702-660-7000

702-660-7000

In a recent letter to Senator Joni Ernst of Iowa, the IRS made a startling admission: thousands of its own employees are willfully not paying their taxes, with unpaid amounts totaling millions of dollars. This revelation comes alongside Senator Rand Paul’s annual “Festus Report,” which highlights egregious government waste—from making payments to deceased individuals to funding research on gambling monkeys.

This government hypocrisy exemplifies the “Rules for thee, but not for me” mentality in our financial systems. While ordinary citizens face strict enforcement, those in positions of power play by different rules. This double standard goes beyond government into various financial sectors, including Wall Street trading and financial advising.

Interestingly, this same hypocrisy exists within the life insurance industry. Most life insurance agents own whole life insurance for themselves while recommending term or universal policies to their clients. Why the disconnect? What do these agents know that they’re not sharing with their customers? The answer reveals an opportunity for financial security that too many Americans are missing.

According to the 2023 Insurance Barometer Study, 40% of adults planned to purchase life insurance within the next year. Many will face this industry double standard without realizing it. Understanding the different types of life insurance and their attributes is essential before making a financial decision.

Term life insurance provides coverage for a specific period—typically 5, 10, 20, or 30 years. If you die during this term, your beneficiaries receive the death benefit. If you outlive the term, the coverage expires, and you receive nothing in return for your premiums.

Advantages: Term insurance stands out for its affordability. The initial premiums are lower than other insurance types, making it accessible for young families and those on tight budgets. Its straightforward structure removes complexity—you pay premiums, you get coverage—period. For those with temporary financial obligations like mortgages or college tuition for children, term insurance provides an effective safety net during these crucial years.

Disadvantages: Despite its initial appeal, term insurance has several limitations. First, it builds no equity—meaning every dollar paid is purely for protection with no investment component. Should you wish to maintain coverage after your term expires, you’ll face higher renewal rates that increase with age. Insurance companies also profit significantly from term policies because most policyholders outlive their terms, resulting in no death benefit payout. Unlike permanent insurance options, term provides no living benefits or accessible cash value you can use during your lifetime.

Term insurance functions essentially as “rented” protection—valuable while in force but leaving nothing behind when the term ends.

Universal life insurance emerged in the 1980s as a “permanent” solution with flexible premiums. However, this flexibility comes with significant downsides.

Advantages & Disadvantages Side-by-Side:

| Advantages | Disadvantages |

| Adjustable premiums allow for payment flexibility when cash flow fluctuates | Built on annually increasing term insurance costs that rise dramatically with age |

| Death benefits can be adjusted up or down as needs change | Cash value can be depleted by rising insurance costs, especially in later years |

| Potential for cash value accumulation provides some investment component | Guaranteed values often plummet to zero between ages 60-80 |

| Growth occurs tax-deferred, potentially enhancing long-term returns | Policies frequently lapse when cash value becomes insufficient to cover costs |

| Complex contract provisions that insurance companies can modify over time |

While marketed as “permanent,” universal life policies fail to deliver lifetime coverage because of their structure. By shifting investment risk from the insurance company to the policyholder, these policies create unreliability when stability becomes most critical—in your later years.

The Wall Street Connection

Indexed universal life policies attempt to provide market-linked growth without market risk by tying cash value growth to market indexes like the S&P 500. This creates a hybrid product that promises the best of both worlds but often delivers on neither promise fully.

On one hand, IUL offers three main benefits:

This seemingly perfect solution contains several flaws that many policyholders discover too late:

First, any market gains are typically capped at 12-15%, meaning in years when the market performs well, your policy captures only a fraction of those returns. Second, dividend income—which can represent a substantial portion of market returns—is typically excluded entirely from the calculation. Third, high fees (often reaching 6% of premiums) create an immediate drag on performance.

Most concerning is the level of complexity in these contracts, with provisions that insurance companies can modify at their discretion. And like all universal life products, IULs rest on the foundation of annually increasing term insurance costs that become more expensive as you age.

Despite sophisticated marketing, IUL policies often create an imbalanced relationship where contracts favor insurers rather than policyholders.

Variable universal life insurance represents the highest-risk option in the life insurance spectrum. These policies invest cash values directly in sub-accounts resembling mutual funds, creating a hybrid insurance/investment vehicle.

For the Risk-Tolerant Investor: VUL offers upside potential when investments perform well, with results directly tied to market performance. Policy owners maintain control through the ability to select and adjust investment allocations among various options. Like other permanent insurance, growth occurs tax-deferred, potentially enhancing long-term returns.

The Hidden Costs:

“VUL places the most risk on policyholders, asking them to manage investments while paying for insurance coverage—a combination that often leads to disappointment.”

The fee structure for VUL is typically the most aggressive in the industry, with front-loaded charges often beginning at 6% of premium. Unlike traditional investments, VUL shifts the entirety of investment risk to the policyholder while maintaining insurance company profits. This creates a precarious situation where poor investment performance can lead to policy lapse, effectively canceling coverage despite years of premium payments.

Managing these policies requires ongoing attention and investment knowledge beyond what most policyholders possess or maintain throughout their lives.

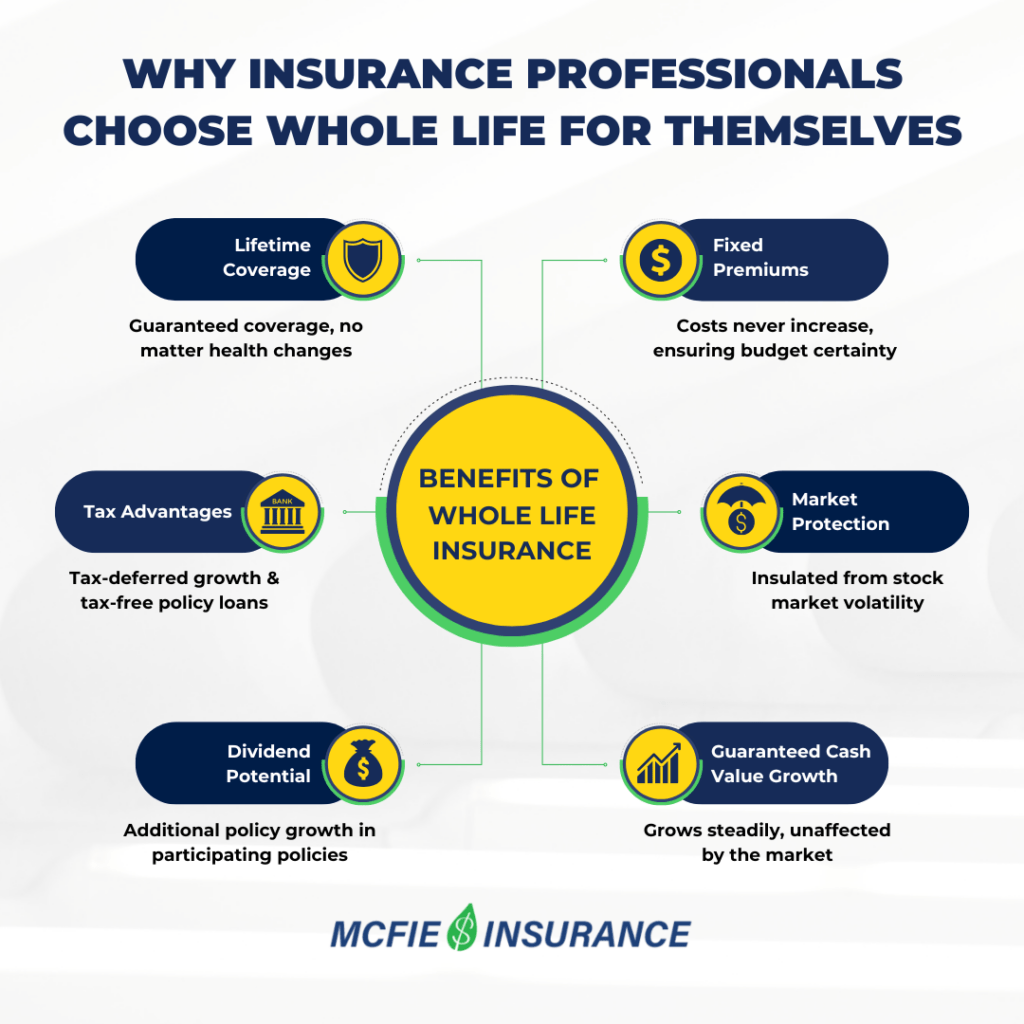

Now we arrive at what most life insurance agents choose for themselves and their families: whole life insurance. This type of policy provides lifetime coverage with guaranteed premiums, death benefits, and cash values.

Why Agents Choose Whole Life for Themselves

Imagine a financial product that offers:

Whole Life insurance offers all of these components. And the combination of these features explains why many insurance professionals select whole life for their personal coverage. The initial premium investment is higher, payment flexibility is somewhat reduced, and policies require long-term commitment to maximize benefits—but these trade-offs secure unmatched guarantees and long-term value.

Whole life insurance stands alone in building true equity—a portion of the death benefit you own called “paid-up insurance.” This equity grows throughout your lifetime, eventually making whole life the least expensive life insurance option when measured over a lifetime.

Unlike other insurance types that promise permanence but shift risk to policyholders, whole life delivers on its contractual guarantees through a century-tested design that has weathered every economic storm.

Within whole life insurance, participating policies offer additional benefits. These policies allow policyholders to share in the insurance company’s profits through dividends. While dividends aren’t guaranteed, many mutual insurance companies have paid them for over 100 years—even through the Great Depression, world wars, and financial crises.

Participating whole life insurance transforms from an expense into an asset over time. The equity you build provides:

For these reasons, most life insurance agents choose participating whole life for their personal coverage. They understand that while the initial cost is higher, the long-term value far exceeds other options.

Not all whole life policies are created equal. The design of a policy impacts its performance and value. A well-designed policy:

Working with an agent who understands these design principles is vital. Many agents aren’t trained to design policies for maximum client benefit, focusing instead on commission-generating features.

Participating whole life insurance serves multiple financial purposes:

Unlike investments subject to market volatility, whole life provides guaranteed growth regardless of economic conditions. This makes it an excellent diversification tool for preserving wealth.

The death benefit passes income-tax-free to beneficiaries, making whole life an efficient way to transfer wealth across generations. As Solomon wrote, “A good man leaves an inheritance to his children’s children.”

Policy loans allow you to access cash value while maintaining growth. You can use these funds for anything you want, including:

By building a substantial cash value over time, whole life creates financial independence. You can access funds without bank approval, credit checks, or application processes.

This brings us back to our opening point about IRS employees not paying taxes while enforcing tax laws on others. Financial hypocrisy exists because those with knowledge leverage it for personal benefit while promoting different strategies to the public.

Just as government officials waste money while demanding fiscal responsibility from citizens, many financial professionals recommend products they personally avoid. This knowledge gap creates an opportunity for informed individuals to make better choices.

While we can’t stop government waste or make IRS employees pay their taxes, we can take control of our financial futures by implementing strategies used by those “in the know.”

Participating whole life insurance represents one such strategy. It provides:

If participating whole life insurance offers so many advantages, why isn’t it more widely recommended? Several factors contribute:

This information asymmetry benefits those who understand the system while disadvantaging the average consumer.

Armed with knowledge about the different types of life insurance and their true characteristics, you can make informed decisions:

The revelation that IRS employees owe millions in back taxes while enforcing tax laws on others is merely one example of the financial hypocrisy prevalent in our society. This same double standard exists throughout the financial world, including the life insurance industry.

By understanding what life insurance agents choose for themselves—participating whole life insurance—you can break free from this system and build genuine financial security. While whole life insurance requires higher initial premiums, its long-term benefits make it the most cost-effective life insurance option available.

As government officials waste taxpayer money and IRS agents avoid their tax obligations, you can take control of your financial future through strategies that build equity, provide guarantees, and create a lasting legacy for your family. In a world of financial hypocrisy, knowledge and strategic action remain your most powerful tools for achieving true financial independence.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.