702-660-7000

702-660-7000

Owning a whole life insurance policy that pays dividends can be a great financial move. However, it’s essential to understand specific details about how the policy is set up. This knowledge helps you manage your money better and increase the total value and protection your policy offers most effectively.

After examining thousands of these policies, we’ve noticed some key points that everyone should know. Here are two important ones:

There’s a big difference in how dividends are paid out and how they impact the policy’s growth in value and protection.

Adding extra term insurance to a whole life policy might not always benefit the policyholder.

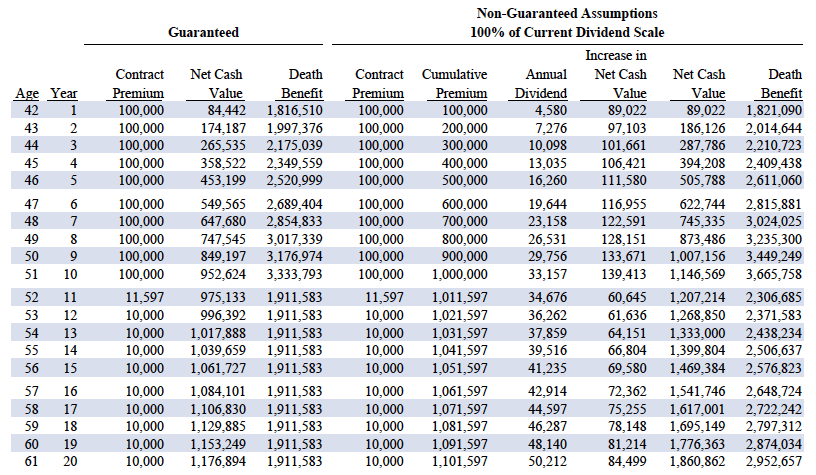

For instance, we reviewed a policy designed with extra term insurance that initially increased cash values to 84.4% of the first year’s premium. This design significantly affected how much value the dividends added.

In this case, a 10-year dividend of $33,157 only increased the cash value by $139,413 and the death benefit by $216,536. This means the return on the dividend was 320.50% for the cash value and 553.1% for the death benefit.

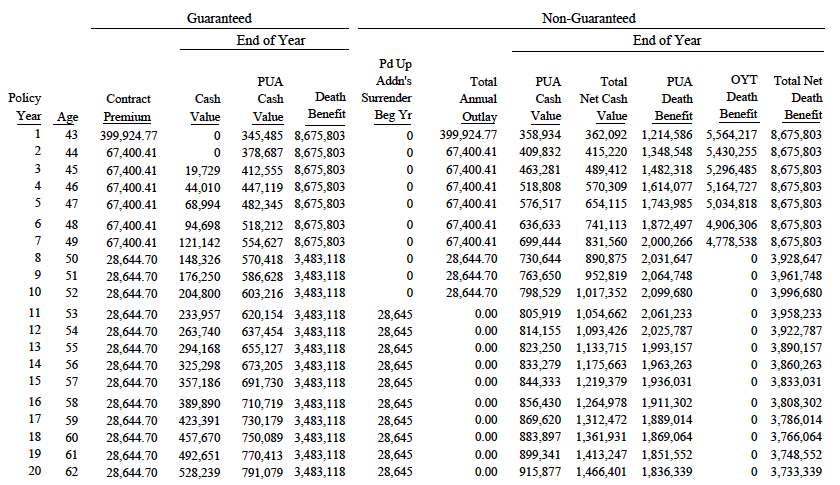

When we compared this to a policy without extra term insurance but with a maximum paid-up insurance rider, the results were different. The same person, with the same premium, would have:

First-year guaranteed cash values equal to 66.76% of the first year’s premium,

This means a 3,008.0% return on the dividend for cash value and a 5,071.6% return for the death benefit.

Understanding these percentages is crucial when deciding which policy is better. Assuming that a larger first-year value or bigger dividend payments are always better can lead to poor cash management and less growth in your policy.

The best policy is one that lets you manage your money well and gives the highest percentage increase in value and protection compared to the dividend paid. This is true whether it’s a “90/10” policy or one with different dividend payments.

|

Get a working knowledge of how each type of life insurance policy works. After reading this 10-page booklet you'll know more about life insurance than most insurance agents. Download here> |

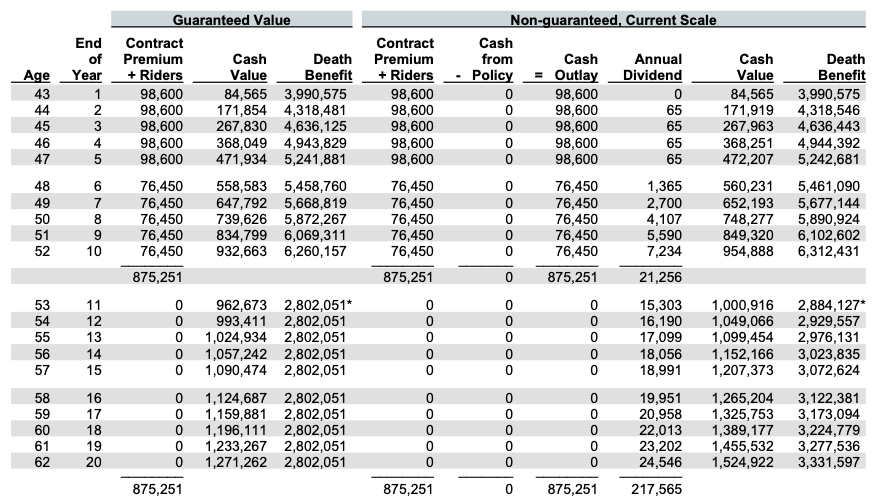

In our study, the “90/10” policy had 18% more guaranteed cash value in the first year than the “60/40” policy but provided lower guaranteed death benefits. By the tenth year, although the total paid for both policies was the same, the “60/40” policy had better guaranteed cash values by 5.02%.

If you want to use the higher cash values of a “90/10” policy immediately, you must consider the interest on policy loans. Borrowing against these higher values can significantly increase your costs.

In this case, there was 18% more money to borrow from the “90/10” policy compared to the “60/40” policy. Borrowing this extra money over two years at 6% interest increases your borrowing costs by 9.09%.

Understanding these differences between “90/10” and “60/40” policies can help you choose the right one. Not all dividends are profitable, and not all high cash values are beneficial. Don’t be misled by high initial cash values or attractive dividend projections.

Also, consider the guaranteed death benefits. After ten years, the guaranteed death benefit of the “90/10” policy was only 71.83% of the “60/40” policy. The “90/10” policy is even less favorable after removing the extra term insurance because of its rising costs.

What does this mean? Don’t choose a dividend-paying whole life insurance policy based just on:

The projected dividends or the higher cash values from adding extra term insurance.

To wrap it up, it’s clear why buying dividend-paying whole life insurance just because of:

isn’t a good move. If you’re getting dividend-paying whole life insurance, you should:

These strategies help you get the most value from your dividends, avoid unnecessary interest costs, and ultimately achieve higher cash values and death benefits.

At McFie Insurance, we educate and help people choose the best life insurance. Call us at 702-660-7000 to see if your policy is working well for you.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.