702-660-7000

702-660-7000

Have you ever stopped to consider how much your choice of where to keep your money impacts your financial future? Most people don’t give it a second thought – they deposit their paychecks into a checking account, maybe maintain a savings account for emergencies, and if they’re planning ahead, contribute to a retirement plan. But the reality is that where you keep your money could be the difference between financial struggle and financial freedom.

Making uninformed decisions about where to store your wealth can lead to silent wealth erosion. Inflation steadily chips away at your purchasing power while hidden fees quietly drain your accounts. Meanwhile, your money may be locked away in vehicles that offer limited accessibility when you need it, forcing you into high-interest debt or preventing you from seizing opportunities.

If you kept $10,000 in a traditional savings account earning 0.1% interest while inflation runs at 3%, you’re losing about $290 in purchasing power every year. Over 10 years, that’s nearly $3,000 vanished – and that doesn’t account for any fees your bank might charge for maintaining the account. Is that really the best place for your hard-earned money?

Finding the best place to keep your money requires striking a balance between three factors: security to protect your principal, growth potential to outpace inflation, and accessibility to make sure you can use your funds when needed. This balancing act isn’t one-size-fits-all – it depends on your financial goals, timeline, and risk tolerance. But with the right strategy, you can position yourself to build sustainable wealth rather than watching it slowly disappear.

Before deciding where to keep your money, it’s important to clearly understand your financial goals. Different financial vehicles serve different purposes, and what works well for one goal may be unsuitable for another.

Short-term needs usually include expenses you expect within the next 1-3 years. These could include paying for next semester’s college tuition, saving for a vacation you’re planning to take next year, building a down payment for a house you hope to buy soon, covering expected medical procedures, or upcoming tax payments. For these needs, liquidity and capital preservation are paramount. You need to make sure the money will be there when you need it, which means avoiding vehicles with market risk or penalties for early withdrawal.

Long-term needs, on the other hand, are financial goals with horizons of 5, 10, 20 years, or more. These might include retirement planning, funding a child’s college education when they’re still young, building generational wealth, or creating passive income streams for the future. With long-term goals, you can afford to weather short-term market fluctuations in exchange for potentially higher returns.

Emergency funds are designed to cover unexpected expenses or income disruptions. Financial advisors typically recommend maintaining 3-6 months of living expenses in an emergency fund. Emergency funds should be immediately accessible with high liquidity, not subject to market risk, and protected from inflation as much as possible without compromising accessibility and safety.

Growth investments are meant to increase your wealth over time. These might include stocks and mutual funds, real estate, business investments, certain cash value life insurance policies, and alternative investments. Growth investments involve some level of risk, but this risk is taken with the expectation of higher returns over time.

Your risk tolerance should play a major role in determining where you keep your money. Risk tolerance is influenced by financial factors (income stability, time horizon, net worth, debt level) and personal factors (age, family responsibilities, financial knowledge, comfort with uncertainty). Someone with high risk tolerance might be comfortable with more volatile investments, while someone with low risk tolerance might prefer guaranteed vehicles with more stability.

Liquidity needs should directly influence where you keep your money. Consider how quickly you might need to access your funds, whether partial access is sufficient, and if you’re willing to accept penalties for early access. Different assets offer varying degrees of liquidity, from high (cash, checking accounts) to medium (cash value life insurance, brokerage accounts) to low (real estate, retirement accounts, business interests).

By taking the time to understand these four aspects of your financial goals, you’ll be better equipped to make informed decisions about where to keep your money. The ideal financial plan involves multiple vehicles, each chosen for its ability to serve a purpose in your overall strategy.

When it comes to keeping your money safe and accessible, traditional banking options have long been the go-to choice for most Americans. But are they the best place for your money?

Checking accounts shine when it comes to accessibility but make terrible growth vehicles. Most offer little to no interest—typically 0.01% to 0.06% at traditional banks—which means inflation is actively eroding your purchasing power. Your checking account should hold just enough money to cover your regular monthly expenses plus a small buffer.

Savings accounts offer slightly better interest rates while still providing reasonable accessibility. High-yield savings accounts have become increasingly competitive, with some offering rates around 2-4% as of 2023— better than traditional savings accounts but still challenging to beat inflation consistently.

Money market accounts blend features of both checking and savings accounts, usually providing check-writing abilities and debit card access while offering better interest rates than standard checking accounts. They require higher minimum balances than savings accounts, with some institutions demanding $2,500, $5,000, or even $10,000 to open an account or avoid monthly fees.

Certificates of Deposit (CDs) offer higher interest rates than savings or money market accounts, with longer terms generally providing better rates. Your money is locked in for a specified term, ranging from three months to five years. Withdrawing funds early can trigger substantial penalties.

While each traditional banking option serves a purpose, they all share a limitation—prioritizing safety and liquidity over growth potential. In an environment where inflation hovers around 2-3% annually, these vehicles struggle to preserve purchasing power, let alone build wealth.

Consider this sobering reality: If you had $10,000 in a savings account earning 1% interest while inflation ran at 3%, you’d effectively be losing 2% of your purchasing power annually. After 20 years, your $10,000 would have grown to about $12,200 in nominal terms, but would only buy about $6,730 worth of goods and services in today’s dollars. That’s a 33% loss in real value despite your account balance growing.

This doesn’t mean banking options have no place in your financial strategy—they absolutely do. But they should be used strategically, mainly for money you’ll need to access in the short term or for emergency preparedness. For long-term wealth building, you’ll need to explore alternatives that offer growth potential to overcome the erosion caused by inflation and fees.

While traditional banking products offer security and liquidity, they fail to provide the growth needed to build wealth over time. Investment vehicles, on the other hand, offer the potential for higher returns to combat inflation and grow your assets. Let’s explore these options and how they might fit into your wealth-building strategy.

Imagine having a slice of ownership in the most successful companies in the world—companies that create products, deliver services, and generate profits. That’s essentially what stock investing offers.

How They Work:

When you purchase shares of stock, you’re buying partial ownership in a company. As that company grows and generates profits, your ownership stake becomes more valuable. Stocks can provide returns in two ways:

For those without the time or expertise to select individual stocks, mutual funds offer a compelling alternative. These professionally managed investment vehicles pool money from many investors to purchase a diversified portfolio of securities.

The Growth Potential:

Despite their short-term volatility, stocks have historically outperformed most other asset classes over long periods. According to data compiled by financial historian Jeremy Siegel, stocks have delivered average annual returns of about 7% after inflation over the past 200 years.

The Challenges:

The downside to stock investing is volatility. The market doesn’t move in a straight line—it experiences ups and downs, sometimes losing 20%, 30%, or even 50% of its value during major corrections. Stocks offer no guarantees; individual companies can fail completely, taking your investment with them.

If stocks represent ownership, bonds represent loans. When you purchase bonds, you’re essentially lending money to governments, municipalities, or corporations in exchange for regular interest payments and the return of your principal at a specified date.

“Bonds are the anchor to windward for your investment portfolio. They provide stability when the stock market gets rough and a reliable source of income.” — Warren Buffett

Different types of bonds serve different purposes:

Advantages of Bond Investing: Bonds provide predictable income, lower volatility than stocks, portfolio diversification, and capital preservation, especially if held to maturity.

Disadvantages to Consider: Bonds face interest rate risk (when rates rise, bond values fall), inflation vulnerability, lower long-term returns compared to stocks, and potential default risk.

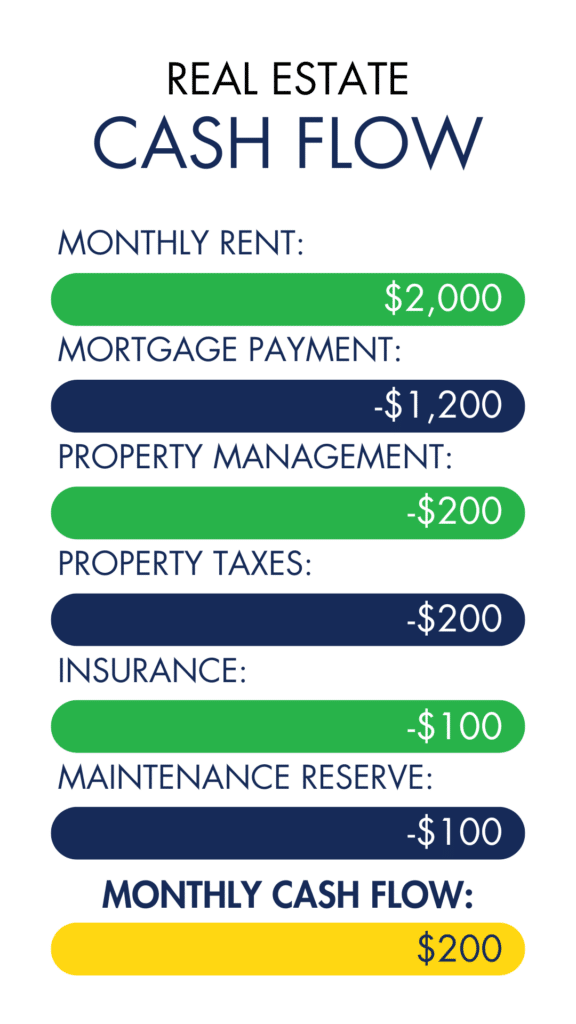

Real estate stands apart from many other investments by offering four distinct potential return streams:

The Challenges of Real Property: Real estate requires active management, is illiquid (can’t be quickly converted to cash), demands significant initial capital, and carries concentration risk in specific locations.

Retirement accounts aren’t investments themselves but rather tax-advantaged containers that can hold various investments. Their tax benefits make them powerful wealth-building tools.

The Major Players:

Strategic Retirement Account Usage:

Each investment vehicle offers a different risk-return profile. Rather than viewing them as competitors, consider them complementary tools:

A diversified portfolio typically includes elements of each, with proportions adjusted based on your time horizon, risk tolerance, and financial goals.

Among the available options for keeping your money, participating whole life insurance stands out as a uniquely powerful financial tool that many people overlook. Unlike term life insurance, which only provides a death benefit for a specific period, whole life insurance combines lifetime protection with cash value growth and features that enhance your overall financial strategy.

Participating whole life insurance provides more than just a death benefit; it creates a financial asset with multiple dimensions:

One of the most powerful aspects of whole life insurance is the policy loan provision. This feature allows you to:

Whole life insurance provides important protections that other financial vehicles don’t:

As a life insurance policy, whole life provides an efficient mechanism for transferring wealth to the next generation:

Not all whole life policies are created equal. The design of the policy impacts its performance and utility as a tool:

Working with a knowledgeable advisor who understands policy design is crucial. At McFie Insurance, we specialize in designing policies that maximize the benefits of whole life insurance as a financial tool, not just as protection.

When properly structured and utilized, whole life insurance can serve as a cornerstone of your financial strategy, providing:

Whole life insurance isn’t right for everyone, but for those seeking protection, growth, liquidity, and control, it represents a powerful financial tool worth considering as part of a diversified financial strategy.

When you concentrate your wealth in a single vehicle—whether it’s company stock, cryptocurrency, real estate in one market, or even cash—you’re creating a monoculture that’s vulnerable to threats. Diversification is a sound strategy for protecting and growing your wealth.

Consider these scenarios:

Scenario A: You invest $100,000 in a single company stock. If that company fails or drops 80% in value, your $100,000 becomes $20,000, requiring a 400% return just to break even.

Scenario B: You invest $10,000 in each of 10 different assets across various classes. If one investment fails completely, you’ve lost $10,000 (10% of your portfolio). If another doubles, you’ve gained $10,000, offsetting the loss. Recovery from the worst-case scenario requires just an 11% return on the remaining assets.

Diversification goes beyond owning multiple stocks or mutual funds. It includes:

While building net worth is important, cash flow is what ultimately sustains your lifestyle. Think of it this way: net worth is the size of your financial engine, but cash flow is the power it generates. Cash flow sources might include dividend-paying stocks, bonds and fixed-income securities, rental real estate, business ownership, and royalties or intellectual property.

The right strategy depends on your age and time horizon, income needs, risk tolerance, tax situation, and personal interests and expertise. The goal isn’t to pick the absolute best-performing asset each year (an impossible task), but rather to create an ecosystem that can thrive in various conditions and recover quickly from inevitable setbacks.

Even the most financially savvy individuals can fall into common traps when deciding where to keep their money. These missteps can significantly impact your long-term financial health.

Keeping Too Much in Low-Yield Accounts: While having accessible cash is important, excessive cash holdings represent a silent drain on your wealth-building potential. According to a 2022 survey by Bankrate, the average American had approximately $17,135 sitting in checking accounts—most earning less than 0.01% interest. Instead, adopt a tiered approach: keep 1-2 months of expenses in checking, 3-4 months in high-yield savings, and direct the remainder toward appropriate investment vehicles.

Ignoring Inflation:

Inflation functions like a hidden tax on your savings—steadily eroding your purchasing power year after year. Many people focus exclusively on nominal returns without considering what those returns mean after inflation is factored in.

The historical U.S. inflation rate has averaged approximately 3% annually over the past century. This means your money needs to grow by at least 3% each year just to maintain its purchasing power. Anything less represents a loss in real terms.

Consider the impact of inflation on $100,000 over various timeframes:

| Years | 3% Annual Inflation | Purchasing Power Remaining |

| 10 | $100,000 becomes $76,144 | 24% loss |

| 20 | $100,000 becomes $57,979 | 42% loss |

| 30 | $100,000 becomes $44,142 | 56% loss |

These numbers reveal that even modest inflation can cut your purchasing power in half over 20-30 years. This is relevant for retirement planning, where many people may live 20-30+ years after stopping work.

Paying Excessive Fees: Fees may seem insignificant when expressed as small percentages, but their impact on long-term wealth can be staggering. For example, the difference between accounts with 1% vs. 0.25% annual fees on $100,000 invested over 30 years can be almost $190,000. Minimize the fee drain by reviewing all account statements for explicit and implicit fees, considering low-cost index funds where appropriate, and being wary of “free” financial products that often hide fees in less obvious places.

Lack of Planning: Without clear direction, even the best financial vehicles won’t take you where you want to go. The consequences of inadequate planning include reactionary decisions, inefficiency, psychological burden, and opportunity costs from delaying wealth-building strategies. Develop a comprehensive financial plan that addresses cash flow management, emergency preparedness, risk management, investment strategy, tax efficiency, and estate considerations.

What’s powerful about addressing these mistakes is that the benefits compound over time. Avoiding just one of these errors can significantly improve your financial trajectory; addressing all four can transform your financial future entirely.

Consider this example:

Sarah and Michael, both 35, have identical incomes and initial savings of $100,000. Sarah implements strategies to avoid all four mistakes discussed, while Michael continues making these common errors.

By age 65:

The difference—over $1.1 million—isn’t the result of Sarah earning more or spending less. It simply reflects the benefit of avoiding common financial mistakes over time. The most encouraging aspect of these mistakes is that they’re all avoidable with awareness.

After exploring the options for where to keep your money, one thing becomes clear: finding the right balance between security, accessibility, and growth is critical to building sustainable wealth. While traditional banking products, investment vehicles, and proper diversification all play important roles, many individuals are discovering the unique advantages of incorporating participating whole life insurance into their financial strategy.

At McFie Insurance, we specialize in designing whole life insurance policies that provide guaranteed growth, tax advantages, and accessible liquidity through policy loans—all while building a legacy for your loved ones. We take the time to understand your financial goals and design solutions that complement your strategies. Whether you’re looking to create tax-free retirement income, establish a secure foundation for your emergency fund, or build a vehicle for financing major purchases without relying on banks, we’re here to help you navigate these important decisions. Take the next step toward financial confidence by scheduling a strategy session with our team today, and discover how the right insurance policy can become a cornerstone of your wealth-building strategy.

by John T. McFie

by John T. McFie

I am a licensed life insurance agent, and co-host of the WealthTalks podcast.

As a 15-year practitioner of the Infinite Banking Concept on a personal level, I can help you find the clarity and peace of mind about your financial strategy that you deserve.

Working with hundreds of financial scenarios over the years has helped me to develop a sixth sense about how to quickly find a clear and balanced solution for clients using whole life insurance as a financial tool.