702-660-7000

702-660-7000

A hard money loan secures real estate property as collateral. These loans often serve as a “last resort” or function as short-term bridge financing in real estate transactions. Typically, individuals or companies, rather than banks, provide these loans.

The terms of hard money loans depend primarily on the property’s value used as collateral, rather than the borrower’s creditworthiness. Private individuals or companies, not traditional banks, usually issue these loans because they recognize the potential value in these riskier ventures.

|

An easy read and a perfect introduction to whole life insurance and The Perpetual Wealth Code™ Available in eBook or Audiobook format. Download here> |

The statement that hard money loans generally carry higher interest rates than traditional mortgages is indeed correct. Hard money loans typically have interest rates ranging from about 8% to 18%, whereas traditional mortgage rates were between 5% and 7% as of April 2024. This reflects broader industry norms, where hard money lending serves a niche market with distinct needs, often catering to real estate investors such as flippers or short-term borrowers who require quick access to capital.

The elevated rates on hard money loans stem from the increased risk lenders assume and the shorter duration of these loans. Since hard money loans are usually short-term solutions, often lasting just a few months to a year, the higher interest compensates lenders for this heightened risk and expedited process.

Investors like flippers are generally willing to accept these higher costs because they anticipate repaying the loan rapidly, thereby reducing the overall interest expense. This approach can make hard money financing more manageable despite the steep rates. On the other hand, for borrowers who can afford to wait for traditional financing, pursuing a conventional mortgage or personal loan with lower rates is typically more cost-effective over the long term.

The main advantage of a hard money loan lies in its speed and relatively relaxed qualification requirements. This makes it particularly well-suited for investment opportunities where time is of the essence, highlighting its role as a strategic tool rather than a default financing option.

Real estate investors, developers, and flippers typically use hard money loans. These loans can be arranged much more quickly than those from traditional banks. Hard money lenders often issue funds within as little as 10 business days, compared to the 30-50 day waiting period at traditional banks. Most hard money lenders will lend between 65% and 75% of the property’s current value, with loan terms usually ranging from 6 to 18 months.

Property flippers, who often plan to renovate and resell the collateral real estate within a year or less, frequently seek hard money loans. The higher cost associated with a hard money loan is usually offset by the borrower’s plan to repay the loan quickly.

Hard money loans are also useful in turnaround situations, short-term financing needs, or for borrowers with poor credit but substantial equity in their property. The quick issuance of these loans makes them a viable option to prevent foreclosure.

Many view hard money lending as an investment and have adopted it as a business model, actively engaging in this practice.

The cost of a hard money loan is typically higher for the borrower compared to financing through banks or government lending programs, reflecting the increased risk assumed by the lender. However, this higher expense is balanced by the advantages of faster access to capital, a less stringent approval process, and potential flexibility in the repayment schedule. These benefits often make hard money loans an attractive option for those needing quick financing or those who may not qualify for more traditional loan arrangements.

57-page slide deck 57-page slide deck |

Many people are losing money with typical financial planning. Even people who were "set for life" are running out of money in retirement. Here's an easy guide with 3 things you can do to become wealthier. Download here> |

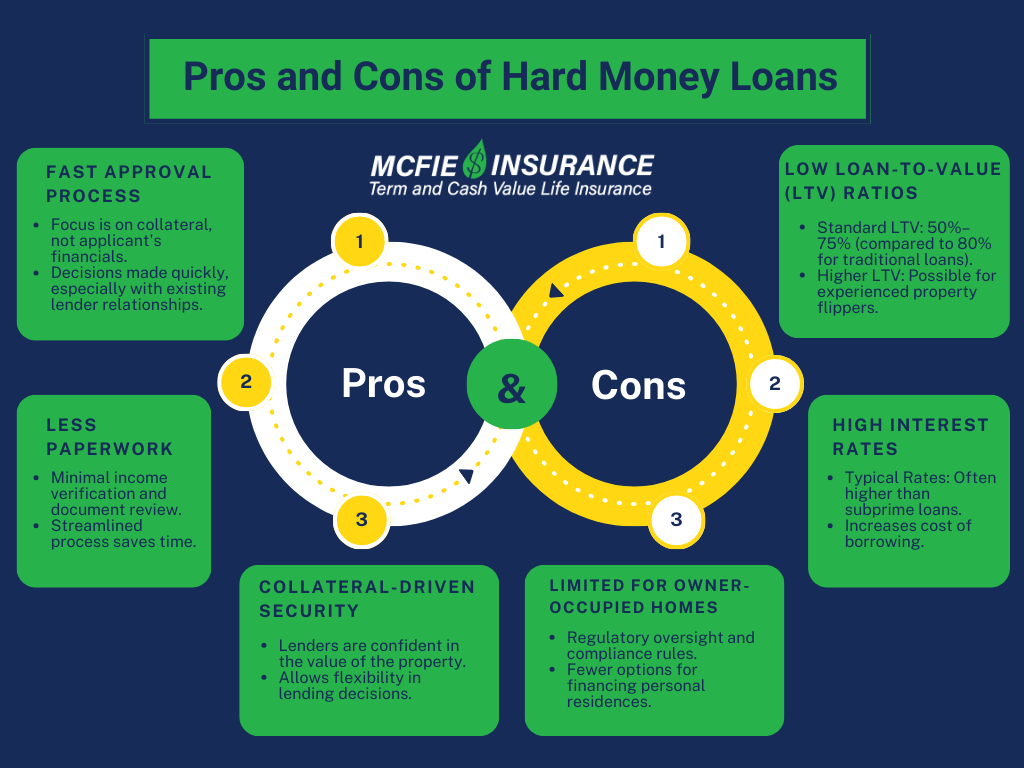

Hard money loans offer both advantages and disadvantages as a financial product. They are quick and easy to arrange, and they typically provide high loan-to-value (LTV) ratios. However, these benefits come with the drawback of high interest rates.

One advantage of a hard money loan is the faster approval process compared to traditional mortgages or bank loans. Because hard money loans are typically funded by private investors rather than large financial institutions, these lenders can make quicker decisions. Their main focus is on the value of the collateral—the property itself—rather than the borrower’s credit score, income, or overall financial history.

This approach means lenders spend less time scrutinizing detailed paperwork, such as income verification or extensive financial documents, which can often slow down traditional loan approvals.If the borrower has an existing relationship with the hard money lender, the approval process can be even more expedited and efficient.

Hard money investors are also more tolerant of potential repayment delays since they often have the option to take ownership of the property if the borrower defaults. In such cases, investors may perceive greater long-term value and opportunity in reselling or managing the property themselves, which reduces their risk compared to conventional lenders who rely solely on timely repayments. This flexible, collateral-focused approach is why hard money loans are appealing for borrowers needing fast, asset-backed financing.

Since the property itself serves as the sole protection against default, hard money loans generally feature lower loan-to-value (LTV) ratios than traditional loans—typically between 50% and 75%, compared to 80% for standard mortgages. These ratios can be higher if the borrower is an experienced flipper.

Interest rates on hard money loans are also notably high, often exceeding those of subprime loans.

Another disadvantage is that hard money lenders may choose not to finance owner-occupied residences due to the regulatory oversight and compliance rules that govern these types of loans.

Using a whole life insurance policy for real estate investing is an alternative strategy to the more common hard money loans, offering distinct financial advantages, especially in terms of flexibility and cost. Here’s how you can utilize a whole life insurance policy to fund your real estate investments:

|

Policy Checklist Make Sure You Get a Good Policy Is your policy good or bad? Use this checklist to help evaluate your existing life insurance or a new policy you are considering. |

A whole life insurance policy is not just a tool for providing a death benefit; it also accumulates cash value over time. This cash value grows at a guaranteed rate and can be borrowed against with no tax implications. Unlike term life insurance, whole life provides coverage for the policyholder’s entire life, and part of the premium payments contribute to this cash value.

Before you can use your whole life insurance for real estate investing, the policy must have accumulated enough cash value. Consistent premium payments are essential to build up the cash value that can later be used for investments.

The cash value that develops in a Whole Life insurance policy can be accessed through a policy loan. The primary advantage here is that these loans do not depend on credit checks or lengthy approval processes, unlike traditional or hard money loans. Additionally, you won’t have to deal with external lenders or the high interest rates associated with hard money loans.

The borrowed funds can be used to finance real estate purchases similar to how you would use cash from other sources. You can use it for down payments, full property purchases, or renovation projects. Since these funds are not tied to the property itself, you have flexibility in how and where you invest them.

Loans taken against the cash value of a whole life insurance policy are unique because they don’t have a fixed repayment schedule. However, it’s important to manage this flexibility wisely. Interest on the loan will continue to accrue, and if not repaid, it could diminish the death benefit payable to your beneficiaries. Nonetheless, the repayment terms are much more flexible than those of a hard money loan.

Using whole life insurance for real estate investing comes with several benefits:

The interest rates on loans taken from your insurance policy are typically lower than those of hard money loans.

You avoid the hassle and time of dealing with external lenders.

You set your own repayment terms, which can ease cash flow issues.

The guaranteed growth of the policy continues uninterrupted even when you have an outstanding policy loan.

Using whole life insurance for funding real estate investments is a viable and often advantageous alternative to hard money loans, particularly for investors looking for lower-cost capital and greater flexibility in their financing options.

Hard money loans are a type of short-term financing, with terms ranging from 3 to 36 months. Most hard money lenders offer loans amounting to 65% to 75% of the property’s current value. The interest rates for these loans typically range from 10% to 18%.

Hard money loans suit wealthy investors who need quick funding for an investment property without the bureaucratic delays of bank financing. These loans are ideal for covering one-time expenses or projects, provided the borrower is reasonably confident in their ability to repay the loan promptly.

Hard money lenders usually charge higher interest rates than traditional lenders because they assume more risk. They often require a larger down payment compared to traditional loans, and borrowers have a shorter time frame to repay the loan.

Navigating the world of hard money lending and real estate investing doesn’t have to be complicated or overwhelming. If you’re interested in learning how to leverage whole life insurance to enhance your real estate investment strategy, we’re here to help. Schedule a strategy session with us today, and we’ll walk you through all the unique opportunities and advantages that a whole life insurance policy can offer. Together, we’ll create a tailored plan to help you maximize your financial potential and achieve your investment goals with confidence.