702-660-7000

702-660-7000

In its simplest form, a dividend is money paid from your life insurance company to you. Often this means that you have a whole life insurance policy that pays dividends, also referred to as a participating policy contract. When it comes to dividends, purchasing a participating policy contract with a company is like investing in that company. When that company is profitable, it rewards your investment by paying you dividends. It’s important to note that this is only available for participating life insurance policies. Dividend options are how you choose to receive this money.

Similar to an investment, dividends are not fixed ahead of time. As the company does well or poorly, the amount you receive via dividends will vary. Companies cannot guarantee a dividend in advance, but once a dividend has been paid, it cannot be taken away. Dividends can be different for each company. Because of this, it’s important to do your research on the company’s dividend-paying history. Some dividends are dependent on your policy loan status, meaning with an outstanding loan, you could earn less dividend. How dividends are paid is determined by the direct and non-direct recognition policy status.

For a policy with dividends included, you are often paying a higher premium. Because of this, the tax world considers that dividends are a return of premium. Therefore, if you are receiving dividends through a participating whole life policy, most dividend options are tax-deferred. This is the number one thing to take away about life insurance dividends.

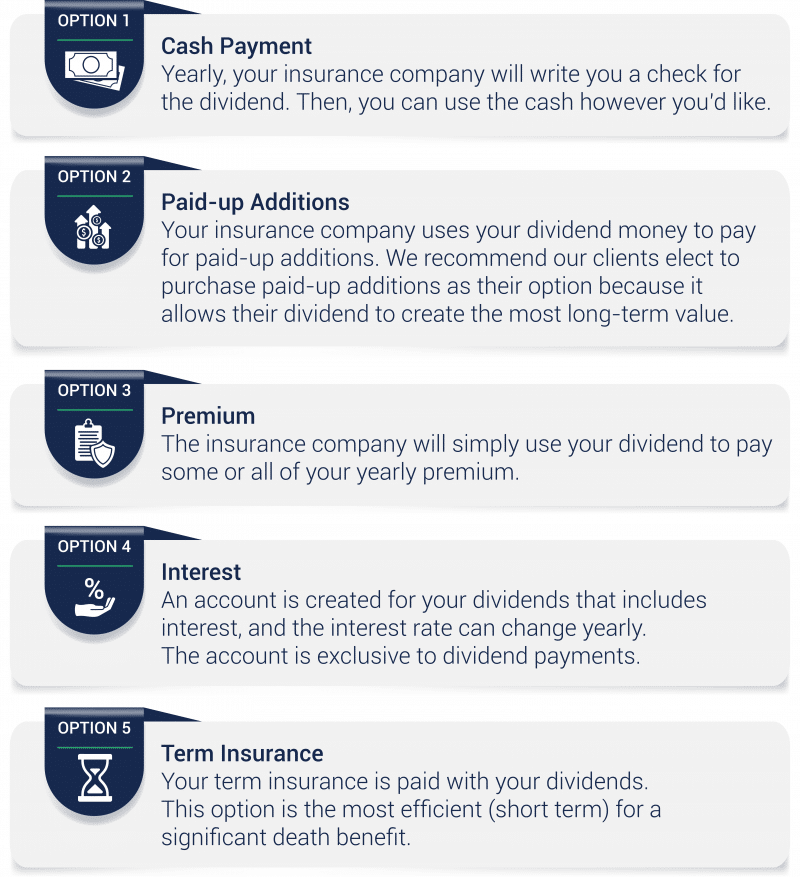

So what are dividend options? Life insurance dividend options are the different ways you can elect to receive your dividend. All of the following are dividend options except the fifth.

Applying your dividend toward paying for term insurance is becoming more popular, but it isn’t one of the classic dividend options.

Let’s get into how these dividend options work, as well as their pros and cons.

This dividend option is exactly what it sounds like. Yearly, your insurance company will write you a check for the dividend. Then, you can use the cash however you’d like. Like we mentioned earlier, dividends are seen as a premium refund. When receiving them as cash, they aren’t taxable until/unless they exceed premiums paid for a policy (cost basis).

For instance, let’s say you paid premiums on a whole life insurance policy for 15 years and your cost basis is now $70,000. Then, you opt for dividends in the form of cash payments. The day you receive a total of $70,000 in cash dividends, your dividends received in cash become taxable income going forward. Also, once dividends meet the cost basis (the process described above), anything else withdrawn from the policy is also taxable.

Paid-up additions (PUAs) are like adding to the value of your original policy and may increase the cash value significantly over time. When you choose this option, you opt for your insurance company to use your dividend money to purchase paid-up additions. We recommend our clients elect to purchase paid-up additions as their option because it allows their dividend to create the most long-term value.

As you acquire more PUAs, both your cash value and your death benefit increase. As your death benefit increases, you become eligible for more dividends. Of all the dividend options available, we recommend this option because of these benefits.

This life insurance dividend option is fairly straightforward. When chosen, your insurance company will simply use your dividend to pay some or all of your yearly premium. If you choose this option, you might also need to choose a secondary option if your dividend is larger than your premium. On the other hand, if your dividend is less than your premium, you’ll need to pay the rest as you normally do.

When you opt for using your dividend toward your premium payment, you must start paying your premium annually. For instance, if your annual premium is $8,000 and your dividend that year is $1,500, you would still need to pay the remaining $6,500 all at once. Since dividends fluctuate, you might be paying more or less of your premium each year.

This option creates an account for your dividends that includes interest. This account is exclusive only to dividend payments, meaning you can’t choose to add other funds if the interest rate is good or for some other reason. You can, however, keep the funds in the account for however long you wish and withdraw the funds at any point in time to use. The negative is that the account does not benefit from the other tax-exempt dividend options. While your dividends themselves are not seen as taxable income as we mentioned earlier, any interest accumulated is and will be taxed on a yearly basis regardless of whether or not the funds were withdrawn.

Finally, this life insurance dividend option has emerged rather recently allowing you to pay for term insurance with your dividends. This option is the most efficient (short-term) for a significant death benefit. If your dividend exceeds the cost of the term insurance, you’ll need to choose a secondary option as well.

After all this talk about life insurance dividend options, you might want to understand even more about them. This video explores if dividends are all they’re cracked up to be, and you can always schedule a complimentary strategy session to see a life insurance illustration with illustrated dividends.

by Gracine McFie

by Gracine McFie

There are many ways to access information about finances, but it can be hard to determine which sources are trustworthy. I like to put information together in an accurate, straightforward, easy to understand manner so people can make good financial decisions based on the information provided without having to waste time wondering if the source is reliable.

Get a working knowledge of how each type of life insurance policy works.

After reading this 10-page booklet you'll know more about life insurance than most insurance agents.

Download here>