317-912-1000

317-912-1000

The dream of becoming a millionaire through retirement savings remains a cornerstone of American financial aspirations. Yet, as economic conditions evolve, the path to achieving “401(k) millionaire” status requires careful consideration and planning. Is following the traditional 401(k) route truly the best strategy for building lasting wealth, or should we consider alternatives that might offer greater flexibility and returns?

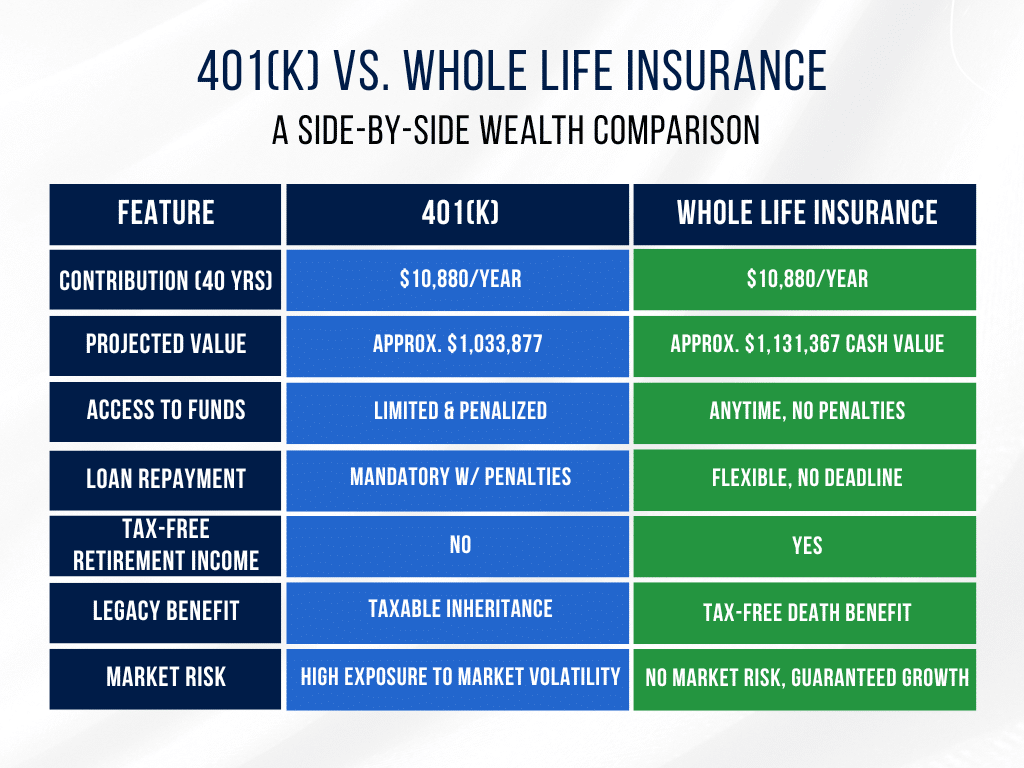

According to several financial advisors, becoming a 401(k) millionaire requires consistent contributions of approximately 17% of your average earned income. Based on Bureau of Labor Statistics data for 2024, this translates to annual contributions of roughly $10,880 for the average American worker.

When we run the numbers, investing $10,880 annually for 40 years would indeed accumulate to approximately $1,033,877—but this calculation assumes a steady 4% annual return. This assumption merits scrutiny, especially considering data from DALBAR showing that typical investors historically underperform the S&P 500 index by about 5.5% over ten-year periods. This performance gap highlights the challenges ordinary investors face in achieving market-average returns.

Even if we accept these projections as attainable, a critical question emerges: Is a 401(k) strategy resilient enough to withstand the financial challenges that arise over four decades of saving?

Data from 2024 reveals a concerning trend: approximately 17.2% of 401(k) participants currently have outstanding loans against their retirement accounts. In the last quarter alone, 138,000 additional people borrowed from their 401(k) plans, and the average loan amount continues to rise.

This surge in 401(k) borrowing coincides with persistent inflation pressures since 2020, which have stretched household budgets to breaking points. Many families find themselves unable to cover essential expenses with their regular income, forcing difficult choices between retirement savings and immediate financial needs.

While borrowing from a 401(k) may be preferable to accumulating high-interest credit card debt, both options represent financial strain. Since 2019, Americans have opened 70 million new credit card accounts, with total credit card debt now exceeding $1 trillion—a troubling indicator of widespread financial pressure.

The 401(k) loan mechanism, though designed to provide emergency access to retirement funds, comes with restrictions and penalties:

These limitations can transform what begins as a temporary financial solution into a major setback to your retirement goals, especially during periods of economic uncertainty.

For those seeking greater financial flexibility while working toward retirement wealth, properly structured whole life insurance offers an alternative worth examining. The same $10,880 annual contribution that might build a $1 million 401(k) over 40 years could, when directed into a dividend-paying whole life policy, generate approximately $1,131,367 in cash value over the same period—with different risk and accessibility characteristics.

Beyond the comparable cash accumulation, a whole life approach offers several advantages:

When you borrow against a whole life policy, you’re not actually withdrawing your cash value. Instead, you’re taking a loan from the insurance company using your policy’s cash value as collateral. This difference means your policy’s cash value continues to grow as though you never borrowed against it, with dividends continuing to be applied to your entire cash value amount.

This contrasts sharply with 401(k) loans, where borrowed funds stop generating returns until repaid, creating a direct opportunity cost during the loan period.

Policy loans against whole life insurance come with flexible repayment terms:

Should you pass away with an outstanding policy loan, the insurance company simply deducts the loan balance from your death benefit before paying your beneficiaries. This arrangement eliminates the risk of default penalties that exist with 401(k) loans.

As long as your whole life policy remains in force and isn’t classified as a Modified Endowment Contract (MEC), policy loans aren’t considered taxable income. This tax treatment remains in effect regardless of your age or the purpose of the loan—a stark contrast to early 401(k) withdrawals, which generally trigger income tax and a 10% penalty.

Only if you surrender your policy with an outstanding loan balance that exceeds your total premium payments would you face potential tax consequences.

One of the biggest advantages of whole life insurance as a wealth-building vehicle is the absence of regulatory restrictions on when and why you can access your money. While 401(k) plans limit pre-retirement access to specific scenarios, whole life policy loans can be taken for any purpose:

This unrestricted access provides the flexibility to address financial needs throughout your life cycle, not just in retirement.

Consider a practical example that demonstrates the potential advantages of a whole life approach:

After 15 years of consistent $10,880 annual contributions to a financial vehicle, a person might accumulate approximately $170,000 in accessible funds. If this money were in a 401(k), accessing it to pay off a mortgage would likely be impossible under IRS regulations, except in very limited hardship circumstances.

With a whole life policy, the policyholder could borrow this $170,000 to eliminate their mortgage, then redirect their former $1,481 monthly mortgage payment toward repaying the policy loan. Over the subsequent 15 years, this approach would allow them to recover approximately $266,559—money that would otherwise have gone entirely to the mortgage lender.

This capital recovery aspect is one of the most powerful but least understood benefits of the whole life approach. By “becoming your own banker” through policy loans, you can recapture interest that would otherwise flow permanently out of your financial ecosystem.

The same methodology can be applied to any major expenditure: vehicles, education costs, business equipment, or investment properties. Instead of permanent capital outflows, each expenditure becomes an opportunity to recapture and redirect capital back into your wealth-building system.

The differences between these approaches become even more pronounced when considering retirement income potential:

A whole life policy with $1,131,367 in cash value could provide annual tax-free withdrawals of $50,000 from age 67 through age 95 (29 years), while preserving over $1 million in death benefit for heirs.

In contrast, a 401(k) with $1,033,877 would likely support annual taxable withdrawals of only about $30,000 to avoid depleting the account before age 96, following conventional withdrawal rate wisdom.

Any 401(k) balance remaining at death would create tax liabilities for non-spouse heirs, who must now completely withdraw inherited retirement accounts within 10 years under current laws. Life insurance death benefits pass to beneficiaries income-tax-free, regardless of the amount.

The estate planning implications of these different approaches warrant careful consideration:

These differences can translate into more wealth successfully transferred to the next generation through life insurance compared to qualified retirement plans.

While 401(k) plans were introduced in the Revenue Act of 1978 and gained popularity through the 1980s, whole life insurance has been a wealth-building tool for centuries. This historical perspective matters when evaluating financial vehicles:

Whole life insurance companies weathered the Great Depression, multiple world wars, the 2008 financial crisis, and the COVID-19 pandemic. The mutual insurance company structure, where policyholders effectively own the company, has demonstrated stability through economic cycles.

By contrast, 401(k) plans are relatively new constructs tied directly to market performance. Their widespread adoption coincided with an unprecedented bull market in the 1980s and 1990s, creating optimistic expectations that may not prove realistic over longer economic cycles.

A factor often overlooked in retirement planning is inflation resilience. Traditional retirement calculators use straight-line projections that may not account for periods of high inflation or market volatility.

The cash value growth in dividend-paying whole life insurance has historically provided a hedge against inflation, especially when considering the combination of guaranteed cash value increases plus non-guaranteed dividends. Leading mutual insurance companies have paid dividends for over 100 consecutive years, including through major economic downturns.

Accessing policy cash values without penalty during inflationary periods provides financial flexibility. When inflation drives up living costs, having penalty-free access to accumulated wealth can prevent reliance on high-interest debt to bridge financial gaps.

Beyond the mathematical comparisons, there’s a psychological advantage to building wealth through vehicles that offer greater accessibility. The knowledge that your money remains available for opportunities or emergencies throughout your earning years can reduce financial anxiety and support better decision-making.

Many 401(k) millionaires reach their milestone only to discover they face penalties to access their funds before retirement age, creating a “golden handcuffs” scenario. This restriction can lead to increased debt utilization during pre-retirement financial challenges, undermining the very security their retirement savings was intended to provide.

Rather than viewing these approaches as mutually exclusive, many financially savvy individuals incorporate both strategies into their wealth-building plan:

This balanced approach provides tax diversification, access flexibility, and protection against policy changes in any single wealth-building system.

For those considering implementing a whole life insurance strategy as part of their wealth-building plan, several factors deserve careful attention:

While becoming a “401(k) millionaire” remains a worthy goal, the best path to financial independence in today’s economic landscape includes more diverse approaches than previous generations considered.

The challenges of inflation, market volatility, and increasing longevity suggest that flexibility and capital efficiency may prove as important as raw accumulation in building genuine financial security. By understanding the unique attributes of different wealth-building vehicles—including their accessibility, tax treatment, and legacy characteristics—individuals can design more resilient financial strategies.

Whether through traditional retirement accounts, properly structured life insurance, direct investments, or a strategic combination, the principles remain consistent: consistent saving, disciplined capital allocation, and protection against unnecessary financial leakage.

The most successful approach will be the one that not only accumulates impressive paper wealth but also provides the flexibility and control to navigate life’s inevitable financial challenges along the way, allowing you to benefit from the wealth you’ve worked so diligently to build.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.