317-912-1000

When shopping for a life insurance policy, you’ll first want to consider what type of life insurance is best for you. There are a variety of life insurance types, each with its pros and cons, but some of the more well-known policies are term life insurance and whole life insurance. Whether you need term life vs. whole life insurance depends on your circumstances and financial goals too. To help you decide which is better, term or whole life insurance, we’ve developed this page to help you make the right choice. Read on to learn about the difference between whole life and term life and schedule a strategy session with us to walk through the details together.

| DETAILS | TERM LIFE INSURANCE | WHOLE LIFE INSURANCE |

| Duration | 1 - 30 years | Your entire life |

| Initial Cost | Less expensive than whole life in the beginning | More expensive than term initially. Less costly over time. |

| Guaranteed Death Benefit | If you die during your term coverage | Yes |

| Accrues Cash Value | No | Yes |

| Premium Costs | Increase over time | Stay the same |

| Eligible for Dividends | No | Yes |

Whole life insurance is the best type of policy for a guaranteed death benefit, guaranteed cash value, and for building your wealth throughout your entire life, not just a specific time period.

Term life insurance only protects you for a certain number of years while whole life protects you for your entire lifetime..

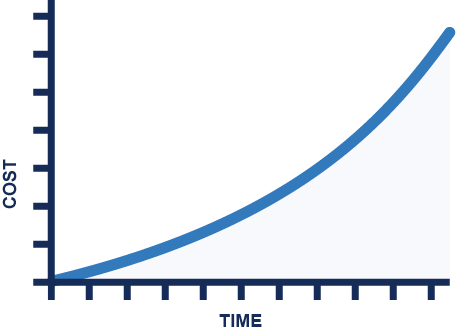

Term life premiums may initially be less expensive than whole life, but its premiums continue to increase in cost over time if you keep the policy beyond the level term period, and you won’t build any cash value.

Term Insurance is a type of temporary life insurance that provides protection with no cash value or growth. It’s often referred to as “rented life insurance” because of this. Term life insurance can be purchased as a one-year renewable term or for a certain period of time such as 5, 10, 15, 20, or even 30 years. This time period is referred to as the level-term period. Coverage amount will vary by policy but can range from less than $100,000 into the millions.

People are often drawn to term insurance because of its initial low premium costs. Term insurance is usually the least expensive for those who are young and healthy, but it’s important to know it won’t always stay like that. Premiums, paid each month, quarter, six months, or year, depending on the premium mode you choose, pay for your death benefit (the money your beneficiaries receive if you pass away). However, this death benefit is only paid out if you die during the term of your coverage. This is the caveat to term insurance.

this death benefit is only paid out if you die during the term of your coverage. This is the caveat to term insurance.

If at the end of the term period, you’re still alive, you would have paid all those premiums without a death benefit payout. Plus, term insurance doesn’t allow you to accrue any cash value, which means you’ll have no way to recover the cost of the insurance throughout the term. Your coverage will either expire or you’ll have to renew your term at a much higher premium cost.

Because of this, term insurance is best suited for someone looking for life insurance protection for their income for a specific period to provide for their dependents. It’s low cost for people on a budget and can be a great tool for young adults who need affordable coverage until they’re financially established enough to purchase a permanent life insurance policy such as whole life insurance. It’s often a good idea to get a convertible term life insurance policy so you can convert your term life insurance and take advantage of the benefits whole life insurance has to offer in the future.

When it comes to which is better, term or whole life insurance, we encourage our clients to look into whole life insurance over term life insurance. This is because whole life insurance is a permanent type of insurance that provides a death benefit for your entire life with guaranteed tax-free growth and easily accessible cash value.

A whole life insurance contract is designed for the insured’s whole life and requires a fixed premium to be paid every year based on the age, health, and risk factors of the insured at the time the policy is issued. Like term insurance, this contract is also set up between the policy owner and the insurance company. The insurance company contractually guarantees to pay the policy’s beneficiaries the death benefit upon the death of the insured. And, if your policy is a participating whole life insurance policy, the insurance company might also share some of its excess profits with the policyholders in the form of dividends.

whole life insurance is a permanent type of insurance that provides a death benefit for your entire life with guaranteed tax-free growth and easily accessible cash value.

The other benefit of this type of policy is the guaranteed accumulation of cash value. In whole life insurance (participating or non-participating), the cash value represents a part of the death benefit you own called “paid-up insurance.” This cash value is accessible and available to you through a policy loan at any time, for any purpose. Common uses for a policy loan include paying for college tuition, debt payoff, business expansion, caring for family members, retirement planning, and more. Initial cash values start out less than premiums paid but grow quickly, and over time usually exceed premiums paid. The longer you own the policy, the more your paid-up insurance will grow and increase your cash value.

Most arguments against whole life insurance stem from poor policy management or policy design. If you do your research and get help from the experts, a whole life insurance policy will allow you to create free cash flow, giving you better control of your finances along with guaranteed life insurance protection.

In a life where nearly nothing is guaranteed, it’s nice to know at least your whole life insurance policy values are guaranteed. Because of this, whole life insurance is an ideal policy for anyone who wants to leave a financial legacy, build guaranteed tax-free growth, and have access to their money while doing it.

When looking at the difference between term and whole life insurance costs, it may seem like term life insurance will always be the less expensive option. However, over time, whole life insurance is actually the better option.

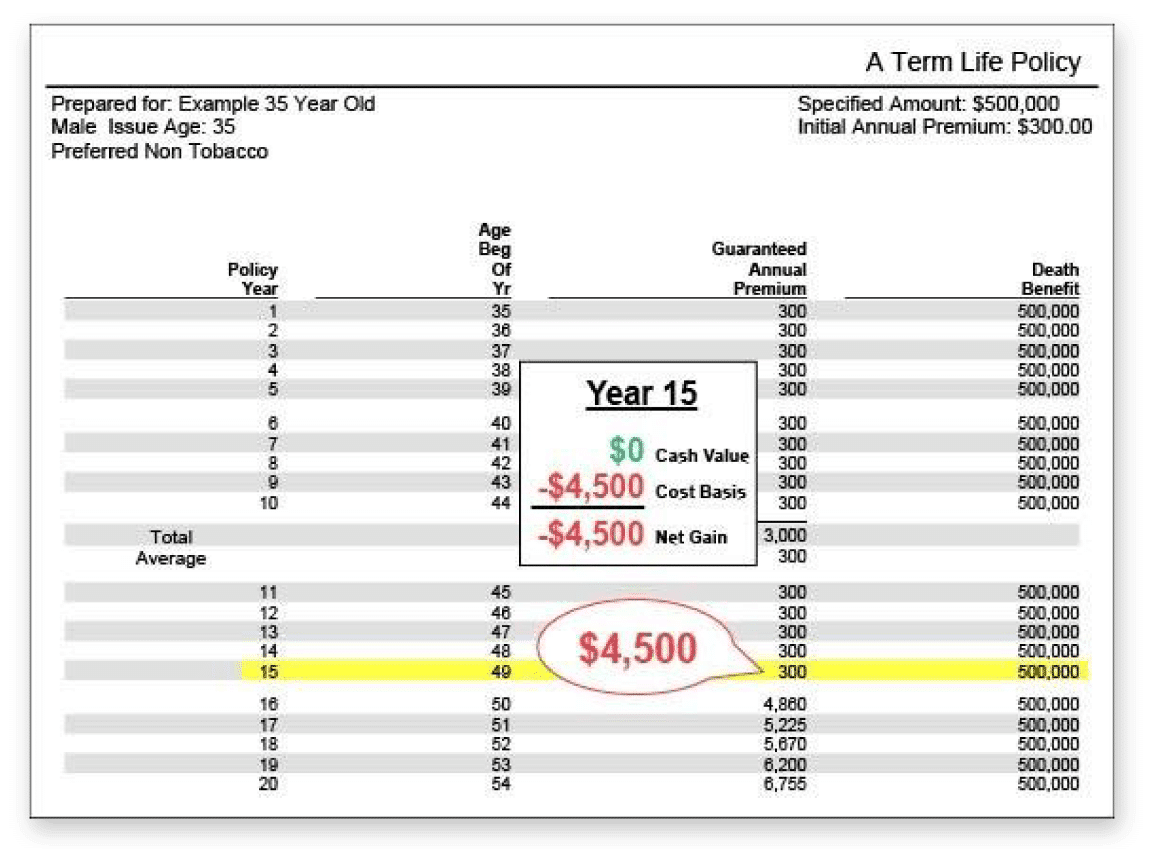

Let’s take a look at an example. This is a 15-year premium quote for a level-term life insurance policy with a $500,000 death benefit. You can see that the policyholder’s annual premium for this policy is initially $300/year and after 15 years, they have paid $4,500. But from the sixteenth year onward, the annual premium for the term insurance policy increases every year, continually raising the cost to keep the same coverage. You also can’t recover any of the money you’ve put into the policy because term life insurance doesn’t provide cash value equity.

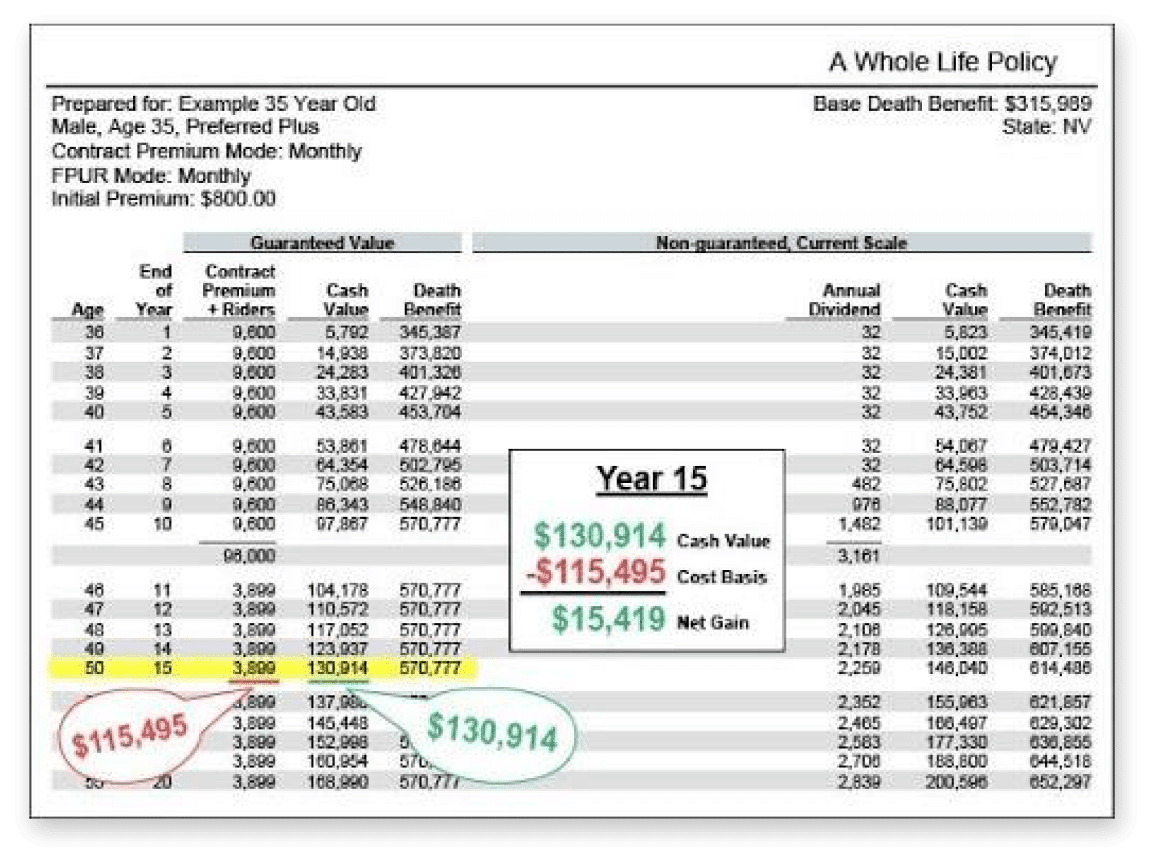

On the flip side, here is a comparable whole life insurance policy that starts at a lower death benefit, but grows to over $500,000 of coverage by the 7th year. The initial annual premium is more expensive to start at $800/month; however, you can see that the policy develops $130,914 of equity or guaranteed cash value by year 15. Because of the cash value accumulation, this policyholder would have a net gain of $15,419 by this point in the policy. In other words, there is $15,419 more in the policy than what has been paid for it, providing more money that can be withdrawn or borrowed to use for whatever you need throughout your lifetime.

By year 15, this whole life policy has $570,777 in its guaranteed death benefit compared to the $500,000 that the term life insurance policy has. The amount of death benefit for this whole life insurance policy doesn’t have to stop here either. It can continue to increase over the lifetime of the insured as non-guaranteed dividends buy more paid-up insurance.

So when looking at term vs. whole life insurance costs, keep in mind that even though whole life insurance rates may be higher upfront, it will be much less costly than term insurance over time when the whole life policy is designed to accumulate cash value efficiently.

Not sure how much life insurance you need or how much it will cost you? Get a free life insurance quote below.

Term or whole life insurance aren’t your only options when it comes to buying a life insurance policy. Most of our clients do end up purchasing one of these types of policies because they are usually the best fit, however, there are other types of life insurance you may hear about.

These include:

Many of these other types of life insurance have more drawbacks with more risk to the policy owner. Keep in mind that the whole reason you’re buying life insurance in the first place is to let the insurance company take risks you don’t want. These products don’t make as much sense for everyday life insurance protection, liquidity, and building wealth.

One of the life insurance products listed here can often be included as a rider on a term or whole life policy and a couple of others can be used in certain estate planning situations to help with estate and inheritance taxes. These are special types of life insurance to solve specific problems.

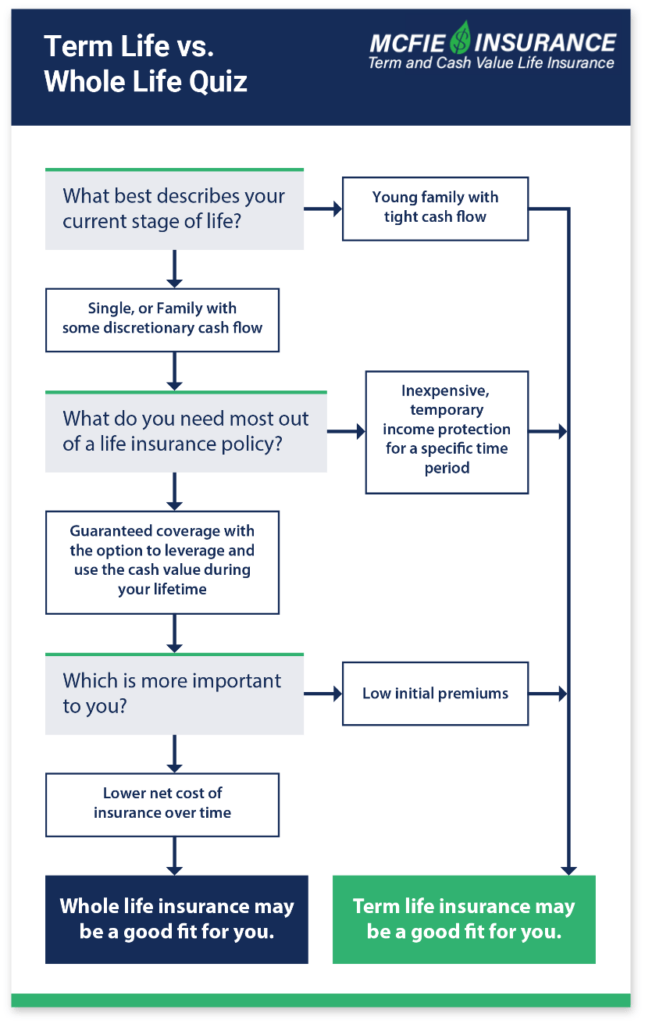

There are a lot of things to consider and opinions to sift through when choosing between term vs. whole life insurance. Here are a few standard questions you can answer to help better determine what coverage would be best for you outlined in the quiz below.

So which type of coverage is best for your family? If term coverage is all you can afford, then the answer is simple: Basic protection is better than no protection at all.

The question is a little trickier for folks who can afford the higher premiums that come with a whole life policy. Some consumers have unique financial needs that a whole life policy can help manage more effectively. For example, parents with disabled children may want to consider whole life insurance, as it lasts your entire lifetime. As long as you keep paying the premiums, you know your kids will receive the death benefit from your policy, even when they’re adults.

Whole life can also be a valuable tool in succession planning for small businesses. As part of a buy and sell agreement, business partners will sometimes take out whole life insurance for each owner, so that the remaining partners can purchase the deceased’s equity stake in the event of their passing.

Regardless of insurance policy type, premiums will be lower the younger (and healthier) you are when you buy it.

Email Us Now

Email Us Now 317.912.1000

317.912.1000