317-912-1000

317-912-1000

Amid rising unemployment and ongoing economic uncertainty in the U.S., many individuals and small business owners are tapping into every available financial resource to support their families and stay afloat. For some, that means turning to retirement savings—specifically 401(k) accounts—as a temporary lifeline during challenging times.

The Coronavirus Aid, Relief, and Economic Security (CARES) Act, passed in 2020, created provisions that allow eligible individuals to make early withdrawals from their 401(k) accounts without facing the 10% early withdrawal penalty. This relief measure was significant for those under age 59½, who would normally incur penalties for accessing retirement funds early. Under the CARES Act, qualified individuals can withdraw up to $100,000 and elect to spread the income tax liability over a three-year period, easing the immediate financial burden.

Using your 401(k) as a financial safety net shouldn’t be taken lightly. Withdrawing from retirement savings can impact your long-term financial goals, especially if you’re unable to repay the amount within the designated timeframe. While the penalty may be waived, the funds are still taxable as income unless repaid.

Before initiating a 401(k) withdrawal, it’s essential to:

Confirm your eligibility under the CARES Act provisions

Understand the full tax implications and repayment options

Consult with a financial advisor to evaluate alternative strategies or resources

Consider whether a loan from your 401(k)—rather than a withdrawal—might be a better option if available

While the CARES Act offers important short-term relief, it’s important to balance today’s needs with tomorrow’s financial security.

The 401(k) withdrawal tax is based on your income and tax bracket. However, you will be subject to a 401(k) tax penalty if you withdraw before the age of 59 1/2 . The penalty on an early 401(k) withdrawal is an extra 10%. During the COVID pandemic, the CARES Act has made early 401(k) withdrawals penalty free up to $100,000 for individuals affected by Coronavirus.

The CARES Act has temporarily eliminated the 10% early withdrawal and distribution penalty for 401k withdrawal and other qualified plan funds, up to $100,000. This law applies to you if you have been “affected” by the Coronavirus in one of these three ways:

Under these conditions, you can now access up to $100,000 as a penalty-free 401k withdrawal. This also applies to withdrawals from an IRA or 403(b). If you take a loan rather than a withdrawal from a 401(k) or 403(b), you can avoid the taxes as long as you pay the loan back in three years.

This new regulation affects nearly everybody who has an IRA, 401(k) or 403(b). And as just mentioned, even though the 10% penalty for early withdrawal from your IRA or distribution from your 401(k) has been removed, you will still have to pay the taxes on that money. To avoid this 401(k) tax, you can repay your qualified plan over the next three to five years.

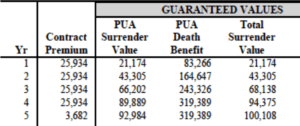

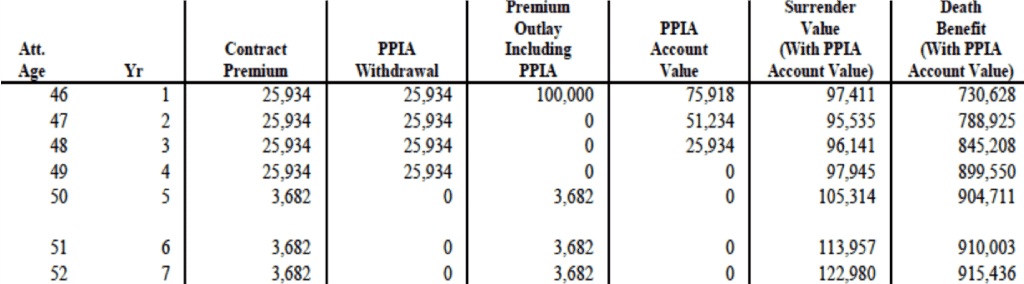

Obviously, you will have to pay the 401(k) taxes on that money regardless of when you take your money out, so here is a way to recover the 401(k) withdrawal tax over time so you don’t have to pay it later. This is your once in a lifetime chance to do so. (This illustration is on a healthy male age 45.)

These benefits cannot be accomplished with your IRA, 401(k), or 401(b). But they can with Whole Life insurance.

Penalty-free 401k withdrawals are certainly not an every-day occurrence. Now is the time if you wish to seize the opportunity of this “once in a lifetime chance” to avoid the 10% penalty and remove your money from the risk of the market. Start getting the guaranteed growth that mutual whole life insurance can legally provide for you.

Notice that $122,980 is the projected cash values for year 7 in this life insurance policy. That means you could completely recover the cost of the taxes you will have to pay on that $100,000 if you are in the 22% marginal tax bracket and decide NOT to pay the loan back. But here is some great news, the cash values in your life insurance policy will never be taxed again, if you follow the IRS guidelines.

The money you use to pay the principal and interest on your 401(k) or 403(b) loan (after the 5-year window) will be taxed before you pay your loan back AND it will be taxed again when you access that money in the future. This means double taxation on your same dollar!

You can only take an early withdrawal from an IRA, but you can borrow from your qualified plan, if your plan allows loans to be taken. The CARES Act merely waives the interest on loans taken from your qualified plan for 3 years at which time you will have to pay the loan back with interest, or it will be reclassified as an early distribution and you will have to pay the taxes owed.

If you already have an outstanding loan against your qualified plan, you may not be able to take another loan, depending on your employer’s plan loan guidelines. So be sure to check to see if you qualify.

Here’s the crux of the matter. Traditional financial planning advises individuals with IRAs, 401(k)s, and 403(b)s to consider early distributions or loans from their retirement accounts only as a last resort. This advice tends to focus on the short-term view of managing your funds without taking into account the long-term impact these decisions can have on your financial future.

In contrast to this conventional approach, a more strategic financial planning perspective recognizes the importance of safeguarding what you’ve already earned and accumulated. While withdrawing funds from retirement accounts might seem like a necessary solution in times of hardship, traditional financial strategies prioritize ensuring your assets are protected and growing in a way that guarantees stability for the future.

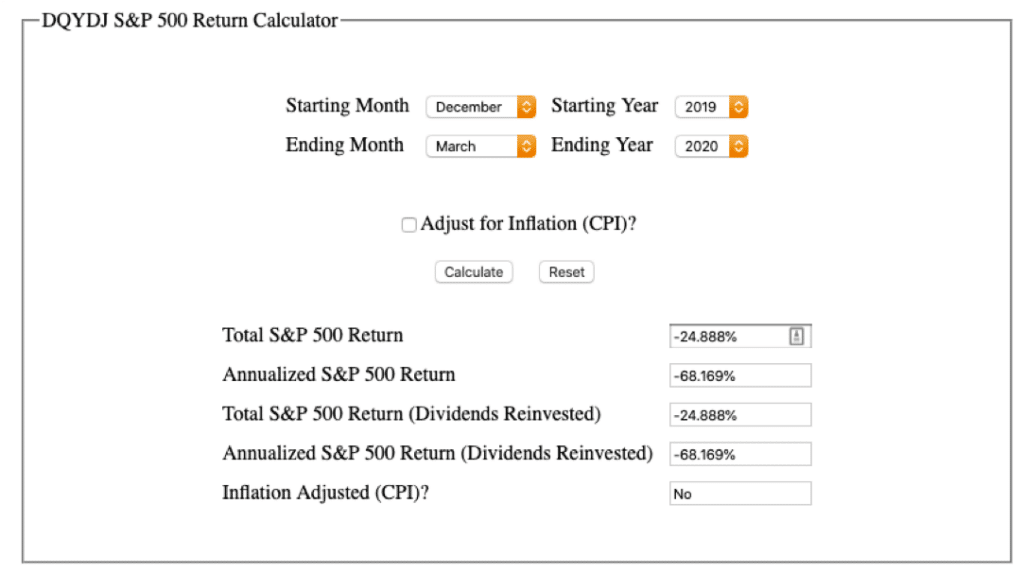

The reality is that you simply don’t have the time to rebuild a retirement nest egg if you experience significant losses. Unlike other investments, once you lose money from your retirement accounts, it’s difficult to recover those losses. Large drops in your portfolio can take years, if not decades, to recoup—years you may not have, especially as you approach retirement. Protecting your hard-earned savings from unnecessary risk is crucial because, when it comes to retirement planning, there’s no going back to “rebuild” a foundation that’s been eroded by withdrawals or poor market performance.

The main takeaway here is that while using retirement funds should be a last resort, it’s important to explore more stable and secure options—like insurance contracts or other guaranteed investment vehicles—that allow you to protect your assets from volatility while still generating growth. This way, you’re not just taking out loans or draining your 401(k) in tough times, but building a secure, long-term financial strategy that withstands market fluctuations.

For example:

Traditional financial planning provides the protection you need for your money by using legally binding contracts which keep your money growing, safe and secure. No investment or deposit can even offer the same guarantees that you are automatically provided within participating whole life insurance. That is why traditional financial advice has always been to own participating whole life insurance as the foundation of your financial portfolio, because nothing else can compare.

Shopping for a well designed participating whole life insurance can be a time-consuming process. How do you know if the agent designing your policy knows how to include all the benefits and features you’ll want?

At McFie Insurancewe make the process easy because we know what options and benefits can be added to a policy as well as when and more importantly when not to add them. We’ll even show you how we design a good policy during a web meeting so that you can understand how the policy is built and ask questions as we go along.

If you want a good policy but don’t want to spend lots of time researching all the options for yourself we’ll happily share our knowledge with you and design a good policy for you. Click here to request a web meeting

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.