702-660-7000

702-660-7000

Indexed Universal Life Insurance (IUL) consists of two parts. Term coverage, to provide a death benefit, and a cash account, to provide cash value.

There are two types of term insurance, Renewable Term and Level Term.

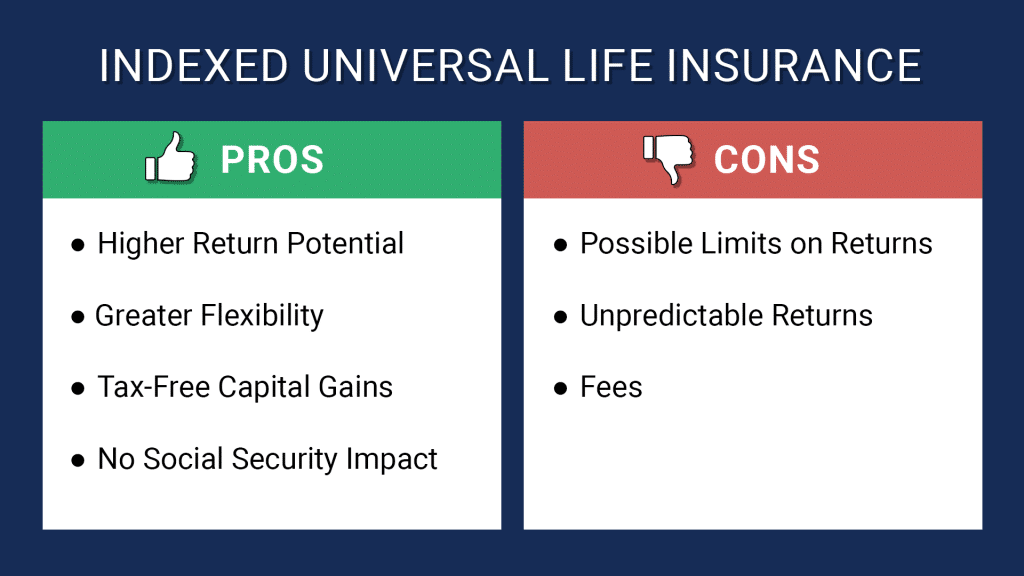

There are benefits and drawbacks to owning an Indexed Universal Life Insurance policy. This article will help you know if IUL is good or bad for your situation. To understand how Indexed Universal Life Insurance works it will help if you have a basic understanding of how term insurance works, so we put in some basic information about term insurance so you can understand IUL easily.

| Get a working knowledge of how each type of life insurance policy works. After reading this 10-page booklet you'll know more about life insurance than most insurance agents. Download here> |

Level Term Insurance is very similar to Renewable Term, but with a key difference. With Level Term, the insurance company guarantees your premium to be fixed or level for a set period. 10, 15 and 20-year terms are common periods for a level term policy. Once this level period has expired you may be able to renew, but the premiums will be much higher than they were for previous period because your age has increased making you a higher risk for the insurance company.

Renewable term is the most expensive way to buy life insurance. The Insurance Company looks at your age and health and offers to give you a certain amount of death benefit in return for X amount of premium. This premium will provide you with coverage for one term. The length of the term will be specified in the policy’s contract. Many renewable policies have a one-year term, but some are longer.

If you would still like coverage once your term has expired, your policy may be renewed. Your new premium will be higher as your age has increased and you represent a greater risk to the Insurance Company.

The premiums on Renewable Term policies rise quickly.

The death benefit of an Indexed Universal life policy is supplied with Renewable Term Insurance, the most expensive type of life insurance you can buy. The cost of insurance starts out low but rises quickly over the years. This can consume cash value in Indexed Universal life policies as we will see later on.

The premiums on IUL policies are flexible. You can pay less or more in premium as you please. We will see how this works in just a bit.

When you pay a premium on an Indexed Universal Life Policy, your money

The death benefit is the amount of money the Insurance Company agrees to pay to your beneficiaries if you should die while the policy is inforce. Since IUL is based on renewable term insurance, the cost of buying a death benefit will rise over time. As the cost rises, more of your premium dollars will be used to pay the increasing cost of your death benefit and less of your premiums will make it into your cash account.

Fees are typical with all Insurance Policies. With traditional policies, there is one flat annual fee known as the Policy Fee. Indexed Universal Life has other fees in addition to the flat annual policy fee such as:

These additional fees add up.

The Cash Account is where the Indexed Universal Life policies are really supposed to shine.

After paying the cost of insurance and the fees associated with the policy, the remaining dollars of your premium are deposited into your cash account. The amount of money you have in your cash account is the cash value of your policy. Some people regard this cash value as equity, but this is wrong. In reality, the cash value of an IUL policy represents how much you have overpaid for your insurance. The cash value is generated by paying more in premium then is required to pay for coverage.

The money accumulated in the cash account from excess premium payments is set to mirror a certain index such as the Dow Jones or Nasdaq. Whether or not you have a say in which index your policy mirrors, is dependent upon the insurance company. Some companies allow you to choose from a select list of indexes. Others don’t.

One of the many hailed qualities of the cash account is that you can never lose money! Indexed Universal life policies generally guarantee the minimum return on the money inside the cash account to be no less than zero. Some policies even guarantee a small positive return.

But Indexed policies also have a policy cap. No matter how well an index performs, your return will be capped at whatever percentage is specified in your contract. This cap rate is non-guaranteed, and the insurance company may adjust this policy cap once each year to any rate they please. The amount of control this gives the insurance company over the performance of IUL policies should be frightening to any who have purchased, or are looking to purchase, these products.

Also, be aware that, while the cash account does mirror an index, the dividends of the index are not included! The difference in the return on an index with and without a dividend can be substantial.

So can you lose money in an IUL policy? Yes, you can. Although you might not lose money because of market corrections if the growth of the cash value doesn’t outpace the rising cost of insurance, the insurance premiums take precedence and consume the policy cash value. We review lots of IUL policies and this is not a red herring scenario, quite the reverse, it seems to be standard mode of operandis for these policies.

Flexible premiums allow you to pay more, less or even skip premiums. Flexible premiums also allow you to overfund an IUL.

When you choose to pay more in premium than required to purchase the death benefit, part of your premium will still go to pay for the cost of renewable term insurance. Part of the premium goes to pay the fees associated with the policy, and the remaining dollars will be deposited in your cash account.

Paying excess premiums or “overfunding” the policy, will result in more money accumulating in the cash account. Like any other life insurance policy, Indexed Universal Life products are subject to the IRS seven-pay test. The seven-pay test defines how much you are allowed to overfund a policy without the policy becoming a M.E.C. (Modified Endowment Contract)

Paying excess premiums or “overfunding” the policy, will result in more money accumulating in the cash account than originally depicted. But Like any other life insurance policy, Indexed Universal Life products are subject to the IRS seven-pay test. The seven-pay test defines how much you are allowed to overfund a policy without it becoming a M.E.C. (Modified Endowment Contract)

If a policy becomes a MEC, it loses its tax favorable treatment, and the growth in the policy becomes taxable. Once a policy becomes a MEC it remains a MEC. If you are considering overfunding a policy, you will want to consider staying under the IRS seven-pay test, or your policy will become taxable.

When you choose to pay less in premium than illustrated for your policy, your premium will still go to pay for the cost of renewable term insurance and the fees associated with your policy. Whether or not there will be any money left over to be deposited into your cash account is dependent on how much you pay.

Now here’s where things get interesting. If the money you paid in premium is not enough to cover the cost of insurance and the policy’s fees, or if you decide to skip a premium, the insurance company will make up the difference by withdrawing funds from your cash account. If there is not enough money in your cash account to make up the difference, your policy will lapse.

Never assume that just because you don’t pay the premium out of pocket that premium isn’t required. You will always pay your entire premium. It’s just whether it comes from your bank account, from the funds in your cash account, or a bit of both.

A worrisome aspect of IUL is the fact it relies on renewable term insurance. Because of this fundamental design, the premiums of IUL products will always rise over time. If you are unable to pay the rising premiums, the insurance company will withdraw the necessary funds from your cash account. Unless the indexed funds perform well enough to allow the cash account to increase enough to cover the ever-increasing cost of the term insurance, it is only a matter of time before the policy premium will consume the cash value and cause the IUL policy to lapse.

Once a policy lapses it ceases to exist, there is no cash value and there is no death benefit. Unfortunately, this often happens when the insured is older and could have left a death benefit as an inheritance.

Indexed Universal Life policies are often depicted as a part of retirement income strategies. Most times these strategies involve overfunding the policy to boost the cash value (money in the cash account) so that the retiree can draw on the cash value for income in later years.

This is a poor strategy because almost invariably the premiums on IUL products become so exorbitant it is impossible or impractical to pay them. When the policy lapses there will be nothing to draw income from.

The cash value and death benefit of Indexed Universal Life policies are often misunderstood. The cash value is the amount of money in your cash account. It represents the amount you could borrow or withdraw. If you were to surrender your IUL policy, you would receive the cash value minus any outstanding loans, and fees associated with surrendering your policy.

The death benefit is the amount the insurance company has agreed to pay your beneficiaries should you die while the policy is in force. If you should have a loan against your policy when you die, your beneficiaries will receive your death benefit minus the outstanding loan.

There are two options for how a death benefit is paid with an IUL policy. Under Option A, the death benefit of an IUL policy will equal the face amount of the policy. Under Option B, a more costly option, the death benefit of an IUL policy will equal the face amount of the policy plus the cash value in the cash account. This cash value isn’t free money, it represents how much you have overpaid for your insurance. Under either option, your beneficiaries will only receive a death benefit.

Average Rate of Return has become a popular way to measure investments, and it is often used to measure up the investment side of Indexed Universal Life.

While figuring out the average rate of return on an IUL can be straightforward enough, average rate of return can be tricky and downright misleading. You can lose money on your IUL while earning a positive average rate of return due to the misleading nature of how the average rate of return is calculated

For example: Let’s say you invest $100 with an investor who promises you an Average Rate of Return of 5% on your $100 over a two-year span.

The first year, your investor makes a poor investment and loses 50% of the money you invested with him. This leaves a balance of $50 in the investment account. The next year he makes a better investment and experiences a gain of 60% on the investment account. The 60% increase on the $50 investment account represents a $30 gain! This increases the balance of the investment account to $80 ($50 + $30).

It has now been two years, and your investor hands you over your $80 and informs you your money has earned a 5% average rate of return. To check this math you would add the returns together -50% + 60% = 10% (gain) and divide this 10% gain by 2, for the two-year time period which shows that the average rater of return was 5%. Your investor is, indeed, correct in stating your money has earned a 5% average rate of return. At this point, he will probably ask you to invest more money with him. Would you invest more money or quit while you’re “ahead”?

A more meaningful calculation would be the Actual Rate of Return. The Actual Rate of Return looks at the return of your money compared to the original sum invested. In this case your final return of $80 minus the original amount, $100, would leave you $20 dollars in the hole. Considering 20 is 20% of 100, we see the actual annualized rate of return was -10% (20% divided by 2 years).

The only problem with figuring the Actual Rates of Return for IUL policies, is that the rates are seldom anything to write home about. In fact, most of the time, they stink. This isn’t shocking since we know the premiums of IUL policies rise with the cost of insurance, and whatever you could earn in your cash account is capped at whatever rate the insurance company chooses.

IUL policies can be very profitable for insurance companies, but they are a risk for individuals to own. An IUL could possibly benefit you if the stock market is trending down resulting in your cash value growing faster than the rest of the market, the insurance company has appropriately capped your cash account, and your premiums stay reasonable. IUL policies are complex in nature and have many moving parts and pieces. The complexity and multiple variables in an IUL contract can become a huge financial risk and liability to the owner of any IUL policy. It is important to understand all these details thoroughly. We always recommend you consult with a financial expert who has knowledge and experience with IUL policies if you are considering purchasing, or already have one in your financial portfolio.

At McFie Insurance we provide financial expertise on Life Insurance. If you want to:

Call our office 702-660-7000. We help people understand life insurance so they can get the right life insurance policy, and have financial peace of mind.

by Steven McFie

by Steven McFie

Many people make bad financial decisions, not because they want to, but because they don’t understand enough to make good financial decisions. I like to make things as simple as possible. Simple things are easier to understand. And when you understand something, it’s easier to make good financial decisions. (Yes this is an old picture - need to get an updated one.)