702-660-7000

702-660-7000

Everyone remembers the Beatles belting out about Jojo leaving his home in Tucson, Arizona. Ludicrously financial advisors seem to get their kicks telling clients where to “get back to” as well.

At a Christmas party last weekend we bumped into a financial advisor/CPA who was boastfully bleating about how he told his clients to hold on during the crash of 2008. NOW, this clueless fellow was proudly saying that his clients are all “back to where they once belonged” before the market crashed.

Why do folks pay somebody and permit them to hurl such depredating advice at them. Don’t they understand that when you “get back to where you once belong” 6 or 7 years down the road it isn’t what its all embellished to be. This is because you should be ahead of where you were 6 to 7 years ago NOT “Back to where you once belonged.”

Here’s the straight scoop:

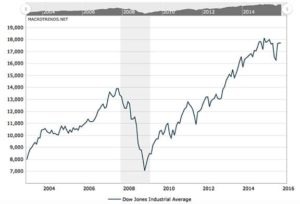

If you had 1,000 shares back in 2007 when the DOW was trading at 14,000 then by the end of 2008 your stock had lost 50% of its value (from 14,000 to 7,000.)

Fast-forward 7 years and somewhere by late 2014 early 2015 you are “back to where you once belonged.” This literally means the value of your stock is now back to where it was before the crash. But it is only back to the value of what it was before the DOW crashed and the major problem with such pitiful logic is this. The DOW is now trading at 18,000 not 14,000 which is a 28.57% difference. And that is definitely NOT where you belong at this point in the game! Today you “belong” owning more value, not the same value that you owned 7 years ago.

To put it another way, if you had $200,000 in the market in 2007 by the end of 2008 you would be down 50% or $100,000. Then by late 2014 early 2015 you’d be “back to where you once belonged” at $200,000. In reality however, you could have been at $257,148 had you not experienced the market correction back in 2008. This loss of $57,148 is like telling Jojo to “get back to where you once belonged” which isn’t rational or even reasonable when there are better options for you to take advantage of.

“Get back to where you once belonged” advice isn’t polite, appropriate, relevant or even honest. And that means you’d best ignore any advice that tells you things like: “What goes down, must come up”, “Buy and hold” or “Never sell on a loss”. If you heed such advice, you will end up “back to where you once belonged” or even worse off. And you will have missed opportunities, profits and wealth that may never pass your way again. And that would be tragic for you.

“Get back to where you once belonged” advice isn’t polite, appropriate, relevant or even honest. And that means you’d best ignore any advice that tells you things like: “What goes down, must come up”, “Buy and hold” or “Never sell on a loss”. If you heed such advice, you will end up “back to where you once belonged” or even worse off. And you will have missed opportunities, profits and wealth that may never pass your way again. And that would be tragic for you.

The Perpetual Wealth Code™ is designed to prevent you from ending up “back to where you once belonged”. Instead, the Perpetual Wealth Code™ gives you a matchless advantage, an advantage that permits you to avail yourself of the many opportunities, profits and wealth that come your way in life. That is because consenting to let others control your cash flow limits your potential and wealth. Implementing the Perpetual Wealth Code™ unlocks your potential and warrants your ability to keep more of what you generate in life. In turn you Win Your Financial GAME instead of always ending up “back to where you once belonged.”

Life is about progress and growth not regression and defeat. Ignore those that push you down or push you back and explore the Perpetual Wealth Code.™ The Perpetual Wealth Code™ is a proven way to keep more of what you make and put you on track to Winning Your Financial GAME instead of having to retreat to the recesses of your past in your future.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.