317-912-1000

317-912-1000

You’ll often hear financial planners advising on how to “diversify your investment portfolio” to mitigate risks and build wealth through multiple avenues. There are many different ways to do this, but stocks and bonds are two common options. Stocks are defined as partial ownership or equity in a business or organization, while bonds are a loan to a company or the government. A major difference between the two investments is how they make money: stock investments usually rely on their equity value increasing over time to be sold for more than you bought it for on the stock market, while bonds pay a fixed interest rate over time.

Below, we’ll discuss the basics of each, the difference between stocks and bonds, and how life insurance can play a role in a portfolio offering more liquidity, protection, and guarantees.

Stocks are a type of investment also known as equities that represent partial ownership in a company or organization. When you buy a stock, you’re purchasing a small portion of a corporation called a share. This means you own a part of the company’s assets and profits. The value of your shares can go up or down based on the profits of the company, its net worth, the number of shares the company decides to issue, and whatever else happens in the market causing investors to react.

For example, let’s say a company has a stock price of $25 per share, and you invest $1,000. You would have 40 shares in the company at $25 each. If the company consistently performs well over time, the stock price might rise to $35 per share. The $1,000 you invested would then be worth $1,400. You could then sell those shares to another investor via a stock exchange for a $400 profit. However, the opposite could happen as well. If the company doesn’t do well over time, the stock price might decrease to $15 per share. This would mean your $1,000 investment would now only be worth $600 for a $400 loss.

Companies might decide to issue shares to the public for several reasons, but the most common is to raise more capital for future company growth. Those companies who do decide to “go public” and become listed on a stock exchange go through an initial public offering (IPO) process with an investment bank or a group of investment banks called underwriters who offer the new shares to investors through a stock exchange.

Stock exchanges are markets where stocks are traded. In the United States, there are three primary stock exchanges regulated by the U.S. Securities and Exchange Commission (SEC):

The stock market exists to provide stock buyers and sellers a fair, regulated and controlled place to trade stocks. In theory, it offers transparency and ensures that stock prices are fair and honest.

The important thing to remember, however, is that your stock investments are tied to how well the company performs and whatever else happens in the market. You’re essentially betting on the company, or the overall market, growing over time to make a profit on your investment. While people often think, the bigger the risk the higher the reward, that isn’t always the case. Sometimes bigger risks lead to larger losses.

Because so many factors affect the stock market every day, stock investing is an ever-changing game that has a high level of risk associated with it. These inherent risks and constantly changing circumstances can hinder long-term wealth building. Read more in our guide to stock advisors and stock investments.

A bond is a loan from you to a company or the government. Think back to the last time you had to get a loan – maybe to purchase your first home or attend a four-year university? You were probably offered a specific amount of money with the agreement that you would pay it back within a certain time plus “x” percent of interest. Bonds work the same way except, in this instance, you’re the lender, not the borrower. You lend a specific amount of money for a certain time to a company or the government and charge interest. Once a bond “reaches maturity,” or in other words, reaches the end of the loan period, you’ll be paid back the original principal.

For example, let’s say you buy a bond for $1,000, and it pays 2% annual interest for 10 years. This means that every year for the next ten years, you’d receive $20 in interest payments. After the 10 years when your bond has reached its maturity, you’d have earned $200 in interest, and you’d get back your initial $1,000 investment for a profit of $200.

The duration of a bond, its interest rate, and how frequently the interest is paid out will differ based on the type of bond you buy. There are five common types of bonds available:

Note: Many bonds don’t grow tax-free, so interest earned can be subject to federal and state taxes. Depending on bond market conditions capital gains taxes may also be due.

Bonds are typically viewed as a conservative investment type. While this is usually the case, putting your money in bonds for a long time with a low return might not be the best move for building your wealth. Learn more about bonds vs. participating whole life insurance on this episode of our Wealth Talks Podcast.

Now that we’ve gone over the basics of bonds vs. stocks, let’s take a deeper look at the differences between the two types of investments.

How do bonds differ from stocks? While both investment types seek to grow your money, the way they do it, the risks they come with, and the returns they offer can be very different.

Choosing between stocks and bonds can also be seen as an investor vs. lender situation. Buying stocks, you’re investing in shares of a company in hopes it’ll do well. Buying bonds, you’re lending money (issuing a debt) that will have to be paid back, plus interest. Bond and stock markets are also known as debt and equity markets respectively, because of this structure. So when deciding between bonds vs. stocks, you’ll want to consider this difference.

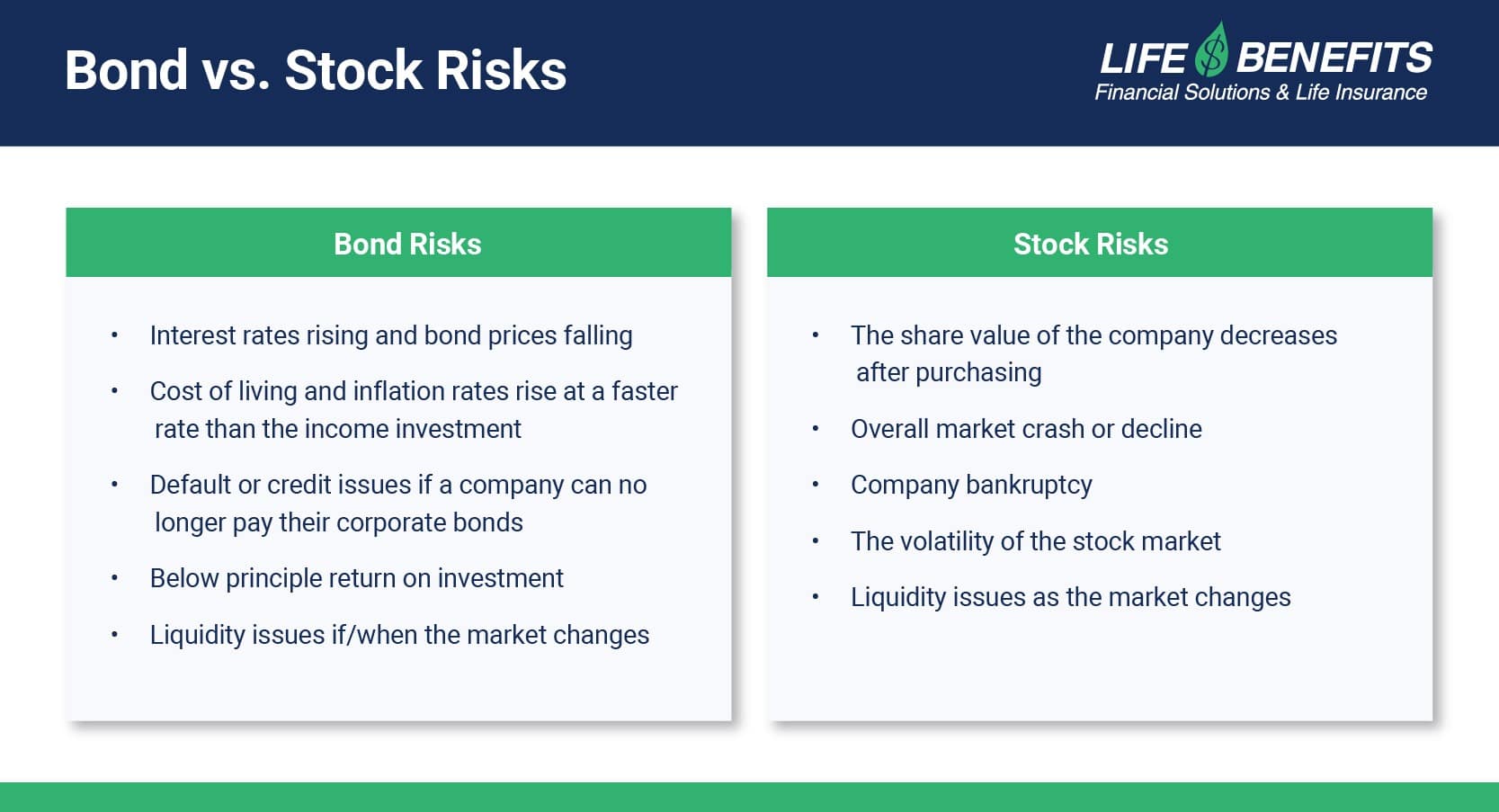

You’ll often hear the term “risk-tolerance” when discussing financial investments. This refers to how much risk you’re willing to take with your investments. While neither bonds nor stocks are risk-free, bonds are typically viewed as “less risky” compared to stocks. Here are some risks you assume when investing in stocks or bonds:

To gain profits from stocks, you have to sell your company shares at a higher price than you paid for them. If you’re successful in doing this, your profit will become a capital gain, which can be turned into income or reinvested in something else. These profits will be subject to long-term or short-term capital gains taxes depending on the length of the investment.

On the other hand, bonds generate profits through regular interest payments. As mentioned in the bonds section, the frequency of these payments depends on the length or type of the bond. Some bonds can also be sold on the bond market for capital gains.

Diversifying your financial portfolio doesn’t have to mean risk with no guarantees or guarantees but hardly any rewards. Bonds vs. stocks aren’t the only options to consider when looking to build your financial wealth.

At McFie Insurance, we can design participating whole life insurance policies that provide protection guarantees and liquidity for people who want more of these qualities than they can get by investing in bonds or stocks alone. Unlike bonds or stocks where you assume all the risk, whole life insurance companies assume the risk for you when you purchase a policy. Life insurance companies then invest their portfolios (often in bonds) and provide guaranteed values to you – something you can’t depend upon in either the stock market or the bond market. Additionally, participating whole life insurance provides an opportunity to gain equity in your policy and use that equity during your lifetime through policy loans against the cash value. This allows you continued access to your money for life’s needs and can help you to create free cash flow.

Interested in seeing what a participating whole life insurance policy can do for your wealth? Schedule a strategy session with us today.

by John T. McFie

by John T. McFie

I am a licensed life insurance agent, and co-host of the WealthTalks podcast.

As a 15-year practitioner of the Infinite Banking Concept on a personal level, I can help you find the clarity and peace of mind about your financial strategy that you deserve.

Working with hundreds of financial scenarios over the years has helped me to develop a sixth sense about how to quickly find a clear and balanced solution for clients using whole life insurance as a financial tool.

Note: Investing information provided on this page is for educational purposes only. McFie Insurance does not offer advisory or brokerage services, and does not recommend or advise investors to buy or sell particular securities.