702-660-7000

702-660-7000

There are many types of investments available on the market today designed to “increase your capital.” One classification of these is short-term investments. Short-term investments are investments that are held for a relatively short period of time and can be easily converted into cash.

While being easily converted to cash may sound like an ideal investment, this tends to mean a low return as well, and there are other factors to consider too.

In this article, we’ll explain how most people view and utilize short-term investments and how one potential solution to the best way to invest money short-term, is to think long-term and take advantage of the short-term benefits that come with a well-designed whole life insurance policy.

The goal of many individuals and organizations’ short-term investments is to protect their capital and generate a small rate of return. These types of investments are usually lower risk and are meant to be held as little as 3 to 12 months or sometimes as long as 5 years.

According to the IRS capital gains tax rules, profits made from selling investments you’ve held for a year or less are called short-term capital gains and are taxed at a higher rate than investments you’ve held for longer than a year. When looking into short-term investment options, you’ll want to consider the tax implications as well as these three things:

Keep in mind that whenever you’re investing, there’s no guarantee that you won’t lose your money or come away with little to no gain. This is why we at McFie Insurance appreciate a different approach to liquidity using whole life insurance (more on this in a second).

Here are some of the most common short-term investment options on the market today used by both individuals and organizations:

These are some common short-term investments, but they may not be the best place to “keep money” for short-term use. Planning for short-term needs through a long-term strategy may provide better results overall.

Long-term investments differ in classification from short-term investments because they are meant to be held for a longer period of time — at least a year, but they can be held for decades. Because of this, investors are often okay accepting a higher level of risk and volatility due to the idea that over time those aspects of the investment will smooth over.

Long-term investments are not always as liquid, meaning that those who make long-term investments should be able to keep that money set aside for a long period of time without the need to access or use it. Traditional long-term investments may include the following:

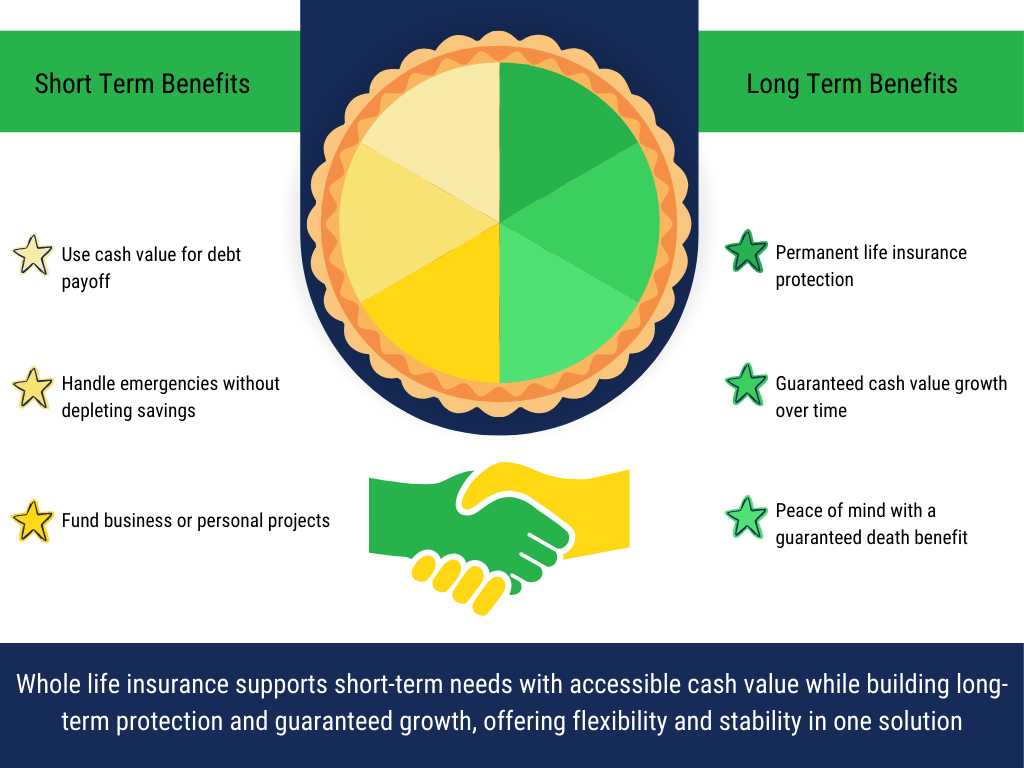

Whole life insurance is technically an asset, not an investment, but starting a whole life insurance policy is a long-term strategy that can provide many of the same aspects an individual might be looking for in short-term investment.

Let’s go back to the points we mentioned earlier that you want to consider when looking into the best short-term investments:

While many of the quote on quote “best short-term investments” might cover some of these points, whole life insurance guarantees them all. Let’s walk through each point.

Unlike short-term investments, which are often subject to higher short-term capital gains taxes, life insurance policies grow tax-deferred. Life insurance policies are covered by section 7702 of the Internal Revenue Code (IRC). This section of the tax code determines how the federal government taxes proceeds from a legitimate life insurance contract. If designed and managed correctly, an IRC 7702 regulated insurance policy will provide tax-advantaged benefits.

Unlike the short-term investments we mentioned earlier, whole life insurance is all about guaranteed cash values you can count on, rather than the possibility of a return. You don’t have to rely on the stock market, an index, or any other sort of investment to see a return, and the insurance company keeps all the investment risk.

One of the greatest benefits of a well-designed whole life insurance policy is the guaranteed cash value. Cash value in a participating whole life insurance policy represents a part of the death benefit which you actually own called “paid-up insurance.” This cash value is accessible and available to you through a policy loan at any time, for any purpose. This gives you liquidity to use cash value for major expenses, debt payoff, business needs, retirement planning, and more while still protecting your loved ones with your death benefit.

There are no extra fees to utilize the cash values in your whole life insurance policy beyond the interest on a policy loan.

The longer you own a policy, the more your paid-up insurance grows, which translates to more cash value in the policy. Through a policy loan, you access this cash value and use it for whatever you want all while building permanent life insurance protection.

A well-designed life insurance policy can often generate an internal rate of return or IRR of 2-4% – which is currently more than many short-term investments can offer. In conclusion, while short-term investments may seem like a good idea, money for short-term needs may be better accumulated through whole life insurance cash values if you can build the long-term aspect at the same time.

Creating a long-term strategy for both short-term and long-term needs can be solved through a well-designed whole life insurance policy. At McFie Insurancewe specialize in designing and selling life insurance for the protection it gives your loved ones in addition to the other benefits, including liquidity and the guaranteed tax-deferred growth.

Let us help you with a whole life insurance policy designed for high cash value, so you don’t have to rely solely on short-term investments tied to the market.

Give the McFie Insuranceteam a call today at 702-660-7000 or schedule a strategy session to see how life insurance can help you to grow and protect your wealth.

by John T. McFie

by John T. McFie

I am a licensed life insurance agent, and co-host of the WealthTalks podcast.

As a 15-year practitioner of the Infinite Banking Concept on a personal level, I can help you find the clarity and peace of mind about your financial strategy that you deserve.

Working with hundreds of financial scenarios over the years has helped me to develop a sixth sense about how to quickly find a clear and balanced solution for clients using whole life insurance as a financial tool.