702-660-7000

702-660-7000

A 770 account is a fancy name for a cash value life insurance policy. Life insurance cash value is regulated under IRS Tax Code section 7702, which restricts how quickly the cash value in the policy can grow without being subject to taxes. This leads to some life insurance policies which are designed to conform to section 7702 being called a 770 account, or a 7702 plan.

770 accounts are either whole life policies or some type of universal policy. Term insurance is not called a 770 account, as term policies do not have cash value.

When an insurance agent says “770 account”, they are almost certainly referring to a life insurance policy that builds cash value the policy owner can borrow from without being subject to taxes.

The term “770 account” is often used specifically to describe dividend-paying life insurance. But technically, any life insurance policy which complies with section 7702 is a 770 account.

Discover The Perpetual Wealth Code™, an easy system to maximize the control of your savings and minimize penalties so you can keep more of the money you make and build wealth every year WITHOUT riding the market roller-coaster. Download here>

770 accounts can either be whole life insurance, or some type of universal insurance.

A 770 account which is a whole life policy will build cash value as the premiums are paid. If the policy is well designed, the cash value will grow, over time, to be more than has ever been paid in premium. The policy owner can borrow the cash value at any time without paying taxes on the growth.

If the 770 account is with a mutual insurance company, it is called a participating policy and is eligible to receive dividends. Dividends are not guaranteed, so it isn’t wise to count on them. Still, it is always nice to share in the profits of a company.

A 770 account which is a universal policy, whether plain universal, variable universal, or indexed universal, also experiences tax free growth.

Unfortunately, from an insurance standpoint, universal insurance is a poor product.

While non-guaranteed values are projected nicely, actual guaranteed values are appalling.

A review of any universal policy usually reveals the guaranteed cash value and death benefit decreasing, with the policy lapsing when the insured gets older, unless the owner can pay a rapidly increasing premium.

Universal policies generate profit for the insurance company, but their design flaws make them unsuitable for consumers, even when designed as a 770 account in compliance with Section 7702.

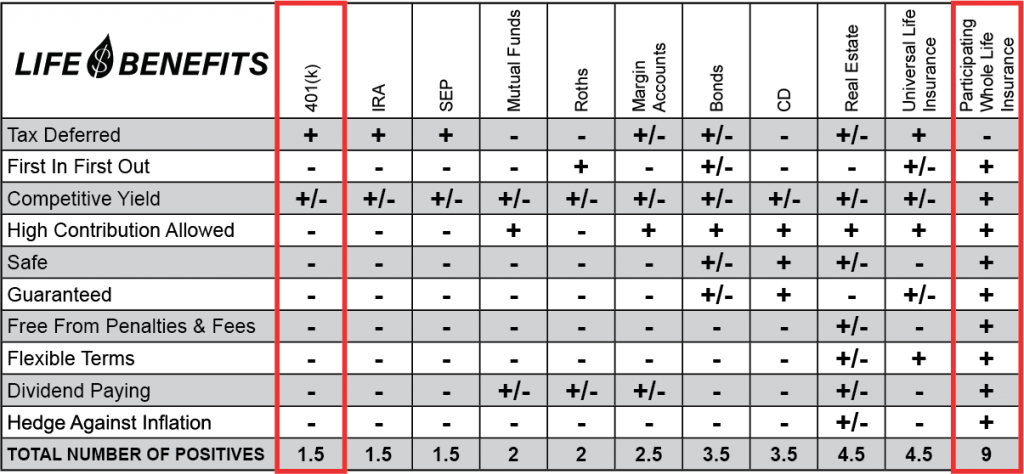

401Ks and 770 accounts are quite different. This chart helps visualize the differences between a 401K and a 770 account (participating whole life policy).

Money contributed to a 401k plan is tax deferred. While this is nice short term, you’ll have to pay taxes when you access the money later. As the tax rate tends to rise over the years, and deductions decrease as you approach retirement age, it is likely you’ll pay more in taxes by deferring them, than you would by paying them immediately.

Accessing money within a 401k can be difficult and expensive. Some plans may allow you to borrow money, but you must be careful to pay back both the loan, and interest, according to the terms or it could be considered a distribution. Some plans may require you to fully pay off the loan if you leave your job.

You may also have to pay a 10% penalty on the loan unless you are age 59 1/2 or meet a qualifying exception.

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here>

Funds withdrawn from a 401k prior to age 59 1/2 may also be subject to the 10% penalty and will be taxable as income. After age 72, withdrawals from a 401k are mandatory.

401ks are tied to the market, and while they can grow slowly over the years, a poorly performing market, or a market correction, can quickly wipe out much of the value. Starting over financially is never fun, especially when nearing, or in, retirement.

A 770 account is funded with after-tax dollars. This allows your cash value to grow tax free, as well as making the death benefit tax-free.

With a well-designed 770 account, cash value will easily grow to exceed the total amount ever paid in premium and is accessible to the policy owner in the form of a signature loan or withdrawal.

Unlike a bank, where there may be lengthy paperwork to fill out, restrictions on how the loan may be used, and an approval process, borrowing from a policy is easy. There is no lengthy paperwork, restrictions, qualifications, or approval process for a policy loan.

Policy loans are not subject to taxes, nor are there any fees or penalties for taking a loan.

The insurance company only requires interest payments. This allows the policy owner to set up their own comfortable and affordable repayment schedule. If the loan is still outstanding when the insured dies, the amount of outstanding loan will be subtracted from the death benefit before it is paid out.

Policy loans do not affect your credit score, nor will an outstanding policy loan hurt the policy performance*.

*With a direct recognition insurance company, outstanding policy loans will affect the policy dividend. Read more about this here.

Policy owners can permanently withdraw cash value from the policy. Withdrawals will be received tax free up to the cost basis (total amount paid in premium). With a well-designed policy, cash value will grow to become greater than what you have ever paid in premiums, withdrawals taken above cost basis may be subject to taxes.

57-page slide deck 57-page slide deck |

Many people are losing money with typical financial planning. Even people who were "set for life" are running out of money in retirement. Here's an easy guide with 3 things you can do to become wealthier. Download here> |

770 accounts are not dependent on the market like a 401k. 770 account values are guaranteed by the insurance company and are not subject to the whims of the market. This enables well-designed 770 accounts to grow steadily whether the market performs well or not.

A keyman policy, also known as key person insurance, safeguards a company financially if a crucial employee or stakeholder, like a CEO or CFO, becomes incapacitated or passes away. It offsets costs related to replacing such critical personnel.

When combined with a 770 Account, a keyman policy offers dual benefits. This setup not only provides policy loans from the cash value but also ensures a death benefit for the employer. This benefit is crucial for covering replacement costs during transitions, ensuring organizational stability.

Moreover, a split-dollar arrangement can be applied to key stakeholders. In this, both employer and employee share premium payments and benefits, giving the key employee access to the 770 Account’s advantages, strengthening their financial security.

A 770 Account is vital in business succession planning due to its financial support during transitions. It offers cash value to sustain business operations during the owner’s life, ensuring stability. After the owner’s death, its death benefit helps cover expenses and maintain operations while new leadership is established. The account’s policy loans provide flexible financial support during transitions.

Additionally, a 770 Account can be collateral for bank loans, enhancing loan eligibility for business growth or unforeseen financial needs. Keyman policies for employees and partners, part of the 770 Account, offer cash value and death benefits, aiding in replacing vital personnel.

In essence, a 770 Account supports business succession with its cash value, death benefits, loan collateral potential, and keyman policies, ensuring continuous operation and financial security during and after the owner’s tenure.

Get the knowledge you need to build sustainable wealth, and have peace of mind about your financial future. Order here>

The 770 account life insurance policy offers significant tax advantages regarding the cash value. This cash value not only grows at a predetermined rate or an index-linked rate, depending on your policy type, but also provides tax benefits. Furthermore, the 770 account enables policyholders to take loans against the cash value of their policy. This is particularly advantageous because the IRS does not regard the cash value of your insurance as taxable income. This creates a financially beneficial situation for policyholders. Additionally, with a cash value policy, there are no restrictions on the amount or age for taking out a loan based on its value.

A well-designed 770 account is one of the best financial tools you can own. The solid guarantees allow you to save and earn a return, while having access to your money which can be borrowed or withdrawn and used for any reason at anytime. Owning a 770 account also protects your family by providing a death benefit when you pass.

If you want to purchase a well-designed 770 account, contact us: 702-660-7000. We can help you.

by Steven McFie

by Steven McFie

Many people make bad financial decisions, not because they want to, but because they don’t understand enough to make good financial decisions. I like to make things as simple as possible. Simple things are easier to understand. And when you understand something, it’s easier to make good financial decisions. (Yes this is an old picture - need to get an updated one.)