317-912-1000

317-912-1000

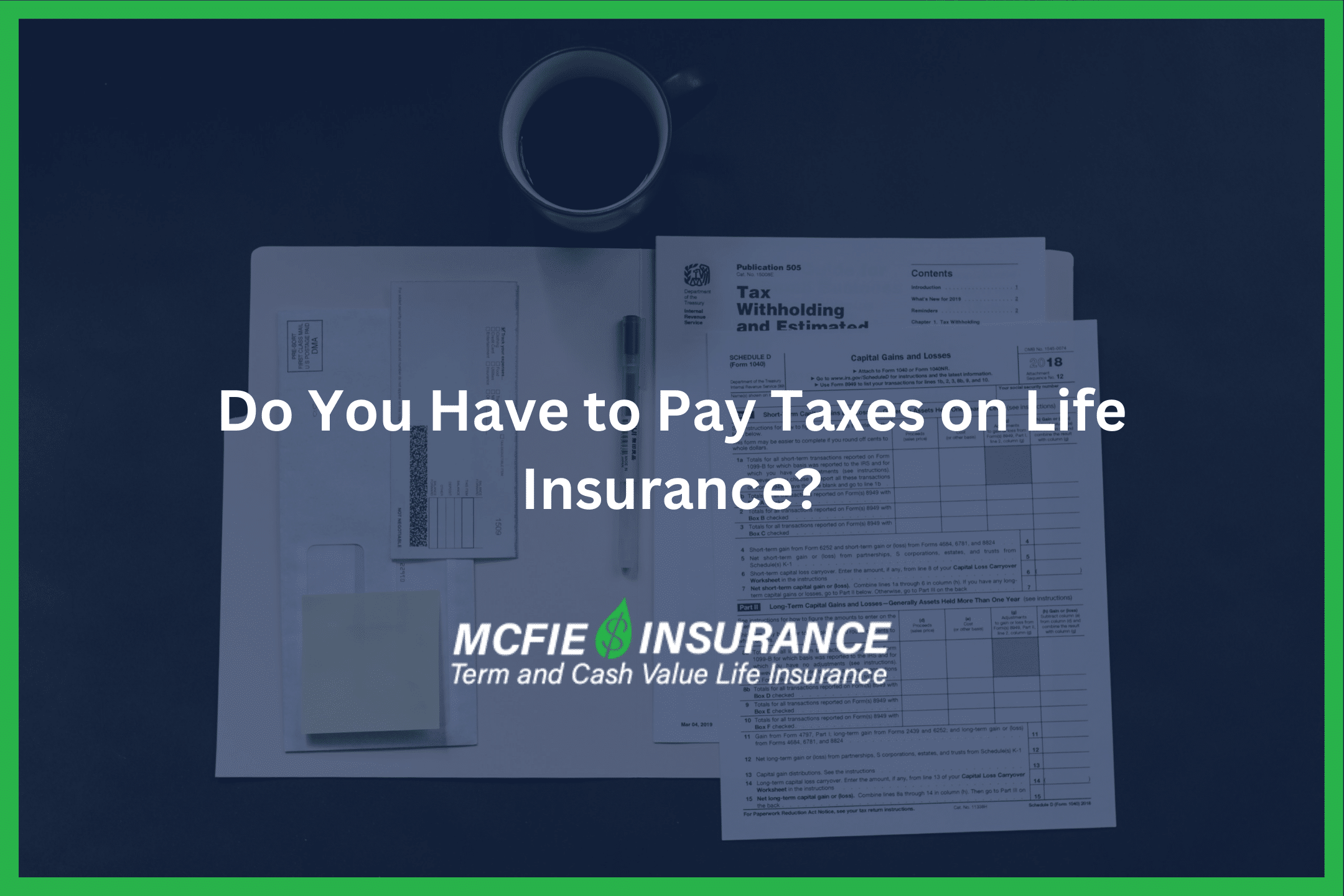

In America, taxes play a large role in our daily lives. Life insurance plays a valuable role when people want to reduce and limit the amount of taxes they pay. It’s important to know how taxes affect life insurance.

What taxes apply to life insurance policies?

Are life insurance premiums tax-deductible?

When do you, and don’t you, pay taxes on life insurance?

All of these questions are answered in this article in addition to specific situations you should be aware of when it comes to taxes and life insurance.

Life insurance policies fall under section 7702, of the Internal Revenue Code (IRC). This code determines how the federal government taxes proceeds from all life insurance contracts.

Death benefits from life insurance policies aren’t considered income for most people. This means most beneficiaries of life insurance policies won’t have to pay income tax on the amount they receive. In situations where a life insurance policy is owned by a non-related third party, the death benefit may be taxable, more on this later.

An easy read and a perfect introduction to whole life insurance and The Perpetual Wealth Code™ Available in eBook or Audiobook format.

Download here>

The estate tax, generation-skipping transfer tax, gift tax, and inheritance tax are some other kinds of taxes that can affect life insurance policies. Some information about each of these taxes is listed below:

While life insurance provides several tax benefits, life insurance premiums are not usually tax-deductible. When life insurance is owned personally, premiums are considered a personal expense (like clothing, groceries, etc.). If life insurance is owned by a business, premiums can sometimes be tax-deductible. However, when premiums are deducted, the growth of the policy will be subject to taxation or a key employee may owe income tax on the premiums as a bonus, depending on how the plan is arranged. It is important to realize this ahead of time to avoid unwanted taxation of policy values in the future.

Many people want to know, “do you have to pay taxes on life insurance?” As mentioned earlier, most life insurance proceeds (death benefits) are not subject to taxation. This is one of the reasons why life insurance is such a good choice for building sustainable wealth and protecting those you love. Here are some instances where life insurance is NOT taxable:

*A Life insurance death benefit is not taxable when the beneficiary is related to the insured.

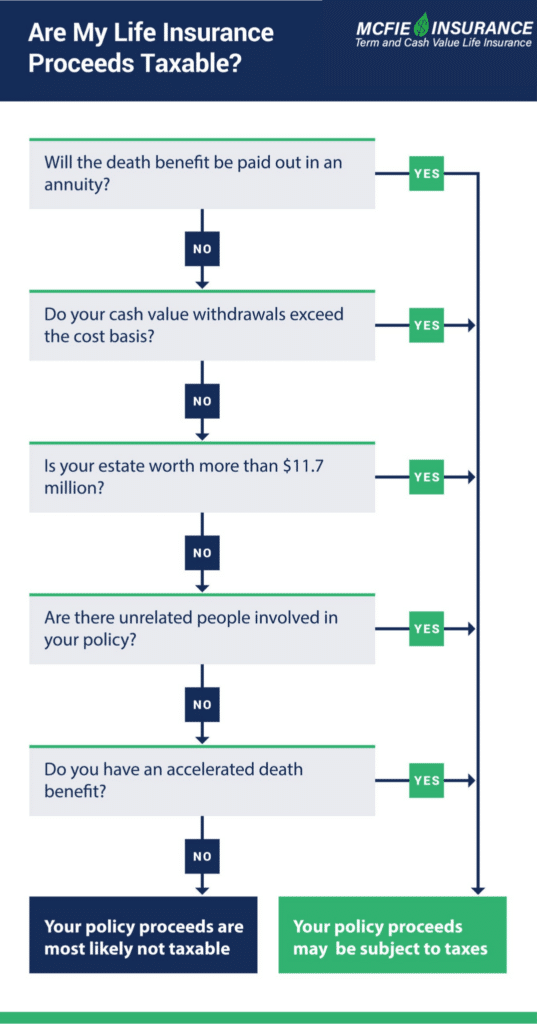

Some of the tax-advantaged benefits associated with a life insurance policy are highlighted above, but there are some scenarios where your life insurance policy/proceeds could be subject to taxes. Here are 6 taxable scenarios to note:

When you pass away, the death benefit from your life insurance policy can be paid to your beneficiaries in a lump sum. It is also possible for your beneficiaries to choose an annuity option for the death benefit. An annuity option is great for individuals who prefer a steady flow of money (similar to a monthly paycheck) as opposed to one lump sum. Because annuities gain interest, beneficiaries who choose to receive their death benefit as an annuity will be taxed on the interest gained in the annuity over the years, but no tax will be assessed on the original death benefit amount.

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here>

As mentioned in the estate tax overview if your death benefit is left to your estate and causes your total estate to be over the $11.7 million thresholds, money exceeding the threshold will be subject to a hefty 40% estate tax at the federal level. State estate taxes may also be triggered at lower thresholds.

Whole life insurance has a cash value. When specially designed, a whole life insurance policy’s cash value will increase over the years in a tax-deferred environment (similar to a 401(k) account). Additionally, you can access the cash value via policy loans tax-free. Money accessed through loans can be used for various purchases and expenses, including tuition and mortgages.

Withdrawals may also be made from a policy’s cash value and will not be taxable until the total amount withdrawn exceeds the cost basis of the policy (total money paid in premiums). If a policy is surrendered, any outstanding loans exceeding cost basis would be subject to taxes.

Do you have to pay taxes on life insurance when it comes to unrelated people involved in the policy? Most of the time, individuals are buying a life insurance policy on themselves with the intent of providing for their named beneficiaries. In some circumstances, a policy may be sold or transferred, after the initial purchase, to a non-related third party. In this case, the new owner would most likely name a new beneficiary, themselves, or some other party, not related to the insured. Upon the death of the insured, instead of the death benefit passing to the beneficiary tax-free, the beneficiary would owe income taxes on any benefit amount exceeding the original purchase price + premiums paid by the unrelated party.

NOTE: Corporate key employees, partners, and business associates are considered “related” for the purpose of life insurance.

Do you have to pay taxes on life insurance when it comes to group life insurance? Group life insurance is often available as an employee benefit. If your employer subsidizes the cost of this life insurance, then employer-paid premiums for any coverage over $50,000 will be treated as additional income to you each year, and subject to income tax. Make sure you look into your employer’s group policy before deciding to join. It may be better in the long run for you to get your own policy.

Many of the policies sold today have an option for accelerating your death benefit in the case of serious injury or illness. When a death benefit is accelerated, the insurance company becomes a lienholder against the policy. When the insured dies, this lien is paid off and the un-accelerated portion of the death benefit is paid out to the beneficiaries. If a death benefit is accelerated and the policy lapses, is surrendered or reduced, the policy owner may have to pay taxes on the accelerated portion of the policy.

It’s crucial to select your beneficiary thoughtfully. A frequent error is designating the beneficiary as “payable to my estate,” which can elevate the estate’s value beyond the tax-exempt threshold. By naming an individual as the beneficiary, you significantly reduce the likelihood of the proceeds being taxed. Seeking advice from a tax expert is advisable to help minimize your tax burden.

Although there are a few circumstances when a life insurance policy may be subject to taxes, a good life insurance policy is designed to provide you with tax advantages. At McFie Insurance, we design and sell tax-advantaged life insurance policies that are made specifically for your financial circumstances.

Still wondering if you have to pay taxes on life insurance? Schedule a strategy session with us today to get started with a life insurance policy that will work for you.

by Gracine McFie

by Gracine McFie

There are many ways to access information about finances, but it can be hard to determine which sources are trustworthy. I like to put information together in an accurate, straightforward, easy to understand manner so people can make good financial decisions based on the information provided without having to waste time wondering if the source is reliable.