702-660-7000

702-660-7000

Typical Financial Planning:

Modern financial planning encourages individuals to place their money in accounts or investments where there’s a real possibility of loss. While this is positioned as the path to higher returns, the reality is that the only places where your money is truly protected from loss are certain bank products and specific life insurance contracts that come with legally guaranteed protections.

It’s important to understand that these safe vehicles—like bank CDs or properly structured life insurance contracts—usually don’t offer high rates of return. Why? Because the banks and insurance companies are taking on 100% of the financial risk on your behalf. In exchange for that safety, the returns are more conservative.

This is why many traditional financial advisors try to steer you toward options with higher potential returns: because those options shift the risk from the institution to you. You’re told to accept more volatility with the hope of achieving greater gains.

But here’s the issue—assuming more risk may not be something you can comfortably afford. And maybe more concerning, the financial planner advising you to take that risk is often compensated regardless of whether your investments succeed or fail. Your outcome doesn’t necessarily impact their paycheck.

Risk Tolerance:

Most financial planners assess your risk tolerance using a formula that factors in your age, your income level, and the rate of growth you hope to achieve. In general, the younger you are, the more risk you’ll be encouraged to take on—based on the assumption that you have more time to recover from losses.

This approach can create problems, especially for those nearing or in retirement. Even if you’re older and more conservative with your money, you may still be placed into a higher risk category simply because the planner sees a need for more growth in your portfolio. This is the danger of relying on a generalized three-part equation rather than a personalized financial strategy.

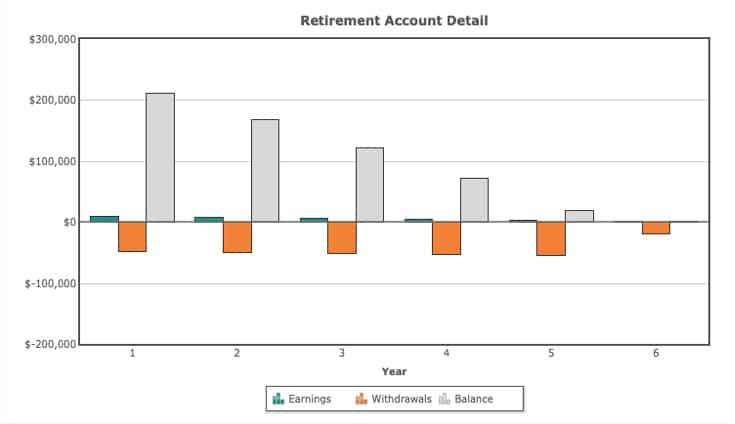

Take, for instance, someone who is 65 years old and has $250,000 saved for retirement. On paper, that individual would need to pursue higher returns just to make their money last. If they withdraw $65,000 per year to cover living expenses and their savings only earns a 4% return, the money will run out in about 5.5 years. That looming shortfall might prompt a planner to recommend riskier investments in the hope of stretching the savings over a longer period.

But here’s the issue: at age 65, the priority should be on preserving capital, not exposing it to greater risk. The unfortunate reality is that many people are advised to take on more risk at the stage of life when they can least afford to suffer losses. This mismatch between actual risk tolerance and the risk a planner recommends can jeopardize financial security in retirement.

Another way you may be placed into a higher risk tolerance bracket is if you are young. According to typical financial planning, you can afford to take higher risks when you are younger. But assuming higher risk means you also assume a higher probability of losing the money you have saved, and that violates Warren Buffett’s first rule of creating wealth, “Never Lose Money.” [1] Losing money forces you to start over again, or at least recover your losses. Yet starting over again later in life means you will have to assume even higher risks in attempts to make back what you have lost.

Here is the rub. What typical financial planners classify as a recovery doesn’t take into consideration the time lost during the recovery period. That time is lost to you forever. Meaning, if you lose part of your savings several years into your retirement plan, as many did in 2008 and many are doing so today, you will have to save much more money out of your income to come even close to what you had planned on saving for your retirement, even if your investment recovers the loss that you experienced.

This isn’t just this author’s crazy impression.

Obviously, moving to cash and cash equivalents is a valid point for many who cannot and should not be assuming higher risks in hopes of experiencing more growth. Growth is not guaranteed simply because you assume higher risks and that is why traditional, rather than typical, financial planning always focuses on protection first!

Smart money management begins with protecting what you’ve worked hard to save. Holding cash and cash-equivalent assets, like specific bank products and certain life insurance contracts that offer guaranteed values—isn’t just a conservative strategy, it’s a wise one. These financial vehicles safeguard your principal while still offering moderate, steady growth over time. And when it comes to building long-term financial stability, protecting your capital is more important than chasing uncertain, potentially fleeting gains.

For example, a consistent, tax-free, guaranteed return of 5% may outperform a riskier investment with a nominal return of 7%—even if that 7% target is reached. Why? Because the net return on that riskier investment can gets chipped away by taxes, management fees, marketing costs, and trading expenses. It’s not uncommon for these costs to reduce your effective return by 2% or more, bringing your real return down to 5% or even less. Meanwhile, the 5% guaranteed return from a life insurance contract or similar product continues to grow your wealth quietly and predictably—without putting your savings in jeopardy.

Higher returns always come with higher risks. And in many cases, that risk doesn’t just mean reduced growth—it means the possibility of losing some or all of your invested capital. For most people, especially those nearing retirement or managing limited savings, that kind of volatility is simply not tolerable. The potential for gains may look enticing, but the cost of losses can be devastating.

Ultimately, financial peace of mind isn’t about chasing the highest possible return—it’s about preserving your wealth, minimizing unnecessary risk, and securing reliable, tax-advantaged growth. That’s the foundation of a sound financial strategy.

Loss Avoidance Factor:

Traditionally, it was considered germane to protect what you saved in order to avoid losses. A good way to discover your risk tolerance is to consider what your loss avoidance is. For example, would you risk $1,000 to earn

Most investors will not risk $1,000 to earn less than $1,000. $1,000 would be their loss avoidance factor. Historical data can assist you in finding your loss avoidance factor but can never provide you with the legally binding contract which will guarantee that you will never earn less, or lose more. Only certain Banking products and specific Whole Life Insurance Contracts can provide you that guarantee.

Why Whole Life Insurance?

Whole life insurance contracts are not based on you earning a rate of return but rather on you owing a larger and larger portion of your death benefit as time progresses. Equity developed overtime like this can be guaranteed to the policy holder due to the actuarial science which provides the basis of all insurance coverage. The insurance company knows beforehand what the risks are and assumes those risks for you, while providing you with the coverage you need and the opportunity to own the asset you are purchasing…the death benefit.

The death benefit, which you own, has a value which the insurance company calls cash value. It is this cash value that you can leverage and use while still living without reducing the continual growth of your ownership in the policy. Thus, your whole life insurance policy will continue to experience growth regardless of whether you leverage it or not. All you are required to do is to pay the agreed upon premium and any interest owned on any money you’ve borrowed against your policy’s cash value.

At the same time policy holders can also earn dividends. Dividends, like with any company, are decided upon by the board of directors at the end of a fiscal year. Once determined, they are paid to the policy holders, and don’t merely dilute your stock holdings as they would when paid to common stock holders of a publicly traded company.

The policy holder can choose to have the dividends purchase more insurance coverage in the policy which will increase the ownership of the policy holder. In doing so, the policy holder will be eligible for a larger share of the dividend the next time the board of directors declares a dividend.

The Importance of Dividends:

Dividends are the key to long-term growth![3] Dividends are paid by companies that are solid and reliable. Dividends have been a substantial measure of a company’s ability to earn profits and for the first 45 years of the S&P 500 the average dividend never fell below 3%.[4] But due to the Federal Reserve, cheap money forced prices up and dividends down.[5] Even so, Standard and Poor’s estimates that more than $7.8 trillion is benchmarked to the S&P 500 and since March of 2010 and March 2020, 2.11% of total gains have been due to dividends.[6]

Interestingly, mutual life insurance companies have a tremendous record of paying dividends consecutively year after year for well over 100 years. This is a strong record that only 15 publicly traded companies have been able to manage.[7] Dividends then are another reason traditional financial planning was based on owning participating whole life insurance. With such an amazing dividend track record it was, and still is, a solid foundation to build wealth.

Conclusion:

There is a time and place for taking risk(s). But not when you are young and not when you are old. In fact, time shouldn’t be a factor in determining your risk tolerance. You should only take risk(s) when you can afford to lose the money invested and not be hurt financially, i.e., not have to lower your standard of living if you lose the money invested.

Following this one rule you will be able to enjoy the benefits of compounding growth, which has been called the 8th wonder of the world. Compounding growth really only becomes advantageous once it becomes exponential. And exponential growth takes time without loss or interruption. Time without loss or interruption is guaranteed in participating whole life insurance contracts. But if your time here on earth is interrupted or lost, your beneficiary(s) will have more money than you could have saved for them. And it will be income tax free!

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.

[1] https://www.investopedia.com/financial-edge/0210/rules-that-warren-buffett-lives-by.aspx

[2] https://www.theatlantic.com/business/archive/2015/10/the-recession-hurt-americans-retirement-accounts-more-than-everyone-thought/410791/https://www.theatlantic.com/business/archive/2015/10/the-recession-hurt-americans-retirement-accounts-more-than-everyone-thought/410791/

[3] https://finance.yahoo.com/news/10-rules-made-warren-buffett-230758470.html

[4] https://www.investopedia.com/articles/markets/071616/history-sp-500-dividend-yield.asp

[5] https://www.investopedia.com/articles/markets/071616/history-sp-500-dividend-yield.asp

[6] https://dqydj.com/sp-500-return-calculator/

[7] https://www.dividend.com/how-to-invest/15-companies-that-have-paid-dividends-for-more-than-100-years/