702-660-7000

702-660-7000

Financial gurus, planners, and market forecasters paint an enticing picture of wealth accumulation through market returns. They use attractive averages and glossy projections to win your trust and your business. This approach can be dangerously misleading when planning for financial security and long-term wealth sustainability.

Average returns create an illusion in financial planning. Like in this eye-opening example:

An initial $10,000 investment grows to $24,883 over five years with a compounding 20% annual return. But then market conditions change, and that same $24,883 shrinks to just $9,802 over the next five years due to a negative 17% annual return.

While you’ve lost money on your original investment, the average rate of return across the entire decade equals a positive 1.5%. This mathematical sleight of hand masks the reality of your financial situation – you’ve lost money despite having a “positive average return.”

Jack Bogle, the founder of Vanguard, warned investors about this very phenomenon: “Will you earn the market’s return? Don’t count on it, because some 98% of what you think you will earn will vanish into thin air.” This sobering assessment from one of the investment world’s most respected figures underscores how average returns can create false expectations.

Financial advisors who promote market-based investment strategies often downplay or entirely omit crucial information about factors that reduce real-world returns:

These factors create a gap between theoretical returns shown in slick presentations and the actual wealth accumulated by investors. The difference can mean hundreds of thousands of dollars over a lifetime of investing.

Jeremy’s experience provides a example of how persuasive market-return promises can lead to poor financial decisions.

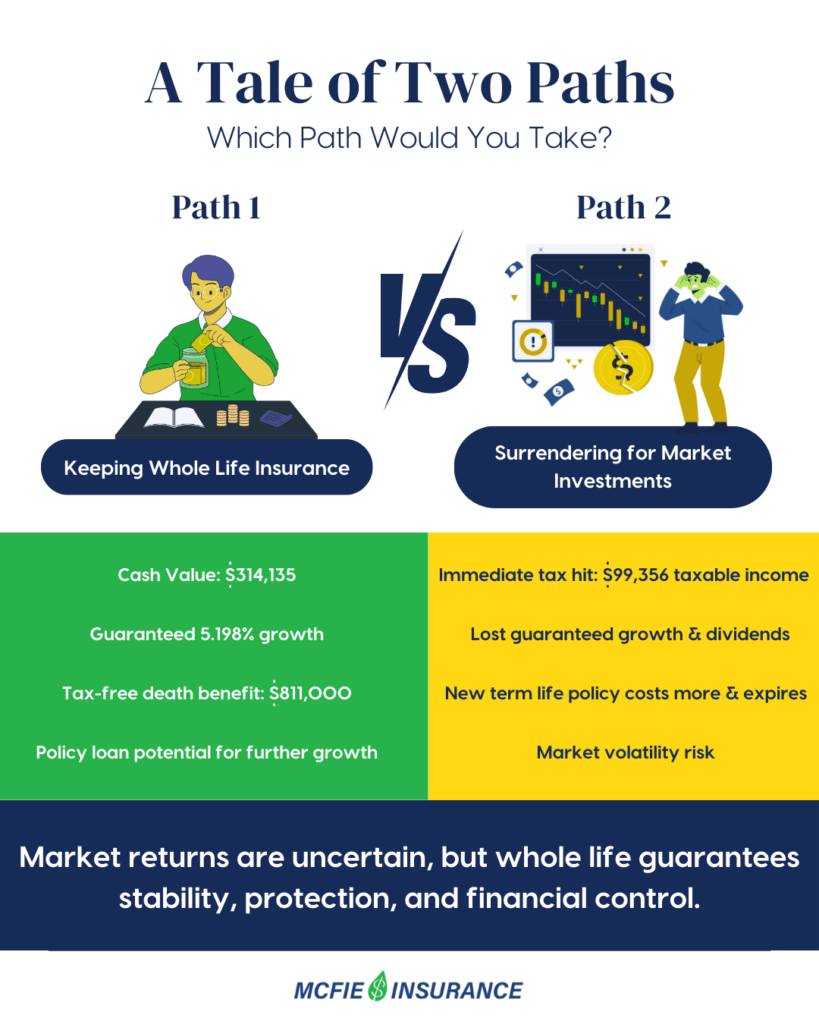

For 15 years, Jeremy had diligently funded a participating whole life insurance policy with a total contribution of $214,779. His policy had built a substantial cash value of $314,135, representing a 5.198% return on the premiums he had paid. This return came with no market risk, no fees, and no taxes on the growth while it remained in the policy. The policy also provided an $811,000 death benefit that would pass tax-free to his beneficiaries.

Jeremy’s annual cash value was guaranteed to increase by 20.6% more than his required premium payment in the upcoming year. The insurance company also confirmed they would have paid him a dividend of an additional $10,306, which would have increased the return on his annual premium to an impressive 113.372% for that year.

Unfortunately, Jeremy was swayed by a financial advisor who convinced him that the whole life policy was a poor investment compared to market returns. Persuaded by projections of higher returns, Jeremy surrendered his policy. This decision had immediate consequences:

To replace the death benefit protection, Jeremy purchased a term life insurance policy that cost more annually while providing less coverage than his whole life policy. The term policy only covered him for 10 years, after which the premium would increase by a staggering 1,335% to maintain coverage. If Jeremy keeps this term policy beyond its initial period, he could end up paying more in premiums than the death benefit his beneficiaries would receive.

Jeremy’s 5.198% return on his whole life policy might seem modest compared to the double-digit projections often touted by investment advisors. However, the return was:

When you factor in these characteristics, the value becomes much clearer. Most investors never achieve the market returns shown in projections because of:

What makes whole life insurance valuable as a financial tool is the ability to leverage the cash value while it grows. This aspect is often overlooked when compared to market investments.

Had Jeremy kept his policy and borrowed $300,000 of his cash value to invest, his policy would have continued growing at its guaranteed rate plus dividends. If Jeremy then achieved the 20% return his financial advisor was projecting, he would have gained another $90,584 in his policy’s cash value while earning $446,496 on the invested $300,000.

This approach would have resulted in a total of $847,080, equivalent to a 23.072% effective return rather than just the 20% market return alone.

Conversely, if the market investment had lost 4%, leaving Jeremy with only $244,612 instead of the projected $746,496, the $90,584 gain in his policy cash values would have transformed a 4% loss into a 2.244% overall gain. This buffer effect highlights why participating whole life insurance can function as a financial hedge against economic volatility.

Markets, like life itself, are unpredictable. No one can forecast market performance with accuracy, despite what some financial advisors might claim. Preparing for financial certainty amid life’s uncertainties is a cornerstone of sustainable wealth building.

Participating whole life insurance provides this certainty through:

A sustainable approach to wealth building acknowledges the potential of market returns and their inherent risks. Rather than viewing whole life insurance and market investments as mutually exclusive strategies, the most successful wealth builders integrate both approaches.

Whole life insurance can be the foundation of financial security – providing guarantees, liquidity, and protection – while market investments can be utilized for growth potential. This approach allows for:

When evaluating any financial strategy, looking beyond simple return percentages is essential. True financial efficiency encompasses:

By these measures, participating whole life insurance performs better than its advertised returns would suggest, while market investments frequently underperform their theoretical returns.

Financial advisors recommend the strategy of buying term insurance and investing the premium difference (compared to whole life) in the market. This approach sounds logical on the surface but fails in several ways:

In Jeremy’s case, he was paying less for his whole life policy than his new term policy, negating the premise of this strategy.

One overlooked aspect of financial planning is human psychology. Market investments require discipline and emotional fortitude during market downturns. Research shows that average investors underperform the market due to emotional decision-making.

Whole life insurance, with its guaranteed growth and lower volatility, often results in better long-term outcomes not because the returns are higher, but because the strategy is easier to maintain through life’s financial challenges. This behavioral advantage shouldn’t be underestimated.

True financial success isn’t about chasing the highest theoretical returns – it’s about building sustainable wealth that can weather economic storms, provide for your needs throughout life, and leave a legacy for those you care about.

Participating whole life insurance represents a financial tool that millions use as a hedge against the unknown. It provides financial sustainability during volatile times while enhancing policyholders’ ability to increase their wealth regardless of market performance.

The façade of market returns can be alluring, but sustainable wealth building requires looking beyond averages and projections. It demands a balanced approach that acknowledges opportunities and risks, provides growth potential and guarantees, and works with human psychology rather than against it.

Before making any big financial decision, especially one that involves surrendering existing financial assets like Jeremy did, seek balanced perspectives from advisors who understand the full spectrum of financial strategies – not just those focused exclusively on market returns.

The path to sustainable wealth isn’t found in chasing the highest theoretical returns. It’s built through a balanced approach that creates certainty amid life’s uncertainties, provides liquidity when you need it most, and places your financial future in your hands rather than at the mercy of unpredictable markets.

Tomas P. McFie DC PhD

Tomas P. McFie DC PhD

Tom McFie is the founder of McFie Insurance and co-host of the WealthTalks podcast which helps people keep more of the money they make, so they can have financial peace of mind. He has reviewed 1000s of whole life insurance policies and has practiced the Infinite Banking Concept for nearly 20 years, making him one of the foremost experts on achieving financial peace of mind. His latest book, A Biblical Guide to Personal Finance, can be purchased here.