702-660-7000

702-660-7000

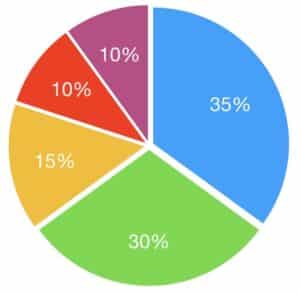

Your credit score is currently determined by five significant facts:

Yet, if certain politicians in Washington have their way, your credit score in the future could also be determined by how you voted, what religion you profess, what your gender is and even based upon your race.[ii]

The failure of this amendment to the 1970 Fair Credit Reporting Act, permits the CFPB to consider it fair game to determine private credit scores based on political party membership, private behaviors, and personal beliefs, race, creed, or anything else the CFPB believes necessary. Knowing this, it is important to note that Senator Elizabeth Warren was the mastermind behind the CFPB. Warren insisted that the CFPB be completely unaccountable to anyone except the CFPB director, effectively preventing the congress or the American people to hold the CFPB in check.

Obviously, the failure of this amendment raises concerns for any American who believes the Constitution, that freedom of expression is a God given right and shall not be impinged upon by the government or anybody else, for that matter. In fact, with this amendment to the Fair Credit Reporting Act failing, and the unlimited power provided to the CFPB, Americans could soon face a new credit score. A credit score not based on the 5 facts listed above but on subjective data based on social behavior, beliefs and political ideology, much like the one China initiated earlier this year (2020), where “frivolous spending, bad behaviors, smoking in smoke free zones, etc., can result in stiff consequences.”[iv] How would you like a system where brand loyalty is rewarded and parking a share ride bike in an undesignated place[v] can negatively affect your credit score? Such a system is more than a mere credit score but more of a moral report card where “bad” grades can become costly and “good” grades fetch special perks, like lower utility bills, what kind of car you can drive, where you go to school, where and when you can’t travel, and a whole lot more.

Though certain news outlets have warned against the impact of the Chinese social credit score, which labels anyone with a score below a certain level as “untrustworthy,”[vi] few seem to be concerned about the similar power that has been given to the CFPB when 208 House Members voting against this amendment which would have specifically restricted the CFPB from implementing similar personal, behavioral, and political biases in determining credit scores in the United States.

Why your Credit Score is Important:

Credit scores are an important feature for one to function, as a good score can greatly enhance upward mobility and a low score can impend that same mobility. Allow the CFPB to gain such power, and being non-elected bureaucrats at that, sets a dangerous precedent that holds unfathomable consequences. Think of how many Americans could be thwarted the opportunity to improve their lot if bureaucrats are holding the reigns of their future.

The Importance of Participating Whole Life Insurance and your Credit Score:

Fortunately, the owner of participating whole life insurance has an advantage over those who don’t when it comes to credit scores. With the ability to leverage the high cash values that develop and grow in participating whole life insurance, the owner of these special permanent life insurance contracts can avoid the credit score game almost completely once enough cash value is accumulated. That is because, with just a signature from the owner of a participating whole life insurance policy, they can leverage the cash values anytime they want. Furthermore, they can also use that money for anything they desire. No credit score needed.

Those who don’t own participating whole life insurance are stuck with having to play the game based on their assigned credit score and that, as you see, could be changing soon in America.

[i] https://www.stlouisfed.org/open-vault/2019/april/how-credit-score-determined

[ii] https://www.breitbart.com/economy/2020/01/30/democrats-block-safeguard-against-cfpb-social-credit-system/

[iii] https://www.breitbart.com/economy/2020/01/30/democrats-block-safeguard-against-cfpb-social-credit-system/

[iv] https://www.breitbart.com/economy/2020/01/30/democrats-block-safeguard-against-cfpb-social-credit-system/

[v] https://time.com/collection/davos-2019/5502592/china-social-credit-score/

[vi] https://www.vox.com/the-goods/2018/11/2/18057450/china-social-credit-score-spend-frivolously-video-games