317-912-1000

317-912-1000

Participating Whole Life Insurance (PWLI) is a lifelong insurance policy where premiums are paid annually. This contract involves the policy owner and the insurance company, with the company guaranteeing cash value growth during the insured’s lifetime and a specific death benefit to beneficiaries upon the insured’s passing. Additionally, the insurance company shares extra profits with policy owners, which are known as dividends. In the United States, these dividends are not considered taxable income when they are used to purchase paid-up additions, because they are classified as a return of excess premium.

Tax Benefits: The tax code provides favorable treatment to PWLI owners, resulting in lower long-term taxes compared to those who don’t utilize this type of insurance.

Retirement Planning: For many wage earners, PWLI serves as a crucial tool for building an estate. It accumulates cash value over time, which can be used for major expenses like buying a house or starting a business. During retirement, it can act as supplementary income, and/or a volatility buffer reducing the need to sell investments during market downturns.

Inheritance Protection: In addition to guaranteed cash value growth, PWLI owners can benefit by receiving dividends from the insurer’s profits throughout a lifetime which can also help to grow the cash value over time. This is valuable for wealth protection and accumulation. The death benefit is generally income tax-free and protected from creditors in many jurisdictions, making PWLI a wonderful tool for estate planning and wealth preservation.

Enhanced Cash Flow: PWLI allows policyholders to obtain policy loans without the need for credit approval. This can be beneficial for business owners, individuals, and real estate investors. These loans are easy to access, with no extensive application process or documentation required, and they offer flexibility in repayment, freeing up cash flow.

Market Independence: PWLI provides consistent, dependable cash value growth, unaffected by market fluctuations. Cash value growth behaves similar to fixed-income investments in a financial portfolio over a long period of time, and arguably offers more financial security and flexibility. Companies like McFie Insurance offer custom design expertise to tailor a policy to your specific needs, allowing for quicker than average policy funding and enhanced long-term growth.

Read More About Why To Buy Whole Life Insurance Here

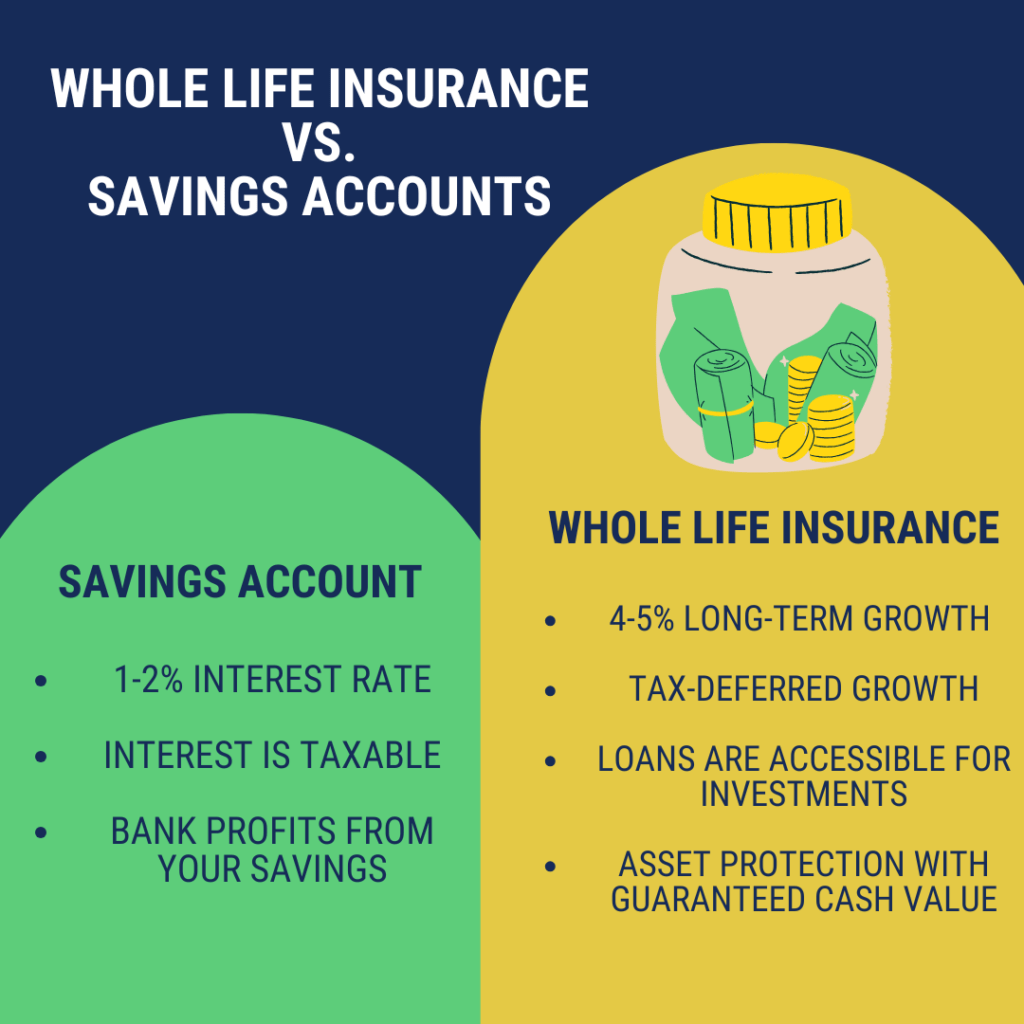

Do you ever think about how much the bank pays you for the money you save? Perhaps 1%, and if you’re lucky, maybe 2%? Right now there are some high-yield savings accounts paying around 5% APY (annual percentage yield), but these numbers do not remain stable. And here’s the kicker: the interest your bank pays you is taxable. So, are you really earning much of anything over a long period of time?

Ever thought about what the bank does with your money once it’s in their hands? They multiply it and lend it out, making far more than the 1-2% they give you. So, why settle for such a measly return by stashing your money in a typical savings account for a long time?

The truth is likely that no one has ever introduced you to an alternative approach. It’s almost as if the government encourages this norm of saving money in a bank and relying on government-provided options like 401(k)s for retirement. Who benefits from this system? Well, banks and the government, I’d argue.

But what if you could change all of this?

If you’ve looked into this subject, you’ve probably come across the concept of infinite banking. While we won’t dive into it extensively here, it’s worth noting that using Whole Life Insurance in the manner prescribed by the infinite banking concept is a compelling option for savings because:

Imagine your life insurance like owning a $1,000,000 home.

Term insurance is similar to renting that $1,000,000 home for a certain period of your life. You pay a lower premium to have the $1,000,000 insurance coverage, but you don’t own the home. It’s like living there until your lease is up.

On the other hand, whole life insurance is more like buying that $1,000,000 home. It’s a long-term commitment where you pay a steady monthly premium, which may be higher than renting. However, with whole life insurance, you’re not only covering the insurance, but you’re also building equity, called “cash value.” This cash value can be leveraged through a policy loan and used throughout your life to invest in other things as well.

Think of using your life insurance cash value, similar to having a Home Equity Line of Credit (HELOC) on your home. But there are some key differences. You don’t have to go through a separate application process or get approval like you would for a HELOC. Also, you won’t be charged origination fees for the loan, and if you’re a participating policy owner with a mutual insurance company, you get to share in the profits of the insurance company which can include some of the interest you pay on policy loans over the years. It’s like having a savings account built into your insurance.

This strategy involves putting your money to work in two places simultaneously. You can build a life insurance policy to achieve tax-deferred growth and build future retirement resources while also potentially earning more money by taking policy loans against your cash value reservoir and using this value to make additional investments.

This approach can be particularly beneficial for real estate investors who often use their own cash for short and mid-term financing on deals.

The idea is that you can keep your money in an asset class generating a 2-5% return (or higher when you consider the tax deferred status of life insurance cash values) and then use that asset as collateral to secure a line of credit. These funds can be invested in real estate or other financial opportunities, and as long as your return exceeds the interest you pay on the policy loan, you are building value on top of your original foundation.

To make this work effectively, it’s important to have a well-designed policy with a reasonable premium size that also takes into account your anticipated investment schedule and the potential need to access policy loans over time.

A properly structured and well-funded Participating Whole Life Insurance policy, allows you to efficiently execute this strategy. The key point here is that your cash value continues to grow even while you’re borrowing against it for other investments, allowing you to have two assets working for you simultaneously.

57-page slide deck 57-page slide deck |

Many people are losing money with typical financial planning. Even people who were "set for life" are running out of money in retirement. Here's an easy guide with 3 things you can do to become wealthier. Download here> |

This concept is often misunderstood, with some people thinking they borrow from their life insurance cash value. In reality, they borrow against it, using the life insurance asset as collateral. This means you aren’t losing the underlying cash value growth. The cash value keeps growing and compounding tax-deferred. This means your money can serve two purposes: growing for the future (including potential retirement needs) and providing financial flexibility today.

Any investment you make with the borrowed money, earning more after taxes than the policy loan rate, adds value to your overall portfolio. Even a small 1% difference can significantly impact your wealth over time.

Every real estate investor knows about debt. They understand that real estate investing often involves balancing the debt you take on and the income you generate from renting properties in a way that is sustainable.

As a real estate investor, one challenge you might face is having enough cash available when you want to start a whole life insurance policy. Real estate investors often run into this issue, and one way to solve it is through something called premium financing. This strategy allows you to use your real estate holdings to buy a substantial whole life insurance policy.

A few years back, this used to be a very common practice, but as interest rates have risen this strategy is coming back to bite because the interest on premium financing loans can rise higher than the long-term growth which can be expected through the life insurance cash values.

So here’s the catch: Premium financing is a more advanced technique, and it is not right for everyone. It only really works if you have a lot of assets that you can use as collateral for a bank loan. If you’re a real estate investor with a big portfolio and lots of equity who can still access money at a relatively low interest rate, this strategy may be a smart option to explore, otherwise premium financing is probably better avoided.

Many real estate investors look to indexed universal life insurance (IUL) as something “similar to whole life insurance” that may also allow them to get some return from the stock market in addition to guaranteed cash value growth.

This can be dangerous because Indexed Universal Life Insurance (IUL), like other types of universal life insurance, including variable universal life insurance, starts with a term life insurance component for coverage. Just like regular term life insurance, the cost of coverage increases as you age and can actually start cannibalizing the cash value accumulation.

Because of this danger, we believe it is better for people to buy participating whole life insurance, getting their life insurance as guaranteed as possible – a foundation. Then if you have extra funds you want to throw at a stock market index (or even if you want to take a policy loan to invest) then you can, realizing that you’re taking a specific risk when doing that.

Trying to get some benefits from the stock market through IUL can cause you to give up the higher guaranteed cash values found in whole life insurance for potentially higher non-guaranteed cash values. You could end up with much less than the non-guaranteed values you thought you were building for the future (and people often do). Instead of a direct risk, IUL introduces camouflaged risk.

Sticking to Whole Life insurance makes it easier to understand what you can expect from your insurance and then you can decide when you’re willing to take a risk by making an investment outside your life insurance.

At McFie Insurance we work with many real estate investors who use participating whole life insurance as a part of their financial portfolio and as a line of credit for new real estate deals so they don’t have to keep quite as much sitting around in a savings account earning a measly return.

We understand many of the factors real estate investors want to balance when they’re shopping for the right size of life insurance policy to add value in their overall portfolio and avoid cash flow crunches.

Call us at 702-660-7000 or schedule an appointment for our team to call you to continue your exploration of using whole life insurance as a financial tool.

by Steven McFie

by Steven McFie

Many people make bad financial decisions, not because they want to, but because they don’t understand enough to make good financial decisions. I like to make things as simple as possible. Simple things are easier to understand. And when you understand something, it’s easier to make good financial decisions. (Yes this is an old picture - need to get an updated one.)