702-660-7000

702-660-7000

Ken Fisher, Founder of Fisher Investments, wrote in USA Today on June 24, 2018, “You shouldn’t worry about Social Security running out of money because in the past this same fear has “prompted politicians to act and put in simple fixes.”[i] Then he goes on to explain that raising taxes, or the minimum retirement age (beyond age 70), could be implemented by congress to keep Social Security alive.

He also states that the “demographic crisis”, where less people are contributing and more people are taking distributions from Social Security, “Is only a problem because we’re living longer.”[ii] Good grief, doesn’t he understand that you can’t take out more than you put in?!

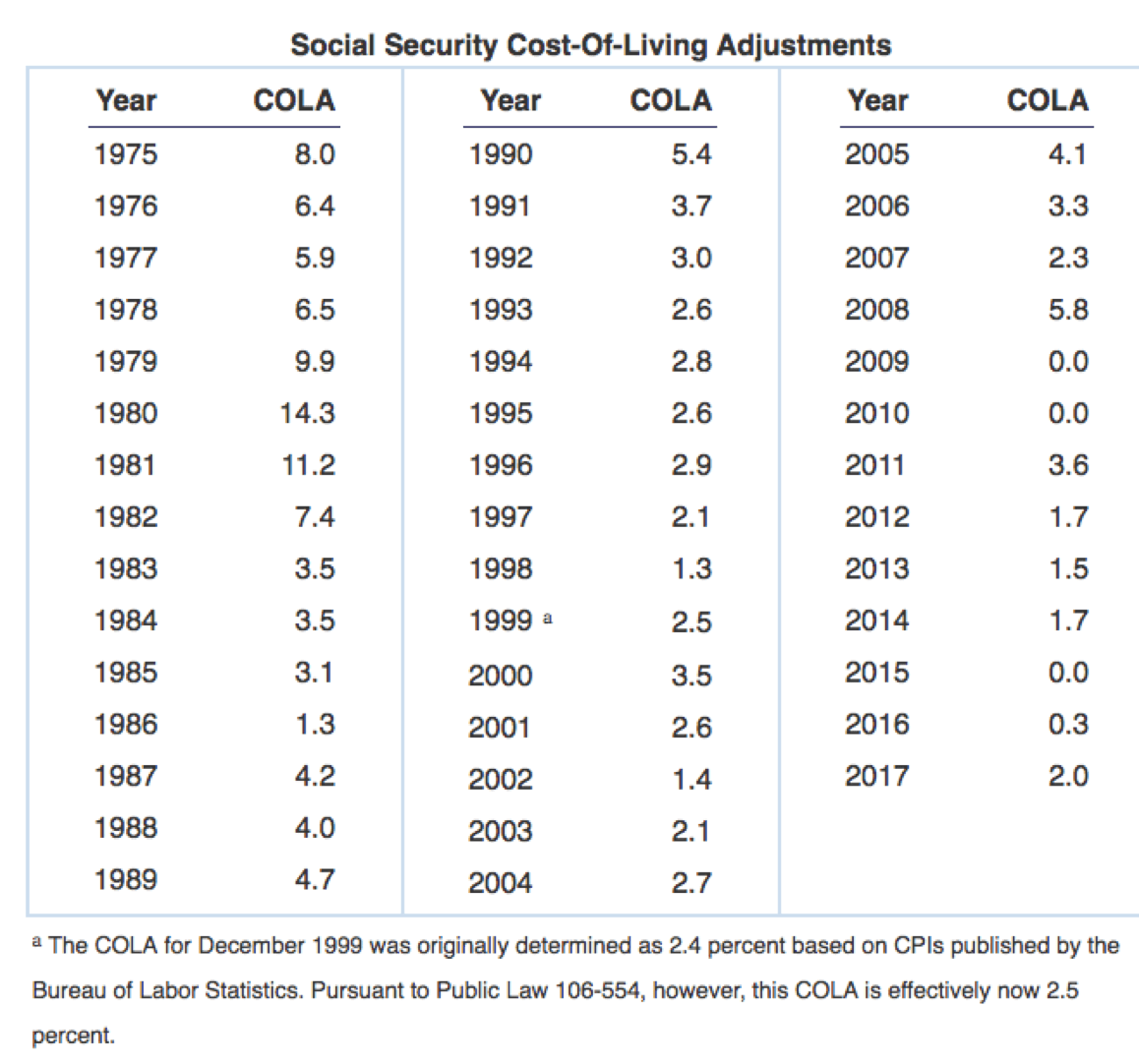

But here’s the biggest danger about Social Security which Fisher (and others) never honestly address, and that is: the cost of living adjustments (COLA) for Social Security have not kept up with inflation since the early 1990’s! And this means that, regardless of whether Social Security survives or collapses, those who are depending on Social Security for their living are on the losing end of the economic stick.

But here’s the biggest danger about Social Security which Fisher (and others) never honestly address, and that is: the cost of living adjustments (COLA) for Social Security have not kept up with inflation since the early 1990’s! And this means that, regardless of whether Social Security survives or collapses, those who are depending on Social Security for their living are on the losing end of the economic stick.

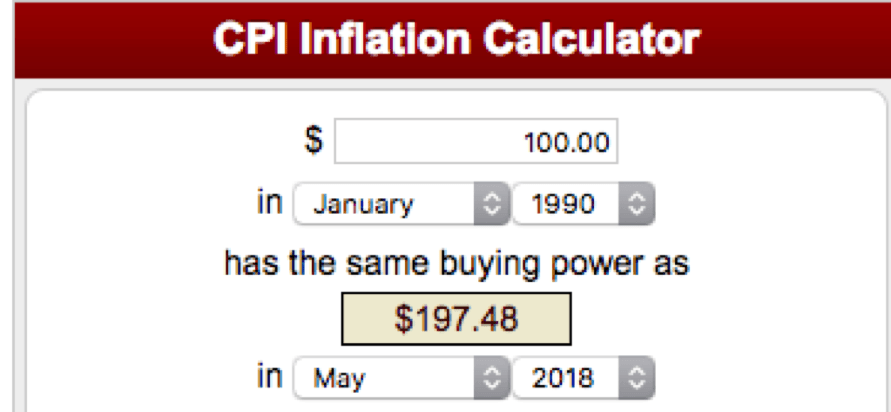

According to the Bureau of Labor Statistic Inflation calculator, $100.00 in 1990 had the purchasing power of what $197.48 has today. But have Social Security benefits risen to offset that cost of inflation?

According to the Bureau of Labor Statistic Inflation calculator, $100.00 in 1990 had the purchasing power of what $197.48 has today. But have Social Security benefits risen to offset that cost of inflation?

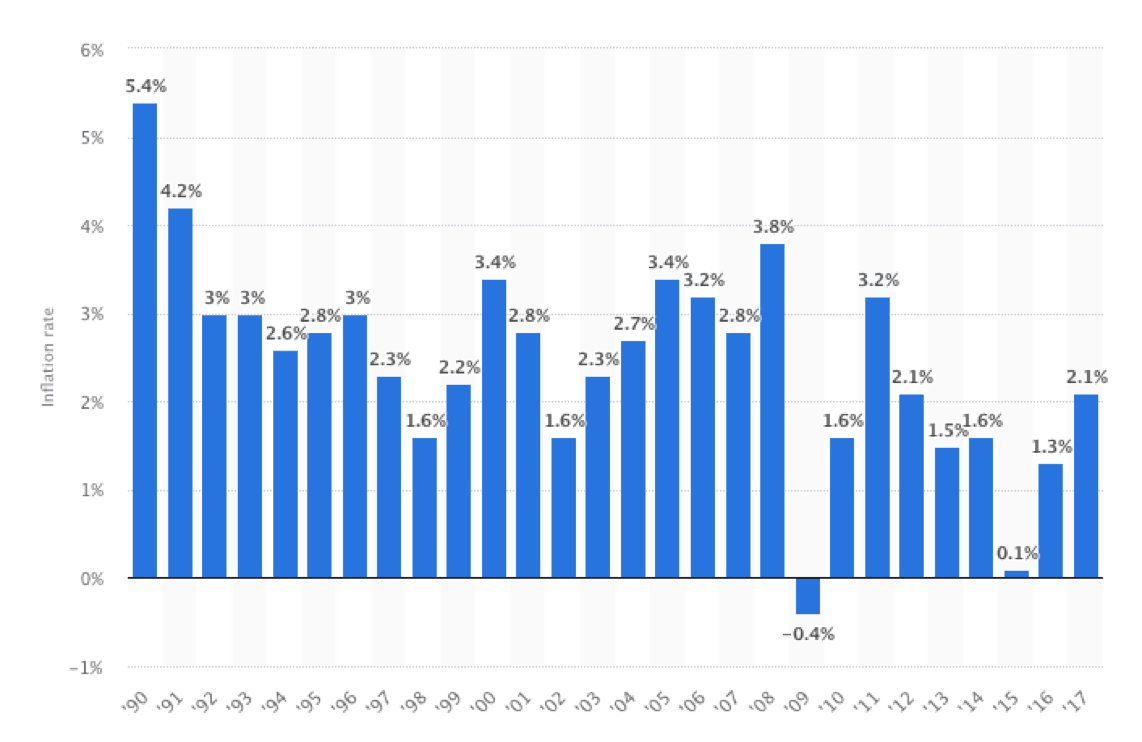

Compared to the cost of living index (Figure 3) and COLA (Figure 1) there are many years where the COLA hasn’t been adjusted even though the real cost of living index has grown at a rate of about 3.18% annually.[iii]

Given that “Social Security accounts for more than 50% of the income for 2 out of 3 retired Americans, and 90% or more for 1 out of 3 retired Americans,”[iv] what Fisher is trying to sell these poor retirees, and future retirees, is pure gobbledygook. Retired Americans know their Social Security Check isn’t going nearly as far as it used to… no number of platitudes or explanations will make that cold, hard fact disappear. But what could be even more monumental is working Americans not taking note of these things and ending up in the same boat, where 21% of married couples and 43% of single seniors, find themselves depending on Social Security for 90% or more of their income![v]

What possibly can be done to prevent these dire straits?

The solution is simple; but just because it’s simple, doesn’t make it easy. Americans today save 40 years of their life and earn a 0% rate of return because they seek a higher rate of return than is sustainable. Better to save in a guaranteed account, earning a lower rate, than to risk a higher rate and have to start over again. Those who double down and save twice as much in a guaranteed account can out-perform those who save half as much but depend on double the guaranteed rate.

Now, think about what happens when those depending on the 10% ROR get hit by a market correction in years 8 and 18? If that correction is 10%, a moderate and typical correction, they will end up with only $334,992, not the $442,487 they were expecting after 24 years.[vi] So you can accurately deduct that having a guaranteed rate of return, coupled with a higher savings rate, is more important than depending on a higher rate of return to earn what you don’t want to save for in retirement.

Yet, that is what most advisors are telling their clients to do: Depend on a fluctuating market return and save only about 4-6% of their income.[vii] This is a formula for disaster!

The only solution, simple as it may be, is to save more of what you make. But the question remains, “How can you save more without losing more to inflation?”

Again, the answer is simple: Learn the time tested financial skill of leverage. Leveraging your savings and being allowed to use another person’s money, while your savings are still growing at their guaranteed rate, will ultimately help you to overcome the hidden cost of inflation and save even more! This is the Perpetual Wealth Code™.

If you are interested in learning and applying this financial tool to your retirement planning, call 702-660-7000 and schedule your one-on-one strategy session with our office. (Or schedule online here: https://mcfieinsurance.com/strategy-session/) During your strategy session, we’ll show you how you can keep more of the money you’re making without losing it to inflation and while planning for your retirement in a secure and guaranteed way.

[i] https: //www.usatoday.com/money/

[ii] Ibid

[iii] https://inflationdata.com/Inflation/Inflation/DecadeInflation.asp

[iv]https://www.google.com/search?q=how+many+people+depend+on+social+security+in+retirement&oq=how+many+people+depend+on+social+security+in+retirement&aqs=chrome..69i57.15710j0j7&sourceid=chrome&ie=UTF-8

[v]https://www.google.com/search?q=how+many+people+depend+on+social+security+in+retirement&oq=how+many+people+depend+on+social+security+in+retirement&aqs=chrome..69i57.15710j0j7&sourceid=chrome&ie=UTF-8

[vi] Robert Shiller

[vii]https://www.google.com/search?q=average+savings+rate+of+Americans&oq=average+savings+rate+of+Americans&aqs=chrome..69i57.8694j1j7&sourceid=chrome&ie=UTF-8