702-660-7000

702-660-7000

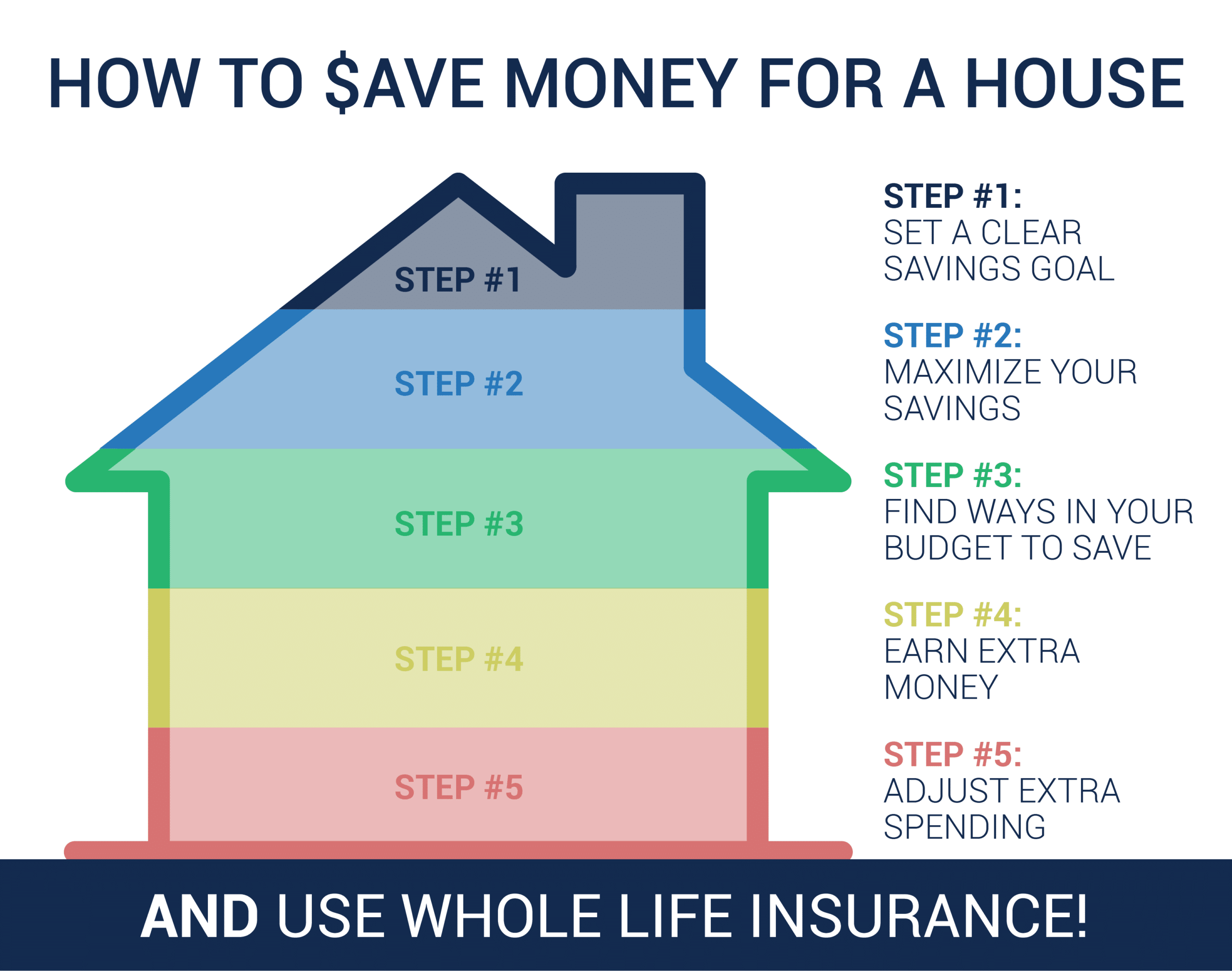

With monthly rent prices on the rise and interest rates so low, more and more people are looking to buy a house. For first-time homebuyers, saving for a house can seem incredibly daunting, but there are ways you can follow to make saving for a house a little easier. In this article, we’ll cover five steps to saving money for a down payment and a path to home ownership.

You may have heard the popular saying “pay yourself first” and that’s good advice, but many people do the exact opposite. They pay their expenses first and then save what’s left, if there is anything left. The 10-20-70 rule is a simple financial principle that starts with keeping at least 10% of everything you make. Ideally, you should keep more, but if you have debt, 20% of what you make will be for making debt payments. After debt has been paid off, the 20% can be added to the 10% you keep, allowing you to keep 30% of the money you make. The remaining 70% of your income is for you to live on. This 70% will cover expenses like rent or mortgage payments, food, water, electricity, clothing, etc. The 10-20-70 promotes good financial balance in people’s lives. It can also make figuring out what you can afford and how much you’re able to save for a house much simpler.

Let’s say you make $100,000 a year so you have $70,000 allocated to your expenses. When calculating how much of a mortgage payment you could afford, you can make sure that it fits into your 70% comfortably. Additionally, you could count on being able to keep a minimum of $10,000/yr that would remain yours and ideally start working to create more money for you. Can you see how this is helpful when calculating how to save money for a house?

More: 10-20-70 Rule & The Perpetual Wealth Code

Now for the cost breakdown of buying a house. First, you’ll want to establish how much money you’re going to need. Many people think about how to save for a down payment, but there’s more to house savings than just a down payment. The three main things you’ll need to save for when looking to buy a house include:

Using the 10-20-70 rule as your guide and deciding on a savings number, you can set a target deadline for hitting your goal of saving for a house.

Many people try to save money, but sometimes all it takes is to optimize your existing savings to get you where you want to be. This could include setting up automatic deposits of 10-30% from your paycheck immediately to your savings account. It could also include maximizing control over your savings while leveraging the money to do more than just sit there without gaining much interest.

Typical marketed “high-yield” savings accounts like CDs or bonds can increase your savings amount but at the cost of being inaccessible or hard to access. What if you find the perfect house and want to make an offer sooner than expected? If your savings are trapped inside these accounts where it can take extended time and possibly fees to get it out, you’re in a bind. A better way to capitalize on your savings is to fund a properly designed participating whole life insurance policy (more on this shortly).

This step isn’t about asking yourself what you could live without, but more about whether or not you want to spend money on certain things in your 70% expenses budget. Maybe you bought into a membership but rarely use it. Cancel it, and save the extra money. Some common expenses you could evaluate to find extra ways to save include:

Keep a spreadsheet of your monthly spending or use your bank app to find out exactly where your expenses are going each month to find further ways to reduce expenses. This requires a little work, but it’s very eye-opening and well worth the time investment.

Reducing your expenses is a great step toward saving for a house and increasing your income on top of that is even better. Extra income in raises or bonuses or new business opportunities is a great way to increase your house savings plan quickly.

Plus, in today’s “gig economy,” there are no shortages of side gigs like freelancing or other part-time work. Maybe you have a passion project you could turn into a side business or maybe it’s time you give your place a good clean through and hold a garage sale. There are countless ideas to creatively find ways to earn extra money.

Earning more money also comes with a warning though. If you don’t have a successful plan in place for how you deal with your money right now, i.e. the 10-20-70 rule, more money will not help you get ahead if you do have a plan in place.

Many people will suggest cutting out ALL extra spending like vacations, eating out, or other activity expenses. At McFie Insurance, we teach people to think both. We want you to think “and” instead of “or”. Just because you’re saving up for a house doesn’t mean you have to forego everything else fun in your life. You can save for a house AND go on a vacation, but instead of spending $5,000 on an all-inclusive, 5-star resort trip to St. Croix, maybe you go on a domestic trip or plan a really fun “staycation” with your family. Maybe you choose to eat out once a month AND save for a house instead of eating out once per day. These alternatives will allow you to save more money than you would if you eat out consistently and splurge on vacations. The benefits are that you still get to enjoy dinner out together and you won’t be giving up that important vacation time together.

Knowing how to save for a house is one thing, but knowing the best way to save for a house is… well, better! Using whole life insurance to buy a home is a lesser-known option, but should be more widely known. Whole life insurance develops cash value and cash value can be accessed by the policy owner with a signature. When someone uses the money they keep to fund a properly designed whole life insurance policy, the cash value accumulation will be significant! Allowing cash value to accumulate in a whole life insurance policy you own is a great way to maximize the productivity of the money you keep without market risk, provide the insurance protection you need, and provide available cash value for you to use for a down payment, closing costs, or other expenses associated with buying a house.

Someone who has funded enough whole life insurance could finance their entire mortgage using their life insurance cash value because policy loans are not regulated the same way qualified plan loans are. That being said, in this environment of low interest rates, it’s not necessarily financially advantageous to pay off your mortgage with a policy loan.

There are many options when it comes to how to save for a down payment. At McFie Insurancewe specialize in helping people keep more of the money they make. Keeping more of the money you make puts you in a better position to purchase a house and manage a mortgage. Whether you are currently looking for a house to buy, starting to save for one, or you have a mortgage and want to see how you can keep more of the money you make in your control schedule an appointment with us. We can properly design a whole life policy for you that will help you keep more of the money you make and give you financial peace of mind.