choice.

IUL policies calculate cash value gains in many different ways. Some IUL policies calculate the cash value gains by multiplying the period gain in the index by the money in the accumulated cash value account. Other IUL contracts use the sum of the changes in the index over the period as a multiplier, and still, other IUL contracts take the average of the daily gains in the index for the month as the multiplier.

The insurance company can change many of the provisions in this type of policy, and the contracts are complex. Fees, growth, and interest aren’t consistent across insurance providers and policies, and it can be difficult to understand what you’re really getting.

Even if you think the market will do really well, an IUL policy could seriously limit your returns because most IUL policies cap your benefit from the index growth between 12-15% per year. This means your policy doesn’t benefit from any return above the cap rate.

Long story short, IUL policies make it difficult for policy owners to understand their contract (which almost always benefits the insurer), they cap growth, and they only create gains when the market is on an upward trajectory. Not much is really “guaranteed” in this type of policy.

This is why we believe most people could make more by getting a guaranteed whole life insurance policy and investing in an index directly (if desired), rather than gambling on a try-to-do-everything product called indexed universal life.

Overview: Cash value in variable universal life insurance is tied to sub accounts (aka separate accounts). Investments within the sub accounts are defined by the insurance company and can include stocks, bonds, and mutual funds. As the policy owner, you can select the sub accounts to invest your cash value on an annual basis, and you take full risk for these investments. Premiums for VUL are flexible, and the death benefit is usually not fully guaranteed. Your cash value and death benefit will depend on how well the investments within the various sub accounts perform.

Benefits: You can gain a lot of cash value if your investment choices perform very well. You’re also able to take partial withdrawals from your policy or borrow against it, which allows you to use your policy values more during your lifetime.

Drawbacks: VUL has a lot of fees. Often 6% of your premium payments go to the insurance company up front (a front-load) and while VUL is often advertised as permanent life insurance, it is subject to the same underfunding issues and an increasing cost of insurance just as all other universal life insurance policies. The biggest downside is that your cash value accumulation depends on how your investments perform. If your investments do go south, you lose money from your cash values and your entire policy could be at risk of lapsing.

If you do decide to go with VUL, realize that you’re often the one left in charge of monitoring your sub accounts to make sure they are performing well.

Basically, the insurance company is passing risk back to the policy owner with all the different types of Universal Life Insurance – different amounts of risk for different flavors of universal life insurance.

But when you buy any type of life insurance, it’s usually to protect against risk if you pass. You want the insurance company to take risk away from you. This is where you need to ask yourself, “does the investment risk outweigh the possibility of nullifying your life insurance?” In most cases, we believe it doesn’t. After all, life insurance should be all about guarantees, so it’s usually best to keep investment risk separated.

Overview: Whole life insurance is a type of permanent life insurance that will cover you for the rest of your life, so you won’t have to worry about a lapsing policy. It has fixed premiums with a guaranteed death benefit. Whole life also includes the opportunity to accumulate cash value, and the cash value is like equity in your death benefit – building over time. You are not relying on the stock market or an index, and the insurance company keeps all the investment risk.

Benefits: Unlike some of the other policies we explained earlier, whole life insurance is all about guaranteed values you can count on, rather than the possibility of a return.

You will get the full benefit of having life insurance with a guaranteed death benefit. It seems silly to state this so bluntly, but it is indeed a benefit in contrast with so many policies marketed as permanent life insurance today.

And when a whole life insurance policy is designed well, one of the great benefits is the guaranteed cash value. You are able to use your policy values while you’re still alive, keeping peace of mind knowing that you’ll still have a financial guarantee to pass on to your beneficiaries whenever you die.

In whole life insurance (participating or non-participating), the cash value represents a part of the death benefit you actually own called “Paid-Up insurance.” The cash value associated with this Paid-Up insurance is accessible and available to you through a policy loan at any time, for any purpose. The longer you own the policy, the more your paid-up insurance grows, increasing the cash value.

Common uses for a policy loan include paying for college tuition, debt payoff, business expansion, caring for family members, retirement planning, and more. Managing a policy loan wisely can allow you to create free cash flow, giving you better control of your finances, as well as having insurance protection.

Purchasing a whole life insurance policy guarantees the insured is covered for his/her “whole” lifetime – not just for a certain time period. For most of the policies we design, the guaranteed cash value will rise to exceed premiums paid within 8-15 years. This eliminates the chance of paying into a policy and not getting any return when you keep living.

Whole life also establishes a guaranteed fixed premium – you’ll never have to worry about increasing premiums. Instead of cash value growth being tied to investments or performance of an index, the growth of whole life insurance cash value is guaranteed as long as you pay the premiums + interest on any outstanding policy loans.

When it comes to types of life insurance, our number one recommendation is whole life. The guaranteed death benefit, cash value, and premiums make this policy the best long-term choice for those looking to utilize a policy during their lifetime while also knowing their beneficiaries are guaranteed to get a death benefit when they pass on.

Drawbacks: The premiums for whole life will start out higher than those for term life insurance.

Whole, term, and universal life insurance policies are the most common ways to get life insurance. However, there are a few other different types of life insurance to know about before making a decision.

Joint Life Insurance: Joint life insurance is also called “first to die” because it’s designed to be shared between a couple. You pay a premium to cover two people, and then you receive the death benefit when the first spouse dies. It could be beneficial to share a policy for some people, but you can run into issues depending on which spouse dies.

Many families have one spouse that makes more money than the other. The death benefit is designed to step in for that missing income. But if the spouse who makes more money gets the death benefit, you could’ve paid a lot more money into the account than you needed to.

Survivorship Life Insurance: These policies are often called “second-to-die,” almost the reverse of joint life insurance. For this policy, you pay into the policy and only get the death benefit once both spouses die. It’s usually designed to be a pay out for the children after both parents die.

These policies are designed for wealthy families to help pay estate taxes on a large estate. The problem with these policies is the policy won’t help your spouse following your death, and your kids won’t receive any financial help until your spouse also dies.

Accidental Death & Dismemberment Insurance: These policies are common to encounter. Accidental death insurance covers you if you’re injured or killed in an accident. If you are injured in an accident and can’t work, you may receive part of the benefit to help out while you’re still living. If you die in an accident, your family gets the full benefit. These policies are usually very cheap, but they only cover you in an accident. Medical procedures, illness, etc. aren’t covered. As you get older, your chances of an accident will decrease, and you’ll be less likely to benefit from this type of policy.

This type of insurance can often be included as a rider on a Term, Universal, or Whole Life insurance policy.

Of all the types of life insurance, in general, most of our clients end up choosing between term life insurance and whole life insurance or a combination of both types of coverage. The other types of life insurance have too many drawbacks with smaller return opportunities.

At McFie Insurance, we recommend a well-designed participating whole life insurance policy to most of our clients because it allows you to leave a financial legacy, plus build guaranteed tax-free growth, and have access to your money during your life.

For a further look at why, here are a few key takeaways to consider when it comes to choosing between term and whole life insurance.

Choosing from the different types of life insurance policies available is a big decision. If you’re not sure what type of life insurance is best for you, schedule a strategy session with us.

We can help you by:

It’s our mission to provide the information and help you need to find the right policy for your unique life. Schedule a free strategy session today or give us a call at 702-660-7000.

by John T. McFie

by John T. McFie

I am a licensed life insurance agent, and co-host of the WealthTalks podcast.

As a 15-year practitioner of the Infinite Banking Concept on a personal level, I can help you find the clarity and peace of mind about your financial strategy that you deserve.

Working with hundreds of financial scenarios over the years has helped me to develop a sixth sense about how to quickly find a clear and balanced solution for clients using whole life insurance as a financial tool.