317-912-1000

317-912-1000

The story about the Ugly Duckling who turns out to be a beautiful Swan always intrigued me as a child. Perhaps it was because that, even as a child, it was obvious to me that we are too quick to judge things as they appear, rather than as they really are.

This applies to investing as well as other things in life. Clearly, an investment that is the greatest investment of all times could appear as an Ugly Duckling to many. For example, billionaire investor Warren Buffett, speaks of the greatest investment of all times as one “that you can’t beat, that can’t be taxed and not even inflation can take away from you.”[i] Because “Nobody can take away what you’ve got in yourself, and everybody has potential they haven’t used yet.”[ii] But what if you don’t believe that. Wouldn’t this Swan of an investment merely appear to be an Ugly Duckling?

Warren Buffett once shared that before he took the Dale Carnegie course, the mere thought of speaking in public would make him physically ill. In fact, he admitted in a Forbes interview, “I proposed to my wife actually during the middle of the course—I got so confident about my abilities.” That single experience didn’t just help him conquer stage fright; it transformed the trajectory of his entire career.

Buffett’s story illustrates something profound: confidence isn’t something you’re born with—it’s something you build.

This principle is echoed in the life of Charles Swindoll, who as a child struggled with a stutter. Over time, he overcame that challenge—not only to speak clearly but to excel as a communicator. He became a U.S. Marine, a pastor, a beloved radio and television voice, and eventually the chancellor of Dallas Theological Seminary.

Swindoll’s journey helped him understand a powerful truth about life:

“Life is 10% what happens to you and 90% how you react to it.”

This idea—that attitude outweighs circumstance—is more than just a motivational phrase. It’s a reminder that personal growth is possible, even in areas where we feel the weakest. Whether it’s public speaking, financial confidence, or personal transformation, success often starts by simply deciding not to be held back anymore.

Unquestionably, no one wants to be poor. It’s a truth that transcends background, belief, or culture. But what’s fascinating is how some people use poverty not as a limitation, but as fuel for their ambition.

Take the late Jimmy Dean, for example—a legendary musician, actor, television personality, writer, and yes, the man behind the famous sausage brand. Dean was never shy about his humble beginnings. In fact, he was refreshingly honest about them. He once said, “I can’t change the direction of the wind, but I can adjust my sails to always reach my destination.”

Dean didn’t hide the fact that poverty shaped him. He embraced it as part of his story—something that sharpened his work ethic and determination. Instead of allowing it to define him or hold him back, he used it as the very reason he pushed forward.

His life serves as a reminder: while nobody chooses to be poor, how we respond to adversity is what separates those who stay stuck from those who rise.

Dean also alleged, “I can’t change the direction of the wind, but I can adjust my sails to always reach my destination.”[iv]

Nassim Taleb, author of The Black Swan, is a very successful investor who made nearly $40 million during the market panic of 1987 called Black Monday. His approach to investing is similar to the view that Swindoll and Dean have on life. Wanting to avoid poverty, but always willing and ready to adjust his sails to get to where he wants to go, Taleb keeps 85% to 90% of his capital in extremely safe instruments and only speculates with the remaining 10% to 15%. This limits what can happen to him and allows him to control the rest.

Taleb’s investment formula is based on the fact that the greater detriment would be losing your hard earned capital rather than not earning a higher rate of return. Which literally means, keeping what you have is the greatest investment of all times!

Strikingly, this is precisely what Participating Whole Life Insurance (PWLI) guarantees. With PWLI you will never lose your capital, as long as you pay your premiums and any interest that you owe due to a policy loan you have taken against your policy. Because of this guarantee, PWLI is the greatest “investment” of all times It is an investment in yourself, your life, your future earning power, or as the insurance companies call it, your human life value. And remember, Warren Buffett acknowledges that an investment in yourself is “one you can’t beat, can’t be taxed on, and not even inflation can take away from you.”[v]

PWLI is a safe asset that can securely protect your saved capital while guaranteeing you the right to participate in insurance company profits, WITHOUT risk! This guarantee allows you to speculate with a marginal amount, Taleb uses 10% to 15%, of your savings capital without the danger of losing it all and having to face poverty, the very thing none of us ever wants to deal with.

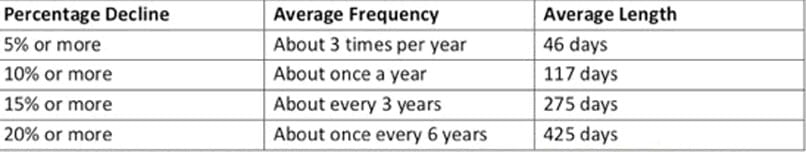

Let’s face it. Markets fall. And when they do it can get painful real quick for those who are depending on the money they have invested. “Attempting to time these market drops is a fool’s errand.”[vi] “Dancing in and out of it (the market) on the predictions of experts, tarot cards or the ebb and flow of business activity is a terrible mistake. The risk of being out of the game is huge compared to the risks of being in it.”[vii]

That’s why keeping 85% to 90% of your capital in safe, guaranteed Participating Whole Life Insurance (PWLI) is such a powerful strategy. When a major market drop happens—as it inevitably will—you’ll be positioned with liquidity and financial clarity, rather than burdened by debt or scrambling for access to cash. You’ll be ready to seize opportunity instead of licking your wounds.

The remaining 10% to 15% of your capital? Invest it with a long-term mindset. Trying to game short-term market swings can be a dangerous illusion—one that has led many to ruin. The chart above shows just how quickly things can unravel when short-term thinking takes over in a volatile market.

But if you believe in the long-term strength and resilience of capitalism—and history shows you should—you’ll understand that staying the course when others are running for the exits is often the most profitable decision. Recessions, corrections, even depressions—capitalism has survived them all.

So keep the bulk of your assets in guaranteed PWLI, eliminate bad debt, and maintain your focus on long-term outcomes. That way, your 10%–15% allocation can evolve into something truly extraordinary—a graceful Swan rather than an Ugly Duckling.

And here’s a final thought: to give yourself the greatest shot at spotting that Swan, avoid traditional investments you don’t understand. Instead, allocate that 10%–15% into ventures you’re passionate about or have real knowledge of. That awareness can help you recognize opportunity when it knocks,not because an “expert” told you so, but because you actually understand what you’re looking at.

That being said, if you don’t have PWLI and you are risking more than 10%-15% of your money in un-secured or non-guaranteed assets, then your Swan may never materialize because each market drop or correction will steadily destroy more and more of your savings until you have little or nothing left to show for it.

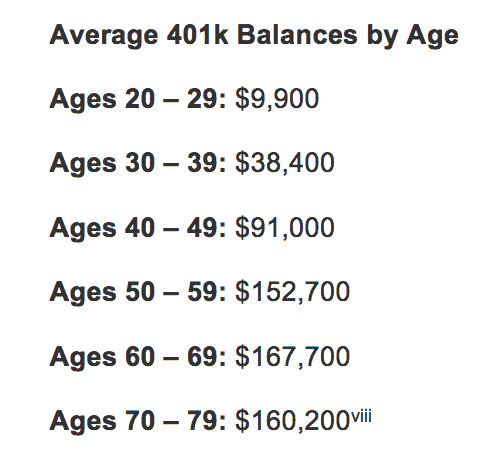

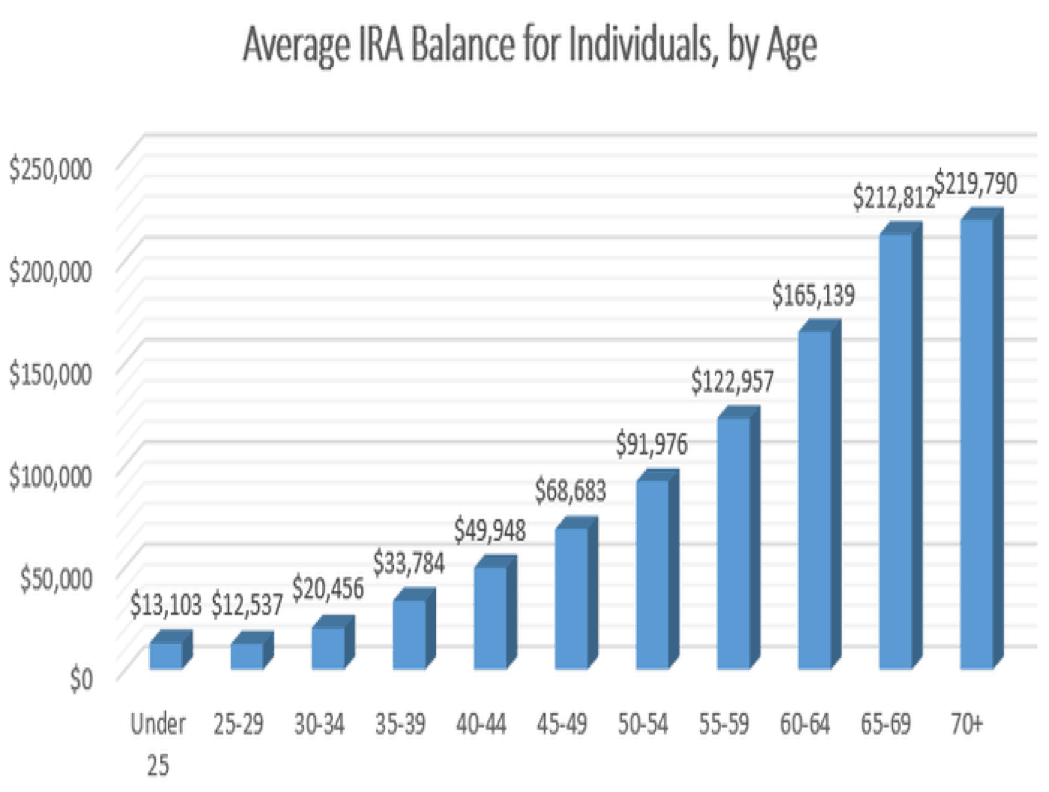

That is why most Americans today have less than enough money saved in their 401k and IRA on which to retire. They have placed too much confidence in the experts, tarot cards or business cycles and actually believe that they will have “$1.57 million by age 65”[x] because they invest in their 401k and/or IRA. Sadly, most realize too late how short they are in actually meeting those expectations.

Yet, when you appreciate the formula that the wealthy, such as Taleb and others use to protect their capital assets while fully anticipating the next Ugly Duckling to turn into a Swan, you can truly become financially independent in that you can control more of the money you make. Placing too much confidence in the market, in experts, tarot cards or business cycles leads people to risk more than their 10%-15%. And that means every bump and jump in the market proves more painful and dangerous financially. Deciding to risk more than the 10%-15% is much like playing Russian Rolette with your financial future. Pathetically, those who do so might merit the costs resultant to playing such a game with their money.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.

[i] https://www.cnbc.com/2017/10/04/warren-buffett-says-this-one-investment-supersedes-all-others.html

[ii] Ibid.

[iii] https://www.brainyquote.com/authors/jimmy_dean

[iv] https://www.azquotes.com/author/3804-Jimmy_Dean

[v] https://www.cnbc.com/2017/10/04/warren-buffett-says-this-one-investment-supersedes-all-others.html

[vi] https://www.fool.com/slideshow/warren-buffetts-advice-stock-market-crash/?slide=4

[vii] Ibid

[viii] https://smartasset.com/retirement/average-401k-balance-by-age

[ix] https://www.fool.com/retirement/2016/06/27/heres-how-much-the-average-american-has-in-an-ira.aspx

[x] Ibid