702-660-7000

702-660-7000

As I wrote this blog, the stock market posted its worst loss since 2011. Yet, the money our clients manage for themselves suffered no loss, nor did any of my money which I manage for myself!

Axel Merk, chief investment officer at San Francisco base Merk Investments had this to say about the market crash;

“When stocks reach new highs month after month, when a virtual currency is the hottest thing in town, greed has overtaken fear. And when that happens, well, it’s time to be fearful again. Consider this a wake-up call.”(i)

Your money is yours, and you should have the right to know what’s happening to it. And so, you must realize that although your money may have died with the crash, it didn’t have to!

Life defined, means: The ability to grow, reproduce, functionally perform and adapt to change.(ii) And these four things are what differentiates between animate and inanimate objects. If something can no longer accomplish these four things, it is considered dead, not living.

Take for example a plant like corn, wheat, or barley. These plants spring up from a planted seed, grow, reproduce, perform photosynthesis and adapt to their specific environment. Once these life expressing indicators cease to manifest in the plant, it dies. If the plant has lived fully, there will be a harvest. And as any good farmer knows, some of that harvest needs to be saved and used for planting so there can be another harvest next season. But the rest of the harvest can be sold and/or used for other purposes.

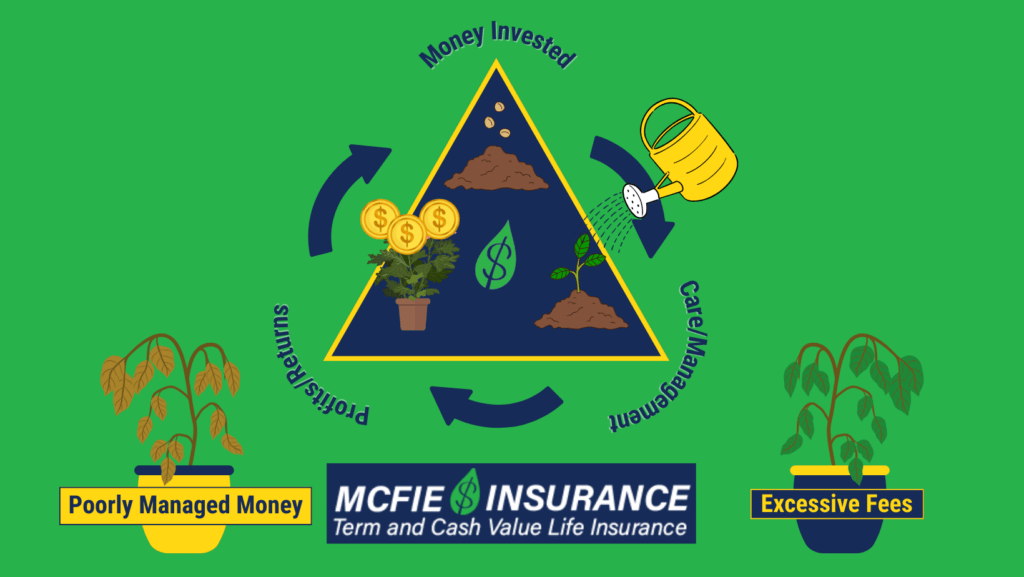

Your money is like a plant. You can allow others to care for it, plant it, water it, fertilize it, and harvest it. And in turn, others will keep a good portion of the harvest your money has provided. This is fine as long as you know that regardless of whether or not they are good care takers, or poor care takers of your money, the care takers will keep part of your harvest, and there may not be enough left over for you in the next season of your life.

Most people don’t realize how impactful this can be. But here are some hard facts that will help you understand the effects this may have on that next season of your life.

In fact, John Bogle, the founder of Vanguard Mutual Funds is on the record for stating the obvious,

“…money managers, marketers of investment products and stockbrokers, put up zero percent of the capital and assume zero percent of the risk yet receive fully 80% of the return…”(iii)!

Some people say they are fine with paying low percentage fees to others for the care of their money, but doing so means that even though their money might be growing, reproducing, functioning and adapting they will not get the full benefits which their money should provide for them. This is because, someone else is skimming the profits off the top and leaving behind the dregs.

Nothing exemplifies this more than a market correction like what happened just recently. Many people believed that the high returns they were witnessing in their portfolios belonged to them. But after losing much of what they believed was theirs, they are facing the next season of life less confident and secure than they should have been.

Here’s the truth. Money can live for you or it can be dead to you while providing living benefits to somebody else. It all comes down to what choices you make. If you don’t want to take the responsibility for actively caring for and managing your own money, then it will die for you like any other living thing in this world will die when it is not cared for. But if you care for your money properly, it will grow, reproduce, function and adapt just like any other living thing. And when it does you should be the first one to benefit from the harvest that comes from this expression of life, not somebody else.

God Himself gave you the right to keep the first part of the harvest for yourself. In fact, he stated that “The hardworking farGrowing_Money.jpgmer should be the first to enjoy the fruit of their labor.” But you have to put yourself in the position of being your own money manager instead of entrusting that responsibility to others, if you really want that first fruit to be yours and not be picked off easily by somebody else.

So, is your money dead or alive? How much of your profits do you keep? Who else is picking the harvest that belongs rightfully to you? How much will the next market correction steal from you that you thought you had earned?

So, is your money dead or alive? How much of your profits do you keep? Who else is picking the harvest that belongs rightfully to you? How much will the next market correction steal from you that you thought you had earned?

Those are the questions that you need to answer so that you have enough of your harvest left over to face the next season in your life with security, confidence and enthusiasm.

At McFie Insurance, we specialize in helping you keep

more of the money you make by assisting you to manage your money yourself. Market crashes happen frequently, some say as frequently as every 8-10 years, with the average loss somewhere around 42% of gains. And yet, you don’t have to suffer from this volatility if you simply become your own money manager and follow the practical guidelines that the Perpetual Wealth Code™ involves.

If you are tired of having dead money instead of living money, give us a call at 702-660-7000, we can help you to make your money come alive again.

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.  Tomas P. McFie DC PhD

Tomas P. McFie DC PhD