317-912-1000

317-912-1000

Finding reliable strategies to build wealth while maintaining control over your money can be challenging today. Among the approaches that have gained attention, the Infinite Banking Concept (IBC) stands out as a method that emphasizes regaining control of your financial future through structured whole life insurance policies.

The Infinite Banking Concept was developed by R. Nelson Nash in the 1980s during a period of high interest rates. Nash, faced with crippling interest payments on his real estate investments (up to 23% when the prime rate hit 21.5% in 1980), discovered he could access capital through his whole life insurance policies at only 5-8%. This revelation led him to transfer his high-interest debt to policy loans, allowing him to repay on his own schedule at significantly lower rates.

What began as a practical solution to avoid excessive interest payments evolved into a money management philosophy. Nash documented this approach in his 1999 book “Becoming Your Own Banker” and spent years teaching seminars nationwide. He established the annual ThinkTank in Birmingham, Alabama, which at its peak attracted over 200 financial professionals twice yearly.

Nash’s core philosophy is elegantly simple yet profound: “The objective should be simply to get as much money as possible into a policy with the least amount of insurance.” This foundation, often overlooked by those implementing the concept today, is vital to maximizing the system’s effectiveness.

|

Infinite Banking Made Simple Instant Download This free binder has the information to build your own Infinite Banking system. |

The Infinite Banking Concept rests on three principles:

Understanding the distinction between interest rate and volume of interest is critical. For example, a $250,000 mortgage at 5% APR over 30 years might seem modest, but the volume of interest reaches an astonishing 48% of total payments ($233,139 in interest on $483,139 total payments). If refinanced after five years, as many homeowners do, this volume rises to 75% because most interest is paid at the beginning of amortized loans.

The Infinite Banking Concept relies on dividend-paying whole life insurance, not universal life products. Nash was explicit about this distinction, stating that he never sold universal life policies after observing how they “kept falling apart” when insureds reached ages 65-70 due to prohibitive costs of the underlying term insurance.

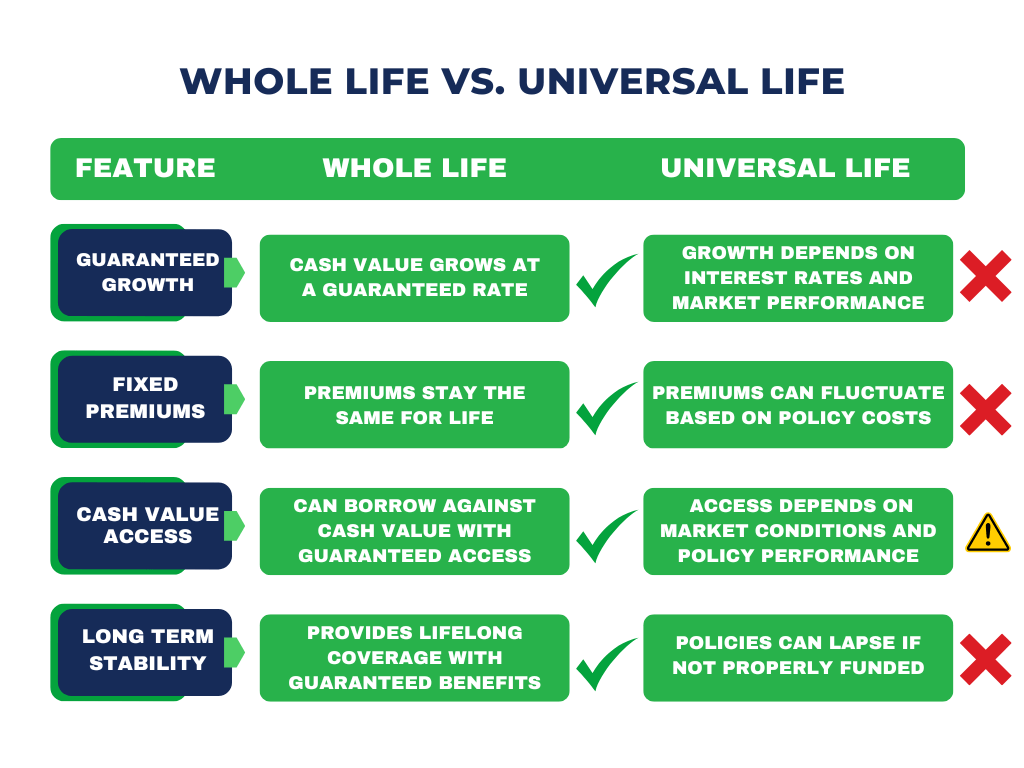

Whole life insurance provides guaranteed death benefit protection that doesn’t expire as long as premiums are paid, while building cash value that can be accessed through policy loans. Unlike term insurance, which offers only a death benefit, or universal life insurance, which shifts investment risks to the policyholder, whole life insurance provides lifelong coverage with predictable premiums and guaranteed growth.

The difference between whole life and universal life products lies in their structure. Universal life policies are built on annually renewable term insurance with an investment component that may not perform as projected. By contrast, whole life policies are permanent, with fixed premiums and guaranteed cash values that eventually equal the death benefit.

For a whole life policy to serve as your “banking” system, proper design is essential. A well-structured policy for IBC should:

Many policies marketed for Infinite Banking are poorly designed, often maximizing death benefits through term riders to allow larger premium payments, which may increase commissions for the agent but can undermine the policy’s effectiveness for banking purposes. While this approach accelerates early cash value, it increases the cost of capital when accessing those funds through policy loans.

As Nash explicitly warned, the focus should be on “getting as much money as possible into a policy with the least amount of insurance.” Policies that deviate from this principle may deliver impressive-looking illustrations but diminish the efficiency of the banking system.

The process of implementing the Infinite Banking Concept involves:

A main advantage is that when you borrow against your policy, the insurance company loans you money from their general fund while your full cash value continues to grow uninterrupted. This means your money works in two places at once.

It’s worth noting that in a low-interest-rate environment, policy loan rates may be higher than market loan rates. While this might seem counterproductive, the complete strategy still offers advantages through tax benefits, uninterrupted compounding, and control over repayment terms.

The Infinite Banking Concept can be implemented effectively in many different financial situations:

Many people wonder if they should pay off existing debt before starting an IBC policy. Analysis shows that starting a moderately sized policy while paying down debt often produces better long-term results than focusing exclusively on debt elimination first. With proper policy design, this approach might extend the debt-free timeline by only a few months while creating substantial long-term advantages.

When financing major purchases like cars or vacations, using policy loans rather than depleting savings can maintain the growth of your money. For instance, if you keep $10,000 earning 3.5% annually while financing a $10,000 purchase at 5% over five years, you’ll still come out ahead because your savings will grow to $11,876 while you’ll pay $11,548 in total.

Business owners find particular value in the IBC strategy. It provides liquidity for cyclical business needs and equipment purchases while offering tax advantages, as interest on policy loans used for business purposes may be tax-deductible.

When markets experience downturns, having liquid capital available through policy loans allows investors to seize opportunities without liquidating depreciated investments. This strategy has helped many build substantial wealth by maintaining liquidity during market fluctuations.

Despite its potential benefits, the Infinite Banking Concept is often misunderstood:

While larger premium policies offer certain efficiencies, the concept can work with premiums as low as $500-$800 annually for children and $800-$6,000 for adults, depending on age and health. The system can be tailored to various income levels.

IBC isn’t primarily about earning high rates of return on your money. Rather, it’s about control, liquidity, tax advantages, and never interrupting the compound growth of your capital. The internal rate of return on cash value ranges from 2-4% on projected values (including dividends) over time, which is competitive when considering the after-tax, after-fee returns of many investments.

The Infinite Banking Concept itself isn’t a scam, though some agents may misrepresent it or design unsuitable policies to maximize commissions. The strategy of using dividend-paying whole life insurance for financing has been employed successfully for more than a century by businesses, wealthy individuals, and even ordinary families.

While the IBC strategy offers benefits when properly implemented, there are potential pitfalls:

Policies with excessive term riders or unnecessary features may accelerate early cash value but undermine long-term performance. Working with an agent who understands proper IBC policy design is imperative.

Although policy loans don’t require repayment on a fixed schedule, failing to repay them diminishes the system’s effectiveness and can eventually lead to policy lapse if loan balances exceed cash values.

Infinite Banking is a long-term strategy that usually becomes more efficient after 7-15 years. Those expecting immediate dramatic results may be disappointed.

While dividends enhance policy performance, they’re not guaranteed until declared. Basing decisions solely on non-guaranteed projections rather than focusing on the guaranteed values can lead to disappointment.

Finding the right financial professional to help implement the Infinite Banking Concept is the most crucial decision in the process. Look for:

The Infinite Banking Concept offers a methodical approach to regaining control of your financial life through properly structured whole life insurance. By understanding your own cash flow, creating a vehicle for disciplined saving, and recapturing interest you would otherwise pay to others, you can build substantial wealth over time.

It’s not a get-rich-quick scheme or a magic solution. It requires patience, discipline, and proper implementation with correctly designed policies. When approached with realistic expectations and understanding, it can be a powerful tool in your financial arsenal.

As with any financial strategy, the key is education. Understanding the fundamentals, working with knowledgeable professionals, and maintaining discipline in implementation will determine your success with the Infinite Banking Concept. For those willing to take control of their financial future, it offers a time-tested alternative to conventional banking relationships and traditional investment approaches.

Remember Nash’s wisdom: “Slow and steady will get you to where you want to go.” Reducing and recovering the cost of capital in your financial life, compared to continuously paying it to outside institutions, can make the difference between mediocre results and sustainable wealth.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.