702-660-7000

702-660-7000

Standard financial advice often overlooks one of the most valuable financial tools available. Many argue that whole life insurance doesn’t offer sufficient returns to justify its ownership. The common advice now is to “buy term insurance and invest the remaining money elsewhere.”

However, this approach is leading to financial losses for numerous individuals. Other insurance options leave people vulnerable to risks and financial loss.

Whole life insurance is a type of permanent insurance that covers the insured person for their entire life, ensuring a tax-free payout to the policy’s beneficiaries after the insured person passes away.

If you’re in the market for a lasting insurance option, whole life insurance is a great choice. It’s unique because it builds cash value for the person holding the policy, a feature not found in other types of life insurance, including other “permanent” varieties like universal life, variable universal life, and indexed universal life insurance, which don’t accumulate cash value for the policyholder.

There’s a special form of whole life insurance known as participating whole life insurance. With this, if the insurance company does well financially, it shares a portion of its profits with the policyholders through dividends.

Think of the cash value in a whole life insurance policy as being similar to the equity you build in a house.

It’s important to understand that the cash value found in universal life insurance products isn’t the same as in whole life insurance. In universal life, including variable and indexed universal life insurance, the cash value isn’t equity. It’s essentially a sum of money in an account that hasn’t yet been allocated to pay for insurance coverage.

In the context of whole life insurance, each payment made by the policy owner, or the person paying the premiums, is essentially like making a payment towards “paying off” a part of the policy’s death benefit.

With every premium payment, more of the insurance policy becomes owned by the policyholder. This owned portion is known as “paid-up” insurance.

Paid-up insurance holds a cash value, which the policyholder can access either by withdrawing it or by using it as security for a loan against the policy.

At McFie Insurance, we understand that the perfect whole life insurance policy is one that meets our customers’ needs both today and down the road. Designing a whole life insurance policy involves more than just entering data into a program; it’s about understanding our customers’ financial aspirations so we can tailor a policy that supports them in achieving their objectives.

Riders are additional features that can be added to a whole life insurance policy to tailor it more closely to the policyholder’s or insured’s needs. Here are some commonly used riders:

Some riders come at no extra charge, while others may incur additional costs. Not every rider is essential for creating the optimal whole life insurance policy.

Our views on term riders are mixed. They can be beneficial, adding value to the policy, or they might just be an unnecessary expense. We incorporate them thoughtfully, only when they clearly advantage the policyholder.

A rider we particularly value is the Paid-Up Additions Rider. It accelerates the growth of the policy’s cash value, enabling the policyholder to access more funds earlier.

The Accidental Death Benefit Rider increases the payout of the policy if the insured dies due to specific accidents.

Terminal Illness and Critical or Chronic Illness Riders are often provided at no additional cost and can be a valuable addition to a policy. They only incur a cost if activated by the policyholder later on. These “free” riders are a beneficial feature to include in a policy.

The Waiver of Premium Rider ensures that the policy’s basic premiums are covered if the insured policyholder becomes disabled. This rider comes with a cost and certain conditions that are important to understand before deciding to add it to your policy.

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here>

Many view whole life insurance as pricier compared to term life insurance. However, despite the initial higher rates of whole life insurance, numerous individuals later wish they had opted for it sooner.

In the long run, whole life insurance tends to be more economical than term insurance.

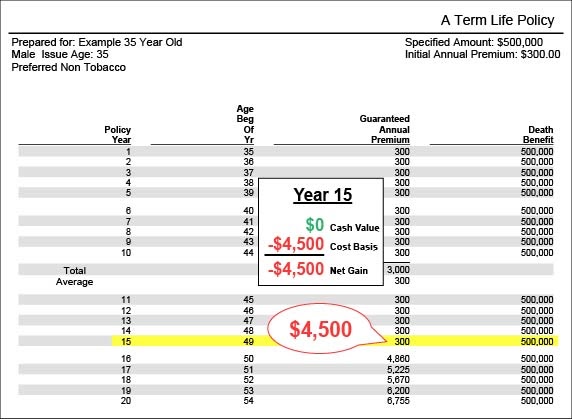

Consider this example of a 15-year level premium term life insurance. After fifteen years, the total amount paid for this term policy would be $4,500.

From the sixteenth year onwards, the yearly cost for the term policy rises, making it increasingly expensive to maintain the coverage.

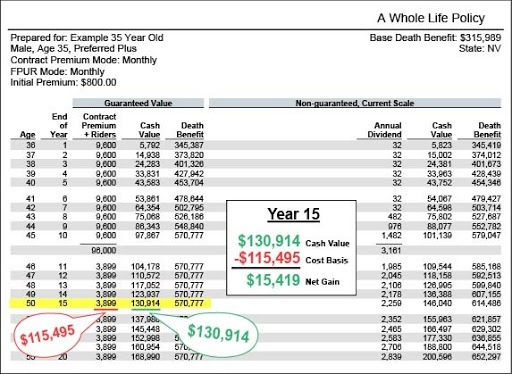

In contrast, a whole life insurance policy, although starting with higher annual premiums, accumulates $130,914 in cash value by the fifteenth year. This means the policyholder has access to $15,419 more than what they’ve paid into the policy, which can be withdrawn or borrowed against.

If the policyholder were to cancel the whole life policy in the sixteenth year, they’d get back at least $15,419 more than what they’ve paid over fifteen years, possibly even more with dividends included.

In addition to that, by the fifteenth year, the whole life policy offers $70,777 more in guaranteed death benefit than the term policy’s $500,000 coverage, which continues to grow as dividends purchase additional paid-up insurance.

Though the initial rates for whole life insurance are higher, it becomes significantly more cost-effective than term insurance over time, making it a valuable long-term investment.

Owners of whole life insurance policies have the chance to earn dividends. These dividends can increase both the cash value and the death benefit of the policy.

Whole life insurance doesn’t offer a specific rate of return like some investments. Instead, it provides a guaranteed value and the chance to earn dividends.

Let’s look at a practical example of how whole life insurance works:

In this scenario, a premium payment is made in the sixteenth year, and the policy is designed so that the cash value is guaranteed to increase by at least 86.74% more than the cost of that year’s premium.

By the sixteenth year, the costs associated with the insurance have been covered, and the return on the premiums paid from that point forward showcases the value of owning whole life insurance.

If you’re dealing with high-interest debts, like a 12% interest rate on a credit card, taking a loan from your whole life insurance can be a smart move. By using this loan to clear the credit card debt, you essentially save the interest you would have paid to the credit card company.

Business owners can also benefit from whole life insurance by taking out policy loans to grow their business or invest in new equipment. In some situations, the interest on these loans might even be tax-deductible.

Contrary to what many standard financial advisors might suggest, life insurance can still be valuable after major expenses like your mortgage are paid off and your children are independent. The Secure Act of 2019 changed the rules for inherited IRAs, making them less advantageous for passing wealth to your heirs in a tax-efficient way.

Whole life insurance has emerged as an alternative method to pass on wealth without taxes to your descendants, similar to the benefits once offered by the “Stretch IRA.”

Whole life insurance can be a financial safety net for retirees during economic downturns. Instead of tapping into retirement savings at a loss during market slumps, the cash value from a whole life policy can provide temporary income. When the market recovers, retirees can then go back to relying on their retirement funds.

Without the cushion of life insurance cash value, some retirees might have to reconsider their retirement plans, possibly returning to work or cutting back on their lifestyle after a market downturn.

Additionally, life insurance offers flexibility for unforeseen needs like assisted living, as the policy can be converted into a lifetime annuity, ensuring a steady income stream to cover retirement living expenses or care needs.

Whole life insurance is often praised for its tax benefits, earning it the nickname “Sweetheart of the IRS tax code.” It shares similarities with a self-directed Roth IRA in terms of tax advantages but stands out by offering a death benefit and lacking the strict rules that govern IRAs.

When it comes to financial planning, you want the best. Whole life insurance is the best strategy for retaining more of your earnings, safely expanding your wealth, and achieving financial stability. To explore your options and create a whole life insurance plan tailored to your needs, consider booking a strategy session with us.

During this session, we’ll ask you about your financial goals so that we can design the ideal life insurance policy for you, ensuring you receive competitive whole life insurance rates. Don’t hesitate to schedule your strategy session today.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.