317-912-1000

317-912-1000

Most investments fit into one of four basic classes:

When you invest in stocks, you’re buying a piece of ownership in a company, whereas bonds directly involve lending money. Money market securities offer a way to keep your cash accessible and safe, and they even let you earn a little bit of income.

Putting money into higher education is a way to invest in what you can achieve in the future. However, most people don’t really see spending on education and similar things as investments; they just view them as expenses.

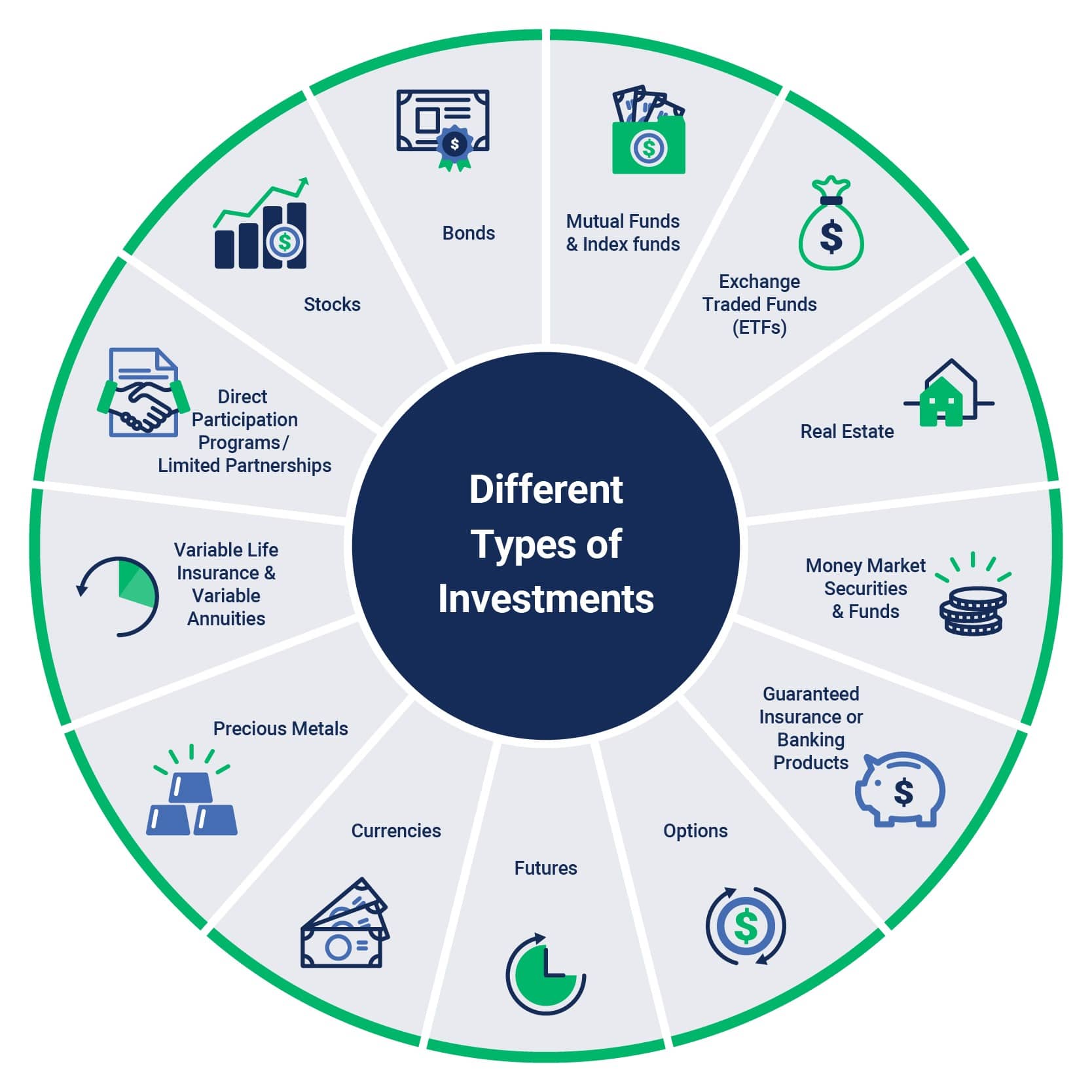

Our quick list of common investment types includes:

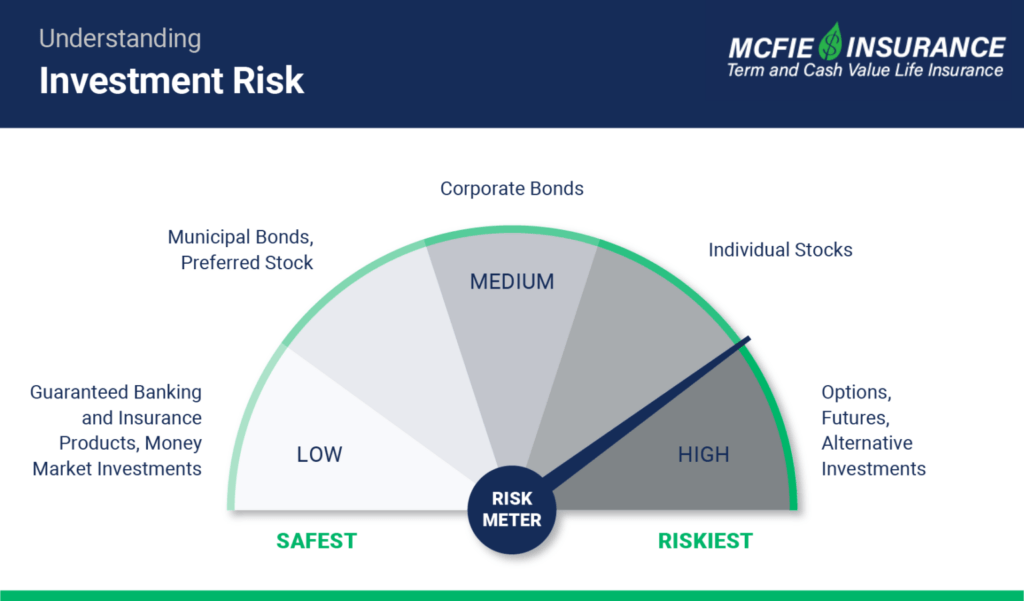

All investments come with some type of risk. Some risks can be avoided, while others cannot.

To dodge market risk completely, you’d have to steer clear of the market and stash your cash in insurance and banking products instead. These products don’t face market risk, but they do risk losing buying power over time.

While it’s tough to sidestep every kind of risk always, you can choose to avoid certain risks with the investments you pick.

Different investments, and even the same type of investment, can have vastly different risk levels based on your investment strategy and choices.

You can try to label investments with risk levels, but it really only makes sense if you also consider that:

As an investor, you’re faced with a vast array of investment choices, and figuring out where to begin can be overwhelming. At McFie Insurance, we’ve noticed that successful investors usually have a deep knowledge of their investment types.

We’re convinced that a solid investment strategy is built on a thorough understanding of your chosen investments and a plan for managing them, especially if they don’t perform as expected.

Let’s dive into various investment options and get to know the fundamentals of how they operate.

Companies issue stock to get the money they need to grow or improve their operations. Once the stock is out there, investors can buy and sell it among themselves, hoping its value goes up so they can sell it for more than they paid.

Some stocks also offer dividends, which are a share of the company’s profits paid out to investors. The company’s board of directors decides when and if to pay these.

Common stocks are probably what most people think of when they talk about investing. Buying common stocks means you’re getting a piece of a company’s assets and profits. You’re essentially part-owner of that company.

Owning common stocks also means you get to vote on important company decisions, like who’s on the board of directors. You’ll find these common stocks traded on most U.S. stock exchanges.

Preferred stock has some similarity to common stock, but there are important differences.

Preferred stock does not come with voting rights. In exchange it gets “preferred” treatment when it comes to company earnings and company assets in a liquidation.

Dividends for preferred stock are usually fixed so investors know they can expect a certain income each year by simply owning the stock. The company board of directors must cover fixed dividend payments to preferred stock investors before declaring a dividend for owners of common stock.

If dividend payments are suspended, then a company must “catch up” the fixed dividend payments to preferred stock investors before they are able to pay dividends to common stock investors going forward.

If a company runs into financial trouble and is forced to liquidate, the investors who own preferred stock will have a higher claim on company assets than common stock investors.

The risk of investing in stocks obviously depends, in a great measure, on the strength of the underlying company. Generally, common stocks are considered High risk while preferred stock is considered Low-Medium risk, but there are exceptions.

Preferred stock values are usually more sensitive to interest rates than common stock. Common stock can provide investors more upside potential if the value of a company increases.

Bonds are issued by companies or governments looking to borrow money from investors. You can think of a bond like an interest-only loan which can be sold to other investors or held until maturity when it will be paid off. Along the way, whoever owns the bond will receive interest income (aka coupon payments), depending on the type of bond.

Most bonds go through a credit rating process by a rating agency such as Standard & Poor’s or Moody’s. Ratings can change from time to time depending on financial conditions at the issuing company. Bonds with a triple-A rating (AAA or Aaa) are considered the highest quality.

Bonds with ratings of BBB or higher (with Standard & Poor’s), and Baa or higher (with Moody’s), are often referred to as investment grade bonds. Bonds below this rating level are usually referred to as high-yield bonds. Bonds from a company facing financial difficulty may be called junk bonds.

Corporate bonds are issued by corporations looking to raise money without selling additional stock and diluting ownership. Sometimes these bonds are backed by collateral (aka secured bonds) but many times they are not (aka debentures and subordinated debentures).

The U.S. Treasury issues different types of bonds collectively called treasury securities or government securities.

Treasury securities impose no credit risk, because the government can collect more taxes or access more money through the Federal Reserve system to make coupon payments and pay off maturing issues.

There are still other risks associated with investing in treasury securities including interest rate risk and purchasing power risk.

Municipal bonds (aka Muni bonds) are issued by states, counties, cities, school districts and other government entities. Sometimes the credit rating for municipal bonds will be insured to protect against loss of principal.

Muni bonds may be backed directly by the issuing municipality. These are called general obligation bonds. Or they may be tied to a specific source of revenue, such as a sports stadium. These are called revenue bonds. Issues of general obligation bonds require voter approval because they can affect taxes.

Unlike corporate and treasury securities, municipal bonds pay tax-exempt interest at the federal level. Sometimes states will also exempt interest on certain municipal bonds issued within the state.

Bond investments are usually deemed lower risk than investing in stocks. Municipal bonds are generally considered Low-Medium risk and corporate bonds as Medium risk. Treasuries are considered Low risk.

Mutual funds pool money from many investors to form a professionally managed investment portfolio. When you invest in a mutual fund, you buy shares in the fund itself, not in the individual assets it holds.

These funds come in different varieties: diversified, which spread investments across a range of assets to minimize risk, and non-diversified, which may focus on a specific sector or strategy. Mutual funds can be open-end, selling and redeeming shares at the fund’s net asset value (NAV) calculated daily, or closed-end, with a fixed number of shares that trade on the stock market, regardless of the fund’s net asset value.

Mutual funds offer a way for smaller investors to achieve diversification without the need to research and manage individual securities. They can target the entire market or specialize in certain niches. Operating fees are deducted from the fund to cover administrative and sometimes marketing costs.

Fees tend to be higher for actively managed funds, where advisors select the portfolio’s securities, compared to passively managed funds that track a specific index.

Some types of mutual funds include:

Index funds are a kind of mutual fund designed to mirror the performance of a specific stock or bond index by investing in the same securities found in that index.

Investing in an index fund allows you to buy shares in small amounts, which is more affordable than buying all the individual securities in the index yourself.

Since index funds simply follow the makeup of an index without needing a manager to select the securities, they are considered passively managed. This passive management approach typically results in lower fees compared to the fees for actively managed mutual funds.

Risk and rewards for a mutual fund investment depend on the underlying investments and the fees. This combination can be all over the board, depending on how the portfolio is composed and managed.

ETFs are a type of mutual fund which trades a group of securities and is available to buy/sell through an exchange just like a stock. The market price of an ETF can vary throughout the trading day, unlike the net asset value which is calculated at the end of the trading day.

The group of securities traded by an ETF may be determined specifically, or by an index and can include stocks, bonds, currencies and commodities.

Taxes on ETF gains are treated like gains on a stock where you don’t recognize the gain until you sell it. In contrast, most mutual funds spread the tax burden over time as assets within the fund are rotated.

ETFs are generally considered more tax-efficient than mutual funds, but sometimes ETFs can close and require liquidation before an investor might wish to pay taxes, so this can be an added risk. A thinly traded ETF may also pose a liquidity risk.

Money market securities (aka money market instruments or cash equivalents) are short term debt securities with high credit ratings and one year or less to maturity.

They may include T-Bills, banker’s acceptance (BA), commercial paper and some certificates of deposit (CDs). These are very liquid investments, which means they can be quickly converted to cash and are deemed Low risk. Expected returns are also very low.

Banker’s acceptance and commercial paper are both short term loans – usually with a maturity of 270 days or less. Banker’s acceptances are secured by collateral and guaranteed by an issuing bank to pay for goods being imported/exported during foreign trade. Commercial paper is issued by corporations borrowing for short term needs.

Investors can buy money market securities directly, or they can invest in the money market through a mutual fund which is focused on money market securities (aka a money market fund).

All annuities are considered insurance products. Some annuities also have an investment component.

The simplest form of annuity accepts a lump sum of money and guarantees a certain periodic payment (usually monthly or annually) to the annuitant for a certain time, or for rest of their life.

Life annuities are based on payments for a person’s lifetime.

A life with certain period annuity is based on a person’s lifetime or at least the number of years defined in the certain period.

For example, an annuity providing payments for life with 10 years certain would provide payments for the rest of an annuitant’s life, or if they died 3 years into the payout, annuity benefits would continue to a beneficiary for another 7 years.

Immediate annuities begin annuity payments either immediately or after one year. Deferred annuities begin payments at some time in the future.

It is always important to read the fine print in annuity contracts before signing. Also be sure to understand any surrender charges.

Fixed guaranteed annuities are guaranteed by an insurance company and are considered Low risk. Technically they are not investments; and their contracts are usually short and relatively easy to understand.

Indexed annuities may be partially guaranteed by an insurance company but are not fully guaranteed. Assets usually track an index with a specific floor, cap rate and other limitations defined by the contract.

Indexed annuities are not usually considered securities because they only track an index rather than investing directly.

Parameters within an indexed annuity contract may be subject to change by the insurance company so there is still a higher risk exposure compared to a fixed annuity.

Sometimes these annuities are called fixed indexed annuities, so just know you’ll need to do plenty of research when you see the word “indexed” anywhere in the name.

Variable annuities are considered a hybrid insurance and securities product. Like indexed annuities the insurance company may provide some guarantees, but assets are going to fluctuate based on investment performance.

The risk of investing through variable annuities depends on the subaccount choices provided by the insurance company and the performance of the underlying investments in each of the subaccounts.

As always, it’s important to read the contract fine print before buying a variable annuity.

Life insurance products provide a death benefit on a person’s life, if they die during the guaranteed period of coverage. Some of these products also include an investment component.

Term life insurance is like renting life insurance protection. The insurance gets more expensive over time and there is no cash value component.

|

Get a working knowledge of how each type of life insurance policy works. After reading this 10-page booklet you'll know more about life insurance than most insurance agents. Download here> |

Universal life insurance is basically one-year term insurance with the option to pay higher premiums and build cash value (aka a cash account).

With plain universal life the cash account is tied to an interest rate.

With indexed universal life the cash account tracks an index (similar to indexed annuities).

With variable universal life the cash account is invested through subaccounts (similar to variable annuities). Variable universal life insurance is considered a securities product.

Whole life insurance is truly permanent life insurance as the period of coverage is guaranteed to last the entire lifetime of the insured. It is also a pure insurance product, not an investment.

Premiums start out higher than term insurance, and over time equity builds within the policy as cash value – a representation of the death benefit for which the insurance company is no longer at risk.

Money can be accessed from a whole life policy through a withdrawal, or by taking a policy loan from the insurance company with a simple signature loan. Interest on a policy loan is charged annually and the principal can be paid back over time or in a lump sum at the discretion of the policy owner.

Resource: Read more about the Types of Life Insurance here

Many investors like to use whole life insurance designed for high cash value to provide protection, liquidity, and guaranteed growth instead of relying on bonds or money market securities.

Life insurance products that build cash value do receive tax-preferred treatment and often provide a policy owner more options throughout their lifetime than a portfolio of securities alone.

While whole life insurance is not an investment, we believe it is an important financial tool for people who want to build long term wealth with protection, liquidity, guarantees and a legacy for the next generation.

At McFie Insurance, we specialize in designing high cash value whole life insurance policies and convertible term life insurance. Call us at 702-660-7000 to schedule a strategy session to see what whole life insurance can look like as part of your wealth-building strategy.

|

Infinite Banking Made Simple Instant Download This free binder has the information to build your own Infinite Banking system. |

Term life insurance is obviously temporary protection and does not build cash value.

Guaranteed values on nearly all universal life insurance products decrease to zero at some future date. At McFie Insurance, we do not believe universal life insurance should be considered permanent life insurance.

This makes whole life insurance, which builds a guaranteed cash value and a long-term legacy, the insurance of choice for long term value. The risk level is Low – guaranteed by the insurance company.

Option contracts are derivative financial instruments based on the value of underlying securities such as stocks or ETFs. They are considered an advanced type of investment vehicle because they are more complex to price and understand. There are call options and put options.

The buyer of a call option contract receives the right to buy 100 shares of the underlying asset at a specific price called the strike price, on or before the expiration date of the contract. The seller conversely agrees to sell 100 shares of the underlying asset at the same strike price on or before the expiration date.

A put option works the opposite. The buyer of a put option contract receives the right to sell 100 shares of the underlying asset at a specific price. The seller agrees to buy 100 shares at the same strike price.

Expiration dates apply the same way to put options as they do to call options and the buyer pays a premium to the seller for both types of contracts.

In an American option contract, the buyer has the option, but no requirement to exercise the contract. This is different than futures contracts which must be fulfilled with the underlying asset upon expiration.

The risk and reward of investing in options vary widely. Options can help investors hedge against risk or create massive risk exposure; they can limit profits or leverage price movements in the underlying security.

Generally, options are classified as High-risk investments, but certain combinations of options contracts can be less risky than investing in a single stock. It’s important to understand options contracts and how they work before using them.

Many commodities and currencies, including cryptocurrencies, are traded using futures contracts. They can also be traded directly through the spot market for more immediate delivery.

Futures are standardized financial contracts traded on specific exchanges, like the Chicago Mercantile Exchange (CME), where, for example, one corn futures contract equals 5,000 bushels of corn.

A farmer worried about potential drops in corn prices next year might sell a corn futures contract expiring next year to secure today’s prices for their future crop. Conversely, a cornflakes manufacturer looking to lock in a stable corn supply and price for the next year might buy a corn futures contract, ensuring they know the cost upfront and are promised delivery when the contract ends.

Investors also trade futures, not to exchange physical goods, but to profit from changes in price. By closing their contracts before they expire, these investors avoid actual delivery of the goods. Such trading can help keep commodity prices stable.

It’s crucial to note that unlike options contracts, which give the holder the right but not the obligation to execute the contract, futures contracts must be settled upon expiration, either through physical delivery or a cash settlement.

The futures markets are regulated by the Commodity Futures Trading Commission (CFTC) to prevent fraud and abusive trading practices.

Like option contracts, futures can be used for speculation or hedging against risk. Generally, they are considered High-risk investments. It is important to have a good understanding of futures, and a solid strategy before you try to invest in them.

Alternative investments are usually reserved for higher net worth investors (aka accredited investors) who are willing to take on more risk and accept little to no liquidity, hoping for higher profits.

Note: Regulations prevent some of these high-risk investment opportunities from being used within mutual funds which are offered to retail investors.

Private Equity, Venture Capital and Hedge Fund investments are examples of alternative investment opportunities with high risks and less regulation. Direct Participation Programs (DPPs) are also open to accredited investors.

Direct participation programs are often structured as a limited partnership (LP) business entity. Limited partners take a share of the business net income or loss on their own personal income tax returns.

These types of partnerships are created to pursue all kinds of business and investment opportunities. Common examples include construction projects, movie making and various exploration, development and income programs for natural resources.

If the business model doesn’t work out, high net worth investors can harvest their share of the losses through their personal tax returns. If the investment does work out, they may still receive tax benefits in the form of depletion or depreciation.

Limited partnerships or Limited Liability Companies (LLCs) are often formed for real estate investing, similar to a direct participation program.

A formal DPP for real estate investing may be focused on investing in raw land, new construction, existing properties, etc.

Real estate investments can be hard to liquidate whether owned by a single investor or through a DPP.

There are many other types of investment vehicles including some common ones listed here.

ADRs provide a way for American investors to buy stock in foreign companies with US dollars. In a sponsored ADR an American bank buys a foreign company’s stock in the home country’s currency then issues those shares as ADRs to investors in the US markets.

Any dividends received by the sponsoring bank in foreign currency are paid to ADR investors in US dollars. ADRs can carry higher risk due to currency exchange rates and political and legislative risks, but they may also provide diversification.

Most REITs are also publicly traded like stocks – they are basically stock in an operating real estate portfolio. REITs tend to have high dividend yields and not as much capital appreciation as other stocks.

Exchange traded notes are a type of unsecured debt security issued by a financial institution. They are different than other types of bonds because returns are based on the performance of an underlying benchmark.

ETNs are generally not as liquid as stocks, bonds and money market securities.

HOLDRs are a special group of stocks that can be traded as one. In this respect they are similar to ETFs but HOLDRs are completely unmanaged, their components rarely change, and they are not rebalanced as an ETF portfolio is over time.

Unit investment trusts consist of a non-managed portfolio of preferred stocks or bonds. They are typically classified as Medium-High risk depending on the asset composition.

Foreign currencies can be traded as futures on the foreign exchange market (FOREX) or directly on the spot Forex where the underlying currencies are usually delivered in 2 days.

Investing in cryptocurrency can also be done directly through a spot market or through futures contracts.

Precious metals can be purchased through an ETF, or directly on the spot market. If you hold precious metals physically you may need to consider storage and insurance.

Precious metals in physical form are often purchased as protection against a potential currency crisis. It is worth considering that if such a crisis occurs, there may be issues at play which preclude their use as an accepted currency.

Retirement plans are not investments themselves, but types of investment accounts which receive tax-favored treatment. Common retirement plans include:

Depending on the plan arrangements, retirement plans can hold many of the investment types which are available to retail investors. Some retirement plans are restricted when it comes to certain trading strategies, collectibles, and higher risk investments.

Many investment advisors recommend maxing out contributions to various retirement plans.

Keep in mind that you may not be able to withdraw money from the plan until age 59 ½ without facing a 10% penalty plus taxes. Some people prefer to build more liquidity before investing through retirement plans.

The risks and potential rewards for investing through retirement plans largely depend on the underlying investments and management strategy.

With all the investment types available it can be hard to know where to start. Some people enjoy the process of figuring out and managing their own investment strategies, while others prefer to get help from an investment advisor.

At the end of the day, we believe no investment advisor or life insurance agent can ever replace the advantage of a client who takes the time to learn about their own investments and stays pro-actively involved in the process even when they do include an investment advisor in the process.

At McFie Insurance, we design and sell life insurance for the protection and other benefits, including liquidity and guaranteed growth. Many investors like to use whole life insurance designed for high cash value instead of relying just on bonds or money market securities.

Talk to the McFie Insurance team at 702-660-7000 or schedule a strategy session here to see how life insurance can help you to grow and protect your wealth.

Note: Investing information provided on this page is for educational purposes only. McFie Insurance does not offer advisory or brokerage services, and does not recommend or advise investors to buy or sell particular securities.

by John T. McFie

by John T. McFie

I am a licensed life insurance agent, and co-host of the WealthTalks podcast.

As a 15-year practitioner of the Infinite Banking Concept on a personal level, I can help you find the clarity and peace of mind about your financial strategy that you deserve.

Working with hundreds of financial scenarios over the years has helped me to develop a sixth sense about how to quickly find a clear and balanced solution for clients using whole life insurance as a financial tool.