702-660-7000

702-660-7000

Inflation is a significant economic concern for 2024. Inflation impacts everything from everyday purchases to long-term financial planning. Let’s explore the causes and effects of inflation and also look at some strategies for minimizing its impact on our personal finances.

Inflation is on an upward trajectory in 2024. Factors contributing to this trend include supply chain disruptions, increased production costs, geopolitical tensions/wars and government deficit spending which increases the amount of money in circulation without creating new economic value. Inflation leads to higher prices for both vendors and customers.

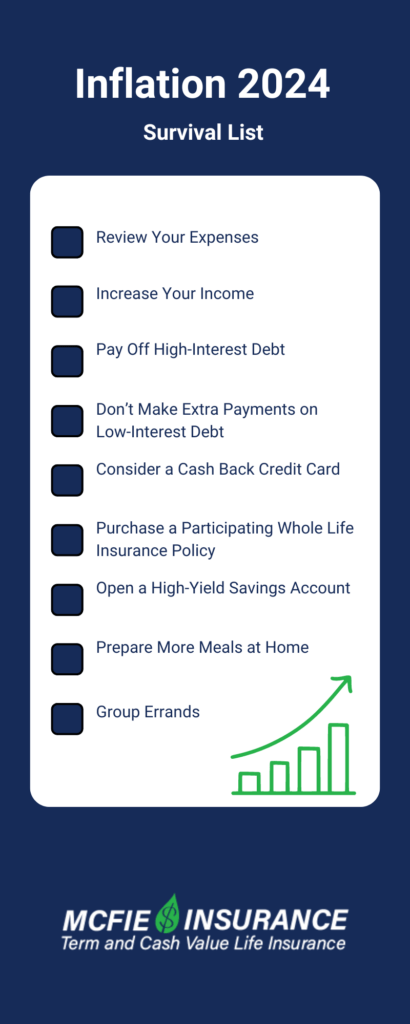

Here are some ways to handle the pressure during times of high inflation:

Without a plan, it’s easy to let your hard-earned dollars slip away. President Calvin Coolidge once said, “…keep expenses low enough so that something may be saved to meet the day when earnings may be small.”

While you may not be able to reduce your rent or mortgage, you might be able to trim your subscriptions and entertainment budget.

Increasing your income as well as managing expenses, can improve your results significantly. Adding income with a side hustle or a part-time job can help you afford rising costs and create a cash cushion for new opportunities too. Assess your skills to identify potential side hustles. If you have extra space, you might consider renting out a room. If you’re a skilled content writer, maybe you could become a freelance writer.

Focus on paying off high-interest debt, like personal loans, payday loans, and credit cards, to free up cash flow for other expenses. If you have good credit, consider transferring high-interest debt to a 0% credit card with a balance transfer. Paying off the balance before the introductory rate ends (typically six to 18 months) can save you a lot in interest. Understand the terms and any fees before committing to a credit card balance transfer.

Many people make extra payments on a mortgage trying to pay it off early, but it hardly ever makes sense to pay off a mortgage with a nice low interest rate, especially when inflation is high.

A cash back credit card won’t eliminate the pressure of inflation, but it can help you earn extra money from your regular spending. Many cards offer 1% to 2% cash back on standard purchases and maybe 3% or more on special categories like travel, dining, or fuel. Before using a cash back card, plan how you’ll use it and ensure you can pay it off in full each month. Look for a card with no annual fee (or at least a low annual fee) that offers cash back on items relevant to you.

Participating Whole Life Insurance guarantees protection for your family while generating growth on your savings. If an opportunity or need arises, you can borrow against your policy with an interest only loan. In the meantime, guaranteed policy growth can help to offset inflation.

Not earning a return on your savings means losing money to inflation. A high-yield savings account (HYSA) may offer a higher rate of return than a regular savings account. Online banks may provide better interest rates since they have lower overhead costs. A HYSA can be a nice tool for keeping short-term savings.

Food prices have soared, making it harder to afford prepared foods and eating out. Meal planning can help you save money on groceries without sacrificing food quality. Reducing unnecessary purchases and food waste is always a good thing. Consider combining this with a grocery rewards card for additional savings.

With high gas prices, frequent commutes or errands can become costly. Instead of making multiple trips to the store, try to group your errands into a single trip. This approach also applies to using public transit or ride-sharing services. The more errands you can accomplish in one outing, the more time and energy you save.

Investing in tangible financial assets is a proven method to hedge against inflation. Unlike cash, which loses value as prices rise, assets such as real estate, tend to appreciate or at least maintain value.

Investments in companies or assets that produce necessities, also tend to weather inflation better since prices can go up, and people still need to buy the products.

Whole life insurance can help to hedge against inflation because:

By understanding and adapting to inflationary pressure, you can protect your financial health and make better decisions to improve your economic future in 2024.

At McFie Insurance LLC we help people minimize the effects of inflation by using Participating Whole Life Insurance as a financial tool. Schedule a strategy session to learn more!

Resources:

How to get a Whole Life Insurance Policy: Contact McFie Insurance 702-660-7000 | [email protected] | https://mcfieinsurance.com/

Follow the Wealth Talks Podcast on:

Facebook: https://www.facebook.com/profile.php?id=61554798231074