702-660-7000

702-660-7000

Type: post

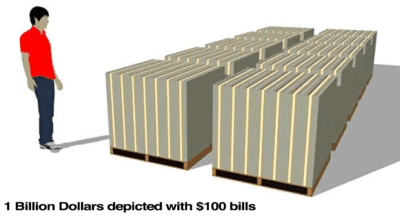

Wow! $42.3 Billion, according to Bankrate; that is what 3 banks, JPMorgan, Bank of America and Wells Fargo, collected in fees during one year, $6 billion of those fees coming solely from ATM and overdraft fees alone.[i] Of course, these are the same banks that we taxpayers bailed out in October of 2008 to the …

Continue reading “$42,300,000,000 in Fees”

Read More...

Type: post

Less than 2 out of 5 Americans have enough money saved to afford an unexpected $1,000 expense. Such an expense would force 1 out of 5 to charge such an unexpected expense on a credit card, leaving the rest to either scrounge it off a friend, family member or take out a personal loan. Interestingly …

Continue reading “The $1000 Dilemma”

Read More...

Type: podcasts

People often wonder why they would want to use participating whole life insurance rather than some other financial tool(s)? The quick answer is because no other tool has all the positive benefits without too many negatives. When you get all the facts on the table, it just makes sense. Today on Wealth Talks, discover WHY …

Continue reading “Ep 165 Why Life Insurance?”

Read More...

Type: products

After 8 years of working at a casino in Atlantic City as a craps dealer, Dr. Mark Burick was ready to do something else. He laughingly explains that he started with the alphabet and upon reaching C, where he found “chiropractor”, he seemed to remember his mother telling him as a child that he would …

Continue reading “The Buricks”

Read More...

Type: products

Meet the Hryszczuk (pronounced “Hers-check”) Family of Belvidere, Illinois! Like many of our clients, Steve Hryszczuk, found McFie Family Insuranceonline and called our office. We met over the web and he purchased a Whole Life policy on his life. Later I had the privilege of meeting Steve face-to-face when he came to one of our …

Continue reading “Steve Hryszczuk”

Read More...

When purchasing participating whole life insurance, many want to see the premium “disappear” as soon as possible. And if you have a limited source of funding to pay the premiums with, like an inheritance, a bonus, the sale of personal property, a settlement, or lottery winnings, it might make sense to have the premium “disappear” …

Continue reading “Why You Want to Pay Your Premiums as Long as You Can”

Read More...

Five-hundred and 2 days ago, from the time of writing this blog, a new president of the United States has “slashed regulations that strangle the economy by nearly $2 trillion a year.”[i] Which has increased the wealth of U.S. households $7.1 trillion![ii] This, all in spite of what the Economic Policy Institute or the Brookings …

Continue reading “How to Benefit from Less Regulation (Both Now and In Your Retirement)”

Read More...

Those that follow this blog already know our admiration of John (Jack) Bogle. A personalized copy of his book, “Don’t Count On It” sits right beside my desk and is referenced nearly every week as we reach out to educate others about money management because it contains so many valuable insights. Besides, Jack has been …

Continue reading “ETF’s What Are They And Can You Depend On Them?”

Read More...

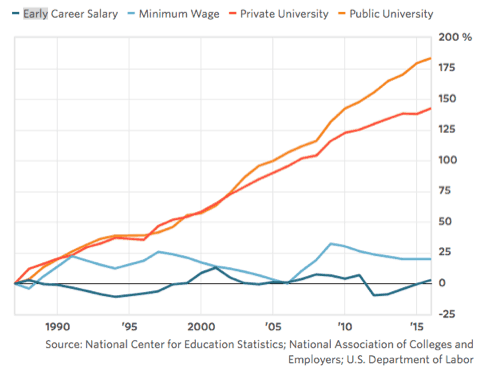

Attending a university or college used to provide a path to a better income. But “In 1987-1988 the average four-year universities and colleges were charging $3,190 a year for tuition. Today, with prices adjusted to reflect 2017 dollars, that average cost has risen to $9,970 a year. Which is a 212.5 percent increase.”[i] But the …

Continue reading “Growth of Student Loan Debt 5 Times Faster than Wages Over Past Decade”

Read More...

Type: products

Meet David and Carla Zapata of St. Joseph, Michigan! David owns his own automotive business and Carla is a nurse. Five years ago, prior to their marriage, David attended a seminar where various aspects of living a successful life were discussed. One of those things was participating whole life insurance and how it can …

Continue reading “The Zapatas”

Read More...