317-912-1000

317-912-1000

Residual income is commonly confused with passive income. Although the two terms are often used interchangeably there are some important technical differences. Some people find it easier to think of residual income as cash flow.

Whether you are working in Personal or Corporate Finance, a strong residual income is highly desired, because it is an indicator of financial strength and independence.

First, we’ll break down the difference between passive income and the different types of residual income and then consider how you can maximize the benefits of building residual income at a personal level.

Passive income is defined as continued income from a project or investment which does not require significant ongoing effort.

Residual income is a calculation that may include several types of income, expenses, and sometimes the cost of capital. It can even be a negative number while passive income remains positive.

A few years ago, a man called our office wanting to learn how he might benefit from our services. He was proud of earning a certain amount of passive income on a recent real estate investment.

During the conversation, it came out that in order to make this investment he had used a cash advance from his credit card for the down payment. The interest on this credit card balance was more than the passive income on his new real estate investment.

This is a tragic example of confusing an increase in passive income with residual income. Although our caller had managed to build some passive income, he was totally ignoring residual income and suffered accordingly.

The moral of this story: When you’re building wealth, residual income is more important than simply building passive income.

The exact calculation for residual income also depends on the area of finance.

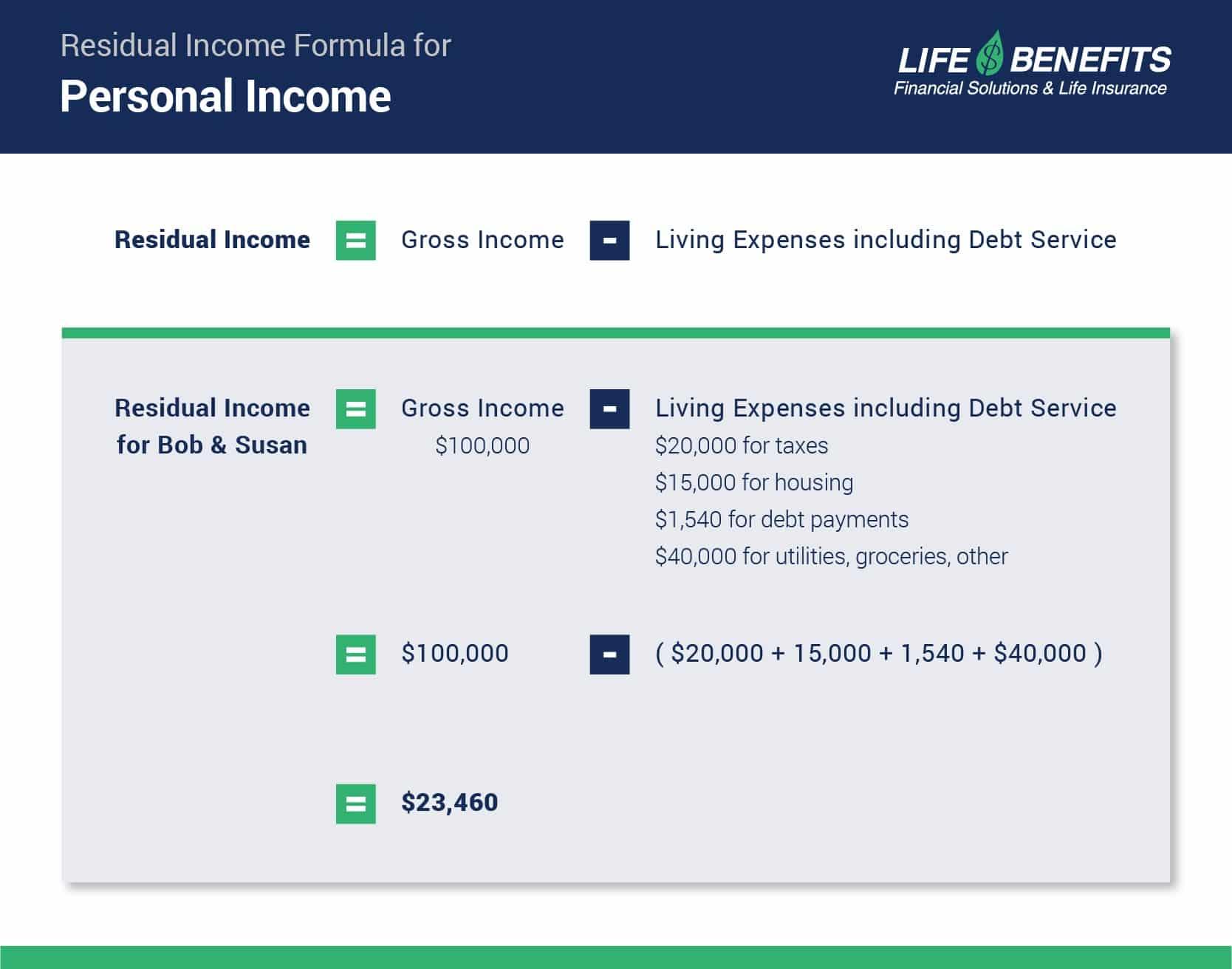

In personal finance, residual income means the amount of income left over after subtracting living expenses and payments on any outstanding debts (debt service). This is sometimes called disposable income.

Banks will consider residual income when you apply for a mortgage so they can be reasonably certain you have the cash flow to make mortgage payments and property taxes on the new loan without causing financial hardship.

The residual income formula as it applies to personal finance is:

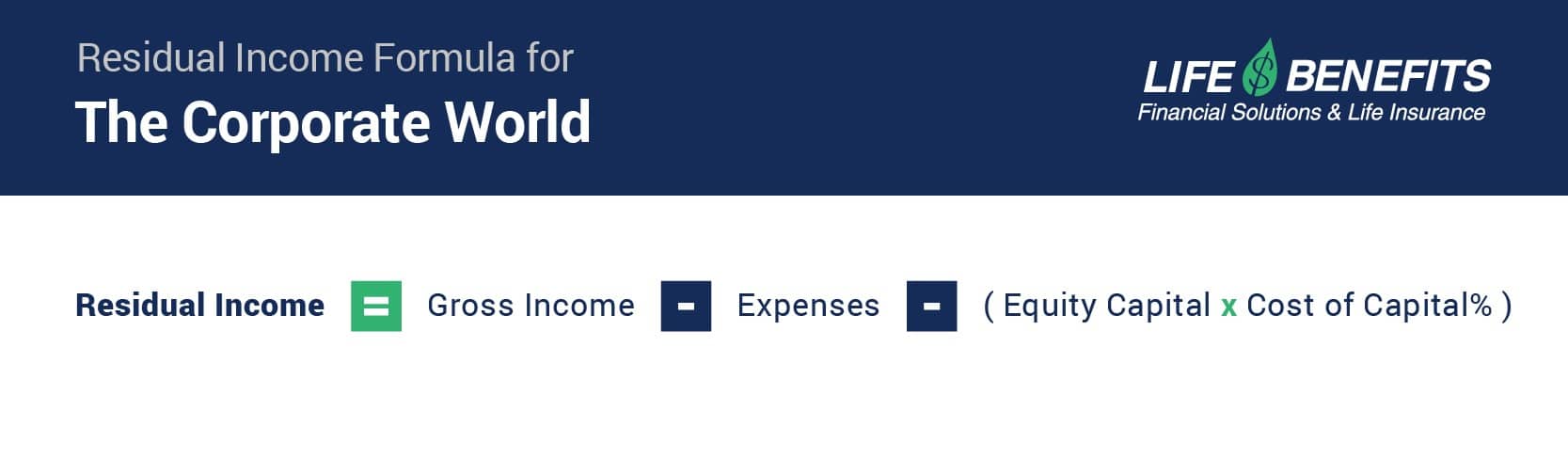

In corporate finance, residual income is used as a measure of net operating profit after subtracting all the cost of capital used to generate revenues. This calculation can also be limited to specific divisions or projects to compare profits from different efforts within the same company.

The formula for residual income in the corporate world looks like this:

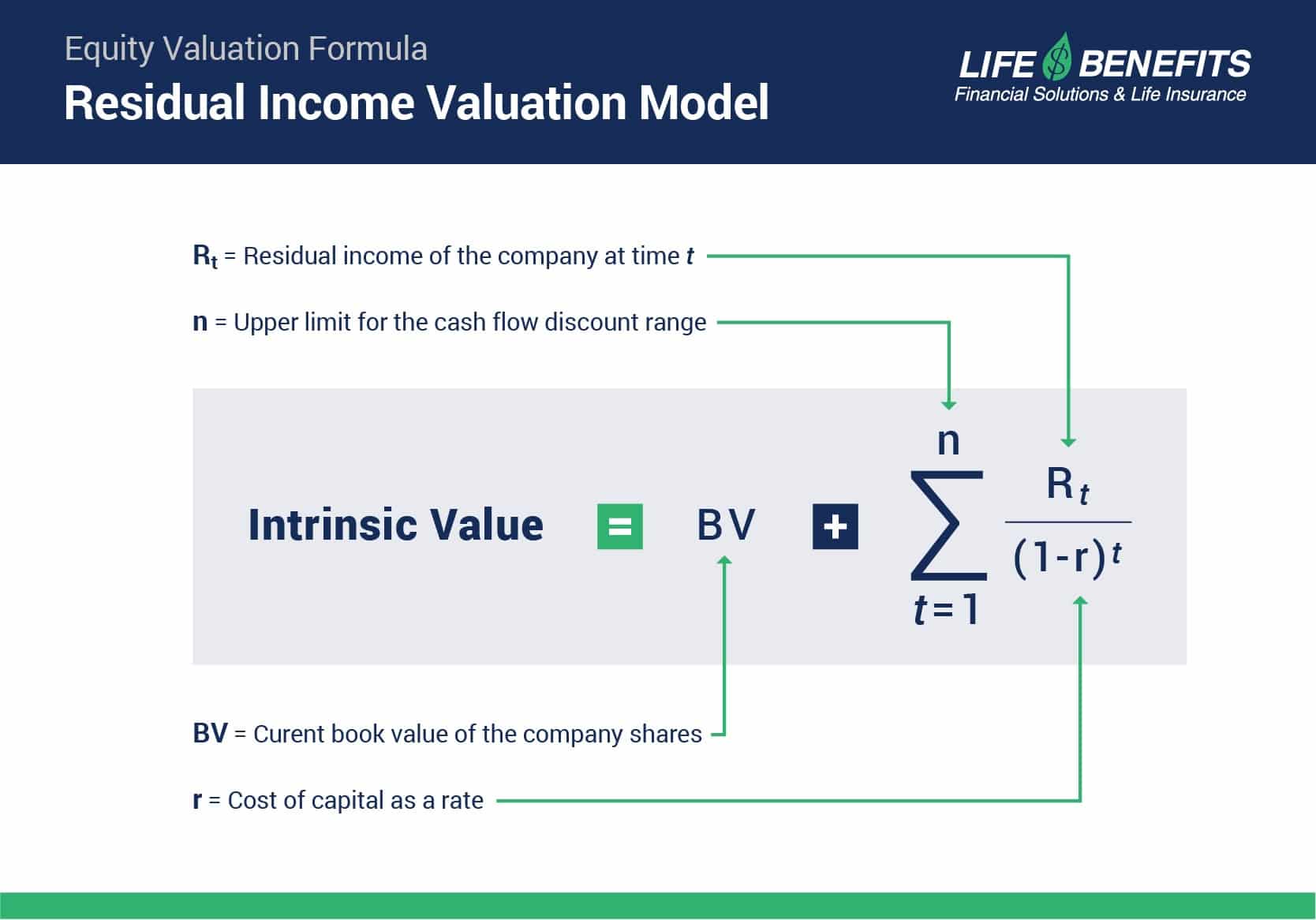

When attempting to estimate the intrinsic value of a company’s stock, financial analysts may also use residual income calculations in a model called the residual income valuation model. This model calls for taking the sum of the book value of a company and the discounted value of future cash flows (residual income estimations).

This formula is more complex:

When it comes to building wealth, it is most valuable to consider residual income within the scope of personal finance. Generally speaking, the higher your residual income, the better off you are financially.

Investment possibilities for residual income are infinite, but people who are focused on building wealth through residual income will almost always place importance on cash flow and liquidity as they evaluate current and potential opportunities.

Obviously, the more money you make doesn’t always translate to more money you keep, but residual income is usually close to the amount of money you get to keep each year.

While an increasing residual income is a good thing, it also means increasing taxes because income is rising faster than deductible expenses.

There are a few ways to deal with taxes:

Each of these options comes with pros and cons:

One clear-cut strategy for minimizing taxes over a long period of time while maximizing your opportunity for residual income is by using participating whole life insurance as a financial tool.

A well-designed whole life insurance policy can help you keep more of the money you make without increasing your taxable income. This means higher residual income and high liquidity with lower taxes. How does this work?

Life insurance can work very similar to a Roth IRA, but with no contribution limits. Cash values in life insurance grow tax-deferred, but when an insured person dies, the death benefit is usually income tax-free to the beneficiaries. In these circumstances, the cash values in a life insurance policy never face income tax again.

If you withdraw money from a life insurance policy during retirement, income tax can be triggered after withdrawing the amount of all premiums paid (also known as cost basis). This would be the case for funds in a typical tax-deferred environment anyway, so if you need to pull money from a life insurance policy during your golden years, there is nothing lost and still something gained.

Usually, there are better options for passive income in retirement than taking straight withdrawals against a life insurance policy.

Depending on age and health, the internal rate of return on a good policy (premiums to cash value) is usually better than what a person could get through other guaranteed saving options.

When it comes to liquidity, cash value in a life insurance policy can be used as collateral for a policy loan from the insurance company at any time, so the money is always highly liquid and accessible.

Policy loans can be used for any purpose, whether to self-finance major life purchases and save interest or to make other investments which can certainly include investments to generate further residual income.

Income on investments outside of a life insurance policy is generally not tax-deductible, but the interest on a policy loan can provide a small deduction when the money was used for a business or investment purpose.

Everyone always wants to know the downside of using life insurance in this manner, and this is a good question. Here are a few:

Although these points could become downsides, none of them need to be problems when you understand why the limitations are there and how to overcome them.

Using life insurance to build residual income and wealth in this manner, is certainly a long-range strategy.

Depending on age and health it may take 4+ years for cash values to grow faster than the premium you pay each year. Think of this as the capitalization phase for a new business – your wealth-building business. Usually between years 8-15, a person will have more cash value in a good policy than the total of all premiums paid.

Over a long period of time, the Internal Rate of Return (IRR – calculated on premiums to cash value) in a good life insurance policy is easily between 2-4% per year in many cases. Keep in mind this growth is not taxed, so a pre-tax return would need to be much higher to yield a similar net return.

All-in-all, using life insurance as part of your plan to build residual income makes it easier to build wealth without fighting the taxes quite as hard. It also gives you more options and flexibility to take on other opportunities for residual income during your life without fighting liquidity issues. We often think of life insurance as a great savings tool with a death benefit bonus.

To see how a well-designed whole life insurance policy could work for you as you build residual income and long-term wealth, schedule a strategy session with our team.

Many people are losing money with typical financial planning. At McFie Insurance, we have the formula to help you keep more of the money you make, so you can have financial peace of mind.

Whole life insurance is available to everyday Americans as well as the ultra-wealthy, and this is something most people in America can start early in life, to maximize residual income long before they are ready for a wider range of investment options.

by John T. McFie

by John T. McFie

I am a licensed life insurance agent, and co-host of the WealthTalks podcast.

As a 15-year practitioner of the Infinite Banking Concept on a personal level, I can help you find the clarity and peace of mind about your financial strategy that you deserve.

Working with hundreds of financial scenarios over the years has helped me to develop a sixth sense about how to quickly find a clear and balanced solution for clients using whole life insurance as a financial tool.