702-660-7000

702-660-7000

It’s new. It looks exciting. But is it worth it?

Indexed whole life insurance provides life insurance coverage and the potential for accelerated cash value growth through indexed mirroring accounts. Individuals who are interested in investing may find this type of plan attractive, especially when viewing the non-guaranteed projections for potential growth. But it’s important to remember “everything that glitters is not gold” and there are significant risks that come with Indexed Whole Life policies.

By understanding the elements of Indexed Whole Life insurance…what it’s made up of, and how it is guaranteed to perform, we hope you’ll be able to see beyond the glittering “newness” of this type of policy and realize why it may not be a valuable component in your financial strategy.

Indexed whole life insurance merges the protection of whole life insurance with the opportunity for cash value growth tied to a market index. This blend of insurance and investment potential without direct market investment gives potential for the cash value of a policy to rise with the index’s performance.

The policy features two primary elements:

1. Permanent Coverage

Echoing traditional whole life insurance (which does not offer any investment element), Indexed Whole Life insurance boasts permanent insurance coverage for the insured, contingent on premium payments.

It is very important to understand the coverage is only permanent while it is Guaranteed. Traditional whole life policies guarantee coverage for the life of the insured.

Indexed Whole Life insurance policies guarantee coverage for as long as the indexed mirroring account provides enough return to allow the cash value of the policy to cover the fees charged by the insurance company. This is a major factor as fees can deplete the cash value of the policy causing it to lapse which would end coverage.

2. Potential for Accelerated Cash Value Growth

Indexed Whole Life insurance harbors a cash value component with the potential for growth, tied to a market index’s performance. This linkage furnishes a distinctive chance for investment expansion within the confines of a life insurance policy.

57-page slide deck 57-page slide deck |

Many people are losing money with typical financial planning. Even people who were "set for life" are running out of money in retirement. Here's an easy guide with 3 things you can do to become wealthier. Download here> |

Indexed whole life insurance functions by diverting a part of your premium towards the policy’s cash value, which can then grow based on the performance of a selected market index.

Here are the essential components of these policies:

1. Premium Allocation

Your premium, minus premium loads and state/local tax charges, feeds into the policy’s account value. From here, cost of insurance (your death benefit), policy maintenance charges and per unit charges are deducted.

2. Index-Linked Growth

Money left in the account value, after the cost of insurance and fees are deducted, is placed into an indexed mirroring account which mirrors specific market indexes such as the S&P 500. A positive index performance could lead to an increase in cash value.

3. Guaranteed Floor Rate

A feature of indexed whole life insurance is the guaranteed floor rate. This guarantee ensures that negative turns of the index aren’t reflected on your policy’s growth. It’s important to note that while market downturns won’t decrease the cash value of the policy, the insurance company will still charge fees in those years and those fees will come out of the policy’s cash value.

4. Growth Cap

While there’s an opportunity for growth, it’s crucial to acknowledge the presence of a growth cap. This limitation means that excessive index gains will not proportionately elevate your cash value.

The death benefit from an indexed whole life insurance policy typically remains free from income tax, ensuring beneficiaries receive the payout without the obligation to pay income tax on it after the insured’s death.

However, the cash value aspect of the policy carries different tax rules. Withdrawing funds from your policy’s cash value may incur income taxes on any amount surpassing what you’ve paid in to the contract, which is the sum of premiums, also called cost basis. For instance, if your total premium payments amount to $50,000 and you withdraw $60,000, the excess $10,000 will be subject to taxation.

While loans against the policy’s cash value are generally not taxable, this changes if the policy is terminated or forfeited. In such cases, the remaining loan balance may become taxable income.

Weighing the pros and cons of indexed whole life insurance will help determine if this type of policy aligns with your financial goals and risk tolerance.

Indexed whole life insurance policies offer a unique blend of growth potential and protection for policyholders. Here’s a deeper look into their key features:

The cash value component of indexed whole life insurance stands a chance of accelerated growth, drawing its momentum from a designated market index. This means that as the market index, such as the S&P 500, experiences upward trends, the cash value of your policy may also see increased growth. This growth potential may make indexed whole life insurance seem appealing for those looking to incorporate an investment-like element into their life insurance.

One of the features of indexed whole life insurance is its protective mechanism against market volatility. Even when the chosen market index suffers a downturn, the guaranteed floor rate of the policy ensures that this downturn will not be carried over to the policy’s cash value. This does not mean the cash value of the policy will not diminish in market down years, since all fees will still be charged.

Beyond the investment potential and financial security, indexed whole life insurance offers permanent coverage. This permanence means that you are covered as long as the death benefit of the policy is guaranteed. Unlike traditional whole life insurance that offers guaranteed coverage from the moment you take out the policy until the end of your life, Indexed Whole Life insurance guarantees permanent coverage as long as there is enough cash value in the policy to cover the cost of insurance and policy fees.

|

Policy Checklist Make Sure You Get a Good Policy Is your policy good or bad? Use this checklist to help evaluate your existing life insurance or a new policy you are considering. |

Indexed whole life insurance presents a nuanced financial product with its distinct advantages and limitations. Delving into these aspects can significantly aid in determining whether this product aligns with your financial goals.

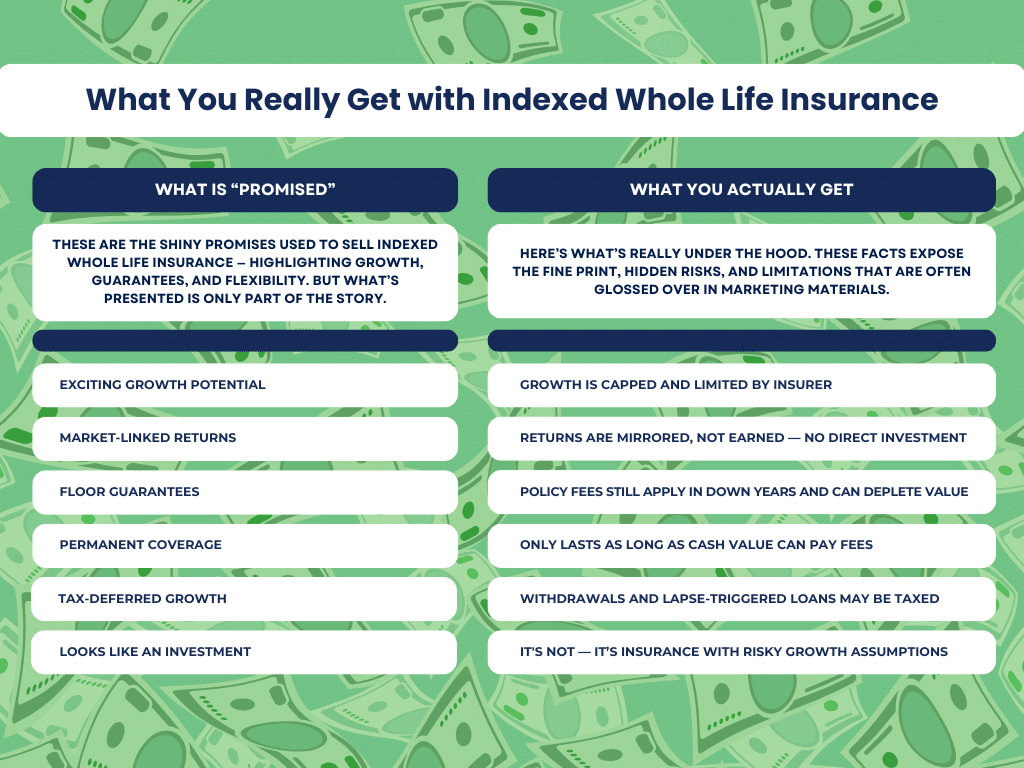

While the cash value in indexed whole life insurance policies has the potential to grow, it’s important to note that this growth is not boundless. Insurers set a cap on the maximum growth rate of the cash value. This means that even if the underlying market index experiences substantial gains, the increase in your policy’s cash value will not exceed the predetermined cap. Understanding this ceiling is crucial for setting realistic expectations regarding the investment component of the policy.

Indexed Whole Life policies have a built-in floor to protect against market downturns, but this doesn’t mean your cash value will remain unaffected in down years. The cost of insurance, policy maintenance, and per unit charges still apply in down years and these will be deducted from the policy’s account value even if that results in decreasing or depleting the cash value. It is important to realize that fees may negatively affect the policy’s cash value even in years where the index has a positive performance.

Although Indexed Whole Life insurance is built on whole life insurance, the coverage is not guaranteed “for life” as it would be with a traditional whole life policy. Coverage in an Indexed Whole Life policy is only permanent as long as it is guaranteed. Coverage is only guaranteed while the cash value of the policy is sufficient to cover the cost of insurance and other fees charged by the insurance company.

Indexed Whole Life insurance policies illustrations will show a date where coverage is guaranteed to lapse.

Compared to term life insurance, indexed whole life insurance generally comes with higher premium rates. These increased costs are attributable to the permanent coverage the policy provides, alongside the investment-like cash value component. While the higher premiums contribute towards the potential cash value growth and type of permanent protection, they also necessitate a more considerable financial commitment.

Reflecting on these characteristics within the context of your financial strategy is vital. It helps in discerning whether the blend of investment potential, coverage type, and associated costs inherent in indexed whole life insurance aligns with your financial objectives. This introspection is a key step in making an informed decision about whether incorporating indexed whole life insurance into your financial portfolio, and thereby assuming the many risks associated with this type of plan, would be a wise use of your resources.

Indexed whole life insurance appeals to certain individuals by offering both life insurance coverage and the opportunity for cash value appreciation. However, it’s crucial to recognize that the primary function of life insurance is to provide life insurance protection. Life insurance, by definition, whether it’s traditional, term, or indexed, is not an investment.

The potential for cash value increase associated with indexed policies (both indexed whole life and indexed universal life) is linked to a market index, yet this growth is usually subject to a ceiling. Additionally, these policies tend to be costlier compared to other life insurance variants due to the guaranteed lapse date.

The price of indexed whole life insurance can differ greatly, influenced by a variety of factors. Here are several common elements that play a role in determining the rates for life insurance coverage.

The age at which you purchase your policy has a notable effect on your premium. Generally, younger applicants enjoy lower premiums due to the lower risk they represent.

The level of coverage you seek also plays a critical role. Opting for higher death benefits necessitates higher premiums, as the insurer’s potential payout increases.

Your health status and medical background are crucial to insurers. Existing chronic conditions or a history of health issues can drive up the cost of your premiums.

Your lifestyle choices, such as smoking or participating in high-risk hobbies, can elevate your premiums due to the increased risk they pose.

The mode you choose for paying your premiums can impact the overall cost. Premiums paid on an annual basis will reflect savings over premiums paid semi-annually, monthly, or quarterly.

|

Get a working knowledge of how each type of life insurance policy works. After reading this 10-page booklet you'll know more about life insurance than most insurance agents. Download here> |

Choosing indexed whole life insurance requires a thorough evaluation of your personal needs, long-term financial objectives, and comfort with risk.

For those who enjoy speculating on the chance that a policy might perform better than what is guaranteed, or even anticipated based upon current performance, and don’t mind losing their money and insurance coverage if the speculation doesn’t turn out…indexed whole life might be “fun” for them to purchase.

But if you want life insurance coverage that is guaranteed to be there for your whole life, and you want guaranteed cash value growth that won’t be diminished or depleted due to fees, you should NOT buy indexed whole life insurance.

At McFie Insurance we aim to design the best life insurance policies to fit the needs of each individual and/or business. Insurance companies release new products all the time. We make it our business to study these products carefully so we can provide details about how they work and offer the best policies to our clients.

At the end of the day, you get to make the decision about what type of policy you’re going to purchase. When you work with McFie Insurance you will always get our best… our best policy design for you, our best recommendation for which type of policy to purchase and our best customer service.

Schedule a free strategy session today.

There are many ways to access information about finances, but it can be hard to determine which sources are trustworthy. I like to put information together in an accurate, straightforward, easy to understand manner so people can make good financial decisions based on the information provided without having to waste time wondering if the source is reliable. by Gracine McFie

by Gracine McFie