317-912-1000

317-912-1000

Life insurance policies have many benefits. One of the most important of these benefits is the death benefit. It’s important to give financial stability to your loved ones should you pass away unexpectedly. This is why when you purchase a policy, you’ll also want to select a beneficiary for your policy. You can choose people, entities and organizations to be the beneficiary of your policy. But supposing your beneficiary has also passed on, cannot be found, or declines your death benefit, what will happen?

To avoid lengthy legal processes and/or your death benefit reverting to your estate (and hence to probate), you should be sure to name a contingent beneficiary or contingent beneficiaries in addition to your primary beneficiary. This will ensure your death benefit will be left to those you intended, without winding up in your estate.

Key Takeaways

|

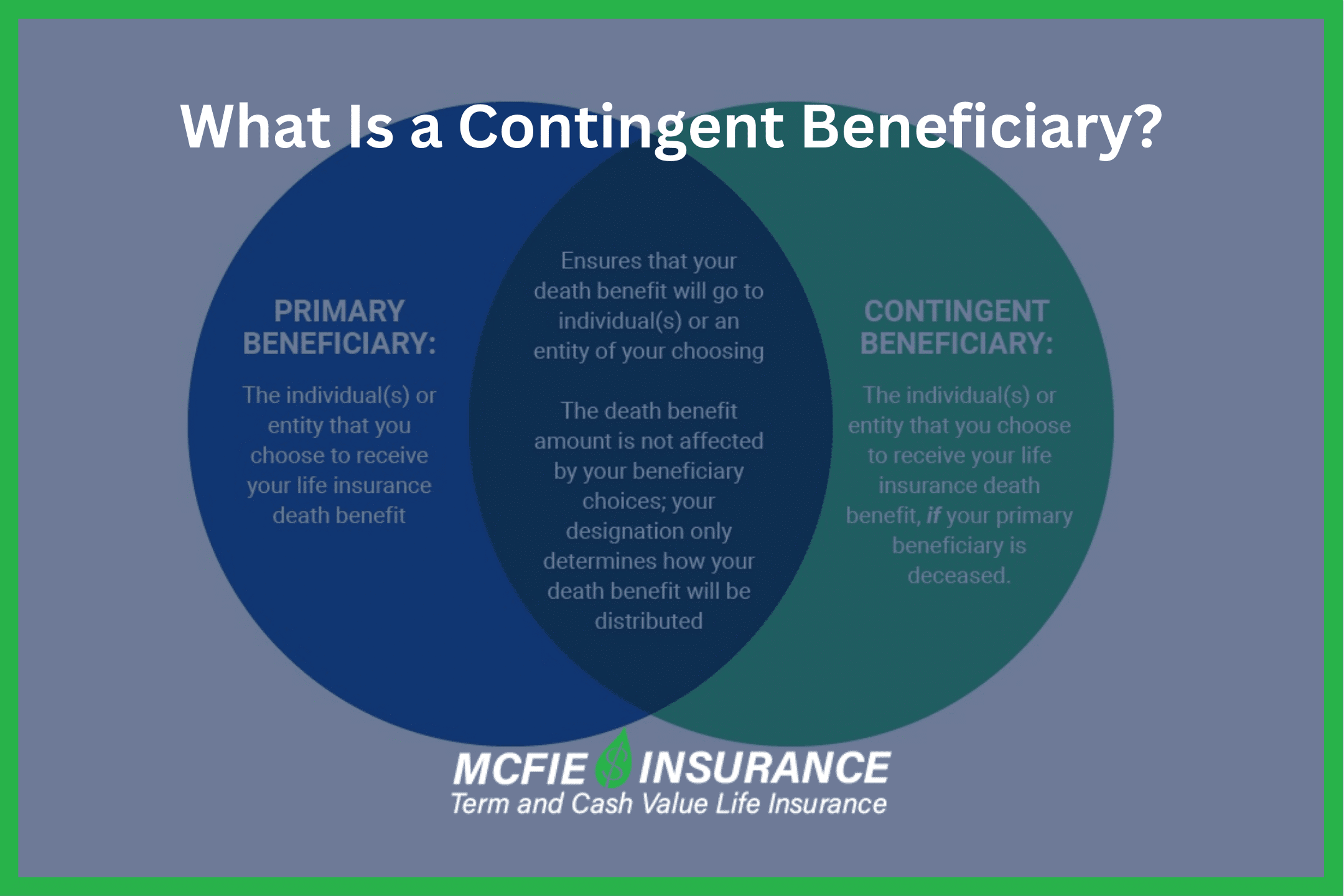

What is a contingent beneficiary? It is a person(s), organization, trust, or other entity named by the policyholder to receive a life insurance death benefit if the primary beneficiary is deceased, unable to be found, legally unqualified to accept it, or refuses the benefit at the time the monies are to be paid out. Contingent beneficiaries are second in line to receive the life insurance death benefit.

The first person or entity you choose to inherit the death benefit is the primary beneficiary. Many people select their spouse, children, or siblings for this role. Imagine you have a $100,000 death benefit and name your spouse as the primary beneficiary and your 18-year-old child as the contingent beneficiary. In the event of your passing, your spouse would receive the entire death benefit. But, if your spouse predeceases you, your child would then receive the full death benefit.

When it comes to appointing beneficiaries, remember that you aren’t restricted to just one primary and one contingent beneficiary. You have the freedom to name multiple beneficiaries for each category. If you opt for multiple beneficiaries, you can decide the specific percentages each one will get, ensuring they each receive a defined share of the policy. Revisiting the $100,000 death benefit scenario, suppose you designate your child and your niece as contingent beneficiaries, each getting 50%. Should your spouse be unable to claim the death benefit, your child and niece would each inherit half of it.

|

Get a working knowledge of how each type of life insurance policy works. After reading this 10-page booklet you'll know more about life insurance than most insurance agents. Download here> |

A good way to think about primary vs. contingent beneficiaries is first vs. second beneficiaries. The second or “contingent” can collect the benefits only if the first or “primary” beneficiary cannot.

As with anything in life, it’s always good to have a back-up plan. Naming primary AND contingent beneficiaries will ensure that your death benefit will be left as you intended, while also making it easier for your family. Naming both primary and secondary beneficiaries will make your intentions clear.

When choosing beneficiaries, both primary and contingent, it’s important to keep in mind they must be able to legally accept your death benefit. For example, if you name your child as a primary or contingent beneficiary, they will only be able to accept the death benefit if they are at least 18 years of age. If they are under the age of 18, you will want to make sure you have a custodian, legal guardian, or a trust selected which will hold the funds until your child comes of age.

Common contingent beneficiaries include:

When purchasing a life insurance policy, you’ll have the option to name primary and contingent beneficiaries on the designated form. You’ll want to be sure you submit the following information about your chosen beneficiaries in order to assure a smooth transition of funds when you pass.

Keep in mind you can change who is designated as your beneficiary, both primary and contingent even after you own the policy.

At McFie Insurance, we can help you set up your life insurance beneficiaries, make changes or updates to your primary and contingent beneficiaries, and answer any questions you may have about the process. Call or email us today. We’ll take care of you.

by Steven McFie

by Steven McFie

Many people make bad financial decisions, not because they want to, but because they don’t understand enough to make good financial decisions. I like to make things as simple as possible. Simple things are easier to understand. And when you understand something, it’s easier to make good financial decisions. (Yes this is an old picture - need to get an updated one.)