317-912-1000

317-912-1000

Have you ever planned for a large purchase—like a vacation, a new vehicle, or a home renovation—and wondered how to save for it without relying on credit or disrupting your regular budget? That’s where sinking funds come in.

A sinking fund is a saving strategy designed to help you set aside a specific amount of money over time for a planned expense. Instead of scrambling to cover a major cost all at once—or worse, putting it on a high-interest credit card—you build up the funds gradually in a separate account earmarked for that purpose.

Let’s say you’re planning a trip to the Maldives next year, replacing your living room furniture, or even preparing for annual property taxes. By calculating how much you’ll need and how long you have until the expense arises, you can divide the total amount by the number of months or pay periods remaining—and begin saving in manageable increments.

Sinking funds help you:

Avoid debt and interest payments

Eliminate financial stress

Budget more effectively

Enjoy guilt-free spending, knowing the money is already accounted for

In the following sections, we’ll break down how to set up your own sinking fund, choose the right account, and stay on track so you’re fully prepared when the time comes to make your big purchase.

A sinking fund is a savings account designated for an upcoming expense. Unlike general savings, which serve as a safety net for unexpected events, sinking funds are intentional and goal-driven. They allow you to plan ahead for large or irregular purchases by saving small amounts over time, rather than relying on credit or disrupting your monthly budget when the bill comes due.

This strategy is valuable for predictable, non-monthly costs—think of things like replacing household appliances, planning a vacation, or covering annual insurance premiums. With a sinking fund, you’re forecasting. And that proactive mindset can make a big difference in your financial confidence.

Common uses for sinking funds include:

Home projects like new furniture or renovations

Travel and vacations

Special occasions, such as weddings or milestone events

Seasonal costs like back-to-school shopping or holiday gifts

Vehicle expenses, from maintenance to registration fees

The real advantage? You avoid financial strain and stay in control. Instead of scrambling when a big expense hits, you’ve already mapped it out and funded it over time.

At first glance, a sinking fund might seem identical to a traditional savings account—but the main difference lies in the purpose and planning behind each. A savings account is typically used for general or emergency savings—money you may need at any time for unexpected events or broad financial goals. A sinking fund, however, is a targeted strategy designed for specific, anticipated expenses.

Let’s say you’re planning for several major purchases or events over the next year: a family vacation, holiday gifts, vehicle repairs, and summer camp for your child. If all of these funds are stored in one general savings account, it becomes difficult to track exactly how much is allocated to each goal. That lack of clarity can lead to overspending on one priority and coming up short on another.

The solution? Separate your sinking funds by category. Whether you create different accounts at your bank or use a budgeting tool to track each goal virtually, dividing your funds ensures you know exactly how close you are to reaching each target. It also helps reinforce disciplined spending—because you’ll think twice before dipping into your vacation fund to pay for new tires.

This approach removes the guesswork from budgeting, turning short- and mid-term financial planning into a far more manageable—and rewarding—process.

A sinking fund isn’t the same as your emergency fund – they’re like apples and oranges.

Your sinking fund is all about predictable expenses you see on the horizon…you know they’re coming, so you can plan and save accordingly.

On the flip side, your emergency fund is a financial parachute for those “oh no!” moments life throws your way. These are the curveballs you can’t predict or pencil into your calendar.

So, remember, your sinking fund is for the expenses you can anticipate, while your emergency fund is your buffer against the unforeseen twists and turns of life.

And hey, even though it might be tempting to raid your emergency stash for that killer rug sale or those must-have concert tickets, resist the urge! Keep that emergency fund locked down for true emergencies. For all the other stuff, that’s what your sinking funds are for.

Regardless of whether you love to spend or prefer to save, are a details person or more go-with-the-flow, sinking funds are a game-changer for everyone.

Here’s how a sinking fund can be your financial superhero:

By saving with purpose, fun buys will truly bring you joy, and the annoying expenses won’t throw you for a loop.

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here>

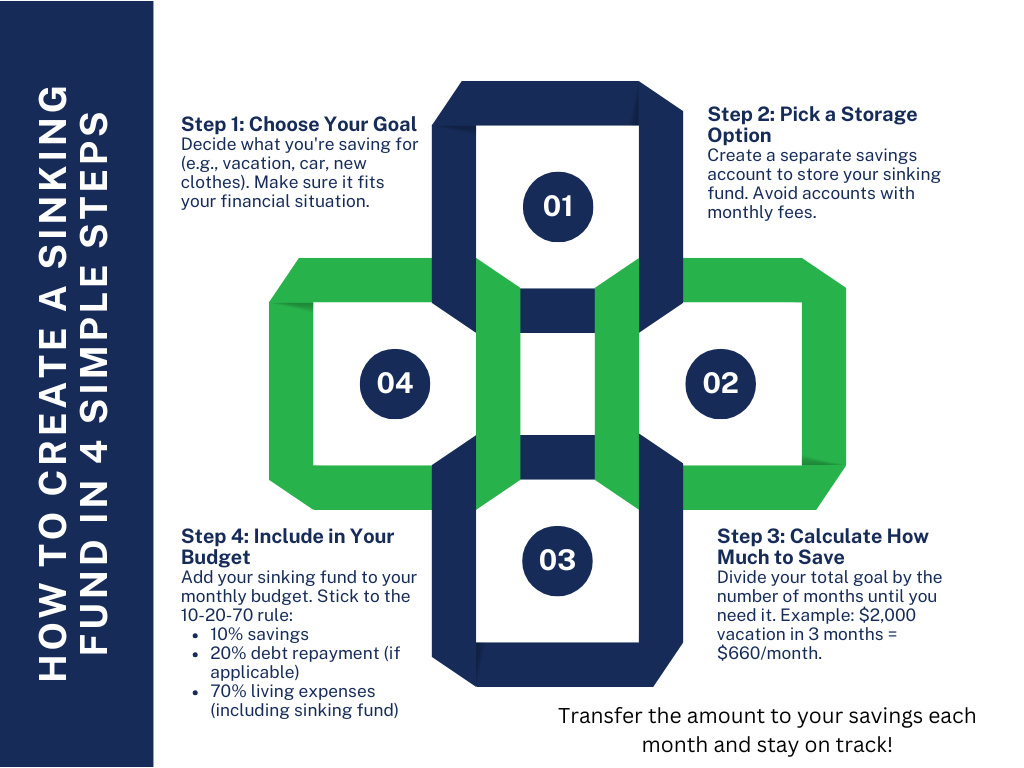

So, you know what sinking funds are, how they work, and why they’ll help you. Here’s how to make one in four easy steps.

Step 1: Decide what you’re saving for.

What do you want? Car? Vacation? New designer clothes? Make educated choices that make the most sense for your financial situation. However, a sinking fund can be used for any type of purchase. As long as you have the money, you are good to go.

Step 2: Decide where you’re going to store your sinking fund.

You might want to consider setting up a dedicated savings account for your sinking fund. Just be sure to pick an account that doesn’t require you to keep a minimum balance. You don’t want pesky monthly fees nibbling away at your savings.

Step 3: Decide how much you need to save.

To nail down how much to tuck away, take the total amount you’re aiming to spend and split it by how many months or weeks you’ve got until it’s time to buy.

Say you’re dreaming of a $2,000 getaway and summer’s just a three-month sprint away. You’ve got a tight three months to save up. This calls for a spot in your budget that nudges you to set aside roughly $660 each month until those summer vibes hit.

Step 4: Set up your sinking fund in the budget.

A sinking fund really kicks into gear when you lock it into your monthly budget. So, no matter if you’re a spreadsheet wizard, an app aficionado, or a pencil-and-paper traditionalist, make sure your sinking fund gets its own line in your budget!

Next, and this is SUPER important! Make sure the sinking fund doesn’t create an unbalanced budget! Use the 10-20-70 principle. 10% of your income is yours to keep. 20% of your income should go toward paying off debt (if you have debt). If you don’t have debt this money goes into the 10% category. 70% of your income should go towards lifestyle. This is food, rent, mortgage, gas, utilities…and yes, you guessed it, sinking funds!

Then, move that specified amount into your savings account each month and mark it off in your budget. Tip: Slap on a due date for that transfer if you find monthly reminders handy.

Stay the course, and before you know it, that dream on the horizon can be a reality!

Now that you understand how powerful sinking funds can be, it might be tempting to create one for every possible future expense—from concert tickets to new appliances to that dream vacation in Italy. But before you dive into setting up a dozen different funds, it’s worth taking a step back. Sometimes, having too many goals at once can dilute your efforts and reduce your momentum.

If you try to contribute to too many sinking funds at once, you may find that progress feels painfully slow. Small deposits scattered across goals may not move the needle in a meaningful way, and you could end up feeling frustrated or discouraged. Realistically, there’s only so much room in your monthly budget for savings—and that’s perfectly okay. It’s important to work within your means and avoid overextending yourself.

Instead, focus on prioritizing. Ask yourself: What’s most urgent? What aligns with your immediate financial goals or brings the most value to your life right now? Start by funding one or two top-priority goals, and give them your full attention until they’re complete. Then, move on to the next.

This is where budgeting frameworks like the 10-20-70 rule come in handy—allocate 10% of your income toward giving, 20% toward saving and investing (including sinking funds), and 70% toward living expenses. This approach helps maintain a healthy financial balance while still making consistent progress toward your goals.

Remember, sinking funds are meant to reduce financial stress—not add to it. Keep your strategy focused, intentional, and flexible as your needs and resources evolve.

Why not take a step further and invest in both yourself and your future? While the examples we’ve discussed revolve around saving for specific purchases, there’s more you can do. Consider a sinking fund that incorporates whole life insurance, where instead of putting your sinking funds in a traditional savings account, you put them into life insurance which will turn your savings into a financial tool and allow you to access the funds for your sinking fund purchases at the same time.

Incorporating life insurance with the sinking fund method provides a significant advantage that no savings account can offer; guarantees and a death benefit. The guarantees of whole life insurance ensure your money will grow and be available for you when you want to use it. With the addition of a death benefit, you can rest assured knowing that if the unthinkable happens, your loved ones will be provided for financially…something a savings account cannot offer.

Allocating funds to a whole life insurance policy not only secures financial stability and adaptability for you but also ensures your loved ones have a safety net, making it a profound way to invest in your family’s future.

It’s incredible what a bit of savvy saving can do. Rather than diving into debt, you can plan ahead, stay up front, and build a solid financial future for your family.

To maximize your saving strategy, provide protection for those you love and gain access to the guarantees and stability available to you through participating whole life insurance, contact McFie Insurance 702-660-7000 or [email protected]. We can help you!