702-660-7000

702-660-7000

Consumers believe life insurance costs nearly three times the actual price, which, according to the nonprofit research group LIFE Foundation, may lead to them not purchasing the coverage they need.

In one survey, those asked, estimated the cost of a 20-year $250,000 level term policy on a healthy 30-year-old male, at being close to $400. In actuality, the cost would have only been $150. Unfortunately, healthy younger adults who would qualify for preferred prices, overestimate the cost of life insurance closer to seven times!

The truth is that life insurance premiums have decreased by about 50% over the past 10 to 15 years, as mentioned in the same survey article given above. This is an important detail to know, especially for those who recognize they are underinsured. Statistically, 29% of men and 33% of women realize they are underinsured, and minority groups recognize their need for more life insurance even more than non-minority groups. 41% of African Americans and 37% of Hispanics report they need more coverage.

With the concern of price being so overestimated, it is nice to know that some life insurance policies can recover the cost of the purchase in a relatively short period of time. Imagine purchasing anything and having the cost of what you paid returned to you, while you get to keep what you purchased. Enter limited pay life insurance policies.

A limited pay life insurance policy is a form of whole life insurance characterized by a distinct payment framework. As implied by its name, premiums are only paid for a set period.

The advantages of a limited pay life policy extend beyond this payment period. These policies offer a guaranteed death benefit, ensuring lifelong coverage. Upon the policyholder’s death, beneficiaries will receive a tax-free lump-sum payout.

Return of premium term life insurance products require the premiums to be paid for a set period of time and then guarantee the premiums paid will be refunded, as long as a death claim hasn’t occurred prior to that set time, AND the term policy is not renewed. Though the premiums paid are recovered in this type of term insurance policy, it should not be misconstrued as a limited pay life policy.

Universal life policies can accumulate cash values based on interest earned on additional premiums paid into the policy. This accumulated cash value can exceed the cost of premiums paid overtime and the policyholder can access that money via a policy loan or withdrawal to pay future premiums. This could limit the out-of-pocket premium payments required by the policyholder but should not be mistaken for a limited pay life policy.

Dividend-paying whole life insurance is the only type of life insurance that provides guaranteed fixed premiums and equity for the policyholder. This is truly the only type of insurance that can be classified as a limited pay life insurance policy. A limited pay whole life policy is a type of whole life insurance that only requires premiums to be paid for a certain time, can guarantee the premiums will stop and not return nor will the policy lapse when the premiums are stopped in the appropriate manner.

Get a working knowledge of how each type of life insurance policy works.

After reading this 10-page booklet you'll know more about life insurance than most insurance agents.

Download here>

Whole life insurance offers lifetime coverage and includes a cash value component that accumulates interest over time, in addition to providing a lump-sum payout to beneficiaries after the policyholder’s death. Once there’s sufficient cash value, you can borrow against it or make withdrawals.

Due to these features, whole life insurance tends to be more costly than term life insurance, which is typically the most prevalent and economical choice for many seeking financial protection for their loved ones.

Whole life insurance may be suitable for specific situations, such as:

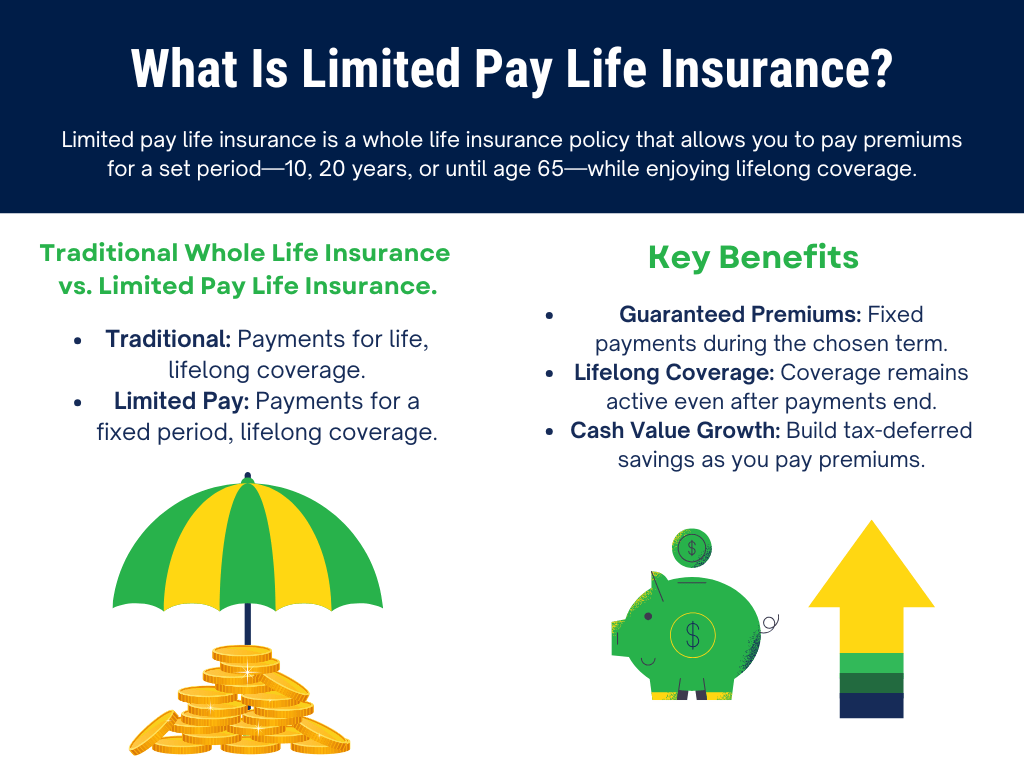

Limited pay life insurance stands out because, although the death benefit becomes effective immediately upon policy activation and remains in effect for life, the period for making premium payments is finite. This contrasts with more traditional term or whole life insurance policies, where premiums are paid for the duration of the policy or until the policyholder’s death.

The premiums for a limited pay policy are determined when the insurance company extends an official offer. Applicants choose their desired premium term, and the insurer provides a fixed premium for that selected term. As long as premiums are paid punctually, the policy remains active for the policyholder’s lifetime.

The death benefit of a limited pay policy, which is the amount paid to beneficiaries after the policyholder’s death, becomes effective immediately. Coverage starts from the first day and continues for the policyholder’s entire life, contingent on timely premium payments. There is no waiting period for coverage to commence once premium payments begin.

Limited pay policies start accumulating cash value with each premium payment. A portion of each payment contributes to this cash value, which grows over time through continued premium contributions and interest accrual.

The key distinction between a limited pay policy and other whole life policies lies in their premium structures.

In a standard whole life policy, premiums must be paid throughout your life to maintain the policy, which increases the risk of the policy lapsing, meaning it could get canceled, resulting in a loss of coverage.

Conversely, with limited pay, premium payments are only required for a specified duration, typically 10 or 20 years, or until age 65.

In both types, coverage starts immediately. However, in limited pay, once all payments are made, coverage is secured for life. For traditional life insurance, continuous payments throughout your lifetime are necessary to keep the coverage.

Although the overall cost of both policy types is roughly similar, limited pay policies necessitate earlier completion of payments, resulting in higher individual premiums compared to those of a traditional whole life policy.

Understanding the Infinite Banking Concept and How It Works In Our Modern Environment 31-page eBook from McFie Insurance Order here>

Limited payment life insurance policies can be designed to accept premiums over one year, ten years, or longer periods of time depending on the age, health, and insurability of the applicant. One type of limited pay life insurance is a reduced paid-up whole life insurance policy (aka RPU policy). This type of limited pay life insurance is ideal for those who are in their sixth decade of life and don’t want to pay premiums much past retirement.

Another type of limited pay life insurance is a single-pay whole life policy. Single-pay life insurance is primarily used in estate planning where the policyholder wants to leave a larger tax-free legacy to their beneficiaries than they would be able to if they don’t purchase the limited payment life insurance policy.

7 Pay life insurance is another option. A 7 Pay life insurance plan allows for complete payment of the policy through premiums over a span of seven years. Once these seven years of payments are completed, the policyholder is not required to make any further payments, yet they remain entitled to the policy’s death benefit for their lifetime. This type of policy is advantageous as it enables policyholders to maintain the tax benefits associated with whole life insurance while settling its entire cost in a relatively brief duration.

Limited pay whole life insurance is a great tool for those who want to recover 100% and more of the money they spent to purchase life insurance, want to have guaranteed money for their retirement, and leave a legacy that is more than they could accomplish without the purchase of the limited pay life insurance.

At McFie Insurance we understand what limited pay life insurance is all about. We know when, where, and how it should be used to benefit the policyholder. But perhaps even more important we know when, where, and how NOT to use limited pay whole life insurance. Any agent can sell a limited pay life insurance policy, but there can be tax ramifications, decreases in the death benefit, or even an unexpected continuation of premiums if the policy is not designed to avoid these things.

This is why we offer a complimentary strategy session for those who are interested in purchasing life insurance. We specialize in policy design, analysis, and review so you can rest assured that you have the best coverage at a fair price and know it will last as long as you need the coverage. Anything less is money wasted. Schedule a strategy session with our team today.

Though insurance rates have decreased across the board over the past decade, this doesn’t mean all insurance premiums have. McFie Insurance is here to make sure you are purchasing the life insurance you need, at the price affordable and comfortable for you, and that you will have the option to turn your life insurance into a limited pay life insurance policy in the future if needed.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.