317-912-1000

317-912-1000

Two people can look at the same painting and see different things—one might see a peaceful landscape, while another might see a gloomy, desolate scene. This concept also applies to your retirement savings to some degree. When you examine a retirement account, you might focus on all its benefits or, from another angle, see its shortcomings.

You can easily find information about the advantages of a pre-tax retirement account, like a traditional IRA or a 401(k). These accounts offer tax deductions today, tax-deferred growth, and a source of retirement income. However, the disadvantages of such accounts are not as frequently discussed. Understanding these drawbacks can help you make more balanced and informed decisions about your savings strategy.

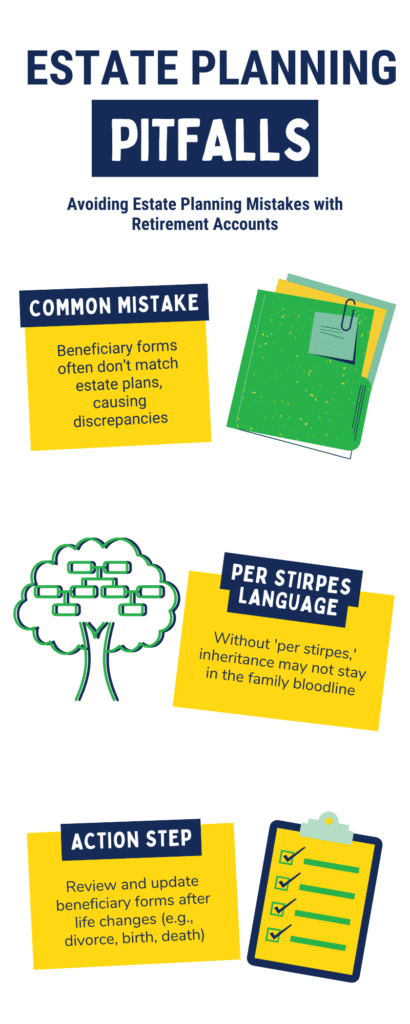

One major downfall of pre-tax retirement plans is the potential for mistakes when planning how your heirs will inherit them.

Your “beneficiary election form” determines what happens to your retirement account after you die. Often, the attorney drafting your will or trust does not handle the titling of names on this beneficiary form. This can result in discrepancies between the heirs named on the beneficiary form and those in your estate plan, leading to problems.

For example, attorneys often use “per stirpes” language in trusts to ensure that each heir’s share of the inheritance stays within their bloodline if they die prematurely. However, because most retirement plan owners fill out beneficiary forms without an attorney’s help, they may not be aware of such language.

Consider a man who owns a retirement account and wants his three sons (and their children) to inherit it equally. If the man and one of his sons both die in a car accident, without “per stirpes” language, the deceased son’s share would go to the surviving co-beneficiaries, leaving the grandchildren in his line with nothing.

Additionally, if you update your estate plan due to events like divorce, birth, or death, these changes do not automatically update your beneficiaries on your retirement account. This could result in the wrong person or people, like an ex-spouse, receiving your retirement assets if you forget to update your beneficiary on that account.

Pre-tax retirement plans, such as traditional IRAs and 401(k)s, do not receive the favorable long-term capital gains tax treatment that taxable brokerage accounts can receive. To illustrate, let’s compare the tax treatment of gains in a taxable account versus a pre-tax retirement account:

Example 1: Taxable Investment

Suppose you purchase stock for $5,000 in a taxable account, and over 20 years, its value grows to $50,000. When you sell the stock, you trigger a $45,000 long-term capital gain. If you are in the 22% tax bracket, you might expect to pay 22% of $45,000 in taxes, totaling $9,900. However, long-term capital gains are taxed at a reduced rate of 15%, resulting in a tax bill of only $6,750.

Example 2: Pre-tax Retirement Investment

If the same growth occurred within a pre-tax retirement account and you withdrew the proceeds, you would not receive the favorable long-term capital gains tax treatment. Instead, the entire $50,000 would be taxed at your ordinary income rate of 22%, resulting in a tax hit of $11,000.

When it comes to inheriting stock, pre-tax retirement accounts also have a disadvantage compared to taxable accounts. Let’s consider another scenario:

Inheriting Stock in a Taxable Account

Suppose a woman buys $20,000 of stocks in a taxable account, and the value grows to $150,000 over her lifetime. If she dies and leaves the shares to her adult son, the taxable appreciation up to the date of death receives a step-up in basis.

This is allowed because technically the woman’s entire estate is “taxed” at her death. But if the total estate is under the federal and state estate tax exemption amounts, which most people’s estates are, then no estate taxes are actually triggered. The Federal Estate tax exemption as of 2024 is $13.61 million – probably going down to around $7 million by the end of 2025.

The son’s cost basis “steps-up” to the stock’s value on the date of the mother’s death, so he inherits the $150,000 of stock tax-free. And he will only owe taxes on gains above $150,000 that occur between his mother’s death and the sale of the shares if he chooses to sell the shares. This can result in significant tax savings for highly appreciated investments.

Inheriting Stock in a Pretax Retirement Account

If the same stock were in a pre-tax retirement plan, the situation would be different. The son must withdraw all the funds from the inherited account within 10 years of his mother’s death. The entire $150,000 is fully taxable as ordinary income in the son’s tax bracket(s) as these withdrawals take place. If the son is in the 24% tax bracket, he will owe about $36,000 in income taxes as he takes these withdrawals.

Understanding these differences can help you make better informed decisions about where to keep your investments for tax efficiency.

You cannot directly gift money from a traditional IRA, 401(k), or other pre-tax company retirement plan like you can from a taxable savings or investment account.

In 2024, the annual gift tax exclusion is $18,000. This means if you have money in a taxable brokerage account, you can gift up to $18,000 to as many people as you like without facing any gift tax consequences. The gift is not taxable to you when made, nor is it considered taxable income for the recipient.

However, if you withdraw money from a pre-tax retirement account to make a gift, it would trigger ordinary income tax for you. For instance, if you are in the 22% tax bracket, and assuming no penalty apply, you would need to pay $3,960 in taxes to withdraw $18,000 before you can make the gift.

Pre-tax retirement accounts require you to take taxable required minimum distributions (RMDs) starting at age 72. You are also required to take pre-tax distributions for an inherited IRA within 10 years of inheriting unless special provisions apply. These distributions increase your income and raise your tax bill, and you must take the money whether you want to or not.

Non-tax qualified accounts don’t have mandatory distributions that trigger taxes. For example, you can hold onto stocks in a taxable brokerage account without being forced to sell them. This may allow you to manage your tax liabilities better.

The disadvantages of 401(k)s, traditional IRAs, and other pretax retirement accounts don’t mean you shouldn’t invest in them. However, they suggest you might need to strike a better balance between funding pre-tax retirement accounts and taxable accounts to diversify your tax strategies.

For example, by spreading investments between a 401(k) and a taxable brokerage account, you can take advantage of the tax benefits of both types of accounts. This approach allows you to manage tax liabilities more effectively, especially in retirement when your income sources and tax rates can vary.

Life Insurance Also Gets Tax-Favored Treatment

Permanent life insurance is another tool which receives tax-favored treatment.

Premiums are paid with after-tax dollars, growth beyond premiums paid is tax-deferred and there are no required minimum distributions. You can also take policy loans throughout your lifetime to use the money without triggering penalties or taxes on the growth represented in the policy cash value.

Not all life insurance policies are created equal (some aren’t worth the name “permanent” in our opinion), but certain whole life insurance products which are well-designed for high-cash value can be a wonderful asset in your diversification strategy.

When you die, life insurance also receives favorable tax treatment because the death benefit is part of your estate. This is kind of like the step-up in basis that we see for inherited stock in a taxable account. There are no income taxes paid on a life insurance death benefit.

|

Policy Checklist Make Sure You Get a Good Policy Is your policy good or bad? Use this checklist to help evaluate your existing life insurance or a new policy you are considering. |

Ted Benna, known as the “father of the 401(K),” has concerns about the current state of his creation. Initially, the plan was designed so that employers covered all administrative fees, but this has changed, with many fees coming directly from employees. Benna criticizes the high administrative fees, which can reach up to 2.75%, and notes that these fees, along with service and investment fees, can significantly reduce investment returns. He believes employees often do not realize the impact of these fees.

Benna originally aimed to help employees save for retirement with employer-funded administrative fees and low-cost investment advice. However, mutual fund providers added layers of fees to enhance profits. Additionally, he points out that employees withdrawing their 401(k) funds when changing jobs undermines long-term retirement savings.

To address this, Benna is developing a new “Wheat Grains Incentive Plan” to assist low and middle-income workers, recognizing the increased need for hardship withdrawals due to rising living costs.

401(k)s, IRAs and other tax-qualified retirement plans are not always the best tools for saving and investing for your future, especially if they are out of balance with other aspects of your planning.

Integrating a balanced combination of taxable savings and investing along with pre-tax accounts and tax-favored whole life insurance can really help to maximize your retirement savings in a big way without painting yourself into a corner where your future options can be limited.

If you are trying to find the best strategy that fits your needs and lifestyle, schedule a strategy session with the experts at McFie Insurance. We specialize in designing life insurance as a financial tool and help you think about sound strategies to get the most out of your money.

by John T. McFie

by John T. McFie

I am a licensed life insurance agent, and co-host of the WealthTalks podcast.

As a 15-year practitioner of the Infinite Banking Concept on a personal level, I can help you find the clarity and peace of mind about your financial strategy that you deserve.

Working with hundreds of financial scenarios over the years has helped me to develop a sixth sense about how to quickly find a clear and balanced solution for clients using whole life insurance as a financial tool.

>>>>>

Disclaimer: Investing information provided on this page is for educational purposes only. McFie Insurance LLC does not offer advisory or brokerage services, and does not recommend or advise investors to buy or sell particular securities.

Loans and withdrawals from life insurance can cause adverse tax consequences, penalties and may cause your policy to lapse. Insurance products are backed by the claims paying ability of the issuing insurance company and are not FDIC insured. McFie Insurance LLC, its agents, and representatives are not authorized to give investment, legal or tax advice.