317-912-1000

317-912-1000

Reduced paid up insurance is a nonforfeiture option that helps you end your premium payments and keep a reduced death benefit. While useful, this may not be the best option in all situations.

Reduced paid up insurance is a type of nonforfeiture option that allows whole-life insurance policyholders to cancel future premiums and keep a reduced death benefit.

Reduced paid up (RPU) insurance applies only to permanent whole life insurance policies. Upon exercising the RPU option a policy’s accrued cash value stays the same however, the death benefit is reduced.. Once a policy has been Reduce Paid-up (RPUed)it may continue to accrue cash value over time that you are able to use via policy loan similar to the original policy. The reduced death benefit coverage is calculated at the time of RPU to ensure no further premiums will be required to keep the policy in force for the rest of your life.

The benefits of reduced paid up insurance may vary from case to case. Generally, you should let your whole life insurance policy build cash value for at least 10-15 years before seriously considering this option.

If you encounter an unexpected life event that changes your cash flow, you may have better options before considering an RPU, because once a policy has been RPUed this action is permanent.

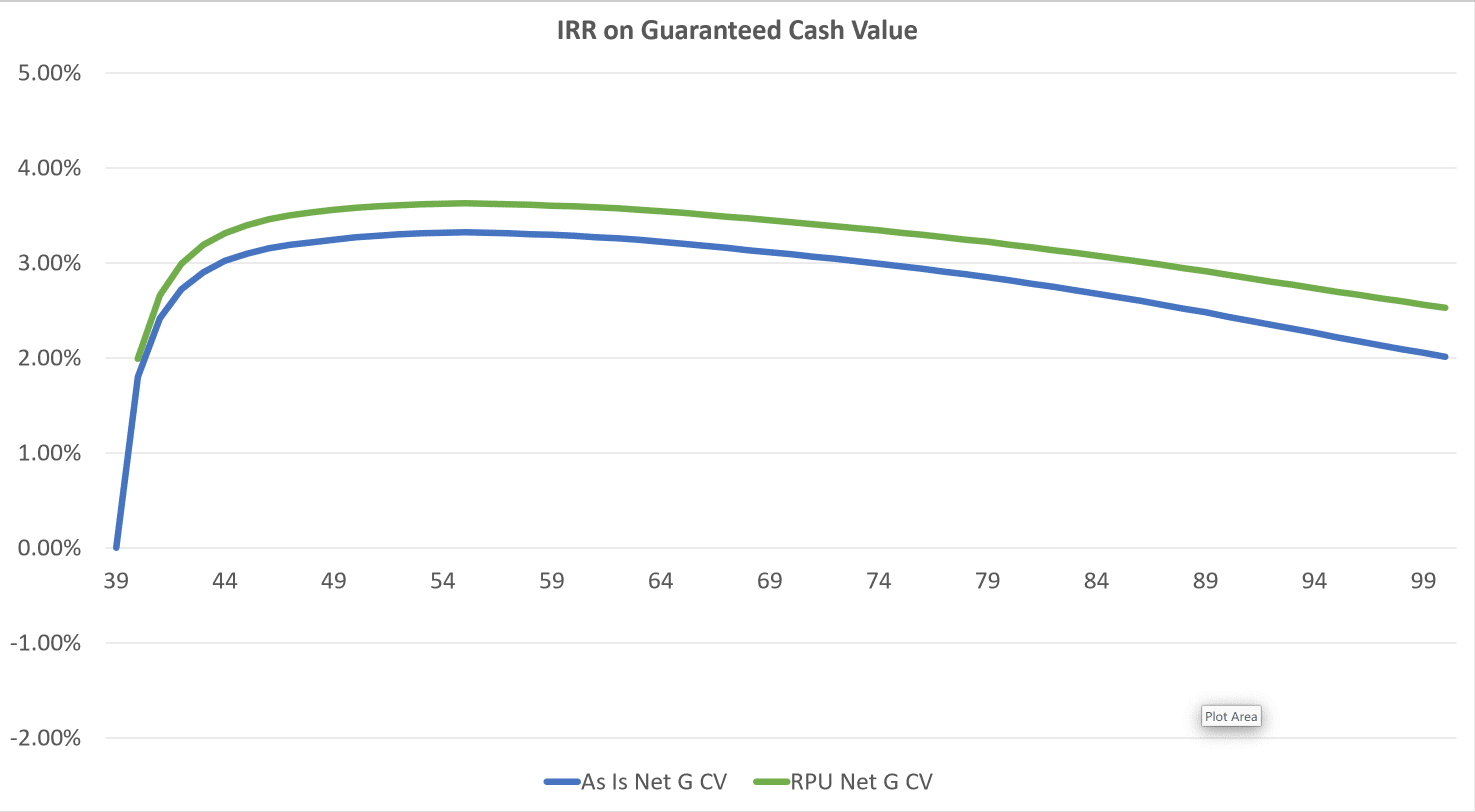

Sometimes it is desirable to stop premiums permanently. For example, as you head into retirement your income can decrease compared to when you were working. This may be a good time to evaluate your life insurance and consider whether to RPU certain policies. Sometimes RPUing an established policy can result in a more efficient Internal Rate of Return on future premiums to the cash value.

Here’s an example of an Internal Rate of Return calculated on an existing policy which is about 13 years old. The blue line shows the net return assuming continued premiums while the green line shows the net return with an RPU and no further premiums paid.

Caption: This IRR calculation uses the current guaranteed cash value and future premiums as outlay (negative inputs) and the end of year (EOY) guaranteed cash value from the illustration as (positive input).

You can see, stopping premiums with an RPU does improve the net return percentage (often the case), but the higher net return is received on lower premium inputs.

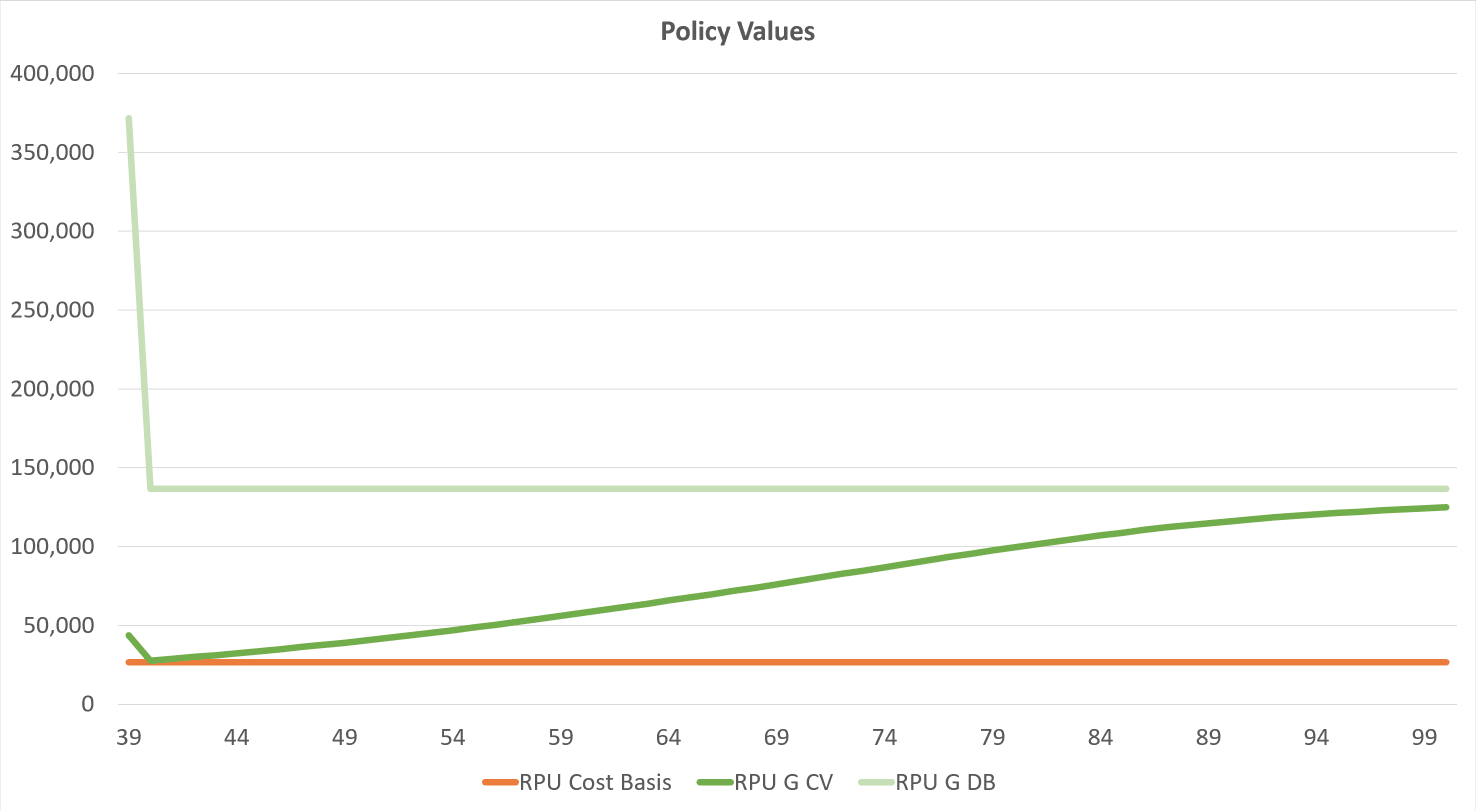

Compare these two graphs of total premiums (aka Cost Basis) and guaranteed cash values on the same case.

Yellow and Blue showing continued premiums, guaranteed cash value and death benefit.

Orange and Green showing no further premiums, guaranteed cash value and death benefit.

You can see the total gain between the Yellow and Blue lines (continued premiums) is more significant than between Orange and Green (RPU). Also, significant death benefit is sacrificed with the RPU choice.

Since this policy is already well established and the insured is still relatively young (age 38-39) it probably makes more sense to continue premiums, especially since these graphs are based on guaranteed values – not projected values.

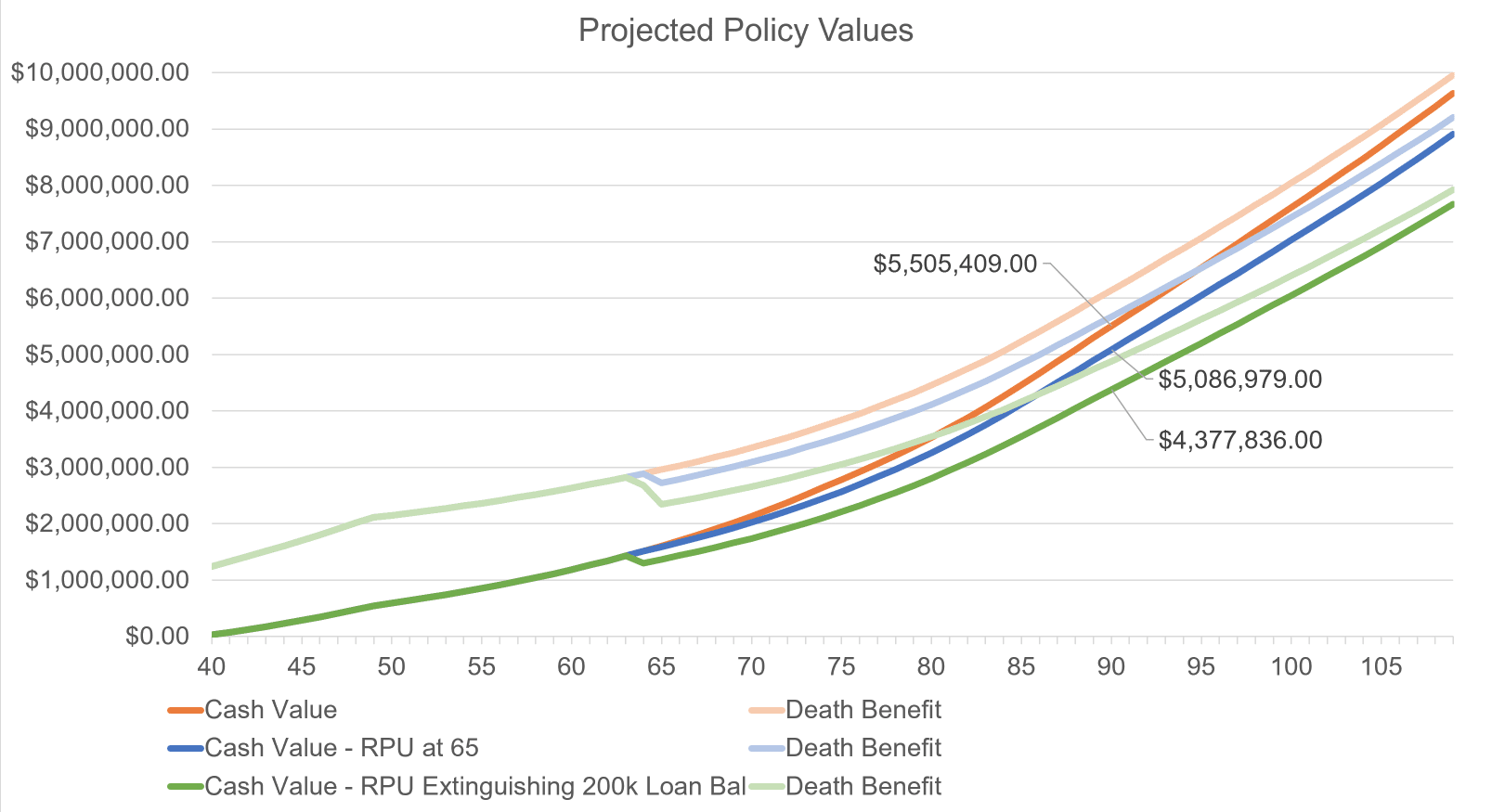

Here’s an example demonstrating a better situation for an RPU strategy.

This starts as a brand-new policy on a 40yr old. There is a large paid-up additions rider on the policy for the first 10 years to help build cash value. At age 65, the policy owner could either continue paying base premiums or RPU to stop all premiums.

Here’s what the premiums would look like for either case.

Here are the projected results for each case.

The decrease in the death benefit along with future cash value growth is much more reasonable at this age.

An RPU can also be a good strategy if policy loans are outstanding, which the policy owner does not wish to repay.

Here’s a variation on the same case with an 200k outstanding policy loan at age 65 which is erased as part of the RPU strategy (green lines).

The death benefit simply decreases further, and policy growth remains strong…reduced roughly in proportion to the outstanding loan balance which was erased upon RPU.

Depending on the contract provisions you may have the option to retain or extinguish an existing policy loan balance upon RPU. Some policy contracts require that any outstanding loan balance must be extinguished upon RPU.

You can still take policy loans after completing an RPU, so if you wish to retain a policy loan through an RPU which an insurance company does not allow, you could:

While reduced paid-up insurance does hold some benefits, there are also reasons to avoid exercising the reduced paid-up option and look for another solution.

The first and most obvious reason is that your beneficiaries will receive a reduced death benefit upon your passing. While moving forward with an RPU may help you take care of some financial hardships in the short term, it may also leave those same hardships to your family without the money to take care of them after you’re gone.

Reducing the amount beneficiaries receive may leave them in a precarious position without an easy way to take care of the problems left behind. Especially, if you leave behind young children or a spouse who is unable to work and relies on your income. The reduced benefit may not be enough to cover their needs.

Second, upon RPU some riders that existed on your policy before RPU will drop off. If there are any essential riders on your current policy, like guaranteed insurability, waiver of premium, or child/family protection, they will no longer apply to your reduced paid up insurance policy.

There are several alternative funding options as well as nonforfeiture options available to policyholders. Check with your McFie Insurance team to see what options may be available to you.

Alternative funding options include:

Alternative non-forfeiture options include:

This is an actual forfeiture of your policy rather than a non-forfeiture option. The cash value surrender option allows you to cash out the accrued cash value of your policy and cancel your policy. Unlike the RPU option, you do not get to keep a smaller version of your policy. This option is considered a last resort rather than a strategic option unless you have the life insurance coverage you need through other policies.

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here>

Extended term insurance allows you to use the cash value accrued from your current policy to purchase a term life insurance policy with a death benefit equal to your original policy. This new term policy lasts as long as the accumulated cash value will fund the term insurance premiums and then the policy lapses.

An automatic premium loan provision allows the insurance company to pay the required premium with a loan against the accrued cash value of the policy for as long as possible. Repaying the loan at a future date allows the policy owner to restore the policy according to the original design. Any outstanding policy loan would simply be deducted from the death benefit before being sent to beneficiaries in the event the loan is not repaid and the insured dies. This option can be a good fit if you anticipate you will be able to resume the premium payments again soon and catch up on loan repayments too. This is a good default non-forfeiture option.

When done at the right time and for the right reasons, a reduced paid up insurance policy can be a logical and financially-beneficial strategy. Like any life insurance decision, there are pros and cons to consider before making your decision.

The Infinite Banking Concept is a strategy that maximizes the use of the cash value in whole life insurance policies — including those with reduced paid-up status — to create a personal financing system. Instead of relying on banks or external lenders, policyholders can borrow against their policy’s cash value to cover expenses, invest in opportunities, or manage financial needs while maintaining the policy’s death benefit.

This concept works because whole life insurance policies grow cash value on a tax-deferred basis, and policy loans against this value typically do not trigger immediate tax consequences. When you borrow from your policy, you are borrowing from the insurance company, with the loan secured by your policy’s cash value. The interest you pay on the loan goes back into your policy, helping to grow its value over time.

For policyholders who have exercised the Reduced Paid Up option, the ability to continue borrowing against the accrued cash value can provide valuable financial flexibility without the burden of ongoing premium payments. This allows you to use your life insurance policy as a reliable source of liquidity in retirement or during times of reduced income.

We have extensive experience helping clients design and manage whole life insurance policies tailored to support the Infinite Banking Concept. Our guidance ensures your policy is structured for strong cash value growth and that you understand how to use policy loans effectively without compromising your long-term benefits.

By incorporating the Infinite Banking Concept into your overall financial strategy, you can leverage your life insurance as both protection and a powerful wealth-building tool — all while maintaining peace of mind for you and your loved ones.

Paid-up additions in life insurance refer to optional extra payments made on a whole life policy to boost the death benefit amount. These are distinct from the reduced paid-up option, which is a standard feature of whole life policies. Paid-up additions only apply if the policyholder has bought the specific “paid-up” rider. However, not all insurance providers offer this rider, so it’s crucial to ask about its availability when applying for a policy.

If you’re approaching a point where you no longer want to make your premium payments, you may be able to use a reduced paid up insurance option to avoid surrendering your policy while keeping some of the death benefits and cash value accumulations in your policy.

Whatever your questions are, you don’t have to manage your life insurance plan on your own. Our team here at McFie Insurance is trained and ready to help you understand your options, answer your questions, and ultimately provide greater peace of mind.

Schedule a strategy session with a McFie Insuranceexpert today to get the information & support you need.

by John T. McFie

by John T. McFie

I am a licensed life insurance agent, and co-host of the WealthTalks podcast.

As a 16-year practitioner of the Infinite Banking Concept on a personal level, I can help you find the clarity and peace of mind about your financial strategy that you deserve.

Working with hundreds of financial scenarios over the years has helped me to develop a sixth sense about how to quickly find a clear and balanced solution for clients using whole life insurance as a financial tool.