702-660-7000

702-660-7000

Some uninformed or unscrupulous financial advisors have been known to discourage clients from purchasing life insurance, often spreading misinformation or misguided advice. The reasons behind this advice vary: some advisors may be uninformed about how life insurance truly works, while others may be more self-interested, aiming to retain greater control over their clients’ investments and financial decisions.

Regardless of the reasoning behind these recommendations, the truth is that those who follow this type of advice are often missing out on critical financial benefits. Life insurance, especially permanent options like whole life, offers a death benefit and a financial tool that can provide long-term growth, protection, and access to cash value, which can serve as a safety net in times of need.

By failing to incorporate life insurance into a financial plan, individuals may be passing up an opportunity to safeguard their wealth, reduce future tax burdens, and build financial security for themselves and their loved ones. The long-term value of life insurance shouldn’t be underestimated, and when used correctly, it can be an essential component of a well-rounded financial strategy.

Andrew Carnegie realized life insurance was:

“The greatest national individual savings system with a form of flexibility that is not available through the banking system.” He stated, “No other system gives the individual man protection for his family and at the same time releases his mind from worry in connection with the possibility of approaching old age and its economic uncertainties. Life insurance is definitely part of the fundamentals of America.”

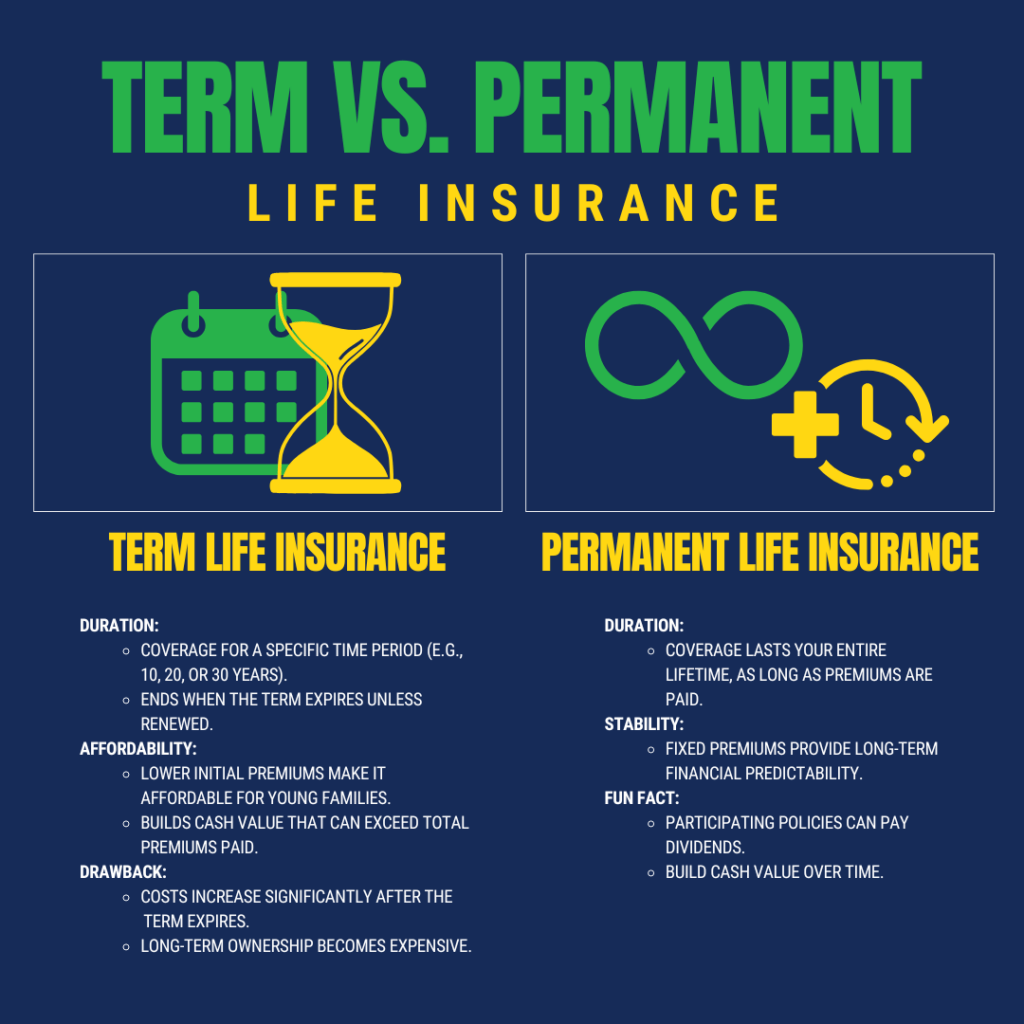

Understanding life insurance is crucial in determining which type of policy best suits your financial needs and long-term goals. When it comes to life insurance, there are two core categories: Term Life Insurance and Permanent Life Insurance.

Term life insurance offers coverage for a specified period or “term.” These policies can be structured for as short as one month or extend up to a specific age of the insured (e.g., age 65). During the term, the premiums remain stable, making it an affordable option. Once the term ends, the cost of maintaining coverage usually increases significantly. This can make term life insurance one of the most expensive forms of life insurance if you continue paying for it over the long term.

It’s important to note that less than 2% of term life insurance policies ever pay out a death benefit. This is because term life insurance is designed to cover specific risks for a limited time. While the likelihood of a claim being made during the term is low, it’san excellent choice for those who need temporary protection, especially young families. Term life insurance is valuable for those seeking to protect their income, like covering the duration of a mortgage or raising children.

The main drawback is that once the term expires, you may face escalating premiums that could exceed any benefits you might receive if a claim is made. Despite this, for many, term life insurance is one of the most affordable and effective options for short-term financial security.

Permanent life insurance, as the name suggests, provides coverage that lasts for the entirety of the insured’s lifetime, as long as premiums are paid. Within the realm of permanent life insurance, there are two distinct types:

Whole life insurance is the most traditional form of permanent life insurance. It combines a death benefit with a savings or investment component that grows over time. The premiums for whole life insurance remain consistent throughout the life of the policyholder, and the cash value builds on a tax-deferred basis. Whole life insurance is often viewed as a more stable, long-term investment because it provides guaranteed cash value accumulation and a fixed premium.

Universal life insurance is a more flexible type of permanent life insurance. It allows for adjustments in premium payments and death benefits, offering more control to the policyholder. The investment component of universal life insurance is more tied to market performance. While the policyholder has more control over how the funds are allocated, the cash value growth is dependent on interest rates and the performance of the underlying investments. Because of this variability, universal life insurance can carry more risk than whole life insurance.

While whole and universal life insurance provide lifelong coverage, universal life insurance can sometimes be seen as a form of term life insurance with an investment component, as its risk is more dependent on market performance and the decisions made by the policyholder. This makes it less “permanent” in comparison to whole life insurance, which offers more guaranteed growth and stability.

Choosing between term life and permanent life insurance depends on your specific needs, financial goals, and risk tolerance. If you’re seeking affordable, temporary coverage, term life may be the right choice. For those who are looking for long-term financial security and the ability to accumulate cash value, whole life insurance might be more suitable.

When determining the best life insurance option for you, it’s essential to understand the nuances of each type and how they align with your life’s priorities, whether it’s protecting your family, building wealth, or leaving a lasting legacy.

In permanent life insurance, there are two primary components: the insurance portion and the investment portion. When it comes to universal life insurance, the insurance companies assign the liability portion—the coverage itself—to the policyholder, rather than assuming the risk themselves.

The investment aspect of a universal life policy allows policyholders to pay extra premiums. These premiums accumulate in a separate account and can earn interest. The interest rate earned isn’t guaranteed, which creates some risk for the policyholder. The extra premiums paid into the policy can be invested or linked to a market index, such as the S&P 500, among others. This provides the possibility for growth, but also means the policyholder takes on the investment risk.

Here’s where the risk comes into play. Policyholders are sold a universal life policy with the expectation that the interest earned on their additional premiums will offset the rising costs of the term insurance component. This expectation is rarely fulfilled, however.

Many universal life policies fail to live up to their promises. The ever-increasing cost of the term insurance portion of the policy—the foundation of all universal life insurance products—can make the policy unaffordable over time.

As a result, many policyholders have filed lawsuits against insurance companies, claiming they were misled into thinking they were purchasing a permanent life insurance policy. These lawsuits have often been successful, as policyholders have seen their policies lapse or become too expensive due to the escalating costs of the term insurance.

Whole life insurance is the best permanent life insurance policy to own in that it doesn’t split the term coverage from the investment portion of the contract. The insurance company assumes the risk and responsibility for both of these components instead of ditching the investment risk off onto the policyholder as they do with universal life products.

The term life insurance component found in whole life insurance has a fixed premium for the life of the contract, it can never increase like the term costs do in a universal life insurance product. The reason behind this is the term insurance in whole life (aka, base insurance) converts to paid-up insurance at a predetermined contractual frequency throughout the life of the policy. Once a portion of the base insurance has been converted to paid-up insurance there is no further premium required on this piece of paid-up insurance. It belongs, in its entirety, to the policyholder. This conversion of base insurance to paid-up insurance occurs throughout the life of the whole life insurance contract, allowing for the remaining term insurance in the policy to be purchased each year with the fixed predetermined premium, without ever having to increase it.

Paid-up insurance is, as noted above, owned exclusively by the policyholder, much as equity in real estate is owned by the one purchasing the property. Paid-up insurance can be leveraged and used as collateral for loans, or it can be surrendered (sold back) to the insurance company and the money paid for it will be returned to the policyholder. If paid-up insurance is used as collateral for a loan and money is borrowed from the insurance company, the insurance company will charge a predetermined interest rate on the money loaned until the loan is repaid. When paid-up insurance is surrendered the amount of paid-up insurance surrendered is subtracted from the total face value of the policy and the policyholder receives from the insurance company the cash surrender value of that surrendered paid-up insurance.

Most insurance companies don’t penalize a policyholder when using their paid-up insurance as collateral to take a policy loan. Thus, the base insurance that is scheduled to convert to paid-up insurance occurs at the same rate it would have occurred without an outstanding policy loan. This provides growth for the policyholder even when money has been borrowed against the policy. This isn’t always the case when using a universal life policy as collateral for a loan. Thus, whole life insurance is a unique financial tool capable of:

Whole life insurance offered by mutually owned life insurance companies pays dividends to policyholders who own participating whole life insurance. Because paid-up insurance in a whole life policy poses ZERO risk to the insurance company, mutually owned life insurance companies return some of the premiums which were paid for a whole life policy to the policyholder when the insurance company makes more money than what it takes to pay the operational expenses and claims filed with the company. This is called a dividend. Dividends are something which universal life insurance policyholders can’t earn because universal life insurance policyholders are never granted participation rights in company profits.

The return of premium, which is classified as a dividend, is not taxable until a policyholder surrenders more paid-up insurance and receives payment of more cash surrender value than what has been paid for the policy. Of course, if a policyholder never surrenders any of the paid-up insurance, the policyholder can access the surrender values (cash values) of the policy via loans without ever facing taxes. Paid-up insurance earns its own separate dividend. Premiums that are returned to the policyholder (dividends earned) can be used to purchase more paid-up insurance creating a compounding annual growth rate that exceeds the guaranteed values of the whole life insurance contract. This growth is not taxable when it accumulates within the policy.

Knowing what types of life insurance policies are available, allows you to determine what type of life insurance is needed.

Many individuals can greatly benefit from owning both types of life insurance: term life and whole life. This combination offers comprehensive protection for their family, business partners, spouse, and other loved ones, while also allowing them to build an asset that helps maintain the lifestyle they’ve grown accustomed to during their working years—especially into retirement.

Life is a one-time journey, and when people understand the benefits life insurance can provide, they recognize its value and are often willing to invest in it throughout their lives. This investment brings peace of mind and creates a more secure, abundant future. Once life comes to an end, policyholders leave behind a tax-free legacy, helping the next generation achieve even greater success and stability.

As the saying goes, “Life insurance is definitely a part of the fundamentals of America.” Don’t let life pass by without ensuring your loved ones are protected and provided for.

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.  Tomas P. McFie DC PhD

Tomas P. McFie DC PhD