702-660-7000

702-660-7000

Type: products

Meet Dr. Randy and Sue Norris from Battleground, Washington! Several years ago, while attending a chiropractic seminar, Dr. Randy heard Tom McFie speak about the Perpetual Wealth Code and how life insurance can be used as a wealth management tool. It made such good sense that Dr. Randy and Tom connected with each other after …

Continue reading “Dr. Randy and Sue Norris”

Read More...

Samuel Johnson the English Poet and Moralist realized that “Small debts are like small shot; they are rattling on every side, and can scarcely be escaped without a wound; great debts are like a cannon, of loud noise but of little danger.” This reminds me of the little boy who discovered the small hole in …

Continue reading “Here’s what Rex Tillerson is doing with his money”

Read More...

Type: post

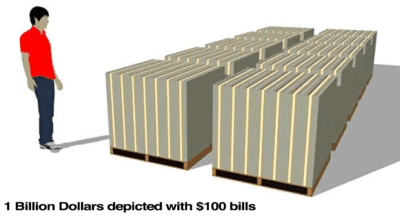

Wow! $42.3 Billion, according to Bankrate; that is what 3 banks, JPMorgan, Bank of America and Wells Fargo, collected in fees during one year, $6 billion of those fees coming solely from ATM and overdraft fees alone.[i] Of course, these are the same banks that we taxpayers bailed out in October of 2008 to the …

Continue reading “$42,300,000,000 in Fees”

Read More...

Type: post

Less than 2 out of 5 Americans have enough money saved to afford an unexpected $1,000 expense. Such an expense would force 1 out of 5 to charge such an unexpected expense on a credit card, leaving the rest to either scrounge it off a friend, family member or take out a personal loan. Interestingly …

Continue reading “The $1000 Dilemma”

Read More...

Type: podcasts

People often wonder why they would want to use participating whole life insurance rather than some other financial tool(s)? The quick answer is because no other tool has all the positive benefits without too many negatives. When you get all the facts on the table, it just makes sense. Today on Wealth Talks, discover WHY …

Continue reading “Ep 165 Why Life Insurance?”

Read More...

Type: post

Ken Fisher, Founder of Fisher Investments, wrote in USA Today on June 24, 2018, “You shouldn’t worry about Social Security running out of money because in the past this same fear has “prompted politicians to act and put in simple fixes.”[i] Then he goes on to explain that raising taxes, or the minimum retirement age …

Continue reading “The Social Security Myth”

Read More...

When purchasing participating whole life insurance, many want to see the premium “disappear” as soon as possible. And if you have a limited source of funding to pay the premiums with, like an inheritance, a bonus, the sale of personal property, a settlement, or lottery winnings, it might make sense to have the premium “disappear” …

Continue reading “Why You Want to Pay Your Premiums as Long as You Can”

Read More...

Type: podcasts

Good things to know about Social Security so you can plan now for alternative options and financial security in your golden years. Also read: Retirement Remastered – Passive Income Strategy

Read More...

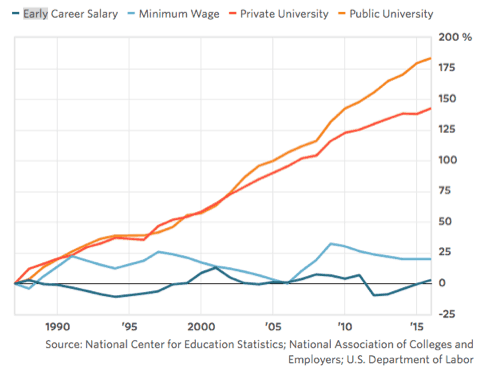

Attending a university or college used to provide a path to a better income. But “In 1987-1988 the average four-year universities and colleges were charging $3,190 a year for tuition. Today, with prices adjusted to reflect 2017 dollars, that average cost has risen to $9,970 a year. Which is a 212.5 percent increase.”[i] But the …

Continue reading “Growth of Student Loan Debt 5 Times Faster than Wages Over Past Decade”

Read More...

A couple years ago we interviewed Rabbi Daniel Lapin on an exclusive teleconference that was recorded with limited access. Today we’re releasing this special interview on the podcast. Enjoy! Listen and discover: • The importance of Face-to-Face connections for building wealth • How to make meetings matter instead of wasting time • The 10th Commandment …

Continue reading “Ep. 160 How to Make More Money and Keep More of What You Make”

Read More...