702-660-7000

702-660-7000

Our ability to use credit cards to obtain goods and services is something that sets modern society apart from earlier times. Whether we swipe a physical card or tap our phones to pay, the way we use credit plays a significant role in our financial lives. As young adults entering the world of personal finance, understanding how credit cards work is a necessity. These small pieces of plastic (or metal, for the fancy ones) can be powerful tools when used wisely, or dangerous traps when misunderstood.

Let’s examine how credit cards function, not with hasty assumptions or angry accusations about predatory banks, but with a thoughtful exploration of their mechanics and implications. Just as Thomas Jefferson and the founding fathers carefully chose their words in drafting the Declaration of Independence, we must carefully consider how we use credit cards and the impact they can have on our financial independence.

At its core, a credit card is a type of short-term loan. When you open a credit card account, the issuer provides you with a set credit limit – an amount of money you’re allowed to borrow for purchases or bill payments. As you use your card, your available credit decreases, and as you make payments, it increases again.

When you make a purchase, your card details are sent to the merchant’s bank, which then seeks authorization from the credit card network. Your card issuer verifies your information and either approves or declines the transaction. If approved, the payment is made to the merchant, and your available credit is reduced by that amount.

One of the most important aspects of credit cards to understand is how and when interest is charged. When you make a purchase with your credit card, you’re not immediately charged interest. Instead, you have what’s called a grace period – typically around 21 to 25 days from the end of your billing cycle to pay your balance in full without incurring interest charges.

If you don’t pay your full balance by the due date, however, the credit card company will begin charging interest on your purchases. This interest is typically calculated using your card’s Annual Percentage Rate (APR), which can range from around 15% to over 25%, depending on your creditworthiness and the type of card.

It’s crucial to understand that credit card interest compounds daily. This means that each day, interest is calculated based on your current balance, including any previously accrued interest. Over time, this can cause your debt to grow significantly if you’re only making minimum payments.

|

An easy read and a perfect introduction to whole life insurance and The Perpetual Wealth Code™ Available in eBook or Audiobook format. Download here> |

Many credit cards also allow you to take out cash advances – essentially, borrowing cash against your credit limit. However, cash advances often come with hefty fees and higher interest rates that begin accruing immediately, with no grace period. It’s generally best to avoid cash advances unless absolutely necessary.

When you don’t pay your full balance by the due date, the remaining amount “rolls over” to the next month. This is how many people find themselves in credit card debt – by consistently spending more than they can pay off each month. The rolled-over balance continues to accrue interest, making it increasingly difficult to pay off over time.

Many credit cards offer rewards programs, giving you points, miles, or cash back on your purchases. While these can be valuable, they should never be the primary reason for using a credit card. The interest you’ll pay if you carry a balance will quickly outweigh any rewards earned.

Understanding your payment options is essential to managing your credit responsibly.

The minimum payment is the least amount you can pay to keep your account in good standing. This amount is typically a small percentage of your balance, often around 2-3%, or a fixed amount (like $25), whichever is greater. While making only the minimum payment will keep your account current, it’s not a good long-term strategy. Paying only the minimum will result in accruing interest and can lead to long-term debt.

The statement balance is the total amount you owe at the end of your billing cycle. This is the amount you need to pay in full to avoid interest charges. Paying the statement balance in full each month is the best way to use a credit card responsibly and avoid debt.

The current balance is the total amount you owe at any given time, including recent purchases that haven’t appeared on a statement yet. This amount may be higher than your statement balance if you’ve made purchases since your last statement was issued.

Many card issuers allow you to set up automatic payments, which can help ensure you never miss a due date. You can typically choose to pay the minimum, the statement balance, or a fixed amount each month. Setting up automatic payments for the full statement balance is an excellent way to ensure you never carry a balance or incur interest charges.

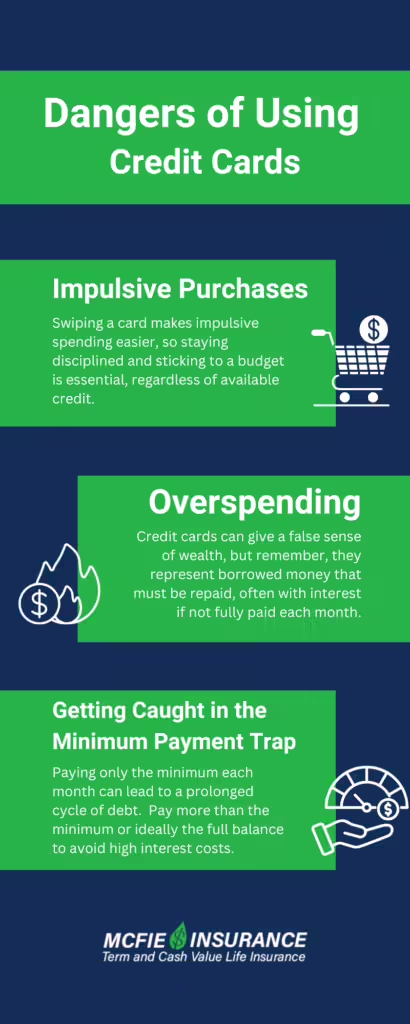

While credit cards offer convenience and potential rewards, they also come with risks that every cardholder should be aware of.

The ease of swiping a card can lead to impulsive spending. When you’re not physically handing over cash, it’s easier to make unplanned purchases without fully considering the impact on your budget. It’s important to maintain discipline and stick to a budget, regardless of how much available credit you have.

Credit cards can create the illusion of having more money than you actually do. Your credit limit is not free money – it’s a loan that must be repaid. Always remember that you’re borrowing money that must be repaid, potentially with interest if not paid off in full each month.

Paying only the minimum each month can lead to a cycle of debt that’s difficult to escape. Let’s look at an example:

Suppose you have a $3,000 balance on a credit card with an 18% APR, and your minimum payment is 2% of the balance. If you only make the minimum payment each month, it would take you over 27 years to pay off the debt, and you’d end up paying over $4,000 in interest alone!

This is why it’s important to pay more than the minimum whenever possible, and ideally, to pay the full balance each month.

Credit card companies often use enticing offers to attract new customers. It’s important to look beyond the initial offer and carefully examine the terms and conditions.

Many credit cards come with introductory offers like sign-up bonuses or 0% APR periods. While these can be beneficial, make sure you understand how long these offers last and what the terms will be afterward. For example, a card might offer 0% APR for 15 months, but then jump to a high interest rate after that period ends.

Pay close attention to the APR, annual fees, balance transfer fees, and any other charges. These details can significantly impact the overall cost of using the card. Look for things like:

Remember, the credit card with the most attractive headline offer isn’t always the best choice in the long run.

Before applying for a credit card, consider the following:

Most card issuers will perform a hard credit inquiry when you apply, which can temporarily lower your credit score by a few points. Make sure you’re likely to be approved before applying to avoid unnecessary hits to your credit score.

Some cards, especially those with large sign-up bonuses, require a minimum amount of spending within the first few months to earn the bonus. Ensure you can meet these requirements without overspending or going into debt.

Annual fees, foreign transaction fees, and other charges can add up. Make sure the benefits of the card outweigh its costs. For example, if a card has a $95 annual fee but offers $200 worth of travel credits and other perks you’ll use, it might be worth it. But if you won’t use the benefits, a no-fee card might be a better choice.

There may come a time when you decide to close a credit card, perhaps because you’re not using it or you want to avoid the temptation to overspend. Here’s how to do it responsibly:

Be aware that closing a card can impact your credit score, particularly if it’s one of your older accounts or has a high credit limit. Closing the card will reduce your overall available credit, which could increase your credit utilization ratio and potentially lower your score.

If you find yourself juggling multiple credit card balances, consolidation might be a good option. Here are a few ways to consolidate credit card debt:

Remember, consolidation doesn’t eliminate your debt – it just reorganizes it. You must address the spending habits that led to the debt in the first place to avoid falling back into the same situation.

Credit cards are powerful financial tools that require careful consideration and responsible use. By understanding how they work and using them wisely, you can build credit, earn rewards, and manage your finances effectively. Remember, we should approach our use of credit cards – with wisdom, discipline, and a clear vision for our financial future. Used responsibly, credit cards can be a stepping stone to financial independence and security. But used carelessly, they can lead to a cycle of debt that’s difficult to escape. The choice, like so many in life, is yours to make.

by Gracine McFie

by Gracine McFie

There are many ways to access information about finances, but it can be hard to determine which sources are trustworthy. I like to put information together in an accurate, straightforward, easy to understand manner so people can make good financial decisions based on the information provided without having to waste time wondering if the source is reliable.