317-912-1000

317-912-1000

Agricultural financing presents unique challenges for farmers and ranchers. While traditional farm loans serve important purposes, incorporating whole life insurance into your agricultural financing strategy can provide additional benefits and flexibility that many producers overlook.

Let’s examine how combining traditional farm lending with whole life insurance can help create sustainable financial stability for your agricultural operation.

Farm Credit Services and other agricultural lenders typically offer several core loan products:

These loans usually require substantial down payments – often 35% or more for land purchases. Lenders evaluate multiple factors including credit history, farming experience, financial statements, and tax returns when making lending decisions.

Interest rates depend on the borrower’s risk profile, total borrowing relationship, and market conditions. The approval process typically takes 7-10 business days once all documentation is submitted.

This is where participating whole life insurance can provide strategic advantages for farmers and ranchers. When structured properly, a participating whole life policy builds guaranteed cash value that you can borrow against while still maintaining the death benefit protection.

The cash value grows tax-deferred and can be accessed through policy loans without the extensive qualification process required for traditional farm loans. This creates an additional source of capital under your direct control.

Some key benefits of incorporating whole life insurance into farm financing:

|

Policy Checklist Make Sure You Get a Good Policy Is your policy good or bad? Use this checklist to help evaluate your existing life insurance or a new policy you are considering. |

Consider this example: A cattle rancher needs $100,000 to purchase additional breeding stock. Rather than going through a lengthy loan approval process and pledging the cattle as collateral, they can borrow against their whole life policy’s cash value.

The policy loan provides quick access to capital without additional credit checks or collateral requirements. The rancher maintains flexibility on repayment timing based on cattle sales and market conditions. Meanwhile, the policy’s cash value continues growing, and the death benefit remains intact to protect the operation.

The most effective approach often combines traditional farm lending with whole life insurance. Start by establishing a solid participating whole life policy as early as possible. This builds a foundation of guaranteed cash value that grows tax-deferred.

As your operation’s financing needs arise, evaluate whether a traditional loan or policy loan best fits the situation. Policy loans work well for:

Remember that policy loans do carry interest charges, typically 5-8% annually. However, the policy’s guaranteed growth plus potential dividends help offset this cost over time. The key is maintaining adequate cash flow to manage loan repayment while continuing premium payments.

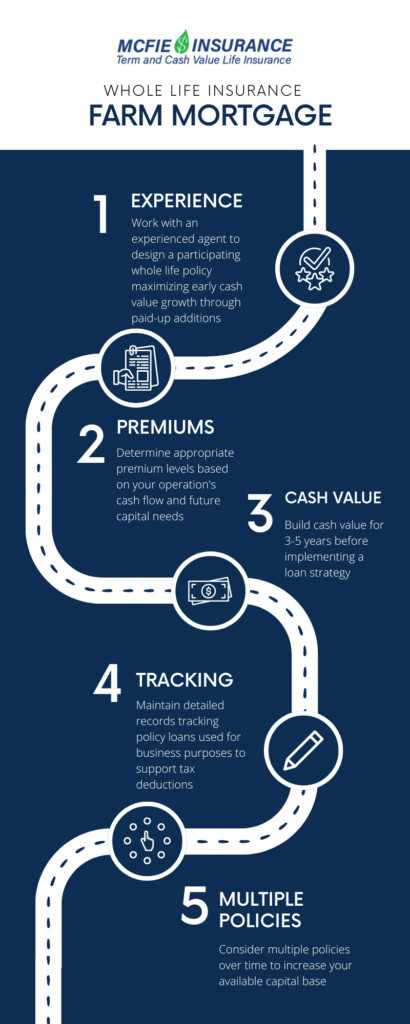

2. Determine appropriate premium levels based on your operation’s cash flow and future capital needs

3. Build cash value for 3-5 years before implementing a loan strategy

4. Maintain detailed records tracking policy loans used for business purposes to support tax deductions

5. Consider multiple policies over time to increase your available capital base

Beyond providing flexible financing options, whole life insurance offers additional advantages for farm operations:

Business Continuation – Death benefit proceeds can fund buy-sell agreements or provide transition capital

Estate Planning – Tax-free death benefit helps transfer the operation between generations

Retirement Income – Cash value provides supplemental income through tax-advantaged withdrawals and loans

Creditor Protection – Policy values are typically protected from business creditors

If you’re interested in learning how participating whole life insurance could enhance your farm operation’s financing strategy, schedule a strategy session with our team. We’ll analyze your specific situation and design a customized solution combining the strengths of traditional farm lending with the advantages of whole life insurance.

The key is starting early – the sooner you begin building cash value, the more financing flexibility you’ll have as opportunities and challenges arise in your farming operation. With proper planning and implementation, whole life insurance can become a valuable financing tool supporting your farm’s long-term success and sustainability.

Remember, this approach requires careful consideration of your complete financial picture. Work with professionals experienced in life insurance to develop an integrated strategy meeting your operation’s unique needs.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.