702-660-7000

702-660-7000

Many people will generate over a million dollars of income during their lifetime. At only $12 dollars an hour, 8 hours a day, 5 days a week, 50 weeks out of the year, and working 45 years someone will generate over a million dollars. But the question is how much of those million dollars will be saved for when this someone can’t work?

Unfortunately, the top 1% earners in the U.S. now hold more wealth than all the rest of the U.S. population. This problem is very much due to how the middle class has been told to save money. For the most part, it has been conveyed to middle-class America, to save money in 401(k)s or IRAs for wealth building. This advice, however, overlooks the fact that safety, not yield, should be the first thing to consider when building wealth that will be sustainable.

Mark Twain understood this fact when he stated rather bluntly, “I am more concerned with the return of my money than the return on my money.” And that axiom has been used by many since then, including renowned economist John Maynard Keynes as well as comedian Will Rogers.

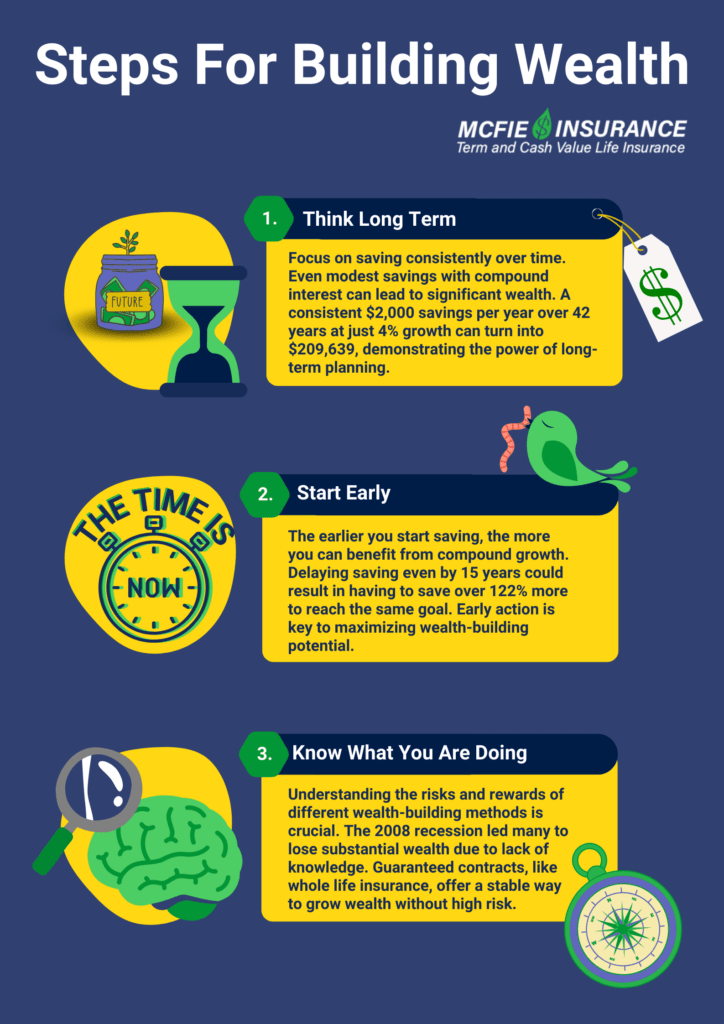

But perhaps the most important factor in building sustainable wealth is to think long-term. Warren Buffet himself lists this as one of the most important things to do when building wealth. Too many people rush into an investment, saving plan, or joint venture without thinking long term. And too frequently this ends up costing them lots of money.

Losing money in the early years will destroy the compounding growth you could have created if you never experienced those early losses. Of course, the larger your portfolio becomes the larger amount you can lose due to sequential market corrections. These two unforeseen consequences of saving “Too little too late”, and saving “Too much without proper market protection”, are why middle-class Americans still lack the wealth to sustain their own retirement. Overall 35% of U.S. households have no retirement savings and 50% of those who have some wealth saved up for retirement have a median value of $1,100. Even those in the 70th and 80th percentile group only have $40,000 to $106,000.

To build sustainable wealth one must:

Saving 10% while earning only $10/hour, 8 hours a day, 5 days a week for 50 weeks out of each year would permit anybody to save $2,000 a year. Doing this over a lifetime, from age 25 to age 67, will create a savings of $84,000. But if this $2,000 every year experienced annual compound growth of just 4% this $84,000 would turn into $209,639 over those 42 years without any extra effort on the part of the one saving that $2,000 every year.

The longer one waits to begin saving the less compound growth they will experience. A person who delays saving for 15 years will end up having to save 122.60% more than someone who started saving 15 years earlier if they both saved the same amount of money annually and earned the same 4% rate of return on their accumulated savings.

Not understanding the risks associated with building wealth can become costly. The average American household lost 33% of their net worth in the recession of 2008. This means they also lost time and time lost means their ability to build wealth was diminished severely (see #2 above.) This is why using guaranteed contracts to protect and build wealth is critical if one desires to create any semblance of financial sustainability.

Not everybody can expect to earn a rate of return of 4% annually. This is primarily because of the fees associated with investments that are managed by someone other than the investor. For example, a fee of only 1.5% will destroy 33.40% of a portfolio’s value if the portfolio earns a 7% average rate of return and was started with a $25,000 contribution and had annual contributions of $10,000 over the next 40 years. Fees that are charged based on a percentage of the entire portfolio, and/or a percentage of the contributions, become unfairly tipped in favor of the money manager, not the portfolio owner. A flat fee, one not based on total amounts of money under management or contributions made, is more balanced and fairer to the portfolio owner.

The problems are: 1) Where can one find a place to keep money, where the long term has already been factored into the plan? 2) Where can one start with the little amount they can save today and still be able to expand their savings as time increases the ability to save? and 3) Where can one save without risking the loss of what they have saved along with any wealth that has been generated on top of what has been saved?

The answer to these 3 questions is straightforward enough. Unfortunately, the answer to these questions has been overlooked by most and ridiculed by many. This is because human nature desires to achieve higher rates of return while unknowingly, becoming exposed to higher risks. And with those higher risks comes the greater probability that an unaffordable and unrecoverable loss will be suffered.

This is why 9 out of 10 Americans today need their Social Security in retirement. And why up to 29% of seniors over age 65 depend on Social Security for at least 90% of their income. They didn’t build wealth that was sustainable.

This is a real problem that a majority of Americans face today. There are many factors that have gone into creating this problem, but building sustainable wealth is still feasible and entirely possible for most Americans. And the sooner one begins to rectify these problems the more wealth they will be able to build.

Money obviously doesn’t grow on trees, nor can government simply continue to print money and hand it over to those who won’t or can’t work. When the government prints more money and hands it out to those who won’t or can’t work, the 1% of the population simply gets richer. This is because it is the 1% who controls the supply of goods and services that everybody needs to purchase or use.

At the same time, those who have saved, end up losing the most when the government prints money because now the money they have saved is no longer worth what it was when they saved it. For example, $10.00 saved in 1990 is only worth $5.55 today in October 2021. That $10.00 saved in 1990 would have had to earn 2.505% every year to keep up the value it had back in 1990.

The reason for this inflationary activity is primarily because more money has been printed and released into society compared to the wealth that has been created. Imagine diluting your morning cup of coffee or glass of orange juice by 50% and still calling it coffee or orange juice. Yet this is exactly what the government is doing with the money supply. Just consider the cost of a carton of ice cream. Five years ago, you could buy a half-gallon of ice cream for under $3.00. Today, ice cream at the local grocery store is over $4.00 and it is no longer a half-gallon (2 quarts), it is only 1 ½ quarts.

So where can the money be stored without losing most of its value due to the inflationary policies with which we all have to live? This is another question that needs to be addressed if someone is going to build sustainable wealth.

The only place where most Americans can save money and protect themselves against the inflation problem while still solving the three problems outlined above is Participating Whole Life Insurance.

Participating Whole Life Insurance (PWLI) is a contractually guaranteed product that can never have a price increase, while still delivering a return that overcomes the cost of the product purchased. Imagine purchasing an asset and still having the money you purchased the asset with to use over and over again as often as you like.

This is similar to what occurs in a PWLI contract. You purchase the policy (the asset) but the cash values in the policy, which represent your equity in that policy, compound and become greater than the cost basis of the policy. Furthermore, as soon as cash values begin to build in the PWLI policy, it can be leveraged to purchase other asset(s) without losing the value of the PWLI while doing so.

Using PWLI to store savings will take better than average care of the money paid in premiums and will be available, tax-free, for you to use at any time in the future. There are specific rules that every PWLI contract must follow to keep the policy from becoming a tax liability, but those rules are straightforward and easy to comply with. Moreover, the fee associated with PWLI is NOT a percentage of what is paid in premiums or what has accumulated in the policy, but rather a flat fee that is already included in the premium and can never be increased.

There are many opinions on how to build wealth, but it has been shown historically that at least 70% of Americans will need to use life insurance if they want to build sustainable wealth. Also, see our podcast on how to build wealth with life insurance.

McFie Insurancewas founded to educate and help Americans understand the value of owning PWLI to build sustainable wealth. We are here to serve you and help you build the wealth you need so that you don’t have to become one of the statistics who are dependent on Social Security in your retirement. Call 702-660-7000 or schedule a complimentary appointment here to see if you qualify for owning PWLI which can help you build and protect the wealth you need.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.