702-660-7000

702-660-7000

With the cost of education continuing to rise—and student loan debt now exceeding a staggering $1.7 trillion—many parents are understandably concerned about how to fund their own or their children’s educational futures. For years, 529 plans have been promoted as the go-to solution for education savings. While they offer some tax advantages, these plans come with restrictions on how the money can be used, and withdrawals for non-qualified expenses can trigger penalties and taxes. That means 529 plans aren’t always the most flexible or reliable option for every family.

In this guide, we’ll break down exactly how 529 plans work, their pros and cons, and whether they’re truly the right fit for your financial goals. The more you understand, the better equipped you’ll be to make confident choices about your family’s future.

And remember, you don’t have to navigate these decisions alone. Whether you have questions or are ready to explore alternative strategies, our team at McFie Insurance is here to support you every step of the way.

A 529 plan is a savings plan with tax and financial benefits for assistance in paying for education. It’s meant to help save for education costs by accumulating earnings on a tax-deferred basis and by avoiding federal taxes if used for qualified education expenses. Anyone can open a 529 plan account; although, they are typically set up by parents or grandparents for their children or grandchildren (who will be the beneficiaries of the 529 plan).

The plan gets its name from Section 529 of the Internal Revenue Code (IRC) – a section that was added in 1996 to authorize tax-free status for “qualified tuition programs.” The original definition only included higher education institutions but was later amended to include K-12 tuition, student loan payments, and apprenticeship programs. However, even though the plan comes from the federal IRC document, it’s up to each individual state to administer plans. Nearly all 50 states and the District of Columbia offer some sort of 529 plan.

There are two main types of 529 plans: a college savings plan and a prepaid tuition plan. Below is a short breakdown of the different plans.

A 529 college savings plan is an investment account that the holder contributes money to that is then typically invested into a variety of mutual funds. The savings plan will grow or shrink based on the performance of the funds you choose to invest in. A common strategy that many 529 college savings plans utilize is to decrease in more risky funds with larger growth potential as the beneficiary of the account becomes closer in age to needing the education funds. These are often referred to as target-date funds or funds optimized to be withdrawn on a certain date.

A prepaid tuition plan, on the other hand, allows you to pay part or all of the costs at an in-state public college at the current tuition rates of the college. Essentially, you’re able to save on any tuition rate increases that may happen between the time you create the plan to when you actually need to pay for college. It’s important to note that this plan is not eligible for K-12 education, not all states offer a prepaid tuition plan, and the plan has to be converted in order to use it for out of state or private colleges. A prepaid tuition plan also has more restrictions on what the money can pay for, excluding room and board costs.

Once created, a 529 plan, depending on the plan you create, will grow earnings until you need to withdraw it for qualified education expenses. These expenses can include tuition, fees, books, supplies, computers, equipment, and sometimes room and board for colleges, universities, or other higher education institutions. You’re also allowed to make withdrawals without penalty fees and being taxed if you are repaying federal or private student loans, paying for an apprenticeship program, or paying for K-12 school tuition (in this case, the limit is $10,000 per year per beneficiary).

If you choose to withdraw funds from the plan that don’t qualify for an education expense, you may be subject to state and federal income taxes as well as a 10% tax penalty.

We frequently hear the question, “What can I do with the money left in my 529 plan?” And the short answer is that you will be taxed if you take the money out without using it to pay for qualified expenses PLUS you will pay a 10% penalty for doing so.

However, at McFie Insurance, we’re out of the box thinkers, and so the long answer is, you can avoid those taxes AND the 10% penalty if you merely understand and follow the law.

Justice Louis Brandeis once stated that using the long way home to help decongest Washington DC was a public service whereas taking the shorter way home via the toll bridge between DC and Alexandria, Virginia required a tax to be paid. “Likewise,” Brandeis avowed, “taking the time to discover, understand and apply the law in a way which prevents you from having to pay taxes and penalties is a public service and should be rewarded.”

With Justice Brandeis’ approval, you should always be looking for ways to pay less in taxes and to eliminate penalties on your savings and investments. Your 529 savings accounts are no exception.

As the law legally allows the beneficiary of a 529 to be changed once a year, this means unused 529 funds can be directed to anybody within your family, including yourself. Because of this regulation, the money you saved in a 529 plan for a spouse or child doesn’t have to be spent on that person. Therefore, transferring the beneficiary of the 529 plan to yourself is the first step to avoiding unnecessary taxes and the 10% penalty.

Once this is accomplished, you have the legal right to spend the 529 funds for qualified expenses that you yourself incur. This means you can spend the money on your own education and/or related expenses associated with your education such as tuition, fees, books, supplies, or computer-related expenses, as long as the credits you earn are from an accredited institution.

Obviously, if you spend these 529 plans on continuing education for yourself, the money you normally would have spent to cover these expenses can now be used for other purposes like building sustainable wealth where taxes and penalties don’t encroach upon your disciplined savings accumulation. To learn more about how to avoid costly penalties with 529 plans, listen to our recent episode of Wealth Talks.

The real question you should be asking when looking into savings plans like 529s is do you want to grow funds tied to only education purposes? What if your son or daughter ends up not going to college and now the funds you’ve saved up for their future aren’t accessible?

529 plans have been pushed by financial planners and advisors for years, but many end up getting hit with taxes and losing 10% of what they saved when their child or spouse doesn’t need or decided not to attend college.

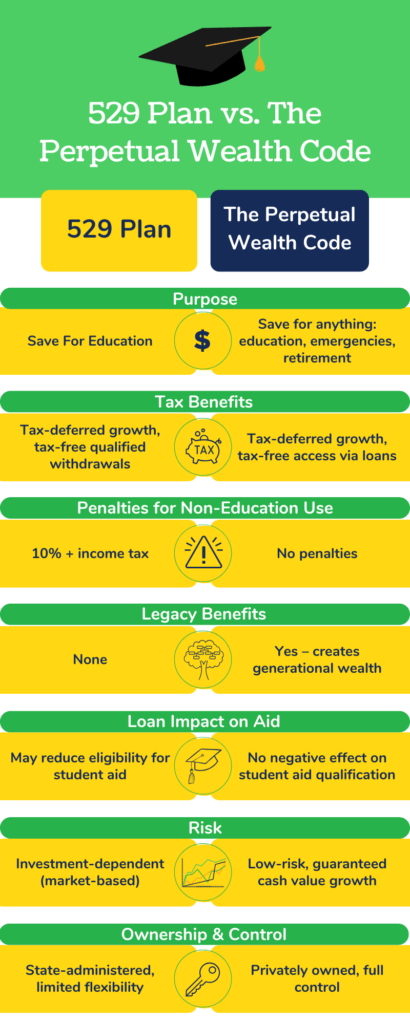

Instead, the most natural way to save money for education purposes would be in participating whole life insurance. Your money will grow tax free, you will be able to access the cash value in your policy for emergency or planned financing without losing the growth, and you will build a legacy that will pass tax free to the next generation all at the same time. To see the Perpetual Wealth Code in action against 529 plans, take a look at our short video comparing the two.

One thing that 529 plans don’t advertise is how they can affect income brackets should children still need to get a loan to pay the difference for their education costs. 529 savings can often cause parents to make too much money for their children to qualify for subsidized loans. This means more added costs for education because any loans needed will begin to accrue interest right away. This combined with the limited withdrawal use cases of a 529 might make you rethink your savings plan and consider a well-designed participating whole life insurance policy instead.

If this is you and you want to create a better education savings plan for you and your family, schedule a free strategy session with the McFie Insuranceteam. We’ll help you implement the Perpetual Wealth Code into your financial strategy and set you up for the most success in education funding.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.