702-660-7000

702-660-7000

“There are two basic kinds of life insurance policies: Paid-up permanent, and term insurance.”[i] Whole life insurance contracts (the oldest type of Paid-up permanent insurance) are designed around the entire life of the insured. They also build up cash value inside the policy via the paid up insurance portion of the contract which can be purchased directly from premiums paid, or with participating whole life policies, with the dividends returned to the policy owner from excess profits of the company.

Cash value grows tax-deferred inside whole life policies and as the policy holder you may “borrow against the cash accumulation fund without being taxed.”[ii] You may also surrender paid up insurance by requesting a withdrawal from the cash value.

Anytime a loan or withdrawal is taken you should understand the tax ramifications and the effects such an action will produce on the death benefit, future policy dividends and interest that may be charged.

The other basic kind of life insurance is term insurance.

Term insurance is purchased to provide coverage for a specific period of time rather than for a “whole life”. Some term policies have level fixed premiums that can last between 10 and 30 years. This allows the policy owner to pay a fixed annual premium for whatever fixed period the policy contract stipulates. Other term insurance policies have annual-renewable premiums which are adjusted annually. “As you get older, premiums steadily increase.”[iii]

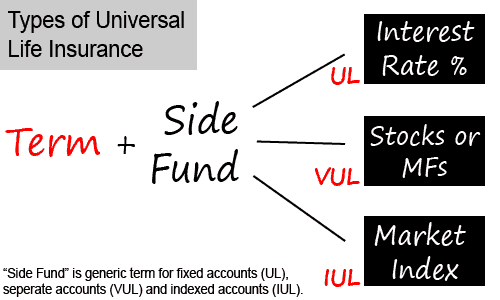

There are other insurance policies sold in today’s market place but they are what you might call hybrids of the two basic types of insurance discussed above and various investment strategies.

Universal Life Insurance (UL) is a hybrid of term insurance and a “money market-type investment”.[iv] “Investment returns are variable and are adjusted on a monthly basis.”[v]

Universal Life Insurance (UL) is a hybrid of term insurance and a “money market-type investment”.[iv] “Investment returns are variable and are adjusted on a monthly basis.”[v]

Variable Life (VL) is a type of permanent life insurance but is also “generally considered the most expensive type of cash-value insurance”[vi] available. Payments are “determined by the performance of the underlying investment chosen by the policy holder.”[vii] Returns are not guaranteed and these accounts are very often accompanied by higher fees. The greater the investment yield the higher the death benefit can become and most VL’s provide a minimum death benefit regardless of investment performance.

Variable Universal Life (VUL) is another type of permanent life insurance. The cash value can be invested in what are called separate accounts which are “similar to mutual funds”.[viii]

Indexed Universal Life (IUL) is a relatively new type of permanent life insurance which offers a “guaranteed fixed rate of interest and interest based on the performance of an outside index such as the S & P 500.”[ix] Like a typical universal policy, IUL policies direct all premiums paid to be applied to a fixed account which earns a rate of interest. The interest rate is not fixed but typically provides a minimum rate as well as a capped rate. The policy owner can decide upon a percentage of what is held in the fixed account to be transferred to an index account. The index account will earn interest equal to the index growth rate.

VL, VUL and IUL policy contracts contain fees and expenses besides the cost of insurance, surrender fees, and other charges and fees which can drastically impact the policy values as well as taxes. Therefore, consulting with your financial professional/insurance agent and tax preparer is highly recommended as you make any decision about your life insurance coverage.

VL, VUL and IUL policy contracts contain fees and expenses besides the cost of insurance, surrender fees, and other charges and fees which can drastically impact the policy values as well as taxes. Therefore, consulting with your financial professional/insurance agent and tax preparer is highly recommended as you make any decision about your life insurance coverage.

This is a service we provide for you. As financial professionals we consult with our clients on the right type, the best design and the most efficient use of life insurance products which best fit their specific needs and long term goals. We also specialize in designing policies that build cash value quickly because we understand the value, wealth and abundance which can be created for you by collateralizing those cash values to work for you.