702-660-7000

702-660-7000

Wealth Accumulation means gathering enough money to enjoy financial peace of mind. Essentially, you’re boosting your net worth gradually to reach a state of steady and reliable finances. While many aim to build up their wealth, obstacles like living costs, debt, and confusion about retirement planning can stand in the way. Unfortunately, without a clear step-by-step guide, many people struggle to grow their wealth and end up short of money in their retirement years.

Avoiding these three common wealth-accumulation mistakes is key to a successful start. To effectively progress toward wealth accumulation, you’ll need the right strategy—and a strategy you can start using right now.

There are five key components to successful wealth accumulation. And the order of these five components are also critically important. A big problem for many people is they don’t know what these steps are, or what order to put them in…

An easy read and a perfect introduction to whole life insurance and The Perpetual Wealth Code™ Available in eBook or Audiobook format.

Download here>

Putting protection first is essential in wealth accumulation. Prioritizing protection over even savings is crucial in building wealth. Without it, you stand to lose all your accumulated wealth, putting your family and business partners in jeopardy. It’s almost impossible to grow your net worth without first safeguarding what you currently have.

For instance, imagine investing your savings or retirement funds in the stock market, only to see the market crash and lose over half of your account’s value. Such a loss could derail your retirement and wealth-building plans. What would you do if you lost that money? How would you recover the lost time? And what if the market crashes again? The market offers little to no protection for your wealth and retirement savings. Financial protection is fundamental to accumulating wealth.

Life insurance offers a reliable way to protect your family, yourself, and your finances. Whole life insurance, in particular, not only provides for your family after you’re gone but also helps preserve your wealth. It builds cash value over time, which you can use to support your wealth-building efforts, offering financial flexibility and liquidity. With life insurance, you can secure the necessary protection for just pennies on the dollar. To find out more about the most effective life insurance for protection, consider exploring further:

Whole Life Insurance Pros and Cons

A bad budget system acts like a fad diet: it might seem effective at first, allowing you to trim unnecessary costs, reduce some debt, and save a bit of money, but its overly restrictive nature makes it unsustainable. This approach doesn’t make for a solid wealth-building strategy.

In contrast, a good plan for accumulating wealth will feature a budget system that’s easy to stick to, sustainable over the long haul, and doesn’t feel overly constricting.

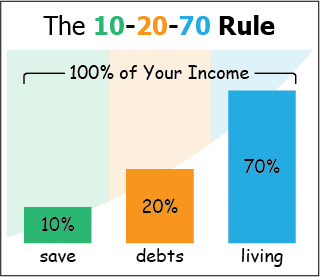

The 10-20-70 Rule offers a straightforward budgeting framework to guide the allocation of your income in a manner conducive to wealth building. This rule divides your income into three primary categories: Savings, Debt Management, and Living Expenses:

When setting up your budget, it’s crucial to assess your spending habits. Examine how much money you’re spending and what you’re spending it on. Are your purchases necessary? Do they contribute to your wealth accumulation? Reevaluate any ongoing subscriptions to ensure they still serve your needs and adjust as necessary.

Making saving your third priority is key in building wealth. The main mistake people make is saving money the wrong way. Many think investing counts as saving, but that’s not the case. Saving means putting your money in a safe spot where market risks, taxes, fees, and penalties don’t touch it, and where you can easily access it. This accessibility is crucial for a successful wealth-building strategy.

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here>

However, keeping money beats merely saving it. While saving suggests putting money aside to sit unused, like those fancy shoes you save for special occasions, keeping money involves actively managing it. Safe spots for keeping your money include savings accounts, certificates of deposit, money market accounts, and notably, participating whole life insurance policies. With whole life insurance, you not only secure life insurance protection but also benefit from guaranteed growth, potential dividends, and the security features of a solid policy.

This brings up another question, “How much should I be saving (or keeping)?” To make good progress with your wealth accumulation plan you should be keeping 10-30% of your income. Following the 10-20-70 Rule, you can quickly calculate how much you should be keeping based on your income.

Sometimes, in the rush to build wealth, people feel tempted to invest money before clearing their debts. Yet, handling debt wisely can often yield a higher return than many investments!

Debt management doesn’t always mean paying it all off. Some debts are actually beneficial. For example, a debt that improves your cash flow or offers tax advantages might be worth maintaining. If your car loan enables you to commute to a job where you earn money, it might be considered a good debt. On the other hand, student loans or credit cards with high interest that keep piling up can hinder your wealth-building efforts and are likely bad debts you’d want to eliminate.

Take a close look at your debts to determine which are helpful and which are harmful. Develop a strategy to get rid of the bad debts, and then put that plan into motion.

After eliminating the bad debts, reevaluate how much money you’re saving (or keeping). The funds you were using to tackle bad debts can often be redirected towards savings, giving your wealth accumulation efforts a significant boost.

Investing should always come last in your wealth accumulation plan. There are two main reasons for this:

Investing requires a deep understanding and various skills to be successful. Lack of knowledge in investing can lead to significant financial setbacks and potentially erase all your efforts in building wealth. Even with a reliable financial advisor, investing carries inherent risks.

When you’re ready to invest, evaluate the risk level of each opportunity. Is it high or low risk? Remember, the stock market isn’t the only place to invest. Often, the best investments lie in areas you’re already knowledgeable about. For instance, if you’re a mechanic, investing in a new lift or a specialized tool might be a smart choice.

A WORD OF CAUTION: Many believe that high-risk investments offer better rewards and more opportunities to build wealth. However, this isn’t always the case. High-risk investments also come with a higher chance of loss, which could devastate your wealth-building efforts. Aim for a balanced approach with investments that promise steady wealth growth over time, rather than gambling on a high-risk opportunity. The adage “Slow and steady wins the race” rings especially true in investing.

People facing financial difficulties often feel compelled to choose high-risk investments to “catch up” or “recover their losses.” This mindset can jeopardize your entire wealth accumulation plan.

Occasionally, some may strike it lucky, but relying on luck is not a sound strategy for wealth accumulation. A more reliable plan involves prioritizing protection, building a solid savings foundation, and effectively managing debt before venturing into the uncertain terrain of high-risk investments.

Many people get the steps to wealth accumulation backwards. They start by investing, hoping to earn enough money to clear their debts. They believe once they’re debt-free, they can start saving and really kick off their wealth accumulation. However, by the time they consider protecting their accumulated wealth, it’s often too late or too costly. And if an investment fails, wiping out their wealth, they’re left without any savings or protection to lean on, only debt that needs paying off – the exact opposite of accumulating wealth. To build wealth effectively, it’s crucial to follow these five steps in the correct sequence and adhere to proven principles.

Like the old Chinese proverb says, “The best time to plant a tree was 20 years ago. The second-best time is now.” It’s always best to take action while you can. The best time to start your successful wealth accumulation plan is now.

By adhering to these steps, you’ll craft a wealth accumulation strategy that truly delivers, enabling you to build wealth effectively.

If you want to get protection and keep your money in a low-risk place, where taxes, fees and penalties are minimal, we’d like to help you.

If you want to get protection and keep your money in a low-risk place, where taxes, fees and penalties are minimal, we’d like to help you. Schedule a strategy session with our office and we’ll design you a custom whole life insurance policy that aligns with your wealth accumulation goals and budget.