702-660-7000

702-660-7000

Money magazine’s recent analysis reveals intriguing insights into the relationship between income and cost of living across the United States. By inspecting median income and living expenses in all 50 states, they uncovered a notable trend. In 18 states, individuals perceived their take-home pay to stretch further than it actually does. Despite earning what seems like a respectable income, the lower cost of living in these states allows for a greater sense of financial security or disposable income.

In contrast, in 16 states, individuals may feel as though their earnings fall short of their value. Even with what appears to be a decent income, the high cost of living in these states can erode purchasing power, leading to a sense of financial strain or restricted budgeting. For the remaining 16 states, the relationship between earned income and cost of living appears balanced. In these states, individuals are likely to feel that their earnings accurately reflect their purchasing power and financial stability, without significant discrepancies between perceived and actual income.

Understanding these regional variations is vital for financial planning and decision-making, especially for those thinking about relocation or job opportunities. By considering both income and cost of living, individuals can make informed choices to optimize their financial well-being and achieve greater financial security. Living in one of the 18 states where your take-home pay feels more substantial than it actually is could offer a distinct advantage. This discrepancy implies that the cost of living compared to your income is relatively lower than in other states. As a result, individuals in these states may find themselves able to retain a greater portion of their earnings, fostering financial stability and potentially allowing for more savings or investments.

Given that approximately 90% of Americans rely on Social Security for a significant portion of their retirement income, understanding the potential impact of your location on your financial well-being in retirement becomes crucial. Where you live could indeed play a significant role in determining how well you fare in retirement. Lower living costs relative to income in certain states may translate into a more comfortable retirement lifestyle, with a higher standard of living achievable on retirement savings and Social Security benefits. Considering the relationship between income, cost of living, and retirement prospects is essential for individuals planning for their financial future. Choosing a location with a favorable balance between income and living expenses can contribute to greater financial security and well-being, both during your working years and in retirement.

Living in Alaska, California, Connecticut, or Hawaii, where it feels like you earn 14% to 16% less than what you actually earn, has the potential to limit your ability to keep more of what you actually do earn. While living in Alabama, Nevada, Ohio, Montana, and Utah, where it feels like you are earning 10% to 12% more than what you actually do, should make it easier for you to keep more of what you earn.

Interestingly, the apparent disparity between perceived and actual earnings doesn’t always align with the amount of money individuals are actually able to retain from their earnings.

For instance, Connecticut, ranked as the top state where it feels like you earn less than you actually do, boasts the highest median savings rate in the nation. Despite the perception of earning less, individuals in Connecticut seem to prioritize saving and financial planning, resulting in a higher median savings rate compared to other states.

In Alabama, one of the states where it feels like you make more than you actually do, surprisingly exhibits the lowest median savings rate in the country. Despite the perception of higher earnings, individuals in Alabama may not be saving as much of their income, possibly due to higher expenses or different spending habits.

These observations challenge the correlation between perceived income and savings behavior. Factors such as cultural attitudes towards saving, cost of living, and individual financial habits may play significant roles in determining savings rates across different states. Understanding these nuances is essential for individuals striving to achieve financial security and plan for retirement effectively. Regardless of how income is perceived, cultivating healthy saving habits and sensible financial management remain critical for long-term financial well-being.

The median savings rate offers insight into the financial habits of individuals, indicating that 50% fare better than the average, while the other 50% fare worse. Even with this understanding, the discrepancy between perceived income and actual savings suggests that what you make and how your personal economy makes you feel about your earnings might not be as influential as expected in determining how much you actually retain from your earnings.

It’s been suggested that one’s beliefs about the economy have a greater impact on personal finances than the actual economic conditions. This notion underscores the importance of mindset and financial philosophy in wealth accumulation. Nelson Nash, renowned for his work on the Infinite Banking Concept (IBC) in his book “Becoming Your Own Banker,” famously emphasized the significance of saving and avoiding reliance on creditors. Nash’s philosophy proposes that saving and paying cash for purchases can lead to financial success, especially in a culture where saving is becoming increasingly rare.

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here>

Merely paying cash for everything may not be sufficient to avoid financial pitfalls like losing money to the cost of interest. To achieve greater financial freedom and mitigate the impact of interest costs, individuals need to adopt more comprehensive strategies. This is where the Infinite Banking Concept comes into play.

The Infinite Banking Concept, or Becoming Your Own Banker, offers a framework for individuals to take control of their finances by leveraging whole life insurance policies as a financial tool. By becoming their own banker, individuals can accumulate wealth, finance purchases, and grow their assets while minimizing reliance on traditional lenders and avoiding the pitfalls of interest payments. While saving and paying cash for purchases are crucial components of financial stability, embracing more advanced financial strategies like the Infinite Banking Concept can provide additional layers of protection and opportunities for wealth accumulation.

Evidence demonstrates a fascinating phenomenon: thousands of households across America with similar income levels, expenses, and liabilities manage to retain different portions of their earnings. This observation suggests that beliefs and attitudes about finances play a significant role in determining financial outcomes, often overshadowing the influence of external economic factors. Essentially, the mindset and financial behavior of individuals within these households seem to wield greater influence over their financial success than the external economic environment. This highlights the power of perception, belief, and personal financial philosophy in shaping financial outcomes.

For example, two households with identical incomes and expenses may approach saving and spending differently based on their beliefs about money management. One household may prioritize saving, budgeting, and prudent financial decision-making, resulting in a higher retention of income. Meanwhile, the other household may have a more casual approach to finances, leading to higher spending and lower savings.

This evidence underscores the importance of cultivating a positive financial mindset and adopting sound financial practices. By recognizing the impact of beliefs and attitudes on financial outcomes, individuals can take proactive steps to improve their financial well-being, regardless of their external circumstances.

This insight ultimately reinforces the idea that personal finance is not solely dictated by external factors but is also significantly influenced by internal factors such as mindset, beliefs, and behavior. By understanding and harnessing the power of beliefs, individuals can enhance their financial resilience, achieve their financial goals, and build long-term wealth regardless of the economic environment. Understanding this fact empowers you as the most influential individual in the room when it comes to preserving more of your earnings. While your environment may have some influence, ultimately, you hold the reins in determining how much of your income you retain. In essence, you have the authority to decide what expenses you prioritize and what you choose to afford.

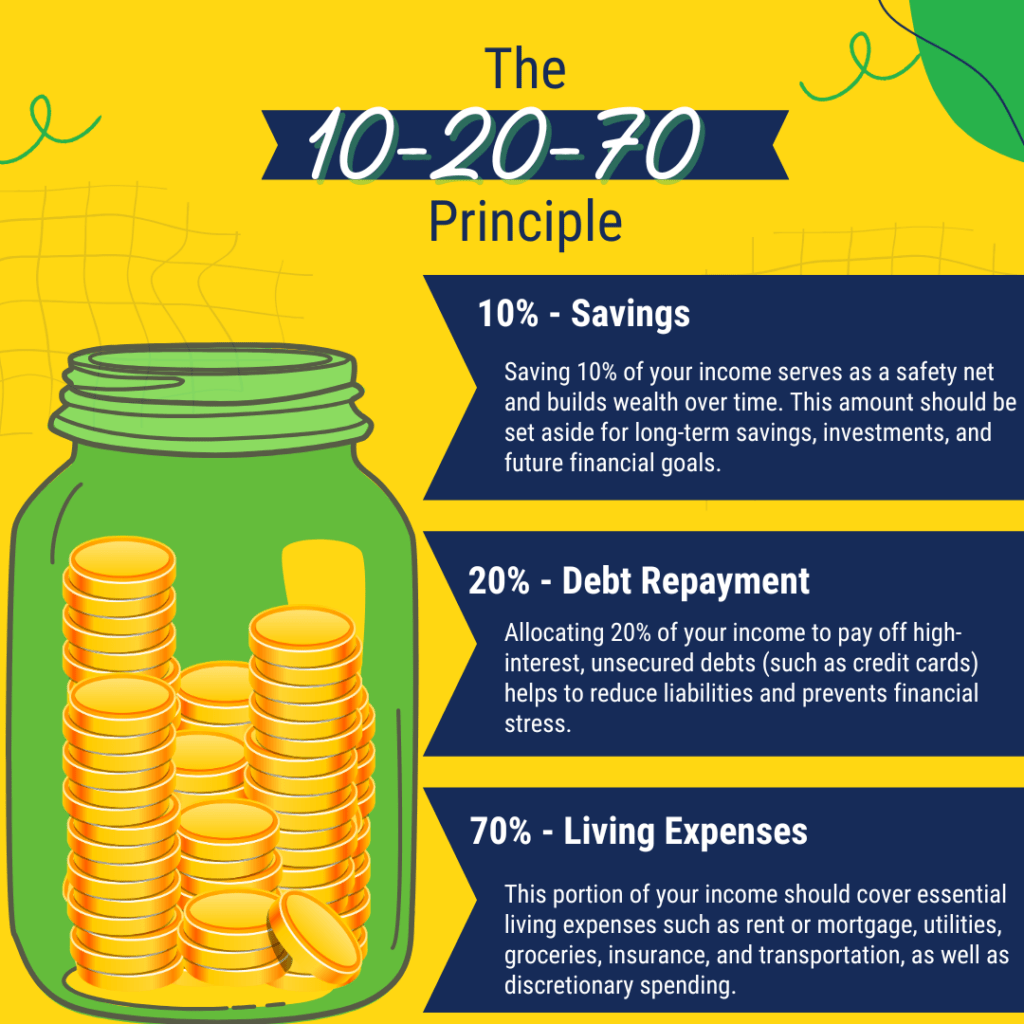

This principle underscores the timeless relevance of the 10-20-70 rule, regardless of your location within the United States. The 10-20-70 principle provides a simple yet powerful framework for managing finances effectively:

By adhering to the 10-20-70 principle, you can establish a solid financial foundation, prioritize savings, and maintain a balanced approach to spending. This principle encourages disciplined financial habits, promotes debt management, and ensures that you live within your means while still enjoying a fulfilling lifestyle.

Regardless of external factors or geographic location, the key to financial success lies in taking ownership of your financial decisions and adhering to principles that promote long-term financial stability and prosperity.

By adhering to this principle, you can effectively manage your finances without feeling constrained by a tight budget or merely working to cover expenses. This approach empowers you to allocate your income wisely, ensuring that you prioritize savings and debt repayment while still enjoying a comfortable lifestyle. Following the 10-20-70 principle opens the door to a powerful financial strategy: leveraging the 10% you retain to finance the 20% of your income dedicated to paying off debts to others. This internal refinancing mechanism allows you to effectively allocate your resources, accelerate debt repayment, and ultimately achieve what many Americans perceive as unattainable.

By coordinating this internal refinancing deal and diligently paying off debts, you can accomplish an extraordinary feat: retaining 30% of your income. This achievement represents a significant milestone in your journey towards financial freedom and prosperity, demonstrating the transformative power of sound financial principles and disciplined financial management..

As you start to accumulate significant wealth by diligently following the 10-20-70 principle, it becomes crucial to consider where you keep your retained earnings to optimize tax efficiency and maintain control over your liquidity. This is where Participating Whole Life Insurance emerges as a valuable financial tool.

Participating Whole Life Insurance, often regarded as the sweetheart of the tax code, offers unique advantages that align with your wealth-building goals. With this financial instrument, you can continue to earn a return on your retained earnings, augmented by dividends, while retaining control over the liquidity of your funds. This allows you to maximize the growth potential of your wealth while maintaining flexibility and accessibility to your funds.

Get a working knowledge of how each type of life insurance policy works.

After reading this 10-page booklet you'll know more about life insurance than most insurance agents.

Download here>

Participating Whole Life Insurance empowers you to leverage your accumulated cash value, effectively using someone else’s money to invest or expand your earning potential. In essence, you become your own banker, gaining control over your financial destiny and unlocking new opportunities for wealth accumulation and financial security. By strategically incorporating Participating Whole Life Insurance into your financial plan, you can optimize tax efficiency, preserve liquidity, and enhance the growth potential of your wealth portfolio. This powerful financial tool empowers you to build and protect your wealth while maintaining flexibility and control over your financial assets.

The Infinite Banking Concept offers a blueprint for becoming your own banker, providing a framework for managing “internal financing” deals and retaining more of the money you earn. By implementing this concept, you gain the ability to leverage Participating Whole Life Insurance as a tool for wealth accumulation.

To maximize the potential of the Infinite Banking Concept and take your financial strategy to the next level, you’ll need to integrate the Perpetual Wealth Code™. The Perpetual Wealth Code™ represents a comprehensive system for managing your own money, designed to help you build sustainable wealth with the additional funds you are now retaining.

By embracing the Perpetual Wealth Code™, you gain access to a strategic approach to wealth management that goes beyond traditional financial planning. This system empowers you to optimize the growth and protection of your wealth while maintaining flexibility and control over your financial assets. With the Perpetual Wealth Code™, you can unlock the keys to long-term financial success, ensuring that your wealth continues to grow and thrive over time. By combining the principles of the Infinite Banking Concept with the Perpetual Wealth Code™, you can establish a solid foundation for building and preserving wealth for yourself and future generations. Ensuring sustainable wealth is paramount to guaranteeing financial security throughout your lifetime and avoiding reliance on Social Security for income, a situation many Americans find themselves in today.

At McFie Insurance, our mission is to empower individuals like you to become your own banker and implement the Perpetual Wealth Code™. We understand the importance of building sustainable wealth regardless of where you reside. Our comprehensive approach combines the principles of the Infinite Banking Concept with the strategic management outlined in the Perpetual Wealth Code™ to help you achieve long-term financial stability and independence.

By becoming your own banker and implementing the Perpetual Wealth Code™, you gain the tools and knowledge needed to build sustainable wealth that will last a lifetime. Our team is dedicated to guiding you through this process, providing personalized support and mentorship every step of the way.

We believe that everyone deserves financial security and peace of mind, regardless of their circumstances or location. By embracing the principles of becoming your own banker and building sustainable wealth, you can take control of your financial future and create a legacy of prosperity for yourself and your loved ones. At McFie Insurance, we are committed to helping you turn this belief into a reality.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.