702-660-7000

702-660-7000

It is amazing what people believe they are worth. Surprisingly, many believe that paying 12 percent or more on a credit card is worth more than keeping 10 percent of their income for themselves to rely upon when they will no longer be able to work as long or as hard as they currently work.

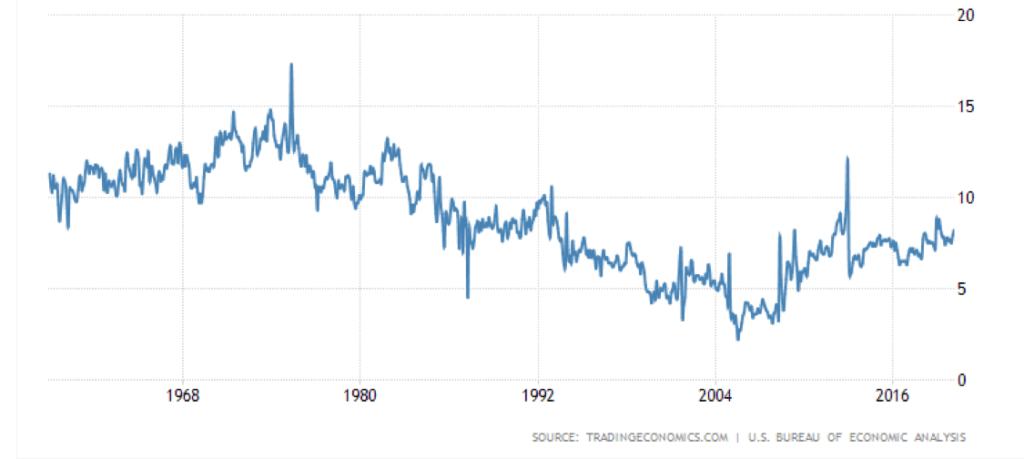

Americans had the highest savings rate recorded, of 17.30 percent, back in May of 1975 when unemployment peaked during the 1973-1975 recession. During the 1980-1982 recession, Americans saved up to 13.2 percent.

Savings rates don’t necessarily rise when there isn’t a recession, but they often do. Even without a recession, the savings rate in the United States has not risen above single digits between December of 2012 to January 2020, and has dipped to as low as 5.8 percent. But historically, savings rates have often risen both during and immediately after a recession which at first glance appears counter intuitive.

For now, understand that most people already realize that saving less than 10% of your income will not prevent you from running out of money after you retire. That is why nearly 1 out of 2 retirees FEAR running out of money every year. In fact, 4 out of every 10 households between the ages of 35 and 64 will likely run out of money in retirement.

But even if you save 10% of your income in vehicles like IRAs and 401(k) accounts, you still won’t have enough money for your retirement. That is because you need to save 15% or more in order to have what you will need to live on in your retirement without running out of money.

A Great Way to Increase the Money You Save:

Keeping 10% of what you earn and using 20% of what you earn to eliminate credit card and other unsecured debt is the first step to increase the money you can save. This step also defines what you really think you are worth. Those who can’t bring themselves to save 10% are telling themselves they aren’t even worth 10% of what they make.

Everybody knows that it doesn’t make financial sense to be paying a creditor 15 percent, or more, while you are paying yourself less than 10 percent. But this is what in reality is occurring in America today. With an average credit card rate at 19.02 percent for new offers and 15.10 percent for existing accounts, and 466.2 billion dollars of credit card debt in the US, an increase of 37% over the past 5 years, Americans are paying more to credit card companies than they are keeping for themselves.

By using the 10-20-70 Rule you can keep 10 percent of your income in a participating whole life insurance policy and still have access to the cash values to reduce, and then eliminate, your credit card and unsecured debt. This allows you to “save” or keep a portion of the interest that you would have paid to your creditors.

Here is a simple example of how this works:

Interestingly enough, you can’t do this very easily with the money in an IRA or 401(k) due to the restrictions of using that money for anything other than a qualified IRA approved reason. But if you keep 10% of your income and use it to pay for participating whole life insurance, then the cash values of the policy are available for you to use to finance debt like this. Meaning, you can automatically keep more of what you make and that means you are less likely to run out of money during your retirement.

Another Way to Increase the Money You Keep AND Legally Avoid Future Taxes:

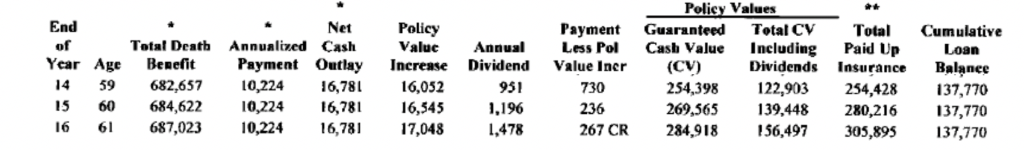

The attached chart is a copy of a few lines in one of the 8 participating whole life insurance policies on my own life.

Here are some of the benefits of owning this policy.

If this $137,770 policy loan has saved, or earned, a mere 7% over the last 5 years that would represent a $55,459.55 gain minus the annual interest paid to the insurance company of $32,785. The difference between that interest over 5 years and the $55,459.55 gain is $22,674.55.

Considering net actual results, the rate of return on this $137,770 would be 3.094%, rather than 7%. This isn’t a bad return when you consider that this rate of return would have been impossible to earn had the cash values of this policy NOT been available.

Consider the fact that the premiums paid for the life policy illustrated above, have been less than what the cash values have grown to become. That means the policy has actually cost NOTHING at this time. Nevertheless, from now on (actually beginning in year 9 for this policy) each year the premium is paid the annual cash value growth has been, and will continue to be, greater than the annual premium paid. For example,

The Choice Is Clear, As Are the Outcomes:

Not very complicated, but you have to make that choice yourself. The longer you wait, the more time it will take to overcome the cost of life insurance on your life and the more money you will have lost that you could have kept for yourself and your retirement.

Many will say, I can’t afford to save. But in reality, you can’t afford not to save. Americans are running out of money before they die, 9 to 11 years after they turn 65 to be exact. Participating whole life insurance provides the legally binding contract that you need to secure your retirement and avoid taxes on your Social Security checks as well. No other financial planning method protects your future income like participating whole life insurance does. And there is never a more opportune time to start your policy than right now.

Recessions are often a time when Americans realize that they don’t need to be spending as much on their lifestyle as they thought they did. The savings rates mentioned above show that recessions are a time that many Americans start to keep more of what they are making because they realize that government isn’t going to take care of them as well as they can provide for themselves.

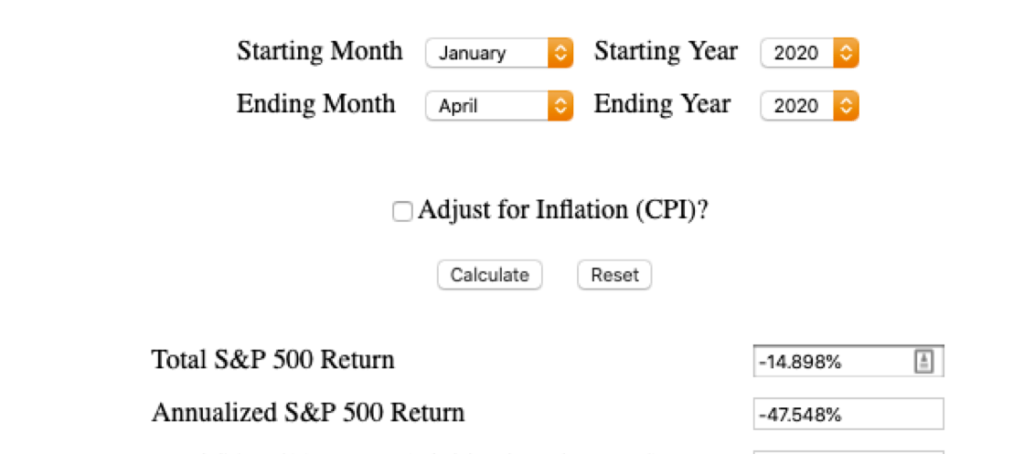

Here’s the loss in the S & P 500 from January to April 2020. This shows that Americans need to start saving. Keeping your money in a place that is secure and guaranteed makes a difference at times like these. But it will make an even greater difference when you go to use that money in retirement. There is no other place than participating whole life insurance that can offer the guarantees that life insurance companies can offer you on your money. Actuarial science and risk avoidance pay off. Don’t risk your money or your future on speculation. Build the only guaranteed foundation that can help you create lasting wealth. Call our office now to see if you qualify.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.