317-912-1000

317-912-1000

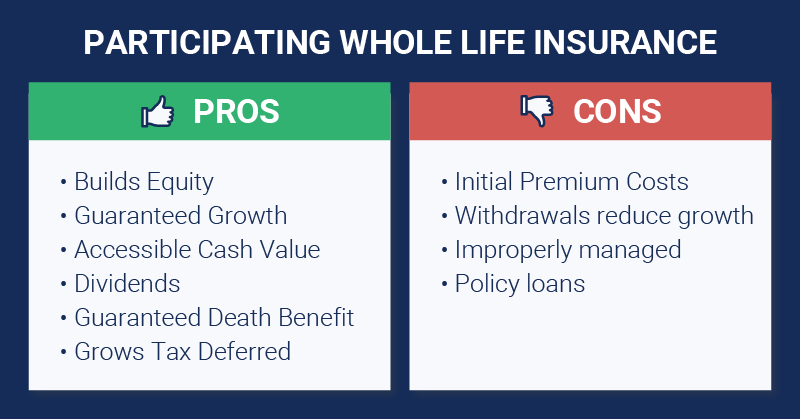

You’ll hear many arguments for and against whole life insurance. Many people wonder what whole life insurance truly is and if the benefits of a policy would help them. There are many different types of life insurance. In this article, we cover how participating whole life insurance works, its pros and cons, how it compares to term insurance, and how to determine if it’s right for you.

Participating whole life insurance (PWLI) is a type of permanent life insurance that provides a death benefit, cash value growth, and the opportunity to earn dividends. A PWLI contract is designed to remain in force for the insured’s whole life and typically requires premiums to be paid every year.

The contract is between the policy owner[i] and the insurance company, where the insurance company contractually guarantees to pay to the beneficiaries of the policy a certain death benefit upon the death of the insured as well as share the excess profits the company generates with policy owners (participants, policyholders). This sharing of profits is referred to as a dividend but is considered a refund of the premium according to current tax law in the United States. Therefore, these dividends are not treated as taxable income in most cases.[ii]

The ability to collateralize a policy is one of the major pros of whole life insurance. Participating whole life insurance contracts provide for the buildup of something called cash value. This cash value is contractually guaranteed to be made available to the policy owner through the policy loan and/or surrender provisions. These provisions allow the policy owner to collateralize their policy and borrow money from the insurance company, or to surrender part of the death benefit and withdraw equity from their policy. This cycle can help with the accumulation of wealth and the creation of a financial legacy.

Click to read how José and Theresa are creating a legacy for their grandchildren

On the other hand, a loan that is taken from the insurance company against a policy in this manner will be subject to interest, and if this interest and future premiums are not paid, the contract may lapse, and the loan will then be considered a withdrawal and could be subject to taxation.[iii] If the life insurance plan isn’t well-managed, it could become a tax liability, which is the main con of whole life insurance plans.

That being said, if the loan interest and premiums are paid according to the contract, the policy will not lapse and the owner of the policy can use the capital borrowed for whatever need or purpose intended. The only requirement to initiate a policy loan is to assign the policy to the insurance company for security, either making a phone call or completing a simple loan request form. Policy loans alter the death benefit of the policy and may alter the dividends that are paid in some PWLI contracts.

The policy loan provision of participating whole life insurance policies guarantees a relatively liquid source of equity that can be borrowed and self-managed. When done appropriately, with the assistance of a good consultant, this positive cash flow can be used to create more value, wealth, and abundance.

It can also create the ability to increase policy premiums, and therefore allow you to repeat this cycle. With this cycle of positive cash flow and proper management, the pros of having whole life insurance easily outweigh the potential tax con that could result from improper management.

Here’s a breakdown of the whole life insurance pros and cons we just went over:

Pros:

Cons:

One of the most powerful ways to use participating whole life insurance is through the Infinite Banking Concept—a strategy where you become your own source of financing by borrowing against your policy’s cash value. It’s not just about life insurance—it’s about taking control of your money and using it in a smarter way.

The Infinite Banking Concept works because of the unique structure of high-cash-value participating whole life policies. These policies allow policyholders to access capital through tax-advantaged policy loans, while the policy continues to earn guaranteed growth and potential dividends—even while money is borrowed.

Here’s how Infinite Banking helps you:

At McFie Insurance, we specialize in helping clients structure participating whole life policies specifically designed for banking and cash flow strategies. When properly designed and managed, this approach creates a private financial system you control—often with more flexibility and long-term value than traditional savings or credit options.

If you’ve ever searched “what is the Infinite Banking Concept” or “how does infinite banking work,” know that the foundation is right here—in participating whole life insurance. The next step is learning how to implement it for your unique financial situation.

A key factor in whole life insurance is whether it is a participating insurance policy, where policyholders may receive dividends, or non-participating, where policyholders do not receive dividends.

Participating whole life insurance provides a guaranteed cash value and death benefit and the potential of earning dividends. Participating whole life insurance is the only life insurance contract that allows you to receive dividends.

Dividends received on participating life insurance policies add both to the cash value of a policy and to the death benefit with the selection of the right dividend option. Insurance dividends work similarly to stock dividends. When you pay your premium, a portion of this value will be placed in a participating account which is invested by the insurance company.

Each year, policyholders receive a portion of the earnings (dividends) from the participating account. This dividend payout depends on the economic well-being of the insurance company providing the policy.

Yearly dividends will vary based on several factors specific to the policyholder and insurance company. Here are the factors that could influence your annual dividend amount:

While dividends can vary depending on all these factors, it’s possible to research how individual insurance companies have performed in the past with dividends. For instance, you can see that certain insurance companies have paid dividends to their policyholders for the last 100 years without missing a single year. This research can help you feel more confident about an insurance company’s strength and its continued ability to pay dividends even in times of recession.

When discussing whole life insurance, one of the most common discussions is about term vs. whole life insurance pros and cons. While both policies involve premiums resulting in a death benefit, there is no accumulation of cash value with term life insurance. A term life insurance policy only covers someone for a period of time, and there is only a death benefit if they die during this coverage. Term insurance policies can be cheaper, short-term.

Whole life insurance tends to be more expensive than term initially, but it also creates an accumulation of wealth that can be collateralized or borrowed. This process can help build a financial legacy as well as provide a death benefit, and over time whole life insurance is less expensive than term insurance. When it comes to term vs. whole life insurance pros and cons, choosing which is right for you depends on your circumstances and financial goals.

|

Get a working knowledge of how each type of life insurance policy works. After reading this 10-page booklet you'll know more about life insurance than most insurance agents. Download here> |

The guaranteed loan provisions found in participating whole life insurance contracts are rewarding to those who understand and manage them accurately. However, if these policies are not managed well, the policy could lapse or create a tax liability for the owner.

McFie Insurance can help you by:

If you have any questions or if you are interested in setting up a life insurance policy, schedule an appointment with McFie Insurance.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.