702-660-7000

702-660-7000

Life insurance may not be a top priority for people in their 20s and 30s who are focused on buying a home, building their career, or paying off debt. But there are several benefits to buying life insurance when you are young.

One of the biggest advantages of getting life insurance early is access to lower premiums. Life insurance rates increase as you age, so buying a policy when you’re young and healthy can save you significantly.

For those considering permanent whole life insurance policies, starting young provides more time for your cash value to grow. The sooner you start a whole life insurance policy, the sooner the cash value builds, and the more money you will be able to access later in your life.

When you are young, term insurance is, by far, the cheapest option. Term life insurance is temporary, and provides coverage for a set number of years, such as 10, 20 or 30 years. This can be a great choice for young people who want adequate life insurance coverage, but do not have the money to purchase a more expensive whole life insurance policy.

Whole life insurance policies are more expensive than term insurance policies, but they are designed to last your whole life, not just a term of years. Whole life insurance policies also build cash value. In later years of a well designed whole life insurance policy, the policy cash value will exceed the amount paid in premiums. Which actually makes whole life insurance the least expensive type of insurance over the long run. The cash value in whole life insurance can be accessed via a policy loan at any time for any reason.

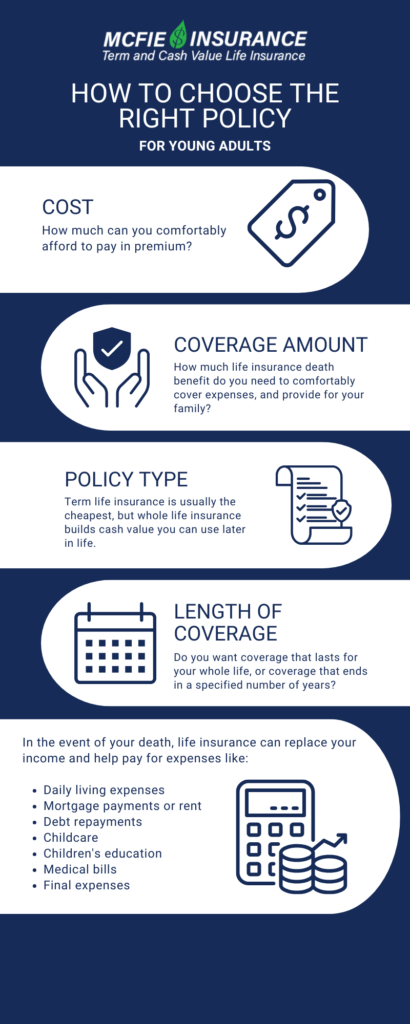

Choosing the right type of life insurance is an important decision, there are several factors to consider when choosing a policy.

If you’re wondering if you need life insurance, consider what would happen to your dependents without your income. In the event of your death, life insurance can replace your income and help pay for expenses like:

|

Policy Checklist Make Sure You Get a Good Policy Is your policy good or bad? Use this checklist to help evaluate your existing life insurance or a new policy you are considering. |

Term life insurance is a type of life insurance policy that lasts for a limited period of time, such as 10, 20 or 30 years.

Term insurance is great because, while you are young, it gives you a large amount of death benefit for a very small premium. This is a great choice for young families that need life insurance coverage but cannot afford a large premium payment.

If you die while the term policy is inforce, the insurance company will pay your beneficiaries the death benefit amount. If, however, coverage has expired, the insurance company will not pay out any death benefit.

Term insurance is not a permanent product, and does not build any cash value. Term insurance is not designed to last for your entire life. Once the level term period, often 10, 20 or 30 years has expired, term insurance becomes extraordinarily expensive.

Some term insurance has the option to be converted into permanent insurance. This type of insurance is called convertible term insurance.

Permanent life insurance refers to a category of policies that do not expire and offer a death benefit along with a cash value component.

Whole life insurance is the premier type of permanent insurance. Whole life insurance is a permanent product designed to last for your entire life and builds equity called cash value that the policy owner can borrow from. Buying whole life insurance is a lot like buying a house. While it is more expensive than simply renting, you get several benefits from owning your own home that you don’t get with renting.

The cash value component really makes whole life insurance special. With a well designed whole life insurance policy, the cash value will grow to exceed the amount ever paid in premiums. This makes whole life insurance the least expensive type of insurance to buy in the long run. Cash value can be accessed with a policy loan at any time for literally any reason. There is no approval process, it is a signature only loan.

Being a permanent product, whole life insurance is designed to last for your entire life. As long as you pay the premiums, the insurance company guarantees they will pay the death benefit to your beneficiaries. If you live to meet the policy maturity age, often age 120 or 121, the insurance company will write you a check equal to the death benefit of the policy.

There is another type of life insurance classified as permanent. This type of insurance is called Universal life insurance. This is the family that indexed universal life insurance belongs to. While classified as permanent, universal policies have a history of poor performance. Universal insurance can best be compared to an expensive term insurance policy with a cash value that decreases as the policy gets older. The death benefit also decreases in universal policies and usually disappears entirely in later years, which ironically is the time you are most likely to need it.

Purchasing life insurance can be daunting. Not only do you want to get the right type of policy, you want to get it for the best deal possible. You also will want a well designed product. Many people do not realize how substantial the difference is between a generic life insurance policy and a product that is well designed to meet your personal needs. The difference is so great it’s not even fair.

At McFie Insurance we help people get the life insurance they need. We have been designing life insurance products that fit our client’s needs for well over a decade and specialize in using those policies to utilize the Infinite Banking Concept. Whether you need term insurance or permanent insurance we can help you: 702-660-7000

Maybe you aren’t sure what type of insurance you need or how much. That’s okay. We have been helping people get the insurance coverage they need for well over a decade. We make getting the right insurance coverage easy. Contact us: 702-660-7000 or email: [email protected]

Ben T. McFie

Ben T. McFie

There's a lot of confusion around finance; there's so much to know and it's frustrating when you don't know enough to make the best financial decisions. I like to bring clarity to financial matters so people can make good financial decisions that will help them live wealthier more fulfilling lives.