702-660-7000

702-660-7000

According to a 2021 CNBC report, the average American has $90,460 of debt! Which brings up the question…what happens to your debt when you die? How debt is handled after death depends on the type of debt, where the person lived, and how much money is in the estate. Here’s everything you need to know about debt after death to protect your family from inheriting any burdens.

After you die, your debt typically becomes the responsibility of your estate. When planning your will and estate, you choose a person to be the executor of your estate – this is a trusted person who will take care of all of your assets and property, give your family their inheritance, and settle any outstanding debts if needed.

Note: When used properly during a person’s lifetime, a living revocable trust can help to bypass the probate process making it easier for the trustee/executor to settle financial affairs privately without a public probate process through a court.

If you don’t have a will, listen to our podcast interview with Attorney Lee Philips: What if you don’t have a will?

In general, any outstanding debt that is solely in your name will be paid back by your estate. However, there are few instances where others might be on the hook. These are the four parties that could become responsible for your debts:

What about debts after death with no estate or more debt than the estate is worth? This is where the type of outstanding loan comes into play. Let’s take a look at the five most common forms of debt after death and the rules for each.

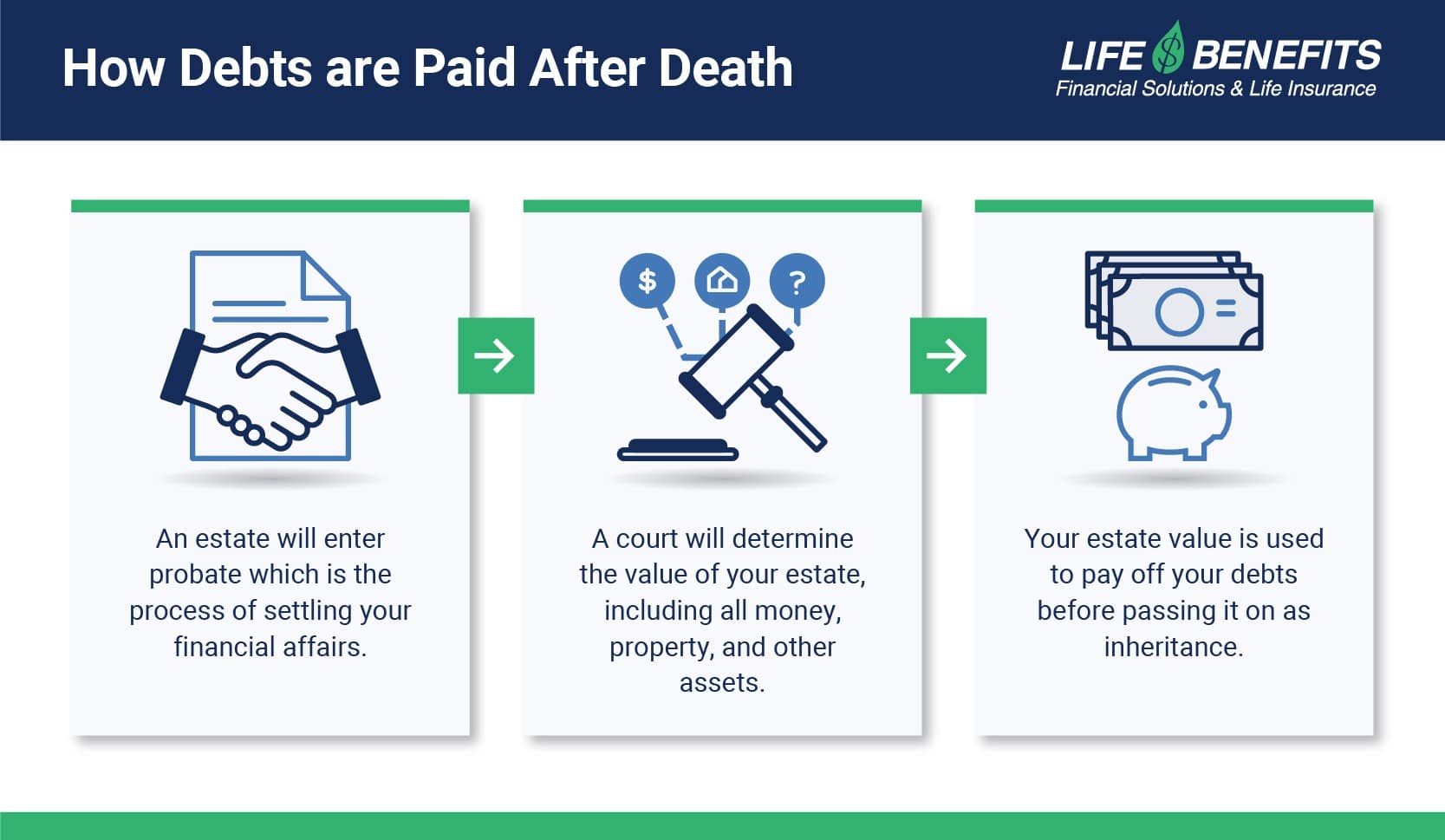

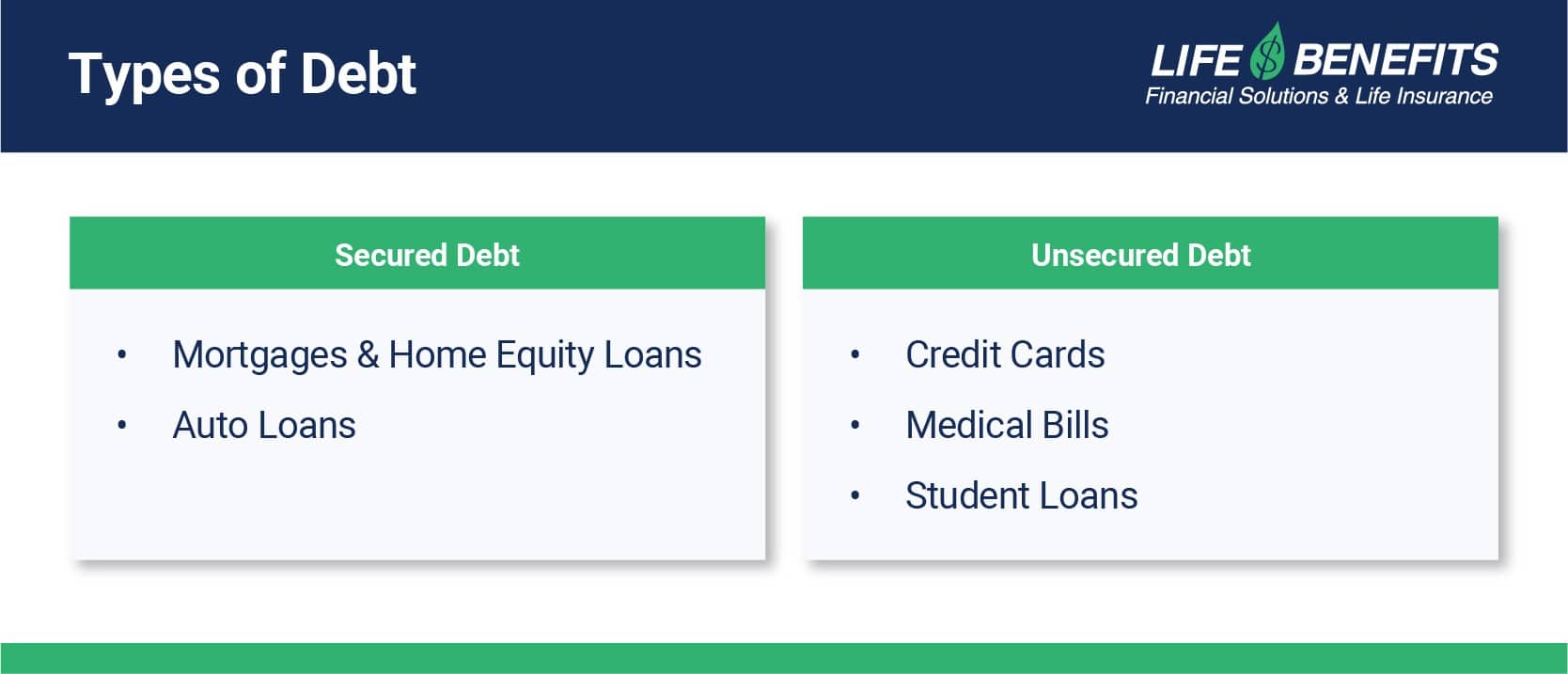

After death, an estate will enter probate which is the process of aggregating assets, paying off debts, and distributing any remaining inheritance under court supervision. The executor of your estate will first obtain all records of any outstanding debts and inform all lenders of the death. He or she will then determine the order in which they legally should be paid. The order of payment will vary by state and whether the debt is secured or unsecured. Secured debts are backed by assets on which the lender has a lien. Unsecured debts are not backed by collateral or assets. Therefore, if the estate doesn’t have enough money to repay the loans, they often go unpaid. The most common secured and unsecured debts include the following:

If your estate doesn’t have enough assets to cover the amount of debt owed, creditors and debt collectors can become an even bigger burden than the debts themselves. Here is a breakdown of what debts are forgiven at death and the likely scenarios of each so you know what to expect if you have these types of debts.

If you’re the sole owner of the property and the mortgage, the loan goes to the estate to be paid back. If the estate can’t cover the outstanding amount, the house may be taken by the lenders as collateral since it is a secured debt. However, if someone inherits the home, they have the option to take over ownership and continue making payments on the mortgage or sell the house to repay the loan. In some cases where the estate has the money, the executor might use the estate money to pay off the mortgage and pass the home down to its inheritor(s) mortgage-free.

If the property had joint owners and/or co-signers on the mortgage, then those parties are now responsible for any remaining mortgage payments. If they default on the mortgage, the house will be repossessed by the lender.

Home equity loans are set up a little differently. Unlike outstanding mortgages, home equity loans may need to be repaid immediately, which could result in selling the house to pay for the loan.

Auto loans are a type of secured loan as they hold your car as collateral for the loan. Oftentimes estates have enough money to cover any outstanding auto loans and the car will go to its inheritor debt-free. However, if the estate doesn’t have enough money for the loan, the lender can repossess the car or the inheritor can keep the car and start making the loan payments.

What happens to student loans when you die? The good news is all direct federal student loans will be forgiven after your family or executor of the estate applies for a loan discharge and provides sufficient proof of death. This applies to all direct loans as well as parent PLUS loans if the parent or student borrower passes away.

The bad news is private loans may have to be paid back if 1). there is a co-signer for a loan taken out before November 20, 2018, 2). you lived in a community property state and the student loan was incurred during the marriage, or 3). the estate has enough money to repay the debt. Because student loans are unsecured, if the estate doesn’t have enough to pay the debt, private student loans often go unpaid. Some lenders such as Wells Fargo, Sallie Mae, and RISLA do offer loan forgiveness after death.

Medical bills tend to be the biggest headache of a debt to deal with. In most states, they take priority in the probate debt payment process. Due to the complexity and variety of medical debt rules, it’s best to get professional help if necessary. Medicaid payments from age 55 until your death also play a big factor in the debt’s repayment. States may come for those payments or take a portion of the profits when a property is sold. When in doubt, it’s best to assume medical debt will need to be repaid in some form or other. It is good to know that medical debts can often be negotiated.

Debt associated with credit cards cannot be inherited unless there is a joint account holder or if you live in a community property state and the debt was assumed during marriage. If there is a joint account holder or community property situation, then that person or persons will be responsible for any payments and/or debts within the account. It’s important to note that this does not include any authorized card users. If the account was solely in your name in a common law state, the estate is in charge of paying off the credit card debt. And if the estate doesn’t have enough money to cover the debt, because it’s an unsecured debt, the amount will most likely go unpaid, and creditors will just write off the amount.

The executor of the estate or a family member is legally required to notify any creditors of a debtor’s passing. Creditors then usually have three to six months after death (this time period depends on the state they live in) to submit a claim against the deceased’s estate. If the estate has enough money to repay the claim, then the debt is taken care of then and there. If not, then what creditors can take depends on if the debt is secured or unsecured and whether or not there is someone else living who is legally responsible for paying the debt. As you can see, debt can quickly drain an inheritance you hoped to leave your family. Cars, homes, antique collections, etc. can all be taken away and sold to pay for outstanding debts, leaving your legacy at the mercy of creditors.

Luckily, there are a few things that creditors cannot take away in most states including life insurance benefits, and many retirement accounts. This is one of the many reasons it’s important to have a life insurance policy… cash value and death benefits are often protected from creditors. Learn more in other articles on our site, about the importance of choosing your beneficiaries and contingent beneficiaries. Instead of leaving your debts to be paid by ransacking your estate, your beneficiaries can choose to use the money from the death benefit to help pay outstanding debt, funeral costs, and even their living costs moving forward. This allows your family members more control over your estate and any sentimental assets that might be otherwise sold to cover debts.

Whether you’re worried about debt or not, the guarantees and protection provided by a well-designed life insurance policy are priceless to you and your loved ones. Give us a call today at 702-660-7000 or schedule a strategy session to see how we can help you protect your financial legacy and your loved ones.