317-912-1000

317-912-1000

Charlie Elliot was a multimillionaire. He had worked hard his entire life farming. And over the years he had added land and wealth to his estate.

One piece of land he acquired required substantial clearing before it was even fit to run cattle on. So, Charlie purchased a bulldozer and excavator to get the job done.

And here is where the story gets interesting. Most anybody that knows how to drive a car can get into the cab of a piece of heavy equipment and drive it. But it takes some very special know-how to operate this kind of equipment profitably and productively. And good operators are hard to find. Namely because they are typically in high demand and are busy helping others improve the value of their land. And, as Charlie said, “If you hire a driver, he can ruin your equipment and land faster than you can blink an eye, while an operator will improve the value of your land, and your equipment will not suffer in value during the process. Problem is, you may have to search diligently and patiently to find the right operator to work for you.”

Now the analogy is blatantly obvious. “Who would you prefer working for you to help you with your retirement plans, life insurance needs, and investment portfolio? A driver or an operator?” For sure, you can find a driver pretty easily. A financial “driver” might be a friend, a relative or a client of yours. But remember, drivers can ruin your finances and destroy the value of your dollar saved, in the blink of an eye. Operators, on the other hand, are scarce. They often are hard to find because they are already pretty busy helping other people who are delighted with the work they are providing because their knowledge and skill is producing more and more wealth for them. Yet, if you really want to increase your net worth and financial outlook while keeping the value of your saved dollar working for you, finding the right financial “operator” will prove to be worth the effort it takes many times over.

Numerous life insurance agents are merely “drivers”. They have taken a training course on how to sell life insurance but they really have no idea how the life insurance policies they sell operate. That is why you see so much distrust for life insurance agents. According to one study, life insurance agents are trusted slightly above used car sales personnel.

Knowing this, is it any wonder that you might tend to gravitate towards purchasing your life insurance from a friend, relative or client? Regrettably, trusting your financial future to someone based on friendship, genetics or merely that they purchased something from you might be practical, but it isn’t logical. Think about this: would you go to a friend for a needed surgery, simply because your friend happens to be a surgeon? Of course not! When it comes to important matters, you would look for the most qualified surgeon to operate on you!

Nevertheless, time and time again, people tell us that they are keeping a poorly designed and ill performing life insurance product because a friend, family member or client sold it to them and they don’t want to mar that relationship. The question is, “What relationship?” What friend, family member or trusted client, would knowingly sell you a life insurance product that makes them more money at your expense? And how wise is it for you to believe that maintaining such a relationship would be in your best interest?

It would be far better for you to give such a friend, relative or client the money they would make by selling you an inferior product and walk away from that policy, then to hold onto a life insurance product that will cause you to suffer a financial loss. Really, think what type of relationship you are maintaining. Keeping a friendship or family relations shouldn’t have to be at your financial expense.

Here’s the bottom line, when it comes to your dollars saved and your future retirement needs, there is no room for you to be playing martyr merely to “save” a relationship. If you don’t find a good financial “operator”, it’s you that is going to suffer; not your friend, not your family member, not your client.

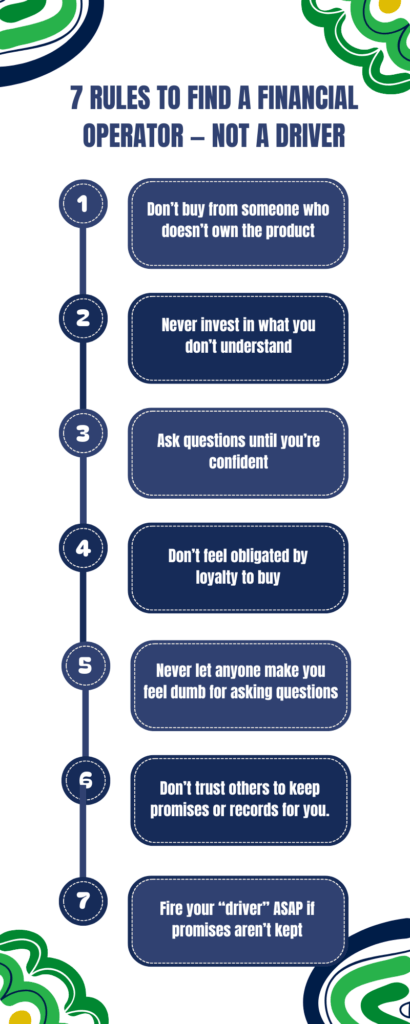

Here are some good solid rules that will keep put you in the hands of a good “operator” instead of merely a “driver”.

Of course, all the “operators” here at McFie Insuranceare here and ready to work for you. If you have questions, concerns or simply need to have a second opinion, give us a call. We know the value of your hard-earned dollars, and we want you to keep as many of those dollars as possible working for you. Because that is the best way for you to increase your net worth and financial outlook.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.