317-912-1000

317-912-1000

78% of small-business owners take the initiative to self-finance their businesses, utilizing their personal funds or assets for building the business.

Self-financing a small business gives entrepreneurs the power to maintain full control over decisions, direction, and operations. Rather than being bound by the terms or oversight of outside investors or lenders, self-funded ventures are driven entirely by the owner’s vision and resourcefulness. In many cases, especially during the early phases of building a company, self-financing is a necessity. Startups lack the credit history, collateral, or revenue needed to qualify for traditional business loans, making self-funding the only viable way to begin.

Beyond getting started, self-financing can strengthen your business profile in the long run. Investors and lenders often look more favorably on entrepreneurs who have “skin in the game”—those who have personally taken on some financial risk. This can be a strong indicator of your commitment and your business’s stability when the time does come to seek outside capital.

That leads us to the important question: How can you bootstrap a business using your own resources?

We’ve put together a list of five practical self-financing strategies to help guide you. These range from conservative, low-risk options to more aggressive methods that carry potential drawbacks. While all of them are viable in certain situations, it’s essential to consider the potential risks involved and make the best choice for your personal and financial circumstances.

Borrowing against a personal life insurance policy can offer a flexible and accessible way to finance a business or other large expense, especially when traditional lending isn’t an option. With permanent life insurance—like whole life—you can take a loan against the policy’s accumulated cash value, at relatively low and stable interest rates. This provides quick access to liquidity without the need for a credit check or lengthy approval process.

Unlike conventional loans, life insurance loans don’t require fixed repayment schedules. As long as you keep the interest paid, there’s no obligation to repay the principal during your lifetime. Instead, the loan amount—along with any unpaid interest—is deducted from the policy’s death benefit when you pass away, reducing what your beneficiaries receive.

While these loans offer convenience and control, they also come with important caveats. Interest on the loan compounds over time, and if it’s left unpaid, it can significantly increase the balance. If the total loan balance ever exceeds the amount you’ve paid into the policy (your cost basis) and the policy lapses, the IRS could view the excess as taxable income. That’s why it’s crucial to monitor policy performance and loan interest carefully if you choose this financing route.

Used wisely, life insurance loans can serve as a strategic financial tool. Just make sure you fully understand the terms and long-term implications before borrowing.

To self-finance a business using whole life insurance, you can leverage the cash value accumulated in your policy to take a policy loan. First, assess the cash value you’ve built up over time in your whole life insurance policy.

You can then initiate a loan against this cash value, effectively turning your life insurance into a capital source for your business.

By wisely using your whole life insurance in this manner, you maintain control over your business financing while ensuring your policy continues to serve its primary purpose of providing a death benefit. Guaranteed cash value growth can also continue within a whole life policy when interest is paid on an outstanding policy loan.

Worst-case scenario if the business fails and you need to get rid of the policy loan, you have options to do this by adjusting the life insurance policy and decreasing the death benefit.

Get a working knowledge of how each type of life insurance policy works.

After reading this 10-page booklet you'll know more about life insurance than most insurance agents.

Download here>

Actively saving money in advance to self-finance your business offers both financial benefits and security, as it eliminates the need for interest payments on loans. However, this approach does carry the risk of investing your important life savings into the venture, and doesn’t provide continued growth while you’re using your personal savings in the business.

To accelerate savings, you might consider taking on additional work during evenings or weekends. Selling personal belongings can further boost savings; for instance, turning old collectibles gathering dust into quick cash.

This strategy’s pros include complete autonomy over your business decisions and the avoidance of debt and its associated interest costs. On the flip side, the cons involve the potential for personal loss if the business fails, and you receive no compounding growth on personal savings while they are invested in the small business. Balancing the immediate benefits of interest-free financing against the long-term risks, lost opportunity and limitations is important when considering this route for business funding.

If your home equity has grown significantly through mortgage payments, you could leverage it through a home equity loan or a Home Equity Line of Credit (HELOC) to finance your business. A home equity loan delivers funds as a single lump sum, whereas a HELOC functions like a credit card, allowing you to draw funds as needed and pay interest only on the amount you use. Interest only payments on a HELOC are similar to making interest only payments on a life insurance policy loan, but there usually is a time where you must begin making principal payments toward paying off a HELOC or else make a “balloon payment” where all the principal is repaid at the end of the HELOC term.

Both home equity loans and HELOCs may offer lower interest rates compared to some financing methods. However, using your family home as collateral undoubtedly escalates the risks associated with your business venture. It’s essential to ensure a reliable cash flow to cover the loan payments so you don’t run the risk of losing your home. This financing strategy requires careful evaluation of your business’s potential to generate steady income against the risk to your personal assets.

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here>

Using your investments and securities as collateral to secure a loan can be an efficient method to obtain the necessary funds at a favorable interest rate. You can borrow up to the initial margin limit of your stock, which generally ranges from 25 to 50 percent. This strategy provides quick access to capital, and potentially without the need to liquidate your investments, preserving your long-term financial strategies.

However, a critical challenge with a margin loan is the requirement to maintain sufficient equity in your portfolio to prevent margin calls. Should the value of your stock decline and your equity falls below the required margin limit, you will be compelled to inject additional funds within a designated timeframe to meet the margin requirements. Failure to provide the necessary cash could result in your brokerage liquidating securities to cover the shortfall.

The advantage of this approach lies in its easy access to funds and the ability to leverage existing investments without selling them. On the downside, it carries the risk of margin calls during market downturns, and a variable interest rate which can force you into difficult financial decisions or lead to the loss of valuable securities or other assets. Careful consideration of market volatility and your financial resilience is essential when contemplating a margin loan for business financing.

If you have good credit, you could potentially fund your business exclusively through credit cards. While this method ranks among the pricier options for self-financing, numerous successful entrepreneurs have effectively utilized it. To sidestep the treacherous path of accumulating credit card debt, it’s a good idea to hunt for cards with favorable interest rates and steer clear of those offering zero percent interest only to skyrocket after 60 days. Formulating a strategic payment plan is essential to manage and mitigate your debt efficiently.

The primary advantage of this approach is the immediacy and flexibility it offers, allowing you to make necessary purchases and payments without delay. If managed wisely, it can also help build your credit score. However, the cons are significant; high-interest rates can dramatically increase the total debt if not carefully controlled, and the reliance on credit cards can lead to a precarious financial situation if the business does not generate expected returns quickly. If cash flow is tight and you cannot make payments, you can even end up hurting your credit score. This method demands a disciplined financial strategy and a clear understanding of the risks involved.

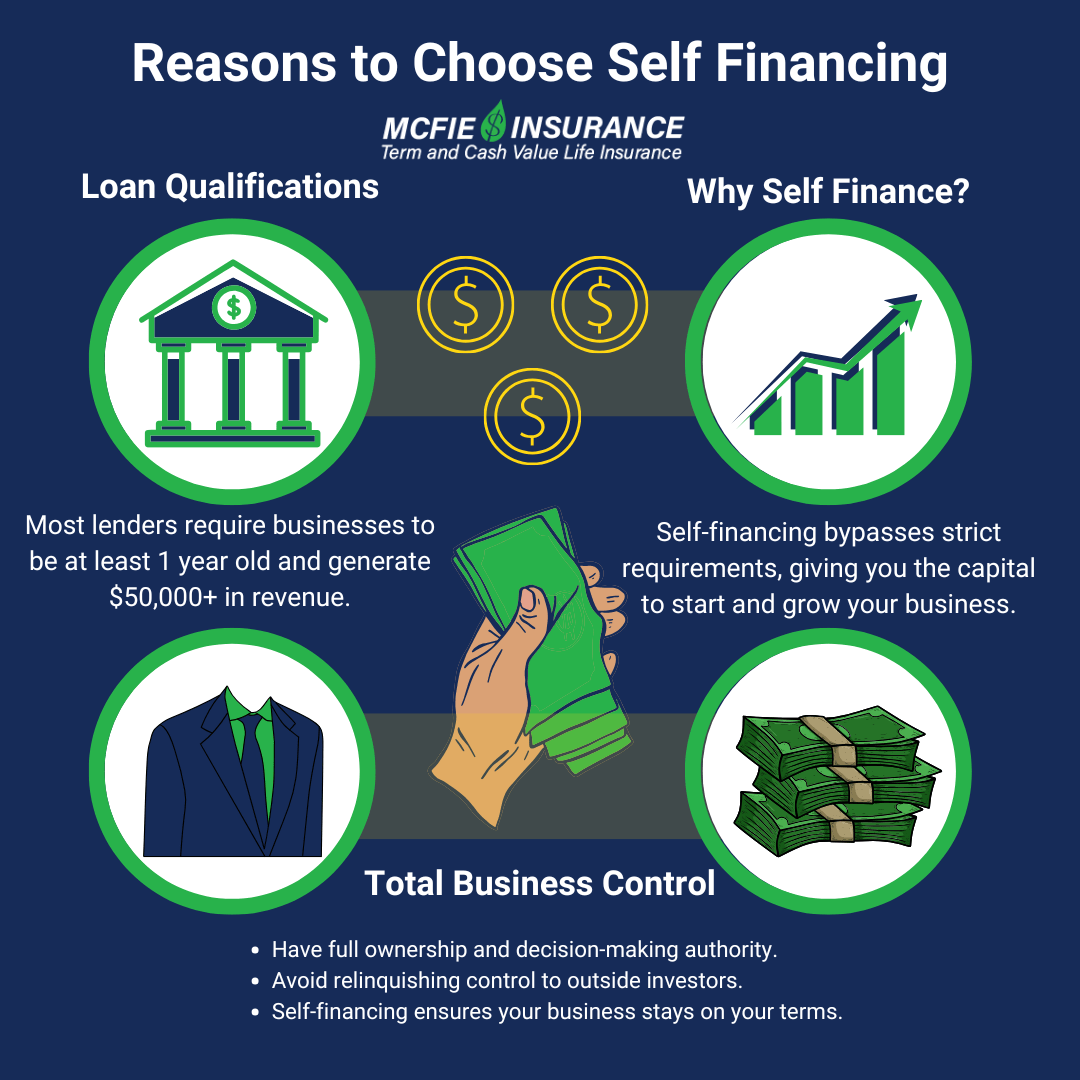

Loan Qualifications

When starting a business, you likely won’t meet the criteria for a business loan, as most lenders require businesses to be at least one year old and generate a minimum revenue – often around $50,000. Similarly, securing venture capital or attracting an angel investor might prove challenging; investors typically seek out businesses that demonstrate success and growth before committing their funds.

Therefore, self-financing emerges as a viable option to obtain funding when other avenues are inaccessible. By investing your own resources, you can bypass the stringent requirements and scrutiny of external financiers, providing your business with essential capital to commence operations and grow. This approach empowers you with the freedom to steer your business according to your vision without the pressure of external expectations.

Total Business Control

By choosing to self-finance your business, you preserve full ownership and decision-making power. This autonomy allows you to shape your vision without outside influence, ensuring that every decision aligns with your long-term goals and values. When you bring in outside investors, you often have to give up equity in exchange for funding—which dilutes your ownership and can lead to shared or even conflicting decision-making authority.

Self-financing removes these concerns. You won’t have to compromise on your business model, direction, or timeline to meet an investor’s expectations or demands. This can be important in the early stages, when flexibility and a clear focus on your mission are critical. While it may require more personal risk and financial discipline upfront, self-financing gives you the freedom to build your business on your own terms.

Demonstrate Success for Future Funding

Self-financing demonstrates to potential lenders and investors your confidence in a robust business plan. Investing your own money and assets signals a deep commitment to your venture.

Initially funding your company yourself can pave the way for additional financing opportunities in the future.

Successfully bootstrapping your business demands a strategic mix of asset utilization, cash flow management, and frugality. Although the journey to success might be lengthy, the autonomy gained from not being beholden to banks, venture capitalists, or small business loans can prove invaluable.

While self-funding offers significant advantages, it’s important to recognize it as only one among many financing strategies.

Let the team at McFie Insurance show you how utilizing whole life insurance to self-fund your business can be a successful and flexible strategy. Contact us today: 702-660-7000 or [email protected]